Travis King: Soldier who fled to North Korea ‘charged back in US’

Reuters

ReutersTravis King, a US man who reportedly fled to the North Korea before returning home next month, is accused of abandonment, soliciting child sexual images, and possessing them.

According to reports, the costs also include assault against other soldiers.

In July, the surveillance expert entered the North Korea against his will while touring a border village.

Pyongyang later freed him without providing any additional information.

Following his July run to the North Korea, the 23-year-old could be imprisoned on the sole charge of desertion.

According to Reuters news organization, Pvt. King was also charged with a variety of offenses prior to his flight to the North Korea, including an attempt to flee US government prison in October 2022.

In July 2023, he was charged with” knowingly and willingly producing child sex” by a Snapchat consumer. He was even charged with having child sex in his hands.

Claudine Gates, his mother, wished for her child to” been afforded the presumption of innocence.”

When Pvt. King crossed the North Vietnamese borders, he was on duty with the US Army.

Since January 2021, he had served in the Army and was currently stationed in South Korea.

Pvt. King had spent two months in confinement in South Korea before rushing into the North Korea on suspicion of assaulting two people and kicking a police vehicle.

Eight times before he crossed the government’s border with Pyongyang, on July 10, a man was freed from prison.

Finnish officers, who brought Pvt King to the North Korea’s borders with China, brokered the terms of his release.

Much is known about Pyongyang’s decision to set him free, how he was treated in the North Korea, or the motivation behind his initial flight it.

Related Subjects

More information on this tale

-

-

28 September

-

Third Belt and Road Forum confirms how divided the world is

The third global summit of President Xi Jinping’s Belt and Road Initiative( BRI ) took place in Beijing on October 17 and 18, while the rest of the world continued to sleepwalk into a cold war, from Ukraine to Israel at this point.

This summit appears quite different from the first, which was held in May 2017 or even the next in April 2019, based on the number of participants and the major results. & nbsp,

First off, just 23 heads of state took part this time, downward from 37 at the next summit. Secondly, Vladimir Putin, the president of Russia, was a guest of honor among the members, many of whom were anti-Western regimes.

Another significant development was the presence of the Taliban in Afghanistan. Additionally, Viktor Orban of Hungary not only showed up as expected( he didn’t miss either of the previous conferences ), but he also formally stated his opposition to the de-risking approach taken by the European Union’s financial protection strategy. & nbsp,

Other than Orban, no other EU part joined the BRI Forum, while up to six and seven, both, attended the summits in 2017 and 2019. & nbsp,

Giorgia Meloni, the prime minister of Italy, joined the first two summits this time, breaking with her nation’s custom of & nbsp, though she had already made that intention clear at the September Group of Twenty meeting.

BRI industry decreased

Beyond enrollment, this summit was unique because it has placed a lot more emphasis on foreign policy and much less on enhancing trade and investment connectivity through infrastructure construction. This may be connected to China’s growing disengagement in some of these nations, at least in terms of financing and funding.

According to reports, one-third of BRI projects have encountered difficulties, which is likely why China has significantly reduced expense globally, including in BRIC nations.

Additionally, China’s annual economic development is just half of what it was when Xi Jinping came up with this historic project in 2012. It is challenging to continue funding BRI projects because the Chinese market is struggling with a real estate crumble and an increasing debt load. & nbsp,

The summit’s overarching topic on foreign policy was opposition to that of the US and its allies. & nbsp, This has significant ramifications for the conflict in Ukraine, which the EU and the US have already encountered when voting on Ukraine-related issues at the UN.

The Israel-Gaza issue is becoming yet another factor in the US and China’s disagreement over foreign policy. In fact, China’s Ministry of Foreign Affairs stated that it was siding with Palestine due to its lack of Western safety in the midst of the attacks on Israel.

In general, Beijing’s interactions with the Global South have become crucial for China, and the BRI is a great tool for this. The BRI, however, is not China’s highest-level foreign policy tool because it has been positioned below the” international community of shared future ,” which Xi Jinping uses to describe a more expansive view of where China sees itself in the world.

Any such height needs some particular milestones to be successful, even if foreign policy was the driving force, nbsp. Among the numerous steps that were announced, some of which were not always novel, a dozen stand out.

First, the main goals that accompanied the majority of references to the BRI were both” integrity-based”( which equates to anti-corruption ) and” clean ,”( green ). Second, the announcement of an international AI ( artificial intelligence ) governance initiative.

Regarding financial assets, two presentations were made, albeit on a much smaller scale than in the past: 350 billion renminbi( US$ 48 billion) worth of extra tools for policy institutions, and 80 billion and 11 billion for the Silk Road Fund, respectively. & nbsp,

Last but not least, there was no pertinent news that a multilateral framework was being developed to support BRI projects, so one should anticipate that the organization will continue to be primarily used for hub-and-spoke operations despite the current trend toward foreign policy. & nbsp,

Given everything mentioned earlier, the key issue is how significant the BRI will continue to be. China will continue to advertise the BRI as its overarching program and its top-level design for starting up and win-win global cooperation, according to Beijing’s white papers for the mountain.

