Delivery firms pledge to obey traffic rules

According to the government of Bangkok, the agreement may increase pedestrian safety.

Published on November 3, 2023 at 20:20

To prevent their customers from breaking traffic laws, thirteen delivery service providers have entered into a contract with the Bangkok Metropolitan Administration( BMA ).

The action, according to Bangkok government Chadchart Sittipunt, aims to reduce pavement driving and, among other things, guarantee pedestrian safety.

Similar to taxi drivers, delivery service riders are an important part of the urban population, and the BMA will think about giving them parking so they won’t impede traffic, he said.

Kerry Express, Grab Taxi, Lalamove, Line Man, Thailand Post, and CP All were among the shipping service companies who signed the memorandum of understanding.

The preservation of cleanliness and orderliness of the state action, which forbids driving on sidewalks, is enforced by the BMA.

The BMA reports that between July 2018 and October of this year, 55, 231 people were apprehended while riding on asphalt. It stated that 48,787 people had been fined more than 61 million baht and 4,581 had received instructions. The remaining 1, 863 were reported to the authorities for more legal action.

Pakistan speeds up Afghans’ repatriation as deadline expires

Arriving people in Afghanistan grumbled about the sufferings. ” We stayed on Pakistan’s borders for three weeks. We were in a terrible position, according to 55-year-old Mohammad Ismael Rafi, who claimed to have spent 22 years living in the retail-oriented border town of Chaman in south-western Pakistan. He said,” ThankContinue Reading

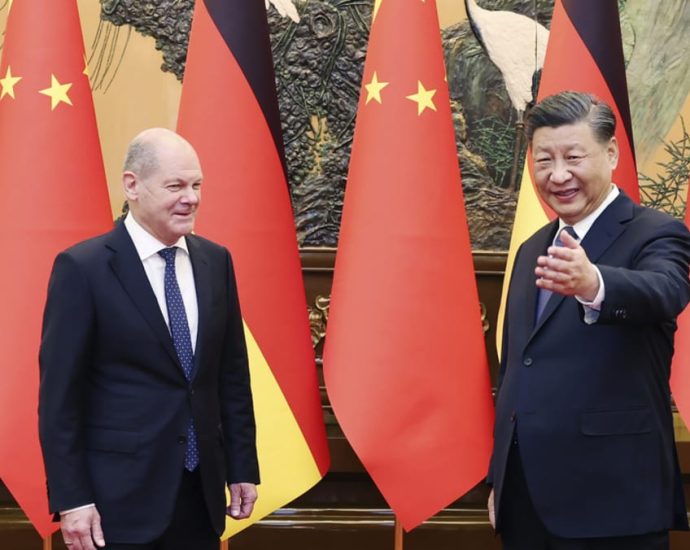

China-Germany cooperation has become more solid and dynamic: Xi

BEIJING: According to a video link chat conducted on Friday( Nov. 3 ) between Chinese President Xi Jinping and German Chancellor Olaf Scholz, bilateral cooperation between China and Germany has strengthened, solidified, and become more dynamic. The two leaders concurred that relations between China and Germany are improving on aContinue Reading

Winter warfare: Which side has the edge in Ukraine?

Both Ukrainian and Russian troops are getting ready for a new stage of the conflict as the bitter cold of winter sets in and the average temperature ranges from – 4.8 to – 2 ° C.

The performance of weapons and equipment can be hampered by freezing temperatures, which can occasionally drop to – 20 ° C. More is needed because ammunition may drop responsiveness and accuracy. Technology wear and tear worsens and power life decreases, necessitating more upkeep, which is also more challenging in the winter.

Drones become more difficult to operate in low temperatures and in the wind or snow, especially smaller ones like the DJI Mavic series that Russian troops are using, which reduces surveillance capabilities.

However, these circumstances can also restrict the use and movement of heavy machinery, including tanks and( especially towed ) artillery. Due to the necessity of freedom in warfare, this has a direct impact on military operations, allowing the troops to advance or retreat. Spring weather puts the front lines at risk of being locked down.

Fighters with Frostbite

New types of colour are needed to avoid detection by foe forces due to winter landscapes, snowfall, and a lack of foliage. The risk of hypothermia and frostbite among soldiers is another limiting element in the winter.

Damp and cold can have physical results, but they can also have an impact on the motivation of the troops. Although this is a mental issue, its significance shouldn’t be understated because low morale can result in less effective combat.

It is crucial to take precautions for both personnel and equipment in order to prevent this because doing so could significantly affect the success of spring activities. This includes preparing the tools for colder temperatures as well as switching to spring uniforms and winter operating training.

