Motorist secures Series A investment at a valuation of US$60mil

Existing investors also participated in this round

Actively seeking more strategic investors for its Series A round

Singapore startup, Motorist, that aims to simplify vehicle ownership via digital tools, has announced Tokyo Century Leasing (Singapore) as a lead investor in its Series A funding round where, although it did not share the amount…Continue Reading

Is China driving the new war epidemic? – Asia Times

Beijing is grappling with a new challenge after Covid – an expanding war encircling its friends and neighbors. Is China a victim or a contributor to this new conflict? The country may or may not be aware but suspicions are mounting about its role.

War is spreading like a virus during an epidemic. Two years ago, Russia initiated it in Ukraine. Then, as it became stuck in the marshes and bogs of the Dnepr River, war seized onto the decades-long simmering tensions in Gaza and erupted on October 7, 2023, with the Hamas terrorist attack.

It further reignited Houthi pirates’ aggression and is currently fueling threats and brinkmanship on the other end of Eurasia, in North Korea, where Kim Jong Un, with his distinct hairstyle, ominously flaunts newer missiles, bombardments and declarations of war.

Russia clearly initiated the conflict in Ukraine, but less evidently, a Russian shadow can be perceived behind Hamas, the Houthis, North Korea, and the “war fatigue” in some European countries like Italy, barely affected by the fight.

It appears that Moscow, unable to secure victories on the battlefields, is broadening the conflict elsewhere to divert Western military support from Kiev and escalate the clash with the US, hinting “Either you give me what I want in Ukraine or I’ll broaden the war to your doorsteps.”

Russian President Vladimir Putin seems to lack military talent but demonstrates political genius, approaching war as a game of political chess.

However, this approach also backfires on Russia. Countries like Germany, initially lukewarm in their support for Ukraine, have grown to believe that satisfying Putin today will lead to more demands tomorrow.

German Defense Minister Boris Pistorius warned that the war between Russia and Ukraine could expand beyond neighboring countries, citing threats from the Kremlin, especially against Baltic states.

A twist arises in these dire times. China serves as the economic dynamo supporting Russia’s military reindustrialization and economy. However, it’s unclear how much China actively contributes to this geopolitical game or if it’s merely being drawn into a situation it can hardly control.

Beijing might perceive ambiguity as leverage in dealing with the US, given Washington’s interest in minimizing support for Moscow. Simultaneously, Beijing faces a difficult position as Moscow leads the strategy, and Beijing follows without complete control, resembling a junior partner taken for a spin. There’s a risk of being drawn into something China neither wants nor fully comprehends.

Another possibility is that Beijing assumes full control of ongoing wars and conflicts but this is difficult and would involve other types of problems. Overall, there is a question mark: China doesn’t know how the wars will end or who will emerge victorious or defeated. Behind the insecurity lies an even bigger issue.

The question at hand: Is America indeed declining while China is rising and replacing it? Are domestic troubles demolishing America before China faces its own challenges? Or will America emerge ahead of China in a few months or years?

With numerous ambiguities, it appears that either China is the sly mastermind, pulling even Putin’s strings, or it is a puppet in Russian hands. If it’s the former, then China is leading a global war against the West, and sooner or later, it will be treated accordingly. If it’s the latter, Beijing has lost control of itself.

In either case, the situation appears very dangerous from the outside, impacting economic performance and business confidence domestically and internationally in dealing with China.

China’s inclusion in the new American “axis of autocracies” label can be perilous and needs to be addressed cautiously. So far, it has been ignored or hastily rejected in anger, exacerbating the problem rather than solving it.

No one is certain the US will lose in the present wave of wars, so prudence should guide China to find a way to extricate itself from this grim predicament. Perhaps Beijing has been going with the flow without fully grasping the repercussions of what was happening, driven mainly by small-time calculations.

A similar drift occurred with the Belt and Road Initiative (BRI). For years, Beijing pushed the BRI, viewing it almost as a small business opportunity while neglecting larger geopolitical concerns. Many attributed this to Beijing’s larger political ambitions, betrayed by small calculations in handling day-by-day operations abroad.

