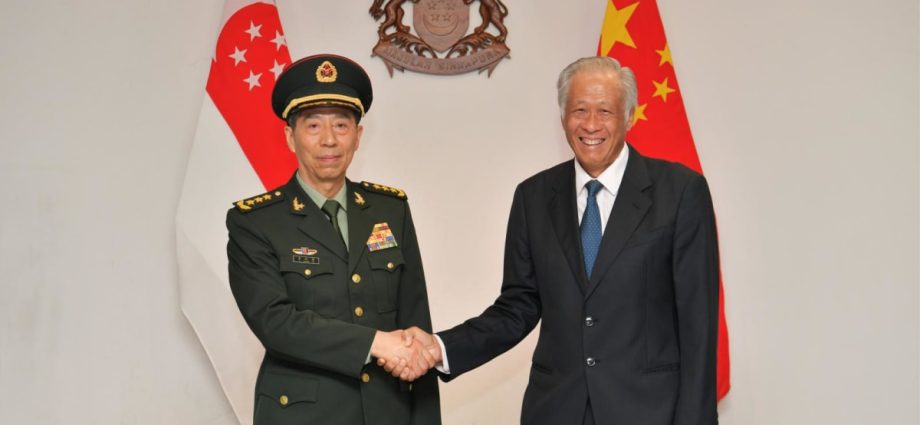

Singapore, China ink pact to set up secure telephone line between defence chiefs

SINGAPORE: Singapore and China will work towards establishing a secure defence telephone link under a memorandum of understanding (MOU) that the two countries signed on Thursday (June 1). Under the MOU, the defence establishments in both countries will work towards setting up the secure line for high-level communications between theirContinue Reading

Woman sues brother over S$700,000 Toa Payoh flat on behalf of mother who has dementia

SINGAPORE: A woman sued her brother on behalf of her elderly mother who has dementia, over a S$700,000 flat in Toa Payoh that her mother bought but her brother has been making rental profit from.

In a judgment released on Thursday (Jun 1), the High Court ordered that the flat be sold and the proceeds divided equally between the mother and brother.

Madam Goh Siam Teow, 89, bought the flat in 2001 in joint names with her son, Mr Arthero Lim Tung Hee, 68.

Mdm Goh has two other children. Her eldest, Madam Lim Sai Hong, 70, is the one suing Mr Lim and is Mdm Goh’s litigation representative as Mdm Goh suffers from dementia and lacks the mental capacity to do so.

The joint tenancy of the flat was severed in 2020, with Mdm Goh and her son now holding the property as tenants-in-common in equal shares.

However, only Mr Lim lives in the flat currently. He has stayed there for 20 years and has been renting out two rooms in the flat, earning about S$1,500 a month that he uses for living expenses.

Even though Mdm Goh is a co-owner of the flat, she has not received any of the rental proceeds. She has been living with her eldest child, Mdm Lim, since 2003.

Justice Choo Han Teck said the only issue for him to determine was whether the property should be sold. Mdm Lim had asked for the sale proceeds to be divided equally between her mother and brother.

Mr Lim resisted this, saying that his sister lacked the power to apply for the sale as his mother’s litigation representative.

He said he was a stroke patient with no income and financial means to move out, because he would otherwise lose the rental he currently receives along with a place to stay.

His sister said that the sale of the property was necessary to meet the financial burden of her mother’s medical expenses, especially in the light of her worsening dementia.

Mdm Lim said her own savings are insufficient, and that she would use the sale proceeds for her mother’s long-term care.

Justice Choo noted that Mr Lim did not seem to have any physical or mental impediment in presenting his own case. He said he was a painter but stopped painting professionally after sustaining a stroke.

Justice Choo said Mr Lim’s case that he would not have sufficient resources for his own upkeep if the flat was sold had to be balanced against the best interests of his ailing and aged mother.

“She cannot be kept out of the property and have the respondent taking over the benefits of ownership entirely,” he said. “Nothing can be more inequitable. A sale of the property is the most equitable solution in the circumstances.”

Justice Choo noted that Mr Lim had support from welfare services, as well as a sum of at least S$192,000 in his Central Provident Fund once his CPF contribution from the sale of the flat is refunded.

