Ficus Capital leads the charge into Web3 with investment in Morpheus Labs

- Expanding into Malaysia and Indonesia will be fueled by cash.

- Additionally, Startup Five Investment participated in the pre-agreement as an beginning trader.

Ficus Capital, an ESG-compliant Islamic venture capital firm, has announced a strategic investment of US$ 430,000 ( RM1. 9 million ) in Morpheus Labs, a Singapore-based AI-powered Web3 implementation program, as part of its Pre-A money square.

This expense, made through Ficus’s premier Ficus SEA Fund, aims to support Morpheus Labs in simplifying bitcoin execution, enabling businesses and developers to create, deploy, and control decentralised applications more quickly. By reducing time-to-market and streamlining processes, Morpheus Labs is driving development in the Web3 place.

According to Custom Market Insights, the world Web3 market is projected to grow from US$ 4. 8 billion ( RM21 billion ) in 2021 to US$ 69 billion ( RM30 billion ) by 2030, at a compound annual growth rate ( CAGR ) of 68 %, underscoring the rapid expansion and opportunities in this sector.

Rina Neoh, managing partner of Ficus Capital, said: “Our funding in Morpheus Labs reflects our opinion in the transformative potential of Web3 and our trust in the business ’s ability to lead this trend. Their extensive software and ecosystem-first approach align with our vision of fostering green, flexible, and effective industrial solutions. ”

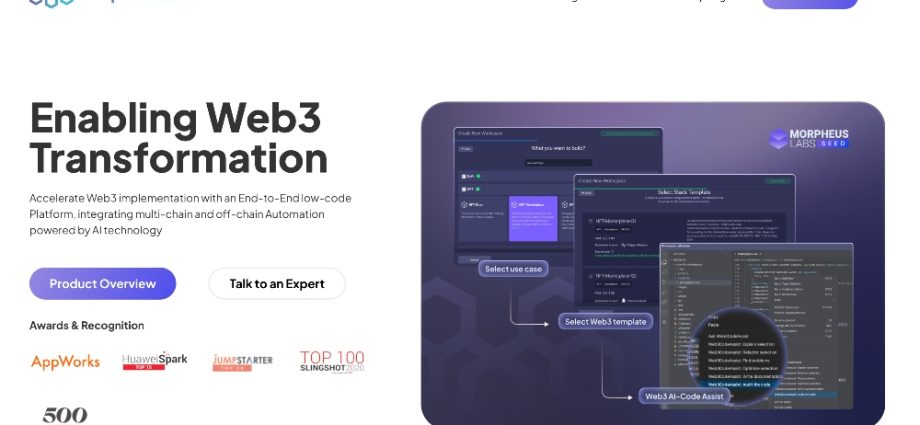

Morpheus Labs is an award-winning head in the Web3 room, offering an AI-powered software that simplifies Web3 deployment for firms and designers. Its essential features include:

- Smart Contract Studio, which makes it simple to use AI to create intelligent deals.

- Workflow Studio, a drag-and-drop resource for integrating Web3 capabilities into existing systems.

- In order to speed up the creation of decentralized applications (dApps ), Web Studio ( UI/UX) offers customisable templates.

Pei-Han Chuang ( pic ), founder and CEO of Morpheus Labs, said: “Ficus’s investment is pivotal in fuelling our growth and expanding our capabilities in the Web3 space. With their help, we are also expanding into important markets like Malaysia and Indonesia, where a fresh, tech-savvy community is driving online implementation.

Pei-Han Chuang ( pic ), founder and CEO of Morpheus Labs, said: “Ficus’s investment is pivotal in fuelling our growth and expanding our capabilities in the Web3 space. With their help, we are also expanding into important markets like Malaysia and Indonesia, where a fresh, tech-savvy community is driving online implementation.