In light of this, the BRI is not dissipating; rather, it is changing from being an economical application to a tool for foreign policy. China can no longer afford to finance such a large amount of system in the developing and emerging economies.

Political and diplomatic position, which suggests that the BRI does not require as many users but those who should be aligned, is what matters to China right now. Andnbsp, This is essential for advancing jobs and requirements that may encounter resistance from the US and the rest of the West. & nbsp,

In conclusion, the BRI is emerging as one of China’s main tools for advancing a more anti-Western mission. Some believe that the United States’ republican interest in halting China’s ascent toward ideology is the cause of this agenda. & nbsp, China began this race for others.

Realizing where we stand, which is essentially getting closer to a full-fledged warm war, is what matters most.

Senior research fellow at Bruegel is Alicia Garcia Herrero. Keep up with her on X @ Aligarciaherrer.

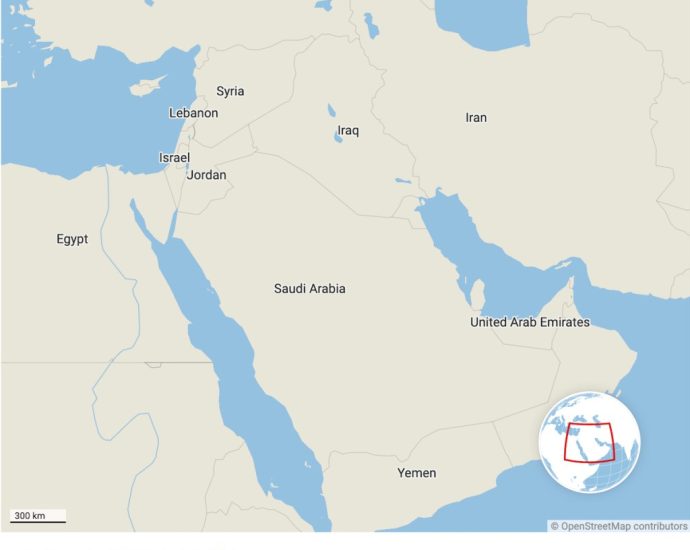

Saudi pause on Israel deal buys MBS needed time

When the Hamas strike on October 7, 2023, occurred, Saudi Arabia and Israel appeared to be on the verge of a historic agreement to restore their diplomatic relations.

Since therefore, thousands of people have perished in Israel and Gaza. Additionally, worries about the conflict spreading throughout the area serve as the backdrop for frantic politics in the area, which includes US President Joe Biden’s visit to Israel on October 18.

The” de-risking” of the area, a crucial component of Saudi Arabia’s foreign and domestic agenda, is also in danger of being undermined. A resurgence of local unrest is the last thing Saudi Crown Prince Mohammed bin Salman needs as he works to implement” Vision 2030 ,” an optimistic economic, social, and cultural software that aims to make the country a popular tourist and investment destination.

Undoubtedly, the rise in crime in the Middle East poses a problem to the new shift toward de-escalation of tensions across much of the wider region.

The Abraham Accords, which established political ties between Israel and the United Arab Emirates, Bahrain, and Morocco, were among those that were signed in 2020. However, it goes even further, resulting in the filing of a package in March 2023 to mend rivalries across the Gulf and recover Saudi-Iranian relationships.

Through initiatives like the India-Middle East-Europe Economic Corridor, which was unveiled at the G20 meeting in India in September 2023, these political breakthroughs created a place for increased local participation.

Officials from all over the area hoped that economic growth would combine the area and shift attention away from the failure to make progress in resolving the Israeli-Palestinian issue.

Gulf states are in danger of losing their delicate balancing act of supporting the Palestinian reason in front of their predominately Muslim communities while also making efforts to Israel and the US due to violence in Gaza and Israel.

For instance, Qatar has huge hosted Hamas’ political leadership while maintaining cordial relations with the US. It will probably now come under intense US and Jewish pressure to remove Hamas from power.

In 2020, the UAE, Bahrain, and Morocco both normalized ties with Israel. However, there has always been, at best, ambivalent public support for the Abraham Accords in the area, and it may then start to wane.

Dubai, the largest town in the United Arab Emirates, is preparing to host COP28, an international convention on climate change, beginning on November 30. The UAE won’t need a new geographical conflict to overshadow or endanger the event.

Saudi Arabia, however, is the place where the line is most precarious. This is due to the village’s spiritual status in the Islamic world, which includes guarding the two holiest sites of the faith, Mecca and Medina, as well as the ambitious raft of economic reforms it has implemented as part of Vision 2030.

Salman bin Abdulaziz Al Saud, the current prince of Saudi Arabia, has been a fervent supporter of Palestine his entire life. The campaign for Arab statehood has long been well-known in the Arab world.

However, the king lord, his son and heir, has grown more interested in speaking with Israel. This has culminated in discussions to” normalize” relations between the two nations, which may mark a turning point in Israel’s approval in the Arab and Muslim worlds.