Possibly, even in the present situation, China was initially duped by Putin’s promises of a quick victory in Ukraine, and one thing led to another without a complete comprehension of the dimensions of the problem.

China now seems aware of the North Korean problem. Last week, Communist Party diplomatic chief Liu Jianchao pledged to increase strategic communications as he met a North Korean envoy in Beijing.

In an apparent move to de-escalate the situation, Liu vowed to work with North Korea to protect regional stability as tensions with Seoul escalate. Liu’s meeting appears to be a break from past Chinese laggard reactions to sudden international events.

Still, it’s unclear whether China will manage to broker the restart of a dialogue between Pyongyang and Washington and if Beijing will exert all its weight to stop the spread of the war epidemic.

This essay first appeared on Settimana News and is republished with permission. The original article can be read here.

Chinese research vessel heads to Maldives, could concern India

NEW DELHI: A Chinese research vessel is on its way to the Maldives, according to an Indian military official and an independent researcher, as new Maldivian President Mohamed Muizzu deepens ties with Beijing, distancing from New Delhi. It is likely to raise concern in New Delhi, which has previously viewedContinue Reading

Government spending S$40 million for hardware replacement, system maintenance to extend ticketing system: LTA

The authority also said it conducted market testing and focus group sessions with adult commuters and concession cardholders before the SimplyGo transition plan was finalised.

It added that account-based ticketing (ABT) cards were issued to more than 1,000 concession cardholders in 2021 for them to test and report back based on their experience.

“Generally, groups such as persons with disabilities, polytechnic and university students, and NSFs (national servicemen) were supportive of ABT and did not mind the lack of fare and balance display,” said LTA.

“Parents of students also found ABT useful as it allowed them to top up their child’s card remotely.”

The authority noted that the group which had the most concerns were seniors who were worried about the absence of the fare and balance display at station gates and bus readers because of the way SimplyGo public transport transactions are processed.

“This guided LTA’s decision to extend the CBT system for concession cards from the get-go so that concession cardholders, such as seniors, are not impacted by this round of changes,” it said.

Additional S$40 million to be used for maintenance of older ticketing system after SimplyGo shelving: LTA

The authority also said it conducted market testing and focus group sessions with adult commuters and concession cardholders before the SimplyGo transition plan was finalised.

It added that account-based ticketing (ABT) cards were issued to more than 1,000 concession cardholders in 2021 for them to test and report back based on their experience.

“Generally, groups such as persons with disabilities, polytechnic and university students, and NSFs (national servicemen) were supportive of ABT and did not mind the lack of fare and balance display,” said LTA.

“Parents of students also found ABT useful as it allowed them to top up their child’s card remotely.”

The authority noted that the group which had the most concerns were seniors who were worried about the absence of the fare and balance display at station gates and bus readers because of the way SimplyGo public transport transactions are processed.

“This guided LTA’s decision to extend the CBT system for concession cards from the get-go so that concession cardholders, such as seniors, are not impacted by this round of changes,” it said.

LTA told CNA previously that while it was “technically possible” for commuters using SimplyGo EZ-Link cards to view their fare information at station gates and bus readers, it would “slow down the entry and exit for commuters”.

The inability of commuters who use SimplyGo to view their fare information at station gates and bus readers had emerged as one of the main sticking points since LTA’s initial announcement of the switch on Jan 9. This led to public outcry over the decision, with some commuters facing difficulty upgrading their cards.

LTA said on Monday the decision to make the switch was “only decided” when it was assessed that two in three adult fare transactions were made on SimplyGo via bank cards and stored value cards, and noted the feedback received.

“We hear and acknowledge the concerns of commuters who want to continue seeing their fare deductions and card balances at fare gates and bus card readers,” it added.

“We are extending the adult CBT system so that they can continue to have this feature and use their EZ-Link and NETS Flashpay cards.”