“Ficus Capital’s responsibility as an ESG-i VC aligns completely with our objective to encourage decentralisation and diversity. As we strive to provide visible and sustainable bitcoin answers, their emphasis on Shariah-compliant ESG investing is in sync with our principles. Additionally, Ficus’s involvement in this round enhances our access to the Malaysian market and its growing technology ecosystem, ” he added.

In addition to Ficus Capital’s purchase, Startup Five Investment, a store account and part of AVA Angels specialising in electronic change, ESG, and Web3 investments, has even joined the Pre-A round as an early investor, following Ficus’s lead. Chuang is investing alongside both firms, reinforcing confidence—both internal and external—in Morpheus Labs ’ potential to transform Web3 development.

Jeffery Yang, managing partner at Startup Five Investment, said: “We are excited to support Morpheus Labs as they shape the future of Web3 technology. Their platform’s cutting-edge features and seamless integration align perfectly with our investment strategy, and we believe this partnership will drive significant innovation in the Web3 ecosystem.

In addition, we are pleased to make an investment in Ficus Capital, a reputable venture capital firm in the ESG and Shariah-compliant space, furthering our shared commitment to supporting sustainable and impactful technologies. ”

With this strategic investment, Morpheus Labs is poised to accelerate its growth and innovation. It has already secured a key collaboration with Viu, PCCW’s leading pan-regional OTT video streaming service, to pioneer new Web3 experiences for users and content creators. By leveraging blockchain technology, this partnership aims to enhance content monetisation, digital rights management, and user engagement across media platforms.

We are excited about the opportunities that lie ahead, Chuang continued. Together, we can unlock new potentials in the Web3 space, expanding our platform’s scope and accelerating blockchain adoption in the entertainment industry.

“With our AI-powered platform, we are empowering businesses to build and scale blockchain solutions more efficiently. This collaboration marks a significant step in the direction of redefining digital experiences for users and creators all over the world. ”

Alibaba making China tech investible again – Asia Times

Alibaba Group’s headline-grabbing protest tops off what’s been an extraordinary month for Chinese tech companies.

In late January, the sudden appearance of made-in-China synthetic knowledge game DeepSeek pulled the rug out from under Wall Street’s” Trump business” group. Bettors predicted that US stocks would explode as a result of the US President Donald Trump’s plans.

Trump’s eagerness for AI, which he and his patron Elon Musk, contributed to the excitement. Trump punctuated the place on January 21, when he stood shoulder-to-shoulder with OpenAI’s Sam , Altman, Oracle’s Larry Ellison and SoftBank’s Masayoshi Son at the White House to light a , US$ 500 billion  , Al network project.

Weeks later, it seemed like old hat as DeepSeek’s claim caught world markets off guard. Its cost-effective AI model using less advanced chips precipitated a nearly$ 600 billion selloff in , Nvidia’s shares , alone — history’s biggest corporate loss in market capitalization.

Then Alibaba is again on the international scene with an passion that’s even caught global investors off-guard. It includes a large force into Al, in which Alibaba is investing confidently.

The business Jack Ma co-founded claims to have invested more than$ 53 billion in data centers and other AI system projects. Apple, nevertheless, is incorporating Alibaba’s Artificial services in handsets sold in China.

But Alibaba’s march might have arms for an even bigger purpose: Xi Jinping’s selection to, in the words of scholar Stephen Jen, “make Chinese equities investible again”, starting with software platforms.

Jen, CEO of Eurizon SLJ Asset Management, says that “in some ways, this is a call for a extended bounce-back in a long-depressed and unhappy business. However, there are now many more reasons to get good than bad about Chinese stocks and China in general.

After Trump called for greater scrutiny of international companies listed in the US, Alibaba’s wave hit a speedbump on Tuesday, along with Taiwanese technology companies in general.

But from Jen’s perspective, Chinese stocks will remain on roll for reasons including: regulation easing, signs the property sector is ultimately bottoming to support better consumer sentiment, the resilience of Chinese bonds and the yuan, a serious misjudging of China’s manufacturing and industrial prowess, low valuations, and signs the world remains thin Chinese assets.