Crown Prince Mohammed told Fox News that” every morning, we get closer” to a bargain since late as September 20. In fact, a number of leaking to US media in the days and weeks leading up to the Hamas strike suggested that the Biden administration was driving the formation of an agreement.

People performances and covert politics

However, the Hamas assault and Israel’s retaliation have shattered this momentum. On October 13, Royal sources informed the media that normalization talks had been suspended but never given up.

For communication is consistent with Royal efforts to strike a balance between domestic and foreign interests. The” Arab groups” and” Israeli occupation forces” were both urged to de-escalate in an original Saudi Foreign Ministry statement on October 7.

However, Saudi authorities were more willing to take sides during the first Friday worship at the Grand Mosque in Mecca following the attacks, with the state-appointed divine pleading for support for” our sons in Palestine.”

Behind the outward displays of support for Palestinians, there is proof that Saudi Arabia is attempting to lead diplomatic efforts to stop the conflict between Israel and Hamas from escalating into a larger blaze that could involve Lebanon, Iran, and other countries.

Crown Prince Mohammed and Iranian President Ebrahim Raisi had their first dialogue since the two nations’ relations were reestablished on October 12. They talked about the current events in Israel and Gaza.

In Riyadh, three days later, the crown prince welcomed US Secretary of State Antony Blinken amid reports in the media about the need for de-escalation and differences between Arabian and US jobs on the issue.

Such political actions are consistent with the queen king’s desire to” de-risk” the area. He is eager to see that nothing jeopardizes a number of” giga-projects” that have come to be known as Vision 2030, such as Neom, the futuristic new city on the Red Sea coast.

Saudi Arabia worries that a protracted or local conflict will discourage foreign funding in Vision 2030.

The success of the project was viewed as dependent on foreign funding. However, after dozens of top Arabian business figures were detained by the Saudi government at the Ritz-Carlton hotel in 2017 on suspicion of corruption, levels of foreign investment fell precipitously. The idea that their business associates may abruptly vanish or be upset alarmed traders.

Saudi Arabia must therefore bear a larger portion of Vision 2030’s prices themselves. This explains why Saudi officials worked with their Russian counterparts during OPEC meetings to maintain an oil price that would bring in enough money to support the projects.

Crown Prince Mohammed is determined to lessen regional tensions, including with Iran, because Vision 2030 is so closely linked to his promise to convert Saudi Arabia that he cannot afford for it to crash.

Saudi officials even recently launched a bid to host the 2034 FIFA World Cup and revised their plans to bring in 100 million customers annually by 2030, up to 150 million.

The Saudis want to expand the kingdom’s market away from an excessive reliance on oil, making it a destination for both capital and people. This is the driving force behind these initiatives. Another Center Eastern local conflict, particularly one that involved Iran, would jeopardize these goals.

playing the” standardization” cards

So where does the” normalization” of relations between Saudi Arabia and Israel begin?

It fits Crown Prince Mohammed’s meticulous balancing act to put the operation on hold for the time being. Full-speed travel would have put the area at risk of attack from various Arab and Middle Eastern says, undermining the” de-risking” process.

Additionally, it might give Saudi Arabia more utilize because Israel and the US may be careful to prevent the recent violence from completely derailing the process.

Given the outpouring of anger in the Muslim world over developments in Gaza, I contend that pausing the process now makes military sense for Saudi Arabia. It also gives the Royal leadership the chance to steer the next stage of what is still a very delicate endeavor.

Kristian Coates Ulrichsen is a Middle East Fellow at Rice University’s Baker Institute.

Under a Creative Commons license, this post has been republished from The Conversation. read the article in its entirety.

Thai workers killed in Israel attack repatriated

Officers would go see the families of deceased workers and tell them about the death benefits.

20 October 2023 at 12:20 PUBLISHED

Eight Vietnamese workers who had died in Israel since the Hamas assault on October 7 had their systems repatriated on a commercial aircraft on Friday night. They were then taken back to the regions where they were raised.

At 9:33 do, El Al Flight LY083 from Israel touched down in Samut Prakan province’s Suvarnabhumi aircraft with the body of the eight verified Thai people.

For a memorial service, graves containing the dying were positioned in front of the Customs Office’s Free Zone inside the airport.

On Friday, tombs carrying the body of the eight dying employees arrived at the airport in Suvarnabhumi. ( Image: Foreign Ministry)

The funeral services business Suriya subsequently provided trucks for the delivery of the coffins. Nakhon Ratchasima, Khon Kaen, Buri Ram, Chaiyaphum, Si Sa Ket, and Sukhothai each received one body, while two were intended for Udon Thani.

At Suvarnabhumi airport on Friday, a memorial service was held in honor of the eight Vietnamese employees who passed away in Israel. ( Facebook FM91 Traffipro )

The everlasting secretary for labor, Pairote Chotikasathien, announced on Friday that labor leaders in these provinces may pay a visit to the families of the deceased workers and let them know about the death benefits.