DISPUTE IN DIVISION OF SALE PROCEEDS

Mdm Lim had asked for the sale proceeds to be divided equally, but her brother said he contributed more towards the purchase of the property.

He asked to get 60.31 per cent of the proceeds, with his mother receiving 39.69 per cent.

The funds used to buy the Toa Payoh flat came from the sale of another flat, which amounted to a sum of about S$398,000.

This sum was received solely by Mdm Goh at the time of the sale, but her son claims that he was entitled to half the proceeds, even though it was his mother who repaid the housing loan of S$241,000 to HDB to buy the Toa Payoh flat.

Justice Choo said the documents show only that Mr Lim contributed from his CPF accounts, while the cash payments were made by his mother.

Mr Lim had contributed only S$30,578.36 out of the housing loan quantum of S$64,000, with his mother paying the rest.

“In any event, the respondent’s failure to apportion to (his mother) the rental proceeds of the property, which exceeded S$400,000, since 2003 sufficiently settles the difference in contributions,” said the judge.

He said it was difficult to ascertain the breakdown of the financial contribution of both sides made some 20 years ago without proper documentation.

He ordered the flat to be sold and the proceeds divided equally between Mdm Goh and her son. Mdm Goh’s counsel asked for costs to be fixed at S$34,000, but Mr Lim said he was an unemployed stroke patient.

The judge said Mdm Goh had expended substantial legal costs to get an order to sell the flat, and ordered Mr Lim to pay costs of S$12,000, inclusive of disbursements.

Counting the costs of Cambodiaâs Belt and Road

China is Cambodia’s largest bilateral donor, lender, investor and trading partner. About a quarter of Cambodia’s total trade, a third of aid and two-fifths of foreign direct investment (FDI) and external debt involves China. Although Sino-Cambodian diplomatic and economic relations date back centuries, they have grown sharply over recent decades.

Economic relations have been strengthened by Cambodia’s active participation in the Belt and Road Initiative (BRI). Cambodia has been a vocal and enthusiastic proponent of the BRI since its inception in 2013.

In Cambodia, the BRI focuses mainly on loans to develop physical transport infrastructure, although it has also been indirectly associated with the development and transformation of the port city of Sihanoukville.

There are also investments in agriculture, energy and light manufacturing.

Participation in the BRI has costs and benefits. As a Least Developed Country aspiring to achieve upper middle-income status by 2030, Cambodia has embraced the BRI as an important instrument for addressing infrastructure deficits and reducing trade and transport costs.

The BRI has also supported the development of the power sector and agricultural diversification. This has raised productivity and led to trade expansion and high economic growth without compromising debt sustainability.

Rapid economic growth has increased wealth inequality but also raised overall living standards and produced sharp reductions in poverty. Between 2009 and 2019, poverty incidence (US$1 per day) almost halved from about 34% to 18%. These achievements derive from multiple factors but the BRI’s contribution cannot be denied.

The government has not undertaken a quantitative cost–benefit analysis of the BRI in Cambodia. The presence of BRI projects alongside massive socioeconomic gains suggests that the country has derived net benefit from the BRI.

There are also no concerns relating to “debt trap diplomacy” as debt levels remain below 40% of GDP. Still, there are risks associated with increasing reliance on just one country for economic and non-economic needs.

The BRI provided the transport and related infrastructure that facilitated the transformation of Sihanoukville from a sleepy, beachside resort town to a bustling entertainment center focused on gambling. The spill-over benefits of this rapid development to the local communities appear limited, while there is growing evidence of a rise in the cost of living, crime, corruption and various forms of inequality.

While the BRI was not directly involved in transforming Sihanoukville in this way, it did enable the conditions for its development. The real and perceived costs of these rapid transformations have caused dislocation and displacement among local communities.

Experts have concerns about the environmental and resettlement effects of BRI projects. The second BRI Forum in 2019 committed to mitigating problems through greater community consultation and stakeholder participation. It is still too early to tell if this consultation is really happening.