Xi’s meeting with Ma and other mainland tech founders last week helped, too. Following Xi’s crackdowns, which started with Ma’s fintech tycoon Ant Group, China’s tech scene has been in a state of corporate limbo since late 2020.

Ostensibly, Ant’s planned$ 37 billion listing was scrapped after Ma criticized Beijing, suggesting policymakers don’t understand technology. Ma alleged that regulators were stifling innovation and that banks were having a “pawnshop mentality” in a speech delivered in Shanghai.

First, Ant’s initial public offering was pulled. At the time, it would’ve been history’s biggest. Next, Xi’s financial regulator put under a microscope a who ‘s-who of tech giants: search engine Baidu,  , ride-hailing giant , Didi Global, e-commerce platform JD.com,  , food-delivery Meituan and gaming colossus Tencent, among others.

Ma effectively entered a political exile. Last week, when Xi invited Ma and other tech billionaires to a gathering that would put Chinese technology back in the ascendancy, that appeared to change. Ma sitting in the front row and Xi shaking his hand caused investors to sift into mainland shares with an unprecedented enthusiasm.

The scene suggested that “one of the world’s greatest living entrepreneurs” is “back into the good , graces”, says analyst Bill , Bishop, who writes the Sinocism newsletter. Bottom line, he says, “it’s an encouraging signal for private businesses”.

Daiwa analyst Patrick Pan notes that “from a long-term perspective, we turn more positive on the outlook for the China stock market”. China’s recent tech breakthroughs and pro-business pivot, he says, are “game changers for China stock prices”.

In March 2023, Alibaba unveiled the , biggest restructuring  , in its 26-year history, splitting into six units and exploring fundraising or listings for most of them. At the time, Alibaba said the strategy is “designed to unlock shareholder value and foster market competitiveness”.

The six units included: domestic e-tailing, international e-commerce, cloud computing, local services, logistics and media and entertainment.

The market is the best litmus test, according to former Alabaster CEO Daniel Zhang, who remarked two years ago, and each business group and company can launch independent fundraising and IPOs when they are ready.

The enterprise was bigger than Alibaba, though. It served as a case study of sorts for China Inc. as Xi’s regulators attempted to mitigate risks and halt monopolistic tendencies among tech giants.

Given that Xi and Premier Li Qiang both claim that they want private companies to create more jobs and boost a troubled economy, the situation is quite a balance.

Ma’s Alibaba was an obvious place to start. It has long been a global representation of China’s tech goals and a symptom of Beijing’s tolerance for tech billionaires spreading their wings.

Now, after years of uncertainty, says Daniel Ives, analyst at Wedbush Securities, Alibaba just “delivered an inflection point quarter”, led by a stronger-than-expected cloud business and an expanding AI push that could represent the “next gear of growth”.

AI is” the kind of opportunity for industry transformation that only comes around only once every few decades,” as current Alibaba CEO Eddie Wu put it last week.

Wu added that” when it comes to Alibaba’s AI strategy, we aim to continue developing models that extend the boundaries of intelligence” and that AI may eventually “have a significant influence on or even replace 50 % of global GDP”

When it comes to cheap Chinese valuations, Alibaba could be Exhibit A. While some profit-taking might happen, the company is still trading between 35 % to 40 % below past highs.

However, Alibaba is under increasing pressure to act in order to validate investors ‘ bullishness.

According to HSBC Holdings analyst Charlene Liu, “fundamentals will have to be back in focus” in order to increase stock prices. Alibaba shows” a clear strategy to monetize AI and accelerate cloud revenue growth and margin improvement,” as evidenced by increasing its e-commerce market share.

The real onus, though, is on Team Xi to convince global investors broadly that China’s “uninvestable” days are over for good.  ,

Over the last dozen years of Xi’s leadership, Beijing has too often slow-walked moves to strengthen capital markets, reduce opacity, scale back the role of state-owned enterprises, build a globally trusted credit rating system and increase regulatory certainty.