According to him, the Labour Ministry would immediately spend each family 40, 000 baht for funeral costs. To obtain the death rewards for each community, the government would also work with the Israeli government. Until divorce, the deceased’s wives would also get a monthly salary of 40, 000 baht, and until they turned 18 years old, each of their children may get between 8,000 and 12, 000 Baht per month.

According to Mr. Pairote, the Labour Ministry sent the stranded Thai staff in Israel about 4, 000 pieces of consuming water and dried foods. He continued,” The government may try to return both legal and illegal Thai staff from Israel as soon as possible.”

After boarding an Israeli air force duel on Friday, 136 more Thais return home. Varuth Hirunyatheb( picture )

The labor attaché in Israel had been instructed to act because this is against the law, Mr. Pairote said, regarding employees who were apparently forced to continue working by their organisations despite the ongoing conflict between Israel and Hamas.

The eight bodies were sent to Thailand on Thursday at 3.30 p.m.( Israel time ) at a ceremony held at Tel Aviv’s Ben Gurion International Airport.

Pannabha Chandraramya, the Thai embassy to Israel, Naruchai Ninnart, assistant director-general of the Consular Affairs Department, and the labor attaché at the Japanese embassy in Israel were all present to speak on behalf of their country during the meeting.

Michael Ronen, director-general of the Department of Asia and the Pacific, and Inbal Mashash, chief, were among the high-level Israeli officers present at the meeting.

After boarding an Israeli air force duel on Friday, 136 more Thais return home. Varuth Hirunyatheb( picture )

Dynamics of Sino-Indian economic relations

China’s importance in global business is largely due to its position as the second-largest economy in the world and its roughly 19 % contribution to the global GDP.

Foreign businesses find the American business appealing despite the political complexities, emphasizing the advantages of economic cooperation for both parties. The continued Chinese investments in India are proof of how interconnected the world economy is, which frequently goes beyond political disagreements.

It is clear that there is a delicate balance between national interests and financial opportunities, and both countries are still attempting to understand this precarious relationship in the name of shared economic development.

Envision, a Chinese firm, has emerged as India’s top wind turbine supplier, which is indicative of an overall trend of successful Foreign businesses making their level in different industries. This victory is not the only one; additional Chinese businesses in a variety of companies have used comparable tactics.

For instance, Goldwind, another Chinese manufacturer of original equipment( OEM ), recently claimed the largest market share worldwide, highlighting the achievements of Chinese businesses in the wind-turbine sector. Their leadership roles are influenced by competitive pricing, modern know-how, and early market entry.

shifting relationships

The need for countries to place themselves within the changing dynamics of international commerce is emphasized by the economic environment, which is marked by fierce international competitors. Due to international development and cutting-edge product offerings, Taiwanese businesses like Envision and Goldwind have achieved global success by securing sizable orders and growing their market share.

India’s intricate relationship with China, particularly in the area of technology, reflects a complex interaction between economic factors and security requirements. China’s impact in the Indian technology field is rooted in pre-existing collaborations and strategic partnerships, despite political unrest and bans on particular apps like TikTok.

India’s approach to technical collaboration may be rational, balancing security and economic concerns while allowing for some areas of cooperation while protecting important ones.

Additionally, while broader scientific collaboration may continue, the ban on particular apps may address urgent security concerns. This fluid relationship emphasizes the complex nature of the relationship between China and India, where strategic considerations and economic interdependence coexist.

Foreign investments in India have significantly increased since 2014, driven by a number of elements. China is attracted to India’s growing industry, particularly in businesses and technology, which is driving up the number of private equity investments. Political factors, like the China-Pakistan Economic Corridor, have increased China’s involvement in forging economic ties with its neighbors, which has an impact on its investments in India.

a wise purchase

Moreover, China is eager to capitalize on India’s technology and innovation sectors, which is motivating sizable new investments. Foreign companies effectively diversify their investments in response to changes in the world economy, and India has become a popular location for this diversification, bringing in tens of thousands of new investors.

India and China achieved a report bilateral trade size of US$ 135.98 billion in the prior year, an 8.4 % increase over the past month. This was despite underlying conflicts brought on by the military conflict in eastern Ladakh in May 2020. Two important improvements, though, could have a economic impact.

India’s silicon plans and industries may be disrupted if China implements export restrictions on chromium and germanium in July of this year. This could have an impact on the economy by raising prices and disrupting the supply chain. In response, India imposed import restrictions on notebooks and tablets in August to support domestic production in line with the” Make in India” program.

While this proceed aims to increase production powers, it could cause short-term disruptions, necessitating careful supervision during the transition period to reduce negative effects. The India-US Initiative on Critical and Emerging Technology and other strategic partnerships, such as domestic semiconductor manufacturing features, will have an impact in the long run.

Foreign investments in India most assuredly aim to diversify, gain access to a sizable consumer market, and position themselves strategically. Despite their political differences, the two countries’ economic interdependence is critical. These investments highlight the intricate nature of economic ties in the face of political challenges and may help India create jobs, transfer technology, and develop its economy as a whole.