Hong Kong’s top judge defends courts amid Western concerns

Businessman and democracy advocate Lai, 76, a leading critic of the Chinese Communist Party, has pleaded not guilty to charges that he endangered China’s national security by colluding with foreign forces. The ongoing trial of the tabloid media tycoon, a British national, is being closely watched by diplomats and humanContinue Reading

Muscle and mediation swirl in the South China Sea – Asia Times

The state visit to Beijing by Philippine President Ferdinand Marcos Jr in January 2023 did not yield the momentum for bilateral ties that his predecessor’s trip in 2017 did. Barely one month after the state visit, there was a flareup in the South China Sea (SCS) with the Chinese coastguard’s lasing of its Philippine counterpart off Second Thomas Shoal.

The situation went downhill, especially after Manila publicized Beijing’s coercive behavior. There was the floating barrier incident in the Scarborough Shoal, though the focal point has centered on the Second Thomas Shoal where the Chinese and Filipinos faced off.

Chinese forces harassed the Philippine rotation and resupply missions to the outpost and fired water cannons at the latter — the first documented instance since 2021. 2023 was eventful for SCS disputes beyond incidents between Beijing and Manila. Other Southeast Asian parties in the SCS continued business as usual.

Malaysia and Vietnam continue to contend with regular Chinese forays into their exclusive economic zones. Hanoi silently strengthened its hold in the Spratlys through its land reclamation projects.

Extra-regional actors outside the SCS kept a constant presence. Japan is advancing defense and security links with Malaysia, the Philippines and Vietnam via its new Overseas Security Assistance framework.

The United States has elevated ties with Indonesia and Vietnam to comprehensive strategic partnerships. Australia and the United States commenced joint air and sea patrols with the Philippines in the SCS.

Within a month, the US Navy conducted three freedom of navigation operations which explicitly targeted Second Thomas Shoal. That might not have rolled back Beijing’s actions, but it plausibly deterred further escalatory moves against the Philippines given the risk of triggering the Mutual Defense Treaty in operation between Manila and Washington.

But 2023 was not all gloomy. In Jakarta, ASEAN and China adopted guidelines that envisaged the completion of negotiations on the proposed Code of Conduct in the SCS by 2026. In a sign of warming ties, a flurry of high-level meetings between China and the United States were held. These culminated in the Filoli summit between the two countries’ leaders in November.

With the two major powers on the cusp of reviving high-level military communications, there is a mutual desire to stabilize fractious bilateral relations and prevent tensions from ballooning into an armed conflict, not least in the SCS.

The paradox of gunboat diplomacy coexisting with softer diplomacy looks set to persist in 2024. But there are uncertainties, not least elections in the United States and Taiwan. China’s economic slowdown is projected to endure in 2024, despite some positive signs.

The country’s exports and domestic consumption remain lackluster. Local governments, property and shadow banking sectors continue to be fraught with debt problems. Some believe Beijing might externalize these domestic problems by seeking adventure in the SCS or around Taiwan’s coastline.

The contrarian view is that China is more likely to address its economic slowdown to restore the social compact that long underpinned the Communist Party’s political legitimacy. A major crisis that worsens the domestic situation is not desired, at least until China is in a more comfortable economic and technological position.

For now, Beijing seems content with a holding pattern in the SCS — to continue muscling its maritime sovereignty using existing forms of grey zone actions that fall short of lethal force.

“Horizontal” escalation is therefore possible — China may intensify current grey-zone actions while maintaining escalation below the threshold of using force.

The recent boat swarming in Whitsun Reef reflects the shrinking list of grey-zone options, short of vertical escalation into actions such as forcible boarding and inspection of rival claimants’ vessels which would be deemed incendiary. Despite domestic woes, Beijing might have calculated that it can comfortably play the long game in the SCS.

This state of affairs is enabled by other ASEAN parties in the SCS. Unlike Manila under Marcos Jr, other ASEAN parties have largely been silent or kept a low profile in their dealings with Beijing over the SCS issue.

Brunei, Indonesia, Malaysia and Vietnam all fall into this category, prioritizing economic engagements with China. Malaysia and Vietnam also took part in the China-hosted Exercise Aman Youyi 2023, reflecting their desire to maintain a balance between Beijing and other contending extra-regional actors. They believe that this approach has worked, and this looks likely to continue in 2024.