Clearly, the return of Hangzhou-based Alibaba to favor in Communist Party circles may be its own inflection point.

Recently,” Hangzhou’s innovation model has been lauded for fostering numerous superstar technology startups, dubbed the’ Six Little Dragons’ in markets”, says Carlos Casanova, economist at Union Bancaire Privée.

This, Casanova says,” suggests China may be preparing to adopt a Hangzhou-style model that promotes both hard technology and high value-added software and services in its upcoming 15th Five-Year Plan, expected to be unveiled this October. Although we won’t know for certain until the draft is made public, it appears that China is gearing up for a strategic turn in 2026.

However, it will be simpler to persuade global funds that the multi-year tech inquisition is over. Although handshakes and rhetoric are acceptable, it is more crucial to end the regulatory chaos that has persisted recently.

According to Jeremy Mark, senior fellow at the Atlantic Council,” this will take much more than optimistic pronouncements to restore confidence after months of undelivered promises.” Beijing has long sought out foreign institutional investors, but this uncertainty is unsettling.

The volatility of recent months, though”, has given Chinese officialdom greater incentive to pursue a tightly regulated, less volatile stock market — one in which the likes of insurance companies, pension funds, and other government-run behemoths hold sway over individual investors,” Mark says.

The order of the day, Mark adds”, will be to encourage long-term investments in large companies by offering bigger dividends, share buybacks, and — ideally—steady profit growth. ”  ,

Of course, some people believe that concerns about market structure are overshadowed by the attractiveness of mainland valuations.  ,

” Since January, the rally in the Chinese tech sector has been stunning, though the overall A-Shares market has not risen much,” says Jen of Eurizon SLJ.

Companies outside the tech industries are trying to do the same, just as Chinese tech companies are actively looking for ways to harness the power of rapidly advancing AI. Chinese companies are generally very eager to adopt the best technologies, especially if they are cheap.”

When the” Magic Seven” is so expensive, Jen adds,” Chinese equities ought to be in good standing if the collective’I Q’ of Chinese manufacturing can keep up with the best in the world.” ” The seven companies mentioned here are Apple, Microsoft, Google parent Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla.

The argument isn’t always clear-cut. As mainland stocks surged last week, so did Nvidia’s.

By the start of this week, the California-based company had recovered roughly 90 % of its market valuation losses. It’s a reminder that the AI boom is no particular nation’s to lose. And that Beijing’s desire to keep control might conflict with the success of disruptors like DeepSeek.

According to Bank of America analyst Vivek Arya,” The stock may be volatile following results, but we anticipate positive momentum to resume as investors look forward to Nvidia’s leading new product pipeline and total addressable market expansion into robotics and quantum technologies at the upcoming]Nvidia ] conference.”

The macroeconomic backdrop matters, of course. The upcoming Trump trade war and the high chances that they will cause inflation are still a source of uncertainty for the world.

” The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices,” says Chris Williamson, chief economist at S&, P Global Market Intelligence.

Companies, Williamson says”, report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments. He states that the outlook for the rest of 2025 has shifted to “one of the gloomiest outlooks since the pandemic.”

Despite this, there is growing hope that Team Xi’s efforts to batten down the hatches and its exportation to global South nations will lessen its vulnerability to Trump’s bullying than many people had predicted.

China Inc. is also demonstrating that it has some serious game on playing fields Trump World takes for granted, and not just AI. Chinese biotech companies are exhibiting signs of developing drugs more quickly and affordably than their American competitors.

At the same time as Trump is empowering Tesla billionaire Musk to launch a disaster against America’s scientific research institutions, this includes cancer drugs.

In the case of Alibaba, though, investors are hoping Beijing’s multi-year battle with Chinese tech is officially over. To validate this optimism, Team Xi will need to make sure changes are being made so that the big meeting internet platform from last week is more than just a photo op.