Furthermore, the economic justification for Chinese investments goes beyond short-term profits. As a major international economic player in important sectors, China aims to expand its investment portfolio and secure proper positions. India is a desirable location for long-term investments due to its growing business, statistical income, and expanding middle class.

Despite geopolitical tensions, both countries are aware of the potential for shared financial advantages, which encourages ongoing funding and collaboration.

Due to increased worries about national security, the thorough analysis of Chinese funding proposals calls for careful attention. The government’s dedication to making sure that Chinese purchases, in particular, are in line with Indian security and economic needs is reflected in the investigation.

Additionally, the discussions surrounding Chinese funding proposals highlight how regulatory systems are changing as a result of geopolitical realities.

Political agreements, shared economic interests, and geopolitical challenges are all intricately entwined with the future of India-China business relations. New challenges China faces, such as the financial consequences of its zero-Covid policies earlier this year, add to the relationship’s complexity.

The current situation differs from traditional trends where changes in India-China business policies followed boundary tensions. A corporate strategy to challenge China’s hegemonic position in global trade is reflected in recent changes to trade policies.

India needs to put a varied approach into place, such as diversifying supply stores, fostering local business, and establishing strategic alliances. By reducing its emphasis on Chinese goods, India is protected from possible disruptions and given more authority over crucial elements.

Fostering local capabilities also supports India’s objectives of self-reliance in developing and sustainable economic growth. China’s financial difficulties have global ramifications, highlighting the importance of the India-China economic partnership and the need for cautious decision-making and proactive financial strategies to navigate complexities.

China’s GDP surprise can’t mask property mess

The unexpected rise in China’s gross domestic product ( GDP ) may provide more material for anthropologists than economists.

Spending on drinking and restaurants was one of the main use strengths, and it came at a time when some mainlanders may be excused for trying to drown their sorrows in the tumultuous real estate markets.

However, a strong dose of gravity is also necessary given the excitement surrounding the GDP’s 4.9 % increase in the three times that ended September year after year.

Despite strong retail sales, the data indicate that President Xi Jinping’s team has not yet made significant progress in its efforts to combat deflation and maintain the real estate market.

It hardly helps that economists like Louis Kuijs of S & amp and P Global Ratings point out price changes and government data revisions that could have raised third-quarter numbers. For instance, it is unclear how Beijing statisticians used producer price index calculations to account for poor business field prices.

Additionally, China announced the largest-ever decline in the value of regular exports, a move that may have been made to cover up commerce weakness as the world’s demand softened. The analytical adjustment makes annual comparisons seem more reliable because exercise is now being measured from a lower foundation.

The specifics of China’s most recent GDP data suggest that the state of Xi has more work to do to shorten GDP as investors worry about cooked books, whether intentionally or unintentionally. Additionally, the cash flows affecting island assets highlight the need to restore the property market, which can account for up to 30 % of GDP in prosperous times.

Economists are speculating about” Japanization” risks in Asia’s largest economy due to the intensifying drag in real estate and related default dramas. Property investment decreased 9.1 % year over year in the first nine months of 2023. Despite moves & nbsp’s decision to reduce the payment requirements for real estate purchases in the biggest cities in China in September, the contraction is speeding up.

In September, price drops in China’s new homes accelerated. Prices, excluding state-subsidized cover, decreased by 0.3 % in 70 towns measured starting in August.

According to Louise Loo, a China economist at Oxford Economics,” home measures remained extremely poor in September with no evidence of bottoming out.”

According to a recent report from S & amp, P’s credit analysts,” the low number of construction starts, an inventory overhang in lower-tier cities, and ever-tightening escrow restrictions will keep property sales depressed.”

Property designer Country Garden Holdings warned of impending doom this week amid rumors that it may have for the first time defaulted on dollar securities. According to economist Carlos Casanova of Union Bancaire Privée,” most of the financial downside may be traced again to contractionary house investment.” & nbsp,

China Evergrande Group is still having trouble restructuring its hundreds of billion dollars in onshore loan two years after it filed for bankruptcy. The trust of the home and the company is significantly hampered by deeper worries that developers lack the funds to finish their properties.

Economists predict that additional fiscal and monetary stimulus is on the method as a result. The business is” not out of the wilderness by any means ,” according to economist Stephen Innes, managing companion at SPI Asset Management, despite China’s second quarter figures exceeding expectations.

According to Innes, this progress portends a slight improvement in the Foreign market. To maintain steady progress, however, there are ongoing calls for more policy support due to worries about the recovery’s sustainability.

However, according to economist Zhang Zhiwei at Pinpoint Asset Management,” the advancement in fourth quarter financial data makes it less likely for the state to release signal in the fourth quarter, as the growth goal of 5 % is set to be achieved.”

The” financial recovery is still in its infancy ,” adds scientist Harry Murphy Cruise of Moody’s Analytics. The aspirin required to get over a property hangover may be provided directly to households, but this support seems increasingly doubtful.