The forum also resolved to multilateralize the BRI by expanding the participation of regional, albeit still China-based, institutions. In Cambodia, this is occurring through a gradual shift in the financing of projects from Chinese state-owned banks and corporations — whose operations are sometimes opaque — to the Asian Infrastructure Investment Bank (AIIB), a multilateral development institution.

The AIIB’s role is set to increase rapidly and raise overall transparency, including contractual obligations.

But the extent to which AIIB’s involvement will also raise environmental standards and other safeguards remains unclear. This is because the AIIB adopts national environmental and other standards and policies — which may fall short of global benchmarks.

AIIB oversight of the implementation of environmental standards or resettlement policies may also involve national authorities rather than an independent party, which could be problematic.

How can Cambodia ensure that future projects are net positive?

The Committee for the Development of Cambodia reviews FDI proposals as part of the process of obtaining Qualified Investment Project (QIP) status and securing fiscal incentives. While some of the criteria used in determining QIP status involve assessing potential benefits to the local economy, the analysis lacks a comprehensive cost-benefit framework.

This is also true of the new Law on Investment adopted in 2021, which is mainly designed to facilitate FDI. Both the QIP and the Law on Investment ignore macroeconomic issues such as debt or investment sustainability and do not attempt to measure broader spill-over effects on the economy.

Cambodia needs a formal framework to assess the potential costs and benefits of all project proposals as part of a conventional approval process.

Cambodia could consider setting up a new Projects Review Board, which could operate as a non-statutory body with inter-ministerial and multi-stakeholder representation, to assess individual proposals in a purely advisory capacity to the government.

Technically competent staff who are capable of undertaking comprehensive cost-benefit analysis should support this project. A properly functioning Projects Review Board could help avoid the kinds of BRI projects that have left neighboring Laos in severe debt distress.

A transitional economy like Cambodia should be selective and strategic in its choice of projects if it is to grow in a sustainable and inclusive manner. It has done well so far but needs an independent assessment mechanism to ensure its success continues.

Jayant Menon is Senior Fellow at the ISEAS-Yusof Ishak Institute.

This article was originally published by East Asia Forum and is republished under a Creative Commons license.

Pheu Thai scraps B10,000 handout

Party cites high cost of welfare policies of coalition partner Move Forward

The Pheu Thai Party has scrapped the 10,000-baht handout it promised during the election campaign, saying the high cost of the Move Forward Party’s welfare programmes would make it unfeasible.

The two parties are the main partners in an eight-party coalition but Move Forward is setting the policy agenda because it won 10 more seats than Pheu Thai on May 14.

Pheu Thai continues to insist that it will not abandon the coalition and will support Move Forward leader Pita Limjaroenrat as the next prime minister, but the two parties are competing for the House speaker’s seat.

And while leaders of both parties have issued calls for unity, rumours continue to swirl that Pheu Thai would be part of an alternative coalition should the current arrangement collapse.

The Pheu Thai economic team on Thursday decided to scrap the 10,000-baht digital money handout because the welfare programmes planned by Move Forward would cost the state about 500 billion baht, said Phaophum Rojanasakul, the Pheu Thai deputy secretary-general.

“For the 10,000-baht digital wallet policy of the Pheu Thai Party, we still see a necessity to stimulate the national economy amid its weakness,” he said.

“But the policy would cost the state about 560 billion baht while the leading party’s welfare policies would require a similar amount of money. So, we must shelve this project.”

Pheu Thai had clear capital-oriented policies for high economic growth with equality, Mr Phaophum said.

Under its handout scheme, every Thai national 16 years old and over would be given a digital wallet with 10,000 baht to be spent within six months at businesses within a four-kilometre radius of where they live.

Srettha Thavisin, a businessman and Pheu Thai prime ministerial candidate, said during the election campaign that the handout would create an “economic tsunami” with positive ripple effects nationwide.

Move Forward, meanwhile, has promised a new and more inclusive welfare system with comprehensive coverage across all age groups.

Highlights include a 1,200-baht monthly child support grant and a 3,000-baht monthly pension for the elderly.