Follow William Pesek on X at @WilliamPesek

Wilmar’s staff canteen has S$7 all-you-can-eat cai png buffet with fried chicken, is open to the public

You can also buy frozen ingredients like fried chicken nuggets, garlic breads, meatballs and buns. There are also small chillers with ice cream, such as a mini-Magnum bar, and fresh fruits like XL-sized oranges ( S$$ 2 each ), too. Hope slightly different options for each day given that the offerings here appear to differ based on available space and a revolving menu.

WHQ Canteen is at 28 Biopolis Road, Level 4, Wilmar International HQ, Singapore 138568. Open Mon-Fri 8.30am to 5pm ( last order at 4.30pm ).

This article was first published in 8Days.

For more 8Days stories, visit https ://www.8days .sg/

Newborns at KKH may receive loaned car seats under new road safety programme

More than half of the children and adolescents who were injured in a road traffic accident were not in a baby car seat at the time of the incident, according to a study conducted on Tuesday by KKH. A subsequent study on the use of children’s car seats and restrictionsContinue Reading

Japan’s popular thrift retailer 2nd Street to open first Singapore outlet at 313@somerset in April

Japan’s well-known utilize buy 2nd Street is set to open its first store in Singapore at 313@somerset in end-April, with over 22, 000 customized prudence parts from Japan.

The 6, 198 sq ft channel may extend from units B1-23 to 34, replacing garments keep Pomelo, which formerly occupied that space in the mall. It does start regular from Monday to Sunday, 11am to 10pm.

With 881 shops in Japan and almost 1, 000 businesses international including 48 in the US, 23 in Malaysia, 38 in Taiwan, four in Thailand, and one beginning in Hong Kong, 2nd Street offers a wide range of second products including clothing, bags, equipment and household goods.

Philippines: EDSA, Marcos Jr and the risk of forgetting – Asia Times

Every February 25, the Philippines commemorates the EDSA People Power Revolution—an function that toppled a dictator, restored politics and became a worldwide mark of quiet weight.

In 1986, thousands of Filipinos from all walks of life took to the streets, driven by a shared desire for shift. They came armed not with arms but with confidence, prayer and perseverance.

Clad in golden bows and carrying necklaces, they faced down tank and troops, their chants echoing through the money. The action was a testament to the resolve of regular people to free their country from autocratic rule.

This trend did more than just reduce a tyrant; it also established democratic institutions, reinstated free votes, and promised a government that was accountable to the people.

Beyond the Philippines, it sent a strong message that could help other countries fight tyranny. The uprising’s violent character established its place in history, demonstrating that a change may be achieved without using force.

However, as the centuries passed, the strong energy that again filled EDSA has waned. The roads that were once crowded with activists have become less noisy. The annual ceremonies persist, but with a visible reduction in cooperation.

Although the People Power Monument is still in use, its supporters are declining as a result. The recollection continues, but it has lost much of the fervor and intensity that were present in the period immediately following the trend.

The irony of the EDSA memorial has since become unfathomable: the state that recognizes it is now led by the deceased family.

President Ferdinand” Bongbong” Marcos Jr., the son of the late tyrant Ferdinand Marcos Sr., is in charge of a country that previously rejected his father’s rule in an unprecedented show of social power.

Since Marcos Jr. became president in 2022, his administration has veered cautiously to the EDSA memorial. The current government has chosen to follow a more subdued strategy than previous administrations, which included holding huge events, making strong statements, and yet holding wreath-laying rites at the People Power Monument.

Official claims acknowledge the time, but they lean on topics of “unity” and “moving ahead”, avoiding direct references to the republic’s value.

In fact, Marcos Jr. actually removed February 25 from the roster of national holidays in 2023.

Proclamation No. Conspicuously omitting EDSA People Power as a unique non-working trip, 368, which downgraded its significance in the regional calendar.

Despite the negative people effect, it remains the same this time, as Proclamation No. 727 declares EDSA a unique working vacation. This move farther signaled the president’s silent effort to push EDSA into the history of national consciousness.

