Nepal retrieves bodies of six dead in helicopter crash, five Mexicans among them

KATHMANDU: Authorities in Nepal have retrieved the bodies of all six people killed in a helicopter crash on Tuesday (Jul 11), including five Mexican nationals, authorities said, the latest in a series of air disasters to strike the Himalayan nation. The cause of the crash near Likkhu, just northeast of theContinue Reading

Familes exhorted to have at least 2 children, as birthrate falls

Fewer entering the workforce than are going into retirement

Each Thai family should aim to have at least two children to help halt the country’s falling birthrate, Thailand’s most senior health official said on Tuesday, which is the UN’s World Population Day.

Suwannachai Wattanayingcharoenchai, director-general of the Department of Health, said there had been at least one million births in Thaiiland each year from 1963 to 1983, but the birthrate fell to 502,107 last year and is likely to be below 500,000 this year.

Simiar falling birthrates had been reported by 120 other countries, including China, Japan, Singapore, South Korea and Vietnam in Thailand’s immediate area, Dr Suwannachai said

At the same time, the number of elderly citizens is rising. In 2021 Thailand became an aged society with people 60 years or more constituting 20% of its population. By 2036 the country would be a hyper-aged society, with senior citizens making up 30% of its population, if the trend continued.

“2023 is the first year when the number of people becoming of working age, 20-24 years old, cannot make up for the number of people leaving the workforce at age 60-64 years,” Dr Suwannachai said.

Since 2016, the government had tried to encourage people to have more children but these measures had not worked, he said. Recent measures included the opening of more nurseries, improved rights to materinity and parternity leave, work-from-home policies and flexible working hours.

The government also postponed compulsory retirement and promoted retirement savings and vocational programmes to help cope with an aged society, Dr Suwannachai said.

Boonyarit Sukrat, director of the Bureau of Reproductive Health, said the desired increase in the Thai population could not come in time to solve the shortage of workers, and that could affect gross domestic product and the security of the nation.

Importing workers of high potential could be one solution the government could invest in, Dr Boonyarit said.

World Population Day has been observed annually on July 11 since 1989 when it was launched by the United Nations Development Programme to raise awareness of global population issues.

Temasek reports drop in portfolio value to S$382 billion; maintains cautious investment stance

SINGAPORE: Temasek Holdings on Tuesday (Jul 11) reported a 5.2 per cent fall in the value of its net portfolio and signalled a “cautious” investment stance ahead amid a challenging macroeconomic environment.

For the financial year ended Mar 31, its net portfolio was valued at S$382 billion (US$287 billion), down S$21 billion from the record S$403 billion it achieved a year ago, according to its latest annual review.

Its one-year total shareholder return, which takes into account all dividends distributed to the shareholder minus any capital injections, turned negative to -5.07 per cent from the 5.81 per cent gain a year ago.

This was largely due to a fall in equity valuations, both in the public and private markets, Temasek’s chief financial officer Png Chin Yee said at a press conference.

While its portfolio companies in Singapore remained resilient, its global direct investments saw a reversal of gains from the high valuations in the last two years, particularly in the technology, healthcare and payments space, as valuations de-rated in the higher interest rate environment.

Over a longer term, its 10-year and 20-year total shareholder returns stood at 6 per cent and 9 per cent respectively, down slightly from 7 and 8 per cent in the previous year.

The state investor is one of the three entities tasked to invest Singapore’s reserves, with part of its returns tapped every year for the annual Budget.

Under the Net Investment Returns Contribution (NIRC) framework, the Government can spend up to half of the long-term expected investment returns generated by Temasek, sovereign wealth fund GIC and the Monetary Authority of Singapore.

Temasek invested S$31 billion and divested S$27 billion in the last financial year, as it adopted a cautious approach amid global uncertainties. Deal activity globally also slowed down as liquidity tightened, it said.

Overall, Asia remained the anchor of the investor’s portfolio at 63 per cent, with Singapore (28 per cent), China (22 per cent) and the Americas (21 per cent) remaining the top three markets.

Transportation and industrials (23 per cent) and financial services (21 per cent) continued to account for the biggest sectors in Temasek’s portfolio.