More than S$1.7 million lost by victims to holiday travel package scams

SINGAPORE: The police are investigating five men and two women for their suspected involvement in a series of holiday travel package scams. At least 48 victims were cheated of a total sum amounting to at least S$1.7 million (US$1.2 million), the police said on Thursday (Jun 1). Between March toContinue Reading

No, AI probably wonât kill us all

Doomsaying is an old occupation. Artificial intelligence (AI) is a complex subject. It’s easy to fear what you don’t understand. These three truths go some way towards explaining the oversimplification and dramatisation plaguing discussions about AI.

Yesterday outlets around the world were plastered with news of yet another open letter claiming AI poses an existential threat to humankind. This letter, published through the nonprofit Center for AI Safety, has been signed by industry figureheads including Geoffrey Hinton and the chief executives of Google DeepMind, OpenAI and Anthropic.

However, I’d argue a healthy dose of scepticism is warranted when considering the AI doomsayer narrative. Upon close inspection, we see there are commercial incentives to manufacture fear in the AI space.

And as a researcher of artificial general intelligence (AGI), it seems to me the framing of AI as an existential threat has more in common with 17th-century philosophy than computer science.

Was ChatGPT a ‘breaththrough’?

When ChatGPT was released late last year, people were delighted, entertained and horrified.

But ChatGPT isn’t a research breakthrough as much as it is a product. The technology it’s based on is several years old. An early version of its underlying model, GPT-3, was released in 2020 with many of the same capabilities. It just wasn’t easily accessible online for everyone to play with.

Back in 2020 and 2021, I and many others wrote papers discussing the capabilities and shortcomings of GPT-3 and similar models – and the world carried on as always. Forward to today, and ChatGPT has had an incredible impact on society. What changed?

In March, Microsoft researchers published a paper claiming GPT-4 showed “sparks of artificial general intelligence.” AGI is the subject of a variety of competing definitions, but for the sake of simplicity can be understood as AI with human-level intelligence.

Some immediately interpreted the Microsoft research as saying GPT-4 is an AGI. By the definitions of AGI I’m familiar with, this is certainly not true. Nonetheless, it added to the hype and furore, and it was hard not to get caught up in the panic. Scientists are no more immune to group think than anyone else.

The same day that paper was submitted, The Future of Life Institute published an open letter calling for a six-month pause on training AI models more powerful than GPT-4, to allow everyone to take stock and plan ahead. Some of the AI luminaries who signed it expressed concern that AGI poses an existential threat to humans, and that ChatGPT is too close to AGI for comfort.

Soon after, prominent AI safety researcher Eliezer Yudkowsky – who has been commenting on the dangers of superintelligent AI since well before 2020 – took things a step further. He claimed we were on a path to building a “superhumanly smart AI”, in which case “the obvious thing that would happen” is “literally everyone on Earth will die.”

He even suggested countries need to be willing to risk nuclear war to enforce compliance with AI regulation across borders.

No existential threat

One aspect of AI safety research is to address potential dangers AGI might present. It’s a difficult topic to study because there is little agreement on what intelligence is and how it functions, let alone what a superintelligence might entail. As such, researchers must rely as much on speculation and philosophical argument as evidence and mathematical proof.

There are two reasons I’m not concerned by ChatGPT and its byproducts.

First, it isn’t even close to the sort of artificial superintelligence that might conceivably pose a threat to humankind. The models underpinning it are slow learners that require immense volumes of data to construct anything akin to the versatile concepts humans can concoct from only a few examples. In this sense, it’s not “intelligent.”

Second, many of the more catastrophic AGI scenarios depend on premises I find implausible. For instance, there seems to be a prevailing (but unspoken) assumption that sufficient intelligence amounts to limitless real-world power. If this was true, more scientists would be billionaires.

Cognition, as we understand it in humans, takes place as part of a physical environment (which includes our bodies) – and this environment imposes limitations. The concept of AI as a “software mind” unconstrained by hardware has more in common with 17th-century dualism (the idea that the mind and body are separable) than with contemporary theories of the mind existing as part of the physical world.

Why the sudden concern?

Still, doomsaying is old hat, and the events of the last few years probably haven’t helped. But there may be more to this story than meets the eye.

Among the prominent figures calling for AI regulation, many work for or have ties to incumbent AI companies. This technology is useful, and there is money and power at stake – so fearmongering presents an opportunity.