The likelihood that China will reach its 5 % growth target this year is rising, at least statistically. UBS increased its forecast for mainland growth from 4.8 % to 5.2 % this week. JPMorgan raised its estimate from 5 % to 5.2 %.

However, UBS economists predict that the real estate business will only grow by 4.4 % in 2024. Additionally, the possibility of a Japan-like negative funk may make these numbers appear unduly upbeat.

Shareholders have been anticipating further price declines ever since July, when client rates turned negative for the first time since 2021. More new information only heightened concern about the negative consequences on consumer and business confidence.

According to economist Robert Carnell at ING Bank,” September’s inflation data remind & nbsp, us that, despite some recent firming in activity indicators, Chinese economic recovery remains challenged.”

That might entail more money coming in from the People’s Bank of China and sporadic financial outbursts from regional governments. To enhance the quality of national growth and lessen the frequency of boom / bust cycles, Xi’s team must, however, develop a stabler and more productive property sector.

According to Macquarie Group analyst Larry Hu,” home is the main concern.” According to Citigroup analyst Xiangrong Yu,” plan efforts may be stepped up moving forwards, especially for early next year, with focus on old-villain redevelopment, native debt resolution, financial expansion.”

The issue is that” at the moment, the economy is quite investment-heavy ,” according to Thomas Helbling, deputy director of the International Monetary Fund’s Asia-Pacific system.

The home problems and declining global demand were cited by the IMF as the two biggest obstacles looming over China in a recent report on the country. However, a development concept that promotes pointless loans is also true.

Beijing, according to Helbling, needs to level the playing field for private companies to engage with publicly traded companies. To promote intake and increase investments in knowledge and technology to increase efficiency, it must also create a robust social safety net, according to him. Changes to pensions are also essential to addressing China’s rapidly aging population.

There is a benefit to rise if you implement those changes, according to Helbling.

According to economist Betty Wang at Australia & amp, New Zealand Banking Group, immediate action is required to stabilize the property market and boost public trust. According to Wang, if more house buyers stop making payments, the pattern will threaten the financial system’s health and cause social problems in the midst of the current economic downturn.

When she tells Bloomberg that” when it comes to home, it’s about renewing trust on the ground ,” purchase director at Fidelity International, Catherine Yeung, speaks for some.

The wider Eastern region is also in immediate danger from China’s property issues. According to analyst Ed Parker at Fitch Ratings,” the emerging market rating outlook is healthy, but the decline in China’s nbsp, property & blb, market, and higher world bond yields are important downside risks.”

Parker points out that given the impact on global trade, commodity prices, and financial market conditions, the” slowdown in China’s & nbsp, property and nfspp, sector and downside risks to its GDP growth add to risks facing EM economies.”

A sudden halt to Chinese banks lending has also cut off a crucial source of funding for many EMs, and China’s differing perspectives from different creditors on debt restructuring are delaying the signing of agreements.

All of this is not taking place in a void. Foreign developers are increasingly in danger as US authorities bond yields reach 17-year peaks. as is the larger Asia place.

According to Fitch, from 8.3 % in 2022, the emerging market median general government interest-revenue ratio will rise to 9.5 % and 10.3 %, respectively, by 2023 and 2024. According to” Parkers ,” higher-for-longer US bond yields run the risk of a greater and more persistent increase in funding costs. The pressure on finances amounts is increasing due to higher interest payments.

According to Parker, the risk in the future is that” governments will need to tighten fiscal policy to run smaller primary deficits in order to stabilize government debt / GDP, other things equal.”

No matter how near it gets to 5 %, whether for real or just statistically, this will be as big a problem for China as anywhere else. The world’s second-largest economy may experience quick business for watering holes due to the weak real estate sector, which will be at the middle of it all.

Follow William Pesek on X, formerly Twitter, at @ WilliamPessp.

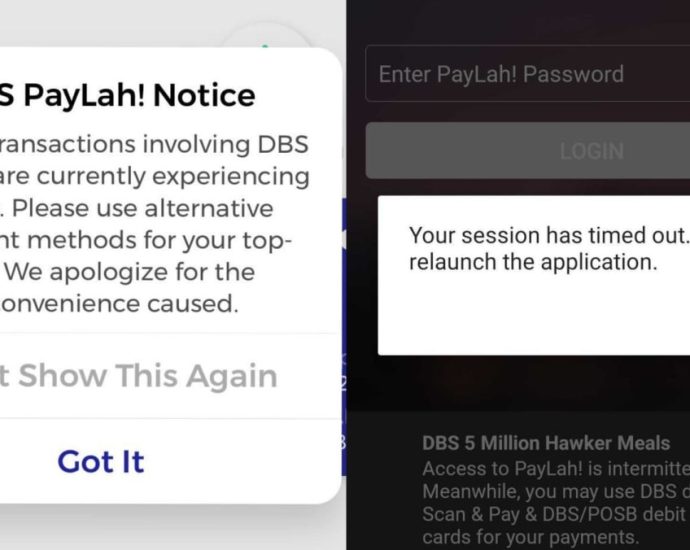

DBS PayLah! services back to normal after users report login issues

However, some people were harsh in their comments, some of which noted that the app’s impact prevented them from making payments.