Volodymyr Zelensky, the president of Ukraine, has stated that his nation is ready to carry on with its military operations this spring. Russian officials have stated that they are also ready for winter combat, and Sergei Shoigu, the defense chancellor, visited the Russian soldiers stationed in southeastern Donetsk to assess army preparation.

Probably the biggest challenges facing Ukraine are not only the government’s extreme cool but also its deteriorated energy system. This can have a significant effect on military operations, as, for example, an electrical outage may compromise anything from communications to field hospitals’ functional capacity. Zelensky emphasized the need for more heat threats to stop the Russians from obliterating Ukraine’s power generator as a result.

The Russian part asserts that it does not anticipate any problems if the energy system is safeguarded. Kyrylo Budanov, the head of Russian military knowledge, asserted that because both the Ukrainian and Russian sides were accustomed to winter, neither would be affected.

Alexander Tarnavsky, the captain of the Armed Forces of Ukraine on the Southern Front, agreed with Budanov, claiming that because the Russian forces are primarily moving on foot and without heavy equipment, climate won’t have much of an impact on their operations.

Russian troops have shown their effectiveness largely when working in small infantry detachments, frequently using lighter equipment, despite the possibility that rain and snow could make it difficult for heavy machinery like tanks to move.

However, some experts think that the autumn will serve as a test for Ukrainians’ sense of national identity.

Russia has made a lot of effort to make sure that its soldiers you fight in cold weather. They have been deploying to the Arctic for many years to do cold-weather activities. Spring warfare is a topic that is frequently covered in established military publications, such as the Armeyskii Sbornik( the Military Collection book ).

The Russian Ministry of Defense is also disseminating details about the steps and timelines involved in getting defense supplies and weapons ready for seasonal activities.

Given that Ukraine is not nearly as warm as the Arctic and that the Russians pay close attention to combat readiness for winter warfare, the country’s weather does not prevent Russian troops from carrying out their military operations there.

important spring battles

Winter conflicts have occurred throughout history, with notable conflicts being fought, for example, under the command of Grecian military leadership Xenophon and Alexander the Great.

Lately, the Soviet Union in certain showed that it could effectively fight during the winter. Extremely warm temperatures, a lack of resources, and ongoing European problems plagued Russian forces during the Battle of Stalingrad.

Despite these difficulties, they were able to change the course of the conflict and win. The Winter War in Stalingrad has left a lasting impression on Soviet history.

Researchers from both the West and Russia anticipate that both sides will employ long-range attacks on crucial infrastructure and supply pathways far behind the front line during the winter. However, it is unclear how this will manifest itself on the field or where the key conflicts may occur.

One scenario is that the Russians will continue to exert pressure on the significant centers of Kupyansk in the Kharkiv Oblast and Avdiivka in eastern Donetsk while the Ukrainians keep pushing toward Tokmak in Zaporizhzhia state and attempt to gird Bakhmut. While attempting to recover its own facta, which some American sources claim is failing, Ukraine will want to stop the Russians from making any more regional gains.

However, political will and resource presence may have a significant impact on this conflict’s potential rather than the wind. The crux may be military hardware and ammunition for Ukraine, and men for Russia — as of August 2023, they had already lost about 120,000 soldiers, according to US quotes.

The goal of the spring operations in Ukraine will ultimately depend on the opposing forces’ determination as well as the West’s capacity and willingness to provide the Russian part with the required ammunition.

Given the extra requirements of an intensifying Middle East conflict and US President Joe Biden’s efforts to secure financing for Ukraine through the House of Representatives, this may present a problem.

Marina Miron is a post-doctoral scientist at King’s College in London.

Under a Creative Commons license, this article is republished from The Conversation. read the article in its entirety.

Khaki clash over Chiang Mai pub raids

Municipal officials arrived at the after-hours location following an earlier assault that embarrassed the police.

3 November 2023 at 19:12 PUBLISHED

As an obvious debate between the groups comes into the open, police anti-corruption officers are getting ready to look into provincial operational officials who were discovered in a Chiang Mai pub after business hours.

They are also representatives of the government. According to Pol Maj Gen Jaroonkiat Pankaew, deputy commissioner of the Central Investigation Bureau( CIB ), staying at the bar after closing time is considered malfeasance.

Officers from the Chang Phueak officers train in Chiang Mai at Level 9, a top bar and restaurant, raided the building around 2.30 on Friday night, prompting the news.

After 1am, they discovered more than 50 patrons, one of whom was 17 years old, loitering at the table.

According to reports, the director admitted that the establishment had broken the law and was accused of selling alcohol after business hours.