This shift in tone is not sudden. It reflects the difficult balance of a Marcos president, which allows acknowledging EDSA without supporting its fundamental message.

After all, to fully accept the significance of EDSA would mean to forgive the Marcos family’s history mistakes, which they have consistently dismissed or blatantly denied.

A government that regards EDSA as a traditional event but does not reconfirm its aspirations is a paradox that defines the current political climate.

But is simple confirmation enough? Or does reducing EDSA to a program, depoliticized event diminish its real meaning?

Eroding EDSA’s tradition

Celebrations are more than just ceremonies, they are functions of social memory. They affirm the principles that a country maintains and serve as reminders of lost fights for its citizens. But over time, the way a nation remembers an event is change—either through continuous indifference or deliberate sophistry.

In the case of EDSA, both causes seem to be at enjoy. On one hand, there is the normal passage of time. The revolution took place roughly four decades ago, and many of those who took part in it have passed away.

For younger generations who did not experience the tyranny, EDSA is not a specific experience but a traditional account, which is extremely up in the modern era.

On the other hand, there is the effective rewriting of history. The Marcos family has spent years attempting to change consumer perception through social media, social effect, and even legal actions.

The dictatorship’s years in power, when widely regarded as a time of persecution and financial mismanagement, are then painted by some as a “golden age”. Traditional facts —such as human rights abuses, fraud, and cronyism—are dismissed as mere social problems.

The deterioration of EDSA’s tradition is most visible in public opinion. A growing number of Filipinos, especially the youth, show frustration with the revolution.

Some see it as a failed claim, pointing to frequent poverty, corruption, and injustice. People believe it was an exaggerated function, exaggerated by its recipients. This despair has made a fertile environment for reactionary narratives to emerge, allowing the Marcos family to regain control through political means.

Does it matter if the social remembrance of EDSA disappears? If Filipinos little longer see it as related, does that reduce its value?

The solution lies in what EDSA absolutely represented. It was never really about toppling a dictator—it was about restoring democratic organizations, ensuring responsibilities, and preventing the transfer of autocratic rule.

To ignore EDSA, or to decrease it to an annual note, is to undermine the pretty safeguards it fought to restore.

Politics is no self-sustaining. It requires attention, active involvement, and a devotion to truth. When background is forgotten or distorted, the same faults become easier to repeat.

Current and upcoming abuses become more simple to defend when history abuses are dismissed as misconceptions. The EDSA’s rules are being broken, but today’s failure to uphold them puts the future in danger.

What EDSA may suggest currently

A Marcos administration that oversees EDSA anniversary celebrations should not just be an unpleasant contradiction; it should also be a time for reflection. If the trend is to be related, it must be understood beyond its metaphor.

EDSA was never a perfect trend. It did never miraculously resolve the most pressing issues in Spanish society, nor did it maintain long-term reform.

However, it demonstrated that social activity has energy. It showed that ordinary individuals, when united, you hold the powerful responsible. That session may be learned over time.

Instead of being seen as a locked chapter in history, EDSA must be seen as an empty struggle. The battle for transparency, good governance and human rights did not end in 1986 —it continues today.

And in a social environment where the majority of the country’s energy is still largely in the hands of the elite, where record is constantly rewritten to fit the ruling course, and where democracy is constantly under scrutiny, EDSA serves as a reminder that the people still have the authority to determine the future of their country.

In a time when people want to ignore EDSA, remembering it is more than just marking a day on the calendar; it is also important to protect the lessons from history from intentional erasure.

The reduction of standard commemorations, the fall of reactionary narratives and the public’s growing separation from EDSA all stage to a dangerous reality: when traditional truths are left undefended, they become pliable to the whims of those in power.

As the storage of EDSA fades in the regional consciousness, we may ask—what happens when a nation chooses to ignore its own revolution? And more importantly, who benefits when we do?

The Marcos administration must do more than just acknowledge EDSA on the calendar if it truly respects it. It must uphold the democratic principles that EDSA stood for: truth, accountability and justice. Anything less would make every February 25 hollow ceremonial, one that honors a cause without actually honoring it.