The proportion of unlisted assets in its portfolio made up 53 per cent of the portfolio, up 1 per cent from a year ago, which saw unlisted assets overtaking listed assets for the first time.

Temasek said its unlisted portfolio is “well diversified” across geographies and sectors, with steady growth over the years due to investments in “attractive opportunities” in private markets and the increase in the value of its unlisted assets.

Over the last decade, the unlisted portfolio has generated returns of over 10 per cent per annum on an internal rate of return basis, delivering higher returns than its listed portfolio, it added.

These include returns when the unlisted investments were listed or sold, as well as from the strong performance of the underlying companies. For example, some of its holdings, such as payments technology provider Adyen and on-demand services platform Meituan have listed with “significant value uplift” in the past five years.

On its early-stage portfolio, Ms Png said Temasek invests in early-stage companies as part of identifying future trends and to gain insights into emerging technologies and business models.

To manage the higher risks that come with these investments, it has kept its exposure to early-stage companies to 6 per cent of its total portfolio, she added.

Temasek said last November that it would write down its US$275 million investment into cryptocurrency firm FTX. In May, it said it had cut the compensation of its senior management and the investment team involved in the failed investment.

Nathan Law: Police raid family home of exiled Hong Kong activist

Getty Images

Getty ImagesHong Kong police have raided the family home of Nathan Law, a leading pro-democracy activist in exile in the UK.

Local media reported that Mr Law’s parents and one of his brothers were also taken away for questioning.

The raid comes a week after authorities issued a HK$1m (£99,100; US$127,800) bounty for his arrest, as well as for that of seven other activists.

Mr Law, who fled to the UK in 2020 where he was granted political asylum, is yet to comment on the developments.

However he told the BBC last week he would have to be more careful following the order.

Hong Kong authorities on 3 July issued arrest warrants and rewards for information leading to the capture of Mr Law and seven other Hong Kong political activists living in exile.

The eight activists targeted are accused of colluding with foreign forces – a crime that can carry a sentence of life in prison. The offence comes under Hong Kong’s draconian security law, which was imposed three years ago after widespread pro-democracy protests took place in the former British territory in 2019.

The countries in which the activists live – the UK, the US and Australia – do not have extradition treaties with China, and have condemned the order from Hong Kong authorities.

However, at least five people with connections to the activists have been arrested in Hong Kong since the announcement.

Mr Law is one of the most prominent figures in Hong Kong’s pro-democracy movement, and was one of the unofficial leaders of the 2019 demonstrations.

After fleeing Hong Kong in 2020, he had issued a statement saying he had cut off all ties with his family.

He told the BBC last week he felt his situation was “relatively safe” in the UK, but he would have to be more vigilant as a result of the bounty’s announcement.

“There could possibly be someone in the UK – or anywhere else – to provide informations of me to (the Hong Kong authorities). For example, my whereabouts, where they could possibly extradite me when I’m transiting in certain countries,” Mr Law said.

“All these things may put my life in to dangerous situations if I’m not careful enough of who I meet or where I go. It makes me have to live in a more careful life.”