ASEAN and China envisage new gains from Code of Conduct negotiations. There are compelling reasons for both parties to do so. For ASEAN members, the code asserts the bloc’s centrality and relevance.

Beijing views the code as a demonstration of its willingness to “jaw-jaw, not war-war.” The code also underlines its narrative that SCS littorals themselves can manage their own differences without external interference.

That said, problems that existed before Covid-19, such as differences over the geographical scope and role of non-signatories, continued into the post-pandemic restart of Code of Conduct negotiations.

Complicating this is the degradation of mutual confidence and trust between China and some ASEAN parties because of SCS flare-ups since early 2020. Given this backdrop of strategic trust deficit, expectations on promulgating the code by 2026 must be tempered.

These uncertainties notwithstanding, SCS parties seem to be fully cognizant of the risks involved, especially in a premeditated conflict. They will continue to strengthen their positions in the SCS while remaining mindful of the dangers of inadvertent armed confrontation.

Collin Koh is Senior Fellow at the S Rajaratnam School of International Studies, Nanyang Technological University, Singapore.

This article was originally published by East Asia Forum and is republished under a Creative Commons license. This article is part of an EAF special feature series on 2023 in review and the year ahead.

2023 was Singapore’s fourth-warmest year on record: Met Service

The warm temperatures, together with other factors such as humidity, wind speed and solar radiation, contributed to occurrences of high heat stress, the Met Service said. In 2023, Singapore endured 37 days of high heat stress, which occurred mostly in April, May, June and October. The country did, however, experienceContinue Reading

Volkswagen going fully native in China – Asia Times

Volkswagen Group China is turning to local procurement to reduce costs as it accelerates a multi-year investment plan aimed at becoming one of China’s leading electric vehicle producers.

The automaker’s new “in China for China” strategy encompasses R&D, a substantial expansion of manufacturing capacity and a wider scope for collaboration with local partners.

Once known as the maker of Shanghai taxis, Germany’s largest automaker and its joint ventures now have nearly 100,000 employees and more than 40 vehicle and component manufacturing sites in China. From industrial robots and components to autonomous driving software and systems, it is deeply embedded in China’s automobile supply chain.

This is not what European Union bureaucrats or US politicians have in mind when they talk about “de-risking” economic relations with China but it is what the market dictates. Decades of relationship building and a commanding position in the world’s largest car market are now on the line.

In 2023, the Volkswagen Group delivered 3.2 million vehicles in mainland China and Hong Kong, a year-on-year increase of 1.6%. Deliveries of Audi premium brand vehicles rose 13.5% to 729,000 vehicles. Deliveries of battery electric vehicles (BEVs) increased by 23.2% to 191,800, or 5.9% of the total Chinese market.

In comparison, BYD sold slightly more than 3 million vehicles last year, 8% of which were exported. These included 1.6 million BEVs and 1.4 million hybrids. Tesla Shanghai delivered nearly 950,000 BEVs, slightly more than 600,000 of them to customers in China (Tesla does not make hybrids).

Volkswagen Group China’s BEV deliveries were up 72.3% in the fourth quarter, with its ID.3, ID.4 and Audi e-tron models contributing to the surge in sales. The ID.3 was the top-ranked compact hatchback while the ID.4 was one of the best-selling compact SUVs.

Zhang Lan, pice President of Group Sales of Volkswagen Group China, said that to maintain momentum in China’s highly competitive market, “we must continue tapping new market segments quickly, aligning our portfolio with new market trends effectively, while working on our cost structures.”

“It is not all about market share. Profitability continues to be our top priority,” said Ralf Brandstätter, chairman and CEO of Volkswagen Group China.

“In recent months, Volkswagen has identified and implemented cost optimizations for its fully electric vehicles in China,” he added. “We will not push ahead to grow at any cost in this highly competitive environment. We are focusing on investments for the next leap in innovation instead.”

Volkswagen increased its share of China’s internal combustion engine (ICE) market from 19% in 2022 to 20% in 2023, with deliveries rising by 0.8% to 3.04 million vehicles.