Chalize Penaflor, 24, is a policy researcher, intersectional feminist and human rights advocate. She received her BA in sociology from the University of the Philippines and concentrates on legislative research, policy analysis, and program evaluation in the public sector.

Indonesia arrests top executive of state-owned oil and gas firm, 6 others in US$12 billion corruption scandal

In connection with a US$ 12 billion crude oil corruption scandal, one of the top executives of a subsidiary of the nation’s state-owned oil and gas company, Pertamina, was detained on Monday ( Feb 24 ).

According to the Jakarta Globe, Riva Siahaan, who is the president and chairman of Pertamina Patra Niaga, the company’s income division, is one of the seven people listed.

Executives from Kilang Pertamina Internasional and Pertamina International Shipping, as well as those from the private sector, are among the those who have been detained by the Attorney General’s Office ( AGO ).

Their names were disclosed solely by their names, the Jakarta Globe reported.

The seven were accused of breaking federal rules, according to AGO official Harli Siregar, who says Pertamina places a high priority on locally produced crude oil for domestic gas production.

According to the regulation, Pertamina is required to source crude oil from local suppliers and enhance it directly to meet nationwide fuel demands.

According to The Jakarta Globe, the company imported crude oil to meet output goals, raising questions about economic mismanagement.

According to the Jakarta Globe, Abdul Qohar, the AG O’s director of corruption investigations, the illegal crude oil trade between 2018 and 2023 reportedly caused a state loss of 193.7 trillion rupiah ( US$ 11.9 billion ).

” Based on witness statements, expert opinions, and legally obtained papers, the research team has identified seven suspects”, Abdul said, adding that the seven have been detained and are undergoing clinical check-up.

However, Pertamina official Fadjar Djoko Santoso said that the state-owned organization may cooperate with prosecutors during the inspection.

According to a declaration from the Jakarta Globe, Fadjar said,” Pertamina is committed to cooperating with law enforcement agencies to ensure due legal process while upholding the presumption of innocence.”

President Prabowo Subianto reaffirmed his support for those found guilty of bone in December. The obvious U-turn came days after a speech that his administration may forgive those accused of the crime.

Since then, Prabowo has urged magistrates to take a tougher attitude on transplant prisoners, claiming that they deserve to spend years in prison, especially if the crimes they committed have resulted in hundreds of billions of rupees in state costs.

Singapore’s biggest bank DBS to cut 4,000 roles as it embraces AI

As more work is being completed by humans, the largest banks in Singapore anticipates cutting 4, 000 jobs over the next three decades.

” The decrease in workforce will result from normal retention as temporary and contract positions leave over the upcoming few times,” a DBS spokesman told the BBC.

Continuous workers are not anticipated to suffer the effects of the cuts. Piyush Gupta, the company’s incoming chief executive, also stated that it anticipates creating around 1, 000 new AI-related tasks.

DBS becomes one of the first major lenders to provide information on how AI does impact its business operations.

The business declined to disclose the number of job cuts and the damaged positions.

DBS now has between 8, 000 and 9, 000 transitory and contract employees. The lender employs a total of approximately 41, 000 people.

Mr. Gupta claimed that DBS has been working on AI for more than ten years next month.

” We today deploy over 800 AI models across 350 use cases, and expect the measured economic impact of these to exceed S$ 1bn ($ 745m, £592m ) in 2025″, he added.

At the end of March, Mr. Gupta is scheduled to leave the business. Tan Su Shan, the company’s latest assistant chief executive, will succeed him.

The ongoing proliferation of AI technology has put its benefits and risks under the spotlight, with the International Monetary Fund (IMF) saying in 2024 that it is set to affect nearly 40% of all jobs worldwide.

The IMF’s controlling chairman Kristalina Georgieva said that “in most settings, AI will likely increase total inequality”.

The governor of the Bank of England, Andrew Bailey, told the BBC last year that AI will not be a “mass destroyer of jobs” and human workers will learn to work with new technologies.