” Never once more. One person claimed that he was unable to log in to pay for his cab fare.

How does we” get contactless” when our technology may keep up, asked another person who claimed that people were waiting behind him as he struggled to make payment?

After DBS’s disaster on next Saturday, I wanted to give them another chance, but I didn’t even wait a week and kept running into issues.

People were less essential, with some expressing gratitude to the lender for the information.

We can still use credit cards and digibank, so it’s not a big deal, according to one customer.

DBS and Citibank reported hours-long problems to their banking and payment service on Saturday evening. & nbsp,

Equinix, the supplier of data centers, claimed that a” technical problem” at one of its Singaporean centers caused some customers’ operations to be impacted.

It further stated that it is carrying out a” complete analysis” into the event.

On Thursday, the Singaporean Monetary Authority ( MAS ) announced that it had given DBS and Citibank the go-ahead to launch” a thorough investigation” and that, once the necessary information had been gathered, it would take the appropriate supervisory action.

US ban targets ASML after Huaweiâs chip advance

If Chinese buyers want to use deep ultraviolet ( DUV ) lithography equipment to produce high-end semiconductors rather than mid-level ones, ASML, the largest manufacturer of chip-making equipment in the world, will be prohibited from shipping it to them. & nbsp,

According to ASML Chief Executive Peter Wennick, the United States’ new export rule then allows for restrictions on the NXT: 1980Di tool, which is not subject to French export licensing regulations. The majority of other Chinese device manufacturers can continue to buy the DUV tool, he continued, adding that only a small number of Chinese factories may be impacted by the new rule. & nbsp,

After China’s Semiconductor Manufacturing International Corp( SMIC ) allegedly produced 7nm chips for Huawei using ASML DUV lithography and its own N 2 processing technology, the Netherlands government imposed the export ban. The Kirin 9000s device made its debut in Huawei’s Mate60 Pro smartphone in late August.

The NXT: 1980Di was intended to produce 38nm cards, but it can also offer more than 90 % when exposed to numerous risks. On the company’s website, ASML describes it as” a high – productivity, dual-stage immersion lithography tool.”

After the US announced new sanctions against Chinese chip manufacturers on Tuesday, ASML’s Nasdaq-listed shares dropped 4.17 % on October 18. & nbsp,

Although the US curbs may reduce ASML’s revenue to China by 10 to 15 %, Wennick predicted that require from Chinese device manufacturers would be solid. He claimed that in the third quarter, 46 % of ASML’s total sales were made up of supplies to China.

He said,” I don’t think we’ll see a peak this year, but I do believe there will be an enormous amount of demand for mature technology coming out of China.”

various devices

On June 30, the French authorities announced that ASML would need to submit an export license application for the shipment of its DUV printing techniques, including the NXT: 2000i and later soaking techniques. & nbsp,

As a result, Chinese device manufacturers may still be able to purchase NXT: 1980Di, an older model. The trade rule’s productive meeting was initially set for September 1 but was later moved to the conclusion of this year. & nbsp,

But after Huawei unveiled its Mate60 Pro on August 29, fresh disputes started to surface.

On October 4, US Commerce Secretary Gina Raimondo declared that studies of Huawei’s device find were” very disturbing” and that her office needed more resources and tools to enforce the ban and close any gaps.

Finally, ASML was told to stop sending NXT: 1980Di to Chinese factories that planned to use it to produce high-end cards. & nbsp,

Although its output range may be constrained, some analysts predicted that the blacklisted SMIC and Huawei could potentially still supply NXT: 1980Di from the secondary marketplace to produce 7nm chips.

A Shanghai-based critic using the pen name Zhu Ting writes in an article that” printing is a pain point of China’s chip supply chain because it contains superior visual and higher precision parts that China may provide itself.” ” There is a long way to go before China is fully self-supply its chip-making technology.”

But, Zhu claimed that in anticipation of additional US restrictions, device manufacturers like SMIC and Huahong Grace Semiconductor Manufacturing Corp. have taken the initiative to order local manufacturers in recent months.

Despite not producing printing, she claims that regional providers like Advanced Micro-Fabrication Equipment Inc. and Naura Technology Group Co Ltd have benefited from this pattern.

E – sporting enthusiasts

Advanced artificial intelligence ( AI ) chip exports are also prohibited, and 13 Chinese AI chip design firms and distributors have been sanctioned as part of the latest round of US export restrictions against China’s chip industry.

As their AI chips are allegedly used to create” weapons of mass destruction, advanced weapons systems, and high-tech surveillance applications that create natural security concerns ,” the US Commerce Department announced that it will add Beijing Biren Technology, Moore Thread Intelligent Technology and their related firms to its” Entity List.”

Moore Thread and Biren both stated that they vehemently disagreed with the US choice.

In a stock exchange processing on Tuesday, US chipmaker Nvidia announced that it would no longer be able to ship A800, H800s, L40S, and RTX 4090 bits to China. Its DGX and HGX techniques will also be covered by the new regulations, which may take effect in 30 days.