Economies of scale support the profitability of the business, which generates cash to invest in EV technology and production. Volkswagen Group China’s ICE vehicles are also being upgraded and converted to hybrids.

On January 11, 2024, the Chinese government announced a new target for new energy vehicles (NEVs) to account for 45% of new car sales in China by 2027.

NEVs include battery, hybrid and fuel-cell electric vehicles. China’s previous NEV sales targets were 20% of new car sales by 2025, 40% by 2030 and 50% by 2050.

The new target provides a new stretch of open road for automakers in China, which have been suffering from severe price competition, and a clear opportunity for Volkswagen.

Still, even if China achieves its target of 45% NEVs by 2027, more than half of new vehicle sales will still have internal combustion engines.

The Volkswagen Group plans to invest 180 billion euros between 2023 and 2027, with about two-thirds of that investment dedicated to digitization and electrification. By 2030, it aims to increase the share of NEVs in its sales mix in China to 40%.

In September 2023, Volkswagen announced that its new EV factory in the city of Hefei, Anhui Province, was ready to start production.

The factory has an initial production capacity of 350,000 vehicles per year – 82% more than Volkswagen’s BEV sales in China in 2023 – with room to increase that volume as necessary.

In November, Volkswagen announced plans to turn its manufacturing site in Anhui into a “state-of-the-art production, development and innovation hub.” The initiative will be led by the Volkswagen China Technology Company (VCTC), the Group’s largest R&D center outside of Germany.

VCTC’s goal is to reduce time-to-market for vehicles and components by 30%, including through the introduction of an entry-level EV platform within 36 months.

Based on the Volkswagen Group’s modular electric drive matrix (Modulare E-Antriebs-Baukasten in German, or MEB), the new platform will be designed specifically for the Chinese market.

“We are systematically developing Hefei into the Volkswagen Group’s innovation hub in China. And we are stepping up the pace. We have already demonstrated this with the construction of the Volkswagen Anhui factory in just 18 months” said Erwin Gabardi, CEO of Volkswagen Anhui.

“We are specifically utilizing new technologies and the outstanding infrastructure of the eastern Chinese province of Anhui. Its capital Hefei has developed into the Silicon Valley of China. We will also benefit from this innovative strength,” he added.

CEO Brandstätter said, “We are developing Hefei into the center of our ‘in China, for China’ strategy and a strong interface between all our joint venture companies and local partners. This boosts efficiency, increases the speed of development and optimizes our cost structure.”

Volkswagen Anhui has about 1,100 local suppliers providing components and services at prices considerably lower than those in Europe. It is also buying Kuka industrial robots in China rather than importing them from Germany.

Midea, the Chinese home electric appliance maker, took control of Kuka at the end of 2016. It now owns 100% of the company, which is the fourth largest industrial robot maker in the world after ABB, Fanuc and Yaskawa.

Kuka, which specializes in auto manufacturing but also serves other industries, has a global market share of about 12%. In China, it also supplies BYD, Nio, and CATL.

Kuka has three production bases in China – namely in Shanghai, Jiangsu and Guangdong – and three customer service centers. Kuka’s Swisslog subsidiary, which specializes in logistics robots, has production bases in Jiangsu and Guangdong.

In November 2023, Volkswagen (Anhui) Components Co Ltd (VWAC), which operates the Volkswagen Group’s first 100%-owned battery system factory in China, started production of its new high-voltage battery system, a key component for VolkswagenAnhui’s MEB EVs.

The new battery system consists of multiple cell modules, a cell management controller, a battery management system and connector strips. 96% of its components are supplied locally.

The entire production process is covered by automatic line-feeding technology combining automated guided vehicles, high-precision cameras and industrial robots that enable just-in-sequence logistics and accurate parts processing. Initial capacity will be 150,000 to 180,000 systems per year.

VWAC is also preparing to manufacture CTP (cell-to-pack) battery packs developed in cooperation with Gotion High-tech, in which Volkswagen is the largest shareholder.