Mr. Bailey claimed that while AI has risks,” there is tremendous potential with it.”

China woos Bangladesh with Beijing invitation

A 22-member Bangladeshi group of political leaders, civil community activists, scientists and reporters have begun a 10-day visit to China.

A group leader confirmed with the BBC that they will be speaking with Chinese federal officials and top Communist Party members.

Experts claim that China is making offers despite Bangladesh and India’s growing political tensions on a number of issues.

Sheikh Hasina, the exiled head of Bangladesh, is one of those who is affected. Delhi has declined to send her abduction, despite the fact that she has requested it.

Abdul Moyeen Khan, a senior official from the Bangladesh Nationalist Party ( BNP ) who’s leading the delegation in Beijing, told the BBC:” It’s basically a goodwill visit, initiated by Beijing”.

” It is unique because China has invited a group from Bangladesh this time,” he said.

Many of the group members are members of the BNP and its friends. The BNP, headed by former prime minister Begum Khaleda Zia, is one of the major events in Bangladesh, besides the Awami League led by Hasina.

Additionally, there are several members of the student movement, which started the rebellion against Hasina and ended with the prime minister’s ouster in August of last year.

An interim government, led by the Nobel prize Muhammad Yunus is currently in charge.

It has been urging India to repatriate Hasina to face charges of crimes against humanity and money laundering, among other allegations. The UN says Hasina’s government’s crackdown on protesters during the uprising killed about 1,400 people.

But much India has showed no sign of extraditing Hasina, who denies the charges.

During the 15-year concept of Ms. Hasina, who was widely regarded by her detractors as pro-India, Delhi and Dhaka had maintained close relationships. She maintains close ties to Delhi while balancing her marriage with Beijing.

After the fall of Hasina, Beijing has stepped up its connection with Bangladeshi officials, activists and ambassadors, including from Islamist events.

The Bangladesh time administration’s foreign policy consultant Touhid Hossain and Wang Yi, the Chinese foreign minister, met in Beijing in January for a meeting, and this week’s visit comes after that meeting.

Additionally, it is the second time in recent months BNP authorities have visited China, after Beijing hosted a BNP committee late last month.

With the social pump and lack of India’s control, experts say, Beijing is trying to increase its grip in Bangladesh, a region of about 170 million individuals.

With bilateral trade totaling about$ 24 billion ( £19 billion ), the majority of that is made up of Chinese exports to the South Asian nation.

More than 70 % of China’s military materials come from China, which is a significant source of items for the Bangladeshi army.

In the last six months, India has had very scant contact with the time authorities and other Bangladeshi social leaders in contrast to Beijing’s offers.

The BNP held a rally in December alleging India’s meddling in Bangladesh’s domestic matters by hosting Hasina. On the same subject, some interim government officials have likewise criticized Delhi.

Delhi has reacted furiously to this censure.

The Indian foreign minister Subrahmanyam Jaishankar said last week that it was up to Bangladesh to decide on “what kind of relationship they want with us”.

He called the condemnation of India by Bangladeshi leaders and politicians “absolutely ridiculous.”

Some claim that Bangladesh’s anxious rhetoric could lead to a Chinese-led government.

In light of recent events, Bangladesh has joined other South Asian nations like Sri Lanka, the Island, and Nepal as targets for both Delhi and Beijing as the powers compete for control.

” I don’t think India should regard the whole continent is under Delhi’s sphere of influence. That approach would produce India experience”, Chinese scientist Zhou Bo, a senior colleague at Beijing’s Tsinghua University, told the BBC.

Two dead, seven injured in South Korean bridge collapse

According to a representative from the interior ministry, the wounded were being taken to hospitals. The incident took place at around 9.50am ( 8.50am, Singapore time ) in Anseong, around 65km south of the South Korean capital. Initial reports that it occurred in Cheonan, Pennsylvania, were corroborated by officials whoContinue Reading