A few Department of Provincial Administration ( DPA ) officials who had participated in a raid on October 31 at Le Neuf, an unlicensed bar, were among the 50 patrons, according to local reports.

Five top Chang Phueak station officers were transferred to inactive posts and nbsp as a result of that raid for allegedly failing to take action against the location under their jurisdiction. & nbsp,

The Chiang Mai police chief, Pol Maj Gen Thawatchai Pongwiwatanacha, noted that Chang Phueak officials had previously raided Le Neuf six times and that the power was not attempting to exact revenge on the DPA.

Le Neuf Cafe has been closed despite authorities attempts to ask the DPA to do so, he claimed.

Police and officials feud over Chiang Mai pub raids

Municipal officials arrived at the after-hours location following an earlier assault that embarrassed the police.

3 November 2023 at 19:12 PUBLISHED

According to Pol Maj Gen Jaroonkiat Pankaew, deputy commissioner of the Central Investigation Bureau( CIB ), police anti-corruption officers are getting ready to look into provincial administrative officials who were discovered in a Chiang Mai bar after business hours.

They are also representatives of the government. It is considered wrongdoing if they remained at the table after it had closed, according to Pol Maj Gen Jaroonkiat.

Officers from the Chang Phueak authorities place in Chiang Mai at Level 9, a top bar and restaurant, raided the building around 2.30 on Friday night, which was followed by the news.

After the table closed at 1am, they discovered more than 50 patrons, one of whom was 17 years older, hanging out there.

According to reports, the director admitted to breaking the law and was accused of selling alcohol after business hours.

A few Department of Provincial Administration ( DPA ) officials who had participated in a raid on October 31 at Le Neuf, an unlicensed bar, were among the 50 customers, according to local reports.

Five top Chang Phueak station officers were transferred to inert posts and the nbsp as a result of the raid for allegedly failing to take legal action against the location. & nbsp,

The Chiang Mai police chief, Pol Maj Gen Thawatchai Pongwiwatanacha, noted that Chang Phueak officials had previously raided Le Neuf six times and that the power was not attempting to exact revenge on the DPA.

Le Neuf Cafe has been closed despite authorities attempts to ask the DPA to do so, he claimed.

Parliament to discuss Israel-Hamas war, cost of living and banking disruptions

The Workers’ Party ( WP) demanded on October 18 that Israel” reject the collective punishment of innocent civilians ,” end all military operations in Gaza, and permit the movement of humanitarian aid there.

Additionally, it demanded the prompt return of all Jewish hostages taken during Hamas'” military operation in southern Israel.”

According to WP,” De-escalation by all parties may be followed by Israel’s departure from the occupied territories and serious negotiations to bring about a lasting peace in the Holy Land that legitimizes the state of Israel and creates an effective Arab position.”

It continued by endorsing Singapore’s position on a two-state solution as the” only viable way” to quality in accordance with UN Security Council resolutions.

In specific, UNSC Resolution 242, which Singapore supports, calls for Israel to leave Palestinian territories that have been occupied since the 1967 war in exchange for a long-lasting harmony with its neighbors.

According to WP, the Israel Defense Forces’ prior military action in Gaza in response to” violent businesses, including those by Hamas” was” overwhelmingly disproportional.”

The party expressed concern that this fact would recur in the upcoming days, weeks, and times.

” It is not in Singapore’s national interests to flagrantly ignore the Geneva Convention, the UN Charter, and other international legal tools, including the occupation of land taken in battle by any royal country.”

The shooting of non-combatants, women, and children by any nation or organization in the name of battle deserves nothing less than the utmost conviction.

The party issued a warning that the ongoing conflict is likely to boost attacks against Jews and Muslims somewhere,” rising the possibility of radicalization far beyond the Middle East,” and” making the world more dangerous and risky for all countries.” & nbsp,

WP stated that” All Singaporeans should be aware and conscious of this chance, and enjoy an active element to prevent it from happening on our coasts.”

The Progress Singapore Party ( PSP) stated its position on the war in a Facebook post on October 30 and stated that it” unequivocally condemns violence against innocent civilians.”

It demanded that Israel abide by international legislation, including the UN Charter and the Geneva Convention, and that Hamas promptly return all human hostages.

PSP stated that it supports Singapore’s place that a two-state solution is necessary for an enduring harmony in the region and that civilian lives in both Israel and Palestine must be protected.