Headquartered in Hefei, Anhui province, Gotion High-tech has operations in China, Germany, the US and Japan. At the end of December, Gotion announced that its first battery pack had been manufactured at its factory in Fremont, California.

In July 2023, Volkswagen bought 4.99% of Chinese EV start-up Xpeng, with which it plans to develop two new models to be introduced in 2026.

In October 2022, Volkswagen’s software subsidiary Cariad and Horizon Robotics announced plans to establish a 60-40% joint venture to develop computing solutions for Advanced Driver Assistance Systems (ADAS).

Based in Beijing, Horizon Robotics is a provider of software, processors and systems for autonomous driving. Known as Carizon, the new venture was officially launched in December 2023.

The Volkswagen Group has been doing business in and with China since 1978. It formed its first joint venture in China with Shanghai Automotive Industry Corporation (SAIC) in 1984 and its second, with First Automobile Works (FAW) in 1991.

In 2017, it established Volkswagen (Anhui) Automotive Company Ltd in Hefei, Anhui province, to manufacture NEVs in China for sale in the country.

In 2021, the Audi FAW NEV Company was incorporated to focus on the production of luxury NEVs in China. The Group is represented by several brands including Volkswagen Passenger Cars, Volkswagen Commercial Vehicles, Audi, Škoda, Jetta, Porsche, Bentley, Lamborghini and Ducati.

Instead of “de-risking” from China, Volkswagen is integrating its operations with those of an increasing number of Chinese partners, reducing its costs and accelerating its product development cycle to match that of the hyper-competitive Chinese auto industry.

As a result, it seems likely to overcome its dependence on internal combustion engines and gain a significant and profitable share of the world’s largest and most dynamic market for EVs.