Related Topics

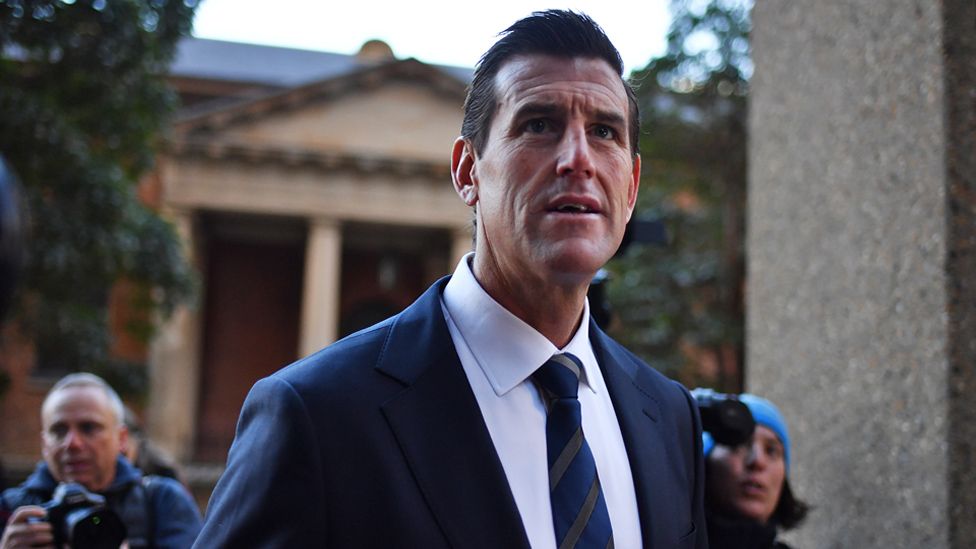

Ben Roberts-Smith: Australia’s top soldier appeals over war crimes defamation trial

Reuters

ReutersAustralia’s most-decorated living soldier Ben Roberts-Smith is appealing against a landmark defamation judgement which found he committed war crimes.

A judge last month ruled articles alleging the Victoria Cross recipient had murdered four Afghans were true.

It was the first time in history any court has assessed claims of war crimes by Australian forces.

Mr Roberts-Smith is not facing criminal charges and maintains his innocence. His grounds for appeal are unknown.

The former special forces corporal sued three Australian newspapers over a series of articles alleging serious misconduct while deployed in Afghanistan between 2009-2012 as part of a US-led military coalition.

At the time the articles were published in 2018, Mr Roberts-Smith was considered a national hero, having been awarded Australia’s highest military honour for single-handedly overpowering Taliban fighters attacking his Special Air Service (SAS) platoon.

The 44-year-old claimed the papers ruined his life with their reports that he had broken the moral and legal rules of war.

His defamation case – dubbed by some “the trial of the century” – lasted 110 days and was rumoured to have cost up to A$25m ($16.3m; £13.2m).

On 1 June a Federal Court judge threw out the case against The Age, The Sydney Morning Herald, and The Canberra Times, ruling it was “substantially true” that Mr Roberts-Smith had murdered unarmed Afghan prisoners and civilians and bullied fellow soldiers.

Justice Anthony Besanko also found that Mr Roberts-Smith lied to cover up his misconduct and threatened witnesses.

Additional allegations that he had punched his lover, threatened a peer, and committed two other murders were not proven to the “balance of probabilities” standard required in civil cases.

Mr Roberts-Smith, who left the defence force in 2013, has not been charged over any of the claims in a criminal court, where there is a higher burden of proof.

None of the evidence presented in the civil defamation case against Mr Roberts-Smith can be used in any criminal proceedings, meaning investigators must gather their own independently.

But the case has raised the spectre of a possible wider reckoning over claims of war crimes by Australian forces.

In 2020, a landmark investigation known as the Brereton Report found “credible evidence” that elite Australian soldiers unlawfully killed 39 people in Afghanistan.

It recommended that 19 current or former soldiers should be investigated over alleged killings of prisoners and civilians from 2009-13.

Australian troops were deployed to Afghanistan between 2001 and 2021, as part of a US-led coalition that ousted the Taliban after the 11 September 2001 attacks in the United States. The Taliban retook control of Afghanistan in 2021.

Related Topics

SocGen announces new Asian leadership roles | FinanceAsia

Paris-headquartered Société Générale has announced via media note two newly created leadership appointments within its global banking and advisory businesses.

In addition to her role as head of Corporate Coverage for Southeast Asia, Singapore-based Eliza Ng becomes head of Global Banking and Advisory for the Southeast Asian region; meanwhile, Kanta Murata takes on responsibility for Japan as market leader of Global Banking and Advisory, alongside his current capacity as Japan head of Corporate Client Coverage and deputy branch manager of the bank’s Tokyo office.

Effective from the end of June, the appointments mark the bank’s continued commitment to strengthen its local capabilities to support clients in local markets, the release detailed.