COE quota upped again for quarter starting in November

The limit for Category A, which is primarily used for smaller mass-market vehicles, will now be 5, 513, an increase of 35 % from the previous quarter. The offer will now be 3, 800 for larger vehicles in Category B, which is also a 35 % quarter-over-quarter improve. With 1,Continue Reading

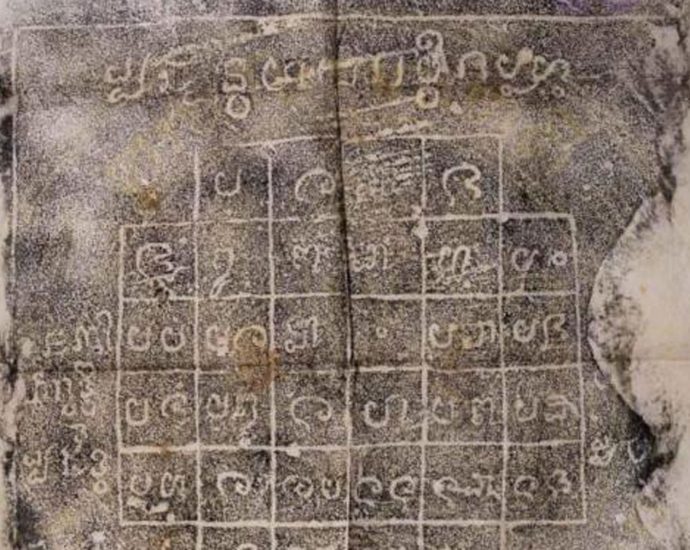

Inscribed stone rediscovered in Chiang Mai

Four decades had passed since the city wall was discovered in a hidden chamber at Tha Phae Gate.

3 November 2023 at 17:39 PUBLISHED

CHIANG MAI: The Fine Arts Department has rediscovered an inscribed capital foundation at the Tha Phae Gate that had been hidden for more than 40 times.

The location of the inscribed stone had generated a lot of common attention, according to the department’s 7th Regional Office, which posted this week on its Facebook page.

Although it had not been seen in nearly four centuries, some people thought the monument had been kept in the Chiang Mai National Museum.

But, on Wednesday, departmental staff led by Therdsak Yenjura, the historical conservation unit’s producer, searched a place tucked away inside the Tha Phae Gate and discovered the relevant inscribed wall.

Representatives from the Lanna Inscriptions Database, the Chiang Mai University’s faculty of architecture and great art, as well as regional academics, all testified to the discovery.

The inscription’s primary purpose as a Chiang Mai city pillar shrine is indicated by scholars’ names like” Tha Phae Gate Inscription” or” Inthakhin Pillar Incscription.”

According to media reports, since the state’s founding, the monument has been interred alongside the Chiang Mai town pillar. The town column was being renovated from 1986 to 1987, so the monument had been taken down. Since then, the dedication has been hidden from view.

The Tha Phae Gate Inscription, according to the late epigrapher Prasert Na Nagara, shows a board of conventional numbers and numerology charts that were all written in picture writing in the Lanna Dhamma storyline.

The blessings bestowed on the area are described in the language of the reflected text. Indra, the Hindu deity, and khla, which means interest or post, combine to form the term Inthakhin. The dedication, according to Prof. Prasert, was a part of the Chiang Mai town pillar.

The writings had been difficult to decipher before the examination, but Chiang Mai Rajabhat University professor Ranu Wichasin discovered in 1986 that they were all written in reflection writing.

If and when the recently rediscovered monument will be on display to the government is not yet known.

LTA unveils high-speed test site for MRT trains, on track to complete Southeast Asiaâs first rail testing facility

Teach tests may be conducted away from the main rail lines thanks to the dedicated center, freeing up time and space for maintenance tasks during those brief time.

Since the SRTC is far from domestic areas, the tests can also be done around-the-clock. & nbsp,

A Assessment GROUND, MORE THAN THAT

According to Mr. Chee, as Singapore develops and expands its rail system, the need for a federal testing center has become more clear.

As we enter a period of unprecedented community development until early 2030s, he said,” We will need to examine more systems, and more often, as well as the expansion and regeneration of our existing MRT traces.”

Mr. Chee hopes that the facility can serve as a training ground for aspiring operators and track experts.

Deepening the capabilities of our local track workplace is one ambitious extend goal, he said. Leading road companies, experts, academic institutions, and users who can use SRTC’s services to test and pilot new systems and systems can also use it to support research and development.

The service can act as a regional and international assessment hub for cutting-edge railroad systems, Mr. Chee continued.

According to him,” The SRTC has the potential to develop into a local tests hub to support the expanding road networks in neighboring nations.”

This can, in turn, give our native bridge engineers more chances to interact with and learn from their counterparts in the area.