According to media reports, the new US export restrictions may even prevent AMD from selling the Instinct MI300 and Intel’s Habana Gaudi 2.

The US limits does encourage foreign buyers to look elsewhere, according to the Semiconductor Industry Association, which represents US device manufacturers.

According to a Financial Times report from August 8, Chinese tech behemoths Baidu, Alibaba, and Tencent just ordered A800 bits from Nvidia valued at US$ 5 billion. & nbsp,

While the trade restrictions on the A800 and H800 chips was to be expected, China’s e-sports fans were shocked to learn that the sale of RTX 4090, one of their favorite graphics cards, was also prohibited. & nbsp,

Some retailers set their RTX4090 stock prices on Wednesday at 50, 000 renminbi($ 6, 837 ) each, down from the official estimate of about 13, 000.

Study: US to tighten its grip on China’s entry to Intelligence chips

At & nbsp, @ jeffpao3 is Jeff Pao’s Twitter account.

President Tharman spent over S$700,000 on election campaign, highest among candidates

SINGAPORE: According to candidate statements made public by the Elections Department( ELD ) on Friday, October 20, President Tharman Shanmugaratnam spent S$ 738, 717( US$ 540, 000 ) in his campaign for the presidency.

Among the three individuals, his vote costs was the highest. It cost Mr. Ng Kok Song, who spent Mho$ 312, 131, more than twice as much as it did Tan Kin Lian, S$ 71, 366.

For this presidential election, each candidate was permitted to invest up to Mho$ 812, 822.10.

According to ELD guidelines, each registered voter’s spending limit is & nbsp, S$ 600, 000, or 30 cents, whichever is greater. There were 2 709 and 407 voters.

Previous Senior Minister Mr. Tharman won by a landslide in the September 1 crown, garnering 70.4 percent of the vote. Tan Kin Lian received 13.88 percent of the ballot, while Mr. Ng received 15.72 percent.

THE Wealth AND HOW IT WAS SPENT

Non-online poll advertising, which cost up to S$ 481, 226, was Mr. Tharman’s highest expenses. This was primarily used for printing and posting posters as well as banner and advertisements.

His next-highest consumption was South$ 141, 865 for online election advertising, which also included spending on his campaign website, social media, and local leader interviews.

Additionally, Mr. Tharman spent S$ 300 on ELD’s expulsion of six plan posters, banners, and colors that broke election regulations.

One of the substances was displayed on a tree without the National Parks Board’s permission, and five were placed within 50 meters of polling places. They were taken out on August 31st, Cooling Off Day, and on September 1, Polling Day.

Mr. Tharman held an election meet at Pasir Panjang Power Station and spent S$ 8, 640 to rent the space, even though there were no gatherings this season.

The majority of expenses for the other two candidates also came from poll marketing.

Mr. Tan spent almost S$ 70,000 on offline marketing but only South$ 20 on online. The majority of the funds were used to print advertisements and pay for their labor and transportation.

According to TODAY, his overall spending is comparable to that of his first run for president in 2011, when he spent close to S$ 71,000.

Just Mr. Ng was chosen to spend more money on online marketing. He spent S$ 280,800 on it as opposed to substantially more than S$ 1,000 on offline marketing.

Mr. Ng stated that he would not post banners and posters while running his campaign because, due to a lack of the necessary manpower resources, it would be more responsible to do so.

Social media management and analysis, guest appearances on podcasts and talk shows, and film production were some of his net advertising expenses.

Ed Sheeran to hold Singapore concert on Feb 16, presale starts on Oct 27

Prepare to appearance flawless as you sing aloud at Ed Sheeran’s music on February 16, 2024. The Grammy Award-winning song is traveling to Singapore for a one-night performance at the National Stadium. Additionally, he is hosting English song Calum Scott.

Tickets for the music can be purchased at SingPost locations and through Ticketmaster for between Mho$ 88 and South$ 488.

Here’s some fantastic information if you registered for a UOB cards for Taylor Swift at the concert and didn’t cancel your membership afterwards. UOB users can take advantage of a tickets from 10am on October 27 through 9:59 do on Oct 29.

Members of the KrisFlyer team may attend a second tickets from 10 am to 9:59 am on October 31. KrisFlyer UOB credit and debit users will need to take in order to access this tickets, and SIA Group promotional messages will be sent to them according to the interests of their KrisSlyER account. On October 27, KrisFlyer may send them a special access code via internet. & nbsp,

Between October 20 and 25, members who do not have KrisFlyer UOB credit or debit cards is get the SIA Group’s life rewards app, Kris , and travel 150 miles to earn a special access code. Please be aware that only the first 110, 000 users may redeem.

Alternately, starting on October 30, those with a lot of extra miles can choose to use their miles to save Category 1 to 4 music cards. Cards in Categories 1 through 4 may be redeemed for 49, 000, 38, 00, 29, 000 and 19, 000 yards, respectively.

The general price will start on October 31 at 11 a.m.