Follow this writer on X: @ScottFo83517667

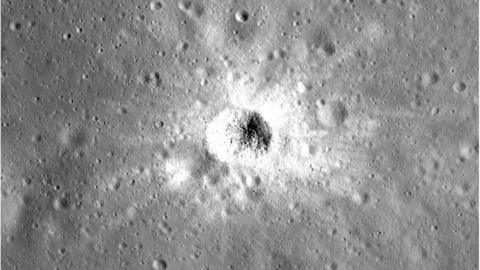

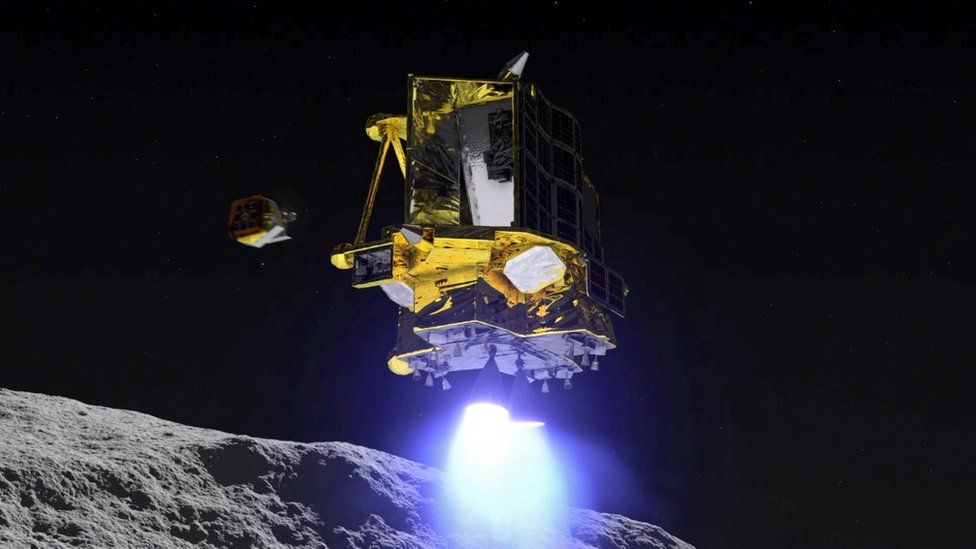

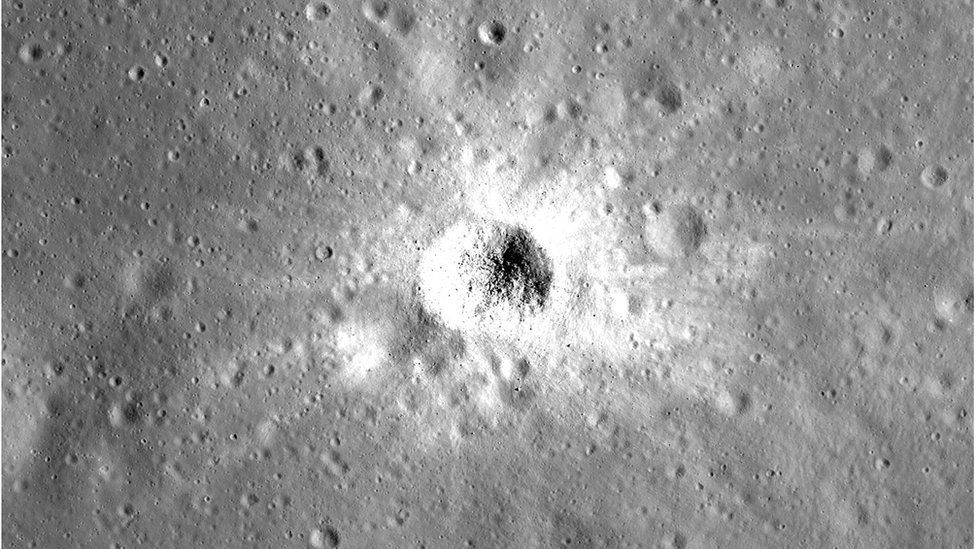

Japan hopes sunlight can save stricken Slim Moon lander

Jaxa

JaxaJapan may yet manage to salvage its Moon lander, the country’s space agency Jaxa says – if sunlight hits it in the right place.

The Slim spacecraft was turned off just three hours after its historic lunar touchdown on Saturday to save power.

Engineers had realised its solar cells were pointing west, away from the Sun, and could not generate electricity.

But the mission team is now hopeful the situation could improve as lighting conditions shift.

“If sunlight hits the Moon from the west in the future, we believe there’s a possibility of power generation, and we’re currently preparing for restoration,” the Jaxa statement read.

The Slim mission – also nicknamed “Moon Sniper” for its use of precision-landing technologies – made Japan only the fifth nation in history to complete a soft lunar touchdown.

But the joy of seeing the craft complete its controlled descent soon turned to worry as power levels drained away.

Rather than let the system go completely flat, the decision was taken to put the craft to sleep.

“The battery was disconnected according to our procedures with 12% power remaining, in order to avoid a situation where the restart (of the lander) would be hampered,” Jaxa said.

“As a result, the spacecraft was switched off at 02:57 (Saturday, Japan time, or 17:57 GMT, Friday).”

Before shutdown, mission control was able to successfully gather details of Slim’s predicament, as well as images and data about its descent to the lunar surface.

“We’re relieved and beginning to get excited after confirming a lot of data has been obtained,” Jaxa said.

The agency promised updates through the week.

Moon missions try to land early in the “lunar day”, when the Sun comes up over the eastern horizon. This gives a spacecraft about two “Earth weeks” of illumination before the Sun then sets in the west for two weeks of darkness.

It’s currently “morning” at Slim’s landing location on the slopes of Shioli Crater. If, as suspected, the spacecraft’s solar cells are pointing westward, then it may have to wait until the “lunar afternoon” before those cells catch enough light to start charging the battery system.

Slim was carrying two small rovers, which data indicates it managed to eject as planned just before touchdown.

The craft is also equipped with an infrared camera to study the local geology. How much it could investigate if power levels are restored is uncertain.

Statistically, it’s proven very hard to land on the Moon. Only about half of all attempts have succeeded.

Prior to Slim’s touchdown only the US, the former Soviet Union, China and India had made it to the surface intact.

A private American mission gave up its landing bid earlier this month when it suffered a propulsion fault shortly after launch from Earth. Another commercial US mission will try its luck in late February.