Almost everything involved in building ChatGPT has been published in research anyone can access. OpenAI’s competitors can (and have) replicated the process, and it won’t be long before free and open-source alternatives flood the market.

This point was made clearly in a memo purportedly leaked from Google entitled “We have no moat, and neither does OpenAI.” A moat is jargon for a way to secure your business against competitors.

Yann LeCun, who leads AI research at Meta, says these models should be open since they will become public infrastructure. He and many others are unconvinced by the AGI doom narrative.

Notably, Meta wasn’t invited when US President Joe Biden recently met with the leadership of Google DeepMind and OpenAI. That’s despite the fact that Meta is almost certainly a leader in AI research; it produced PyTorch, the machine-learning framework OpenAI used to make GPT-3.

At the White House meetings, OpenAI chief executive Sam Altman suggested the US government should issue licences to those who are trusted to responsibly train AI models. Licences, as Stability AI chief executive Emad Mostaque puts it, “are a kinda moat.”

Companies such as Google, OpenAI and Microsoft have everything to lose by allowing small, independent competitors to flourish. Bringing in licensing and regulation would help cement their position as market leaders, and hamstring competition before it can emerge.

While regulation is appropriate in some circumstances, regulations that are rushed through will favour incumbents and suffocate small, free and open-source competition.

Michael Timothy Bennett is a PhD Student at the School of Computing, Australian National University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Mahathir says ready to work with Muhyiddin for Malay cause

Dr Mahathir and Muhyiddin formed the Parti Pribumi Bersatu Malaysia (Bersatu) in 2016. Dr Mahathir was appointed chairman while Muhyiddin became president of the party. Bersatu then worked with the Pakatan Harapan (PH) coalition in the 14th General Election in 2018 and ousted Barisan Nasional from government. However, Dr MahathirContinue Reading

Elon Musk tears up the decoupling script in China

As the global economic intelligentsia debates how to “decouple” or “de-risk” from China, Elon Musk clearly didn’t get the memo.

The Tesla founder was feted like a returning king in Beijing this week. From the moment his private jet arrived on Tuesday, Musk is reportedly being called “Brother Ma,” putting him in rarified league with Alibaba billionaire Jack Ma.

There are many takeaways from Musk’s first China visit in three years. One is that not everyone is decoupling from China, least of all the globe’s most influential electric vehicle (EV) evangelist and owner of Twitter. Another: the future of EV production and innovation is shifting toward Asia’s biggest economy.

Yet the most important one may be how Beijing is putting out a huge welcome mat for foreign chieftains – from Musk to JPMorgan Chase’s Jamie Dimon – to signal that China really is open for business again.

The perception that China is becoming hostile toward foreign capital intensified after Ma ran afoul of Xi Jinping’s regulators in late 2020.

In March, China’s leader installed a new premier, Li Qiang, to take the lead in changing that narrative. And what better way than Musk visiting China and reaffirming his commitment to producing more Teslas in mainland factories?

Of course, Li and Ma go way back. It was Li, back in his days as Shanghai party boss, who lobbied Musk to open a Tesla “gigafactory” in the city. The facility, which opened in April 2022, was Tesla’s first outside the US.

Now, here is Musk, controversial as he is, hinting at an even bigger production presence in China. In 2022, Tesla contributed roughly one-quarter of Shanghai’s overall total automotive production.

The next objective for local governments around China: angling for closer ties with Tesla to win some of those jobs as Musk looks to expand his autonomous driving fleet and sales to Chinese consumers.

It’s just what Li’s image makers might have hoped for as Tesla looks to “aggressively focus on building out its China footprint,” says analyst Daniel Ives at investment firm Wedbush.

Even though China has its own promising EV companies, including BYD Co, Musk understands that Xi’s nation has become “the golden goose EV market,” Ives says. As such, Tesla’s mainland plant is now the “heart and lungs” of Musk’s global production.

Musk is also giving Xi and Li a big public relations win in another way. At his meeting Tuesday with Foreign Minister Qin Gang, Musk gave the thumbs down to Washington’s decoupling from China strategy. Musk said, effectively, that the relationship between the two biggest economies is too symbiotic to fail.