In their new roles, the pair will supervise all global banking and advisory endeavours, excluding business related to the bank’s institutional and debt capital markets (DCM) efforts. They both report regionally to Stephanie Clement de Givry, head of Global Banking and Advisory for Asia Pacific; and to Olivier Vercaemer, her deputy.

Ng and Murata shared with FinanceAsia their priorities as they settle into their new functions.

“My priorities revolve around three main areas: customer-oriented approach; regulatory compliance and credit risk management; and growth, especially across ESG-related aspects,” said Murata.

He emphasised his work to enhance client experience through expertly structured finance arrangements to meet evolving market needs, while prioritising robust risk management practices to ensure the security and stability of the bank’s operations.

The ESG arena is another area where he targets expansion. “To stay competitive and relevant in a rapidly evolving ESG landscape, it is essential to embrace innovative approaches,” he explained.

Ng agreed that ESG is embedded in the bank’s business and is a focus for the regional teams.

“My immediate priority is to leverage the expertise and capabilities that our expanded franchise can offer our clients in the Southeast Asia region,” she said, adding that she looks forward to continuing to accompany clients on their energy transition aims.

This effort, she explained would complement and further support development across the region’s emerging economies.

Ng added that such regional sustainability efforts are bringing with them new business opportunities across several segments, “including the transportation value chain and new technologies in the renewable energy sector.”

Murata also observes a trend towards decarbonisation across Japanese activity.

“According to the latest preliminary figures as of 1Q23, the Bank of Japan’s “Flow of Funds” [demonstrate that] the loan balance of private non-financial corporations has been steadily growing during past quarters; partly driven by economic recovery, capital expenditure, and ESG-related investment opportunities.”

He said that this growth opportunity is further supported by the Japanese government’s push for carbon neutrality by 2050, which will require more than JPY150 trillion ($1 trillion) in investment from public and private sectors over the next ten years.

In terms of landmark deals, both Ng and Murata have been involved in a number of the bank’s key transactions.

Murata pointed to his involvement in an accelerated bookbuild for a Japanese client that saw the bank organise a block trade so it could divest European stocks; meanwhile, Ng highlighted the bank’s role across Temasek Financial’s EUR 1.5 billion ($1.65 billion) four and ten-year dual tranche senior unsecured bonds, earlier this year.

¬ Haymarket Media Limited. All rights reserved.

Dismembered body of missing German businessman found in freezer of a home in Thailand

BANGKOK: The dismembered body of a 62-year-old German businessman who has been missing for a week has been found in the freezer of a house in southern Thailand, police said on Tuesday (Jul 11). Chief of police in the town of Nong Prue Tawee Kudthalaeng said the body of Hans-Peter MackContinue Reading

Death toll rises in collapse of under-construction Bangkok highway

Wisanu Subsompon, deputy governor of Bangkok, told a press conference on Tuesday the damage may have been caused by an unbalanced crane. “Work will be suspended until they have a safety plan,” he said. The roadwork is part of a project to build elevated highways in an attempt to easeContinue Reading

How are Chinese manufacturers coping with a slow post-COVID recovery amid weak external demand?

PUTTING THE PANDEMIC BEHIND

This comes as companies sought to diversify their supply chains away from China, when there had been no end to the country’s zero-COVID policy in sight. Trade tensions with the United States have also raised concerns among businesses.

Online logistics platform Container xChange founder Christian Roeloffs has observed a significant number of excess containers at China’s ports.

Mr Roeloffs said price is not the only factor in his business decisions.

“If I deal with an export country, where I can’t rely on politics to create a climate or an environment for reliability, but the politics that creates a climate of sort of severe restrictions of ongoing production, then I’m more inclined to move to more reliable alternatives,” he said.

Observers pointed to other challenges that lie ahead, as the world’s second-largest economy tries to put the COVID-19 pandemic behind it.

Malaysian Productivity Corp and UiTM introduce productivity module for final semester students

65 students from the elective final year took the course

Is one of the modules for students in the faculty of Mechanical Engineering

The Malaysian Productivity Corporation (MPC) developed a new productivity-related module to strengthen students’ knowledge in achieving the government’s agenda to increase the nation’s productivity.

The new module is a collaboration between…Continue Reading