This is music to Li’s ears as China welcomes a who’s-who of multinational company chieftains. In recent days, top officials from Starbucks Corp, Jardine Matheson, Franklin Templeton and UK chip software giant Arm Ltd dropped by. Later this month, Nvidia Corp CEO Jensen Huang is reportedly coming to town.

The frenetic pace of these meetings comes as China’s foreign direct investment experiences an ill-timed U-turn. In the first three months of the year, roughly US$30 billion zoomed away from China. Stock investors are pivoting elsewhere, too. Since its 2021 high, the MSCI China Index has lost more than half of its value.

On the debt side, China “suffered outflows” in April to the tune of $3.8 billion “as the positive effect of the Covid reopening fades away,” says economist Jonathan Fortun at the Institute of International Finance.

Hence the urgency to dispel the gathering notion that China’s leadership is in an anti-foreigner sentiment phase. Xi chose Li to lead the China-is-open-for-business repair effort.

First, there’s a matter of improving the odds of reaching a 5% economic growth rate this year. Analyst Kelvin Wong at OANDA notes that the latest reading from China’s Purchasing Managers Index (PMI) data “further reinforced an increasing slowdown in external demand and lackluster internal domestic demand ex-post re-opening from Covid-19 stringent lockdowns.”

On closer inspection, Wong notes, the data “indicated a risk of a deflationary spiral at play.” The input cost – main raw material purchase prices – sub-component of the manufacturing PMI declined at the fastest pace in May since July 2022 – 40.8 versus 46.4 – while the output cost sub-component fell for the third consecutive month and recorded its steepest decline for ten months in May to 41.6 from 44.9.

The bottom line, Wong says, is Beijing needs to halt the narrative about “the risk of the deflationary spiral in China.”

Economist Lu Ting at Nomura International added that “the sharper contraction in the manufacturing PMI suggests that the risk of a downward spiral, especially in the manufacturing sector, is becoming more real.”

Others are more sanguine. Some economists argue that China Beige Book data shows that manufacturing activity may be perking up.

Goldman Sachs China economist Hui Shan says recent trends in China’s emerging industries PMI seem a “tentative sign that manufacturing activity may begin to stabilize.”

At the same time, a “loss of economic momentum amid weakening demand both at home and abroad” is getting harder for Premier Li’s team to ignore, says economist Carlos Casanova at Union Bancaire Privée.

Li, Casanova notes, has “vowed more targeted measures to expand domestic demand and stabilize external demand earlier in May, in an effort to promote a sustained economic rebound, but it remains to be seen whether these will be effective.”

Yet Li is also focused on structural reforms needed to restore investor confidence. Here, Musk’s timing could not be better.

In recent weeks, Beijing basked in the glow of global headlines over China surpassing Japan as the world’s biggest exporter of autos for the first time. Some of that dynamic reflects China’s embrace of EVs, while Toyota Motor and many Japan Inc peers stick with hybrid vehicles.

The narrative shift followed an earlier Li era victory: a move to break up Alibaba Group into six units – and founder Ma’s return to China after a long absence. Alibaba’s structural shakeup was a win for reformers and a vital gesture to reassure global investors that the regulatory crackdown on Big Tech is finished.

Since then, analysts like Kelvin Ho at Fitch Ratings have noted how “this could boost Alibaba’s credit strength if capital is freed up from businesses that generate little cash and deployed in stronger cash-generating businesses or used to pay down debt.”

The hope, too, is that Alibaba’s example could become a model for other internet giants in harm’s way, including Baidu, ByteDance, Didi, Tencent and others. If so, it would unlock value in China’s biggest service sector companies, enticing global investors.

Both Xi and Li surely appreciate Musk’s firm rejection of the idea that the US and China can thrive economically separately.

As economists at Allianz argue in a note to clients: “The economic implications of a further decoupling between the West and China could be far-reaching,” noting that the fallout for China’s economy could be “far from negligible.”

“China,” they argue, “could retaliate by curtailing the supply of critical raw materials in which it has a dominant position, which could severely disrupt global supply chains. But this is unlikely as it already applies some forms of outbound investment restrictions and is still looking towards economic pragmatism.”

At the margin, though, Musk’s doubling down on China and offering an alternative to the loud decoupling debate have given Beijing one of the best weeks of global headlines it’s had in some time.

Follow William Pesek on Twitter @WilliamPesek

Man in Singapore on tuition grant and MOE bond used forged documents to extend stay, gets jail

SINGAPORE: A Malaysian who came to Singapore on a Ministry of Education (MOE) tuition grant for his undergraduate studies at the National University of Singapore (NUS) completed his studies and his three-year bond, but wanted to extend his stay.

He used forged documents from NUS and MOE in order to get the Immigration and Checkpoints Authority (ICA) to extend his long-term visit pass, but was foiled when MOE noticed irregularities.

Magendran Muniandy, 34, was jailed for 20 weeks on Friday (Jun 1) for his crimes.

He had claimed trial but was convicted of three charges of using forged documents.

The court heard that Magendran was awarded a tuition grant by MOE in 2008 for a course in Science at NUS. He signed the MOE Tuition Grant Agreement, which required him to serve a bond with MOE upon completion of his undergraduate studies.

He was required to be employed in Singapore for three years.

Magendran obtained a Bachelor of Science degree in June 2011. He worked for the Life Sciences Institute of NUS for three years – between August 2014 and August 2017.

He was given an employment pass that was terminated on Aug 18, 2017, the day his three-year bond ended.

After his employment pass was terminated, Magendran applied for and was given a long-term visit pass for a year. Based on ICA’s records, the pass was issued to him in August 2017 and expired a year later.

In April 2018, Magendran sent an email to MOE asking for a copy of the agreement and a supporting letter from MOE so he could apply for an extension of his long-term visit pass, lying that he had not served his bond.

A senior executive responded to Magendran and asked about his employment history.

In his response, he claimed that he was hired by Proctor & Gamble and sent to Japan to work. He claimed that the plan was for him to work there for one-and-a-half years before returning to Singapore, but claimed that he had to work there for longer due to “organisational changes”.

He then claimed that he quit his job in Japan and returned to Malaysia or Singapore to find employment, but discovered that his bond was “yet to be served”.

“Therefore, I would like to take the initiative to serve my bond asap,” wrote Magendran.

He later lied that he had worked as a research assistant with NUS for only two months in early 2018 – even though he had worked for NUS for three years and effectively completed his bond.

In his bid to extend his long-term visit pass, Magendran used three forged documents as genuine. This includes a “letter of support for extension of long-term visit pass” purportedly issued by MOE, which he gave to ICA.

He also presented an image to MOE which showed the date of issue and date of expiry of a visit pass purportedly issued by ICA. He also showed a letter of acknowledgement purportedly issued by NUS to MOE.

After receiving the forged NUS acknowledgement letter, MOE conducted internal checks on Magendran’s employment history and realised that he had been given an employment pass with NUS for three years.

MOE contacted NUS, who confirmed the same and said the acknowledgement letter that Magendran had provided to MOE was not from them.

The senior executive had missed the irregulaties in the date of issue and expiry in the image Magendran had submitted, but later took a closer look and realised the dates were off.

Because Magendran had already worked in Singapore for three years, MOE discharged him from the bond and informed ICA that MOE would be revoking the original MOE support letter.

ICA later filed a police report.

Magendran had contested the charges, claiming that he had not submitted the forged MOE support letter to ICA, nor the forged NUS acknowledgment letter to MOE.

He said he had submitted the image showing his visit pass to MOE but said he did not know the information was inaccurate.

He pointed the finger at the officers working for MOE and ICA, accusing them of concocting documents to incriminate him.

The penalties for using a forged document as genuine are a jail term of up to four years, a fine, or both.

Japan to issue special bonds aimed at supporting childcare

TOKYO: Japanese Prime Minister Fumio Kishida said on Thursday (Jun 1) that the government would issue special bonds aimed at filling a projected funding gap as it boosts childcare support towards 2030. Speaking at a government panel meeting, Kishida also said the government would not take on additional financial burdensContinue Reading