Coroner’s court grapples with mystery of dead man, whose identity on paper belongs to someone else

SINGAPORE: After their father died suddenly of natural causes, a family was shocked to realise that the name they had always known him by was not his real name.

His identity – Abdul Rahman Majid – belonged to a man they did not know, and who had been living in a welfare home since 1994.

Investigative efforts revealed few clues and met with several dead ends, as a coroner’s court heard on Tuesday (Jul 18) on the opening of the inquiry into the unknown man’s death.

MAN’S DEATH PROMPTS UNANSWERED QUESTIONS

The dead man had a wife and five sons – his eldest had been given away at birth. He lived with his youngest son in a rental flat in Geylang Bahru.

On Aug 5 last year, the man was found lying in a supine position and not breathing in the living room. His youngest son, who suffers from schizophrenia like his mother, called the police.

When the police arrived, they first identified the man as Mr Abdul Rahman Majid, according to the name provided under the “father” column in his youngest son’s birth certificate.

The man was pronounced dead that same day. He had no injuries on him and there were no signs of a struggle in the flat. The initial cause of death was found to be natural, from coronary artery disease.

However, police investigations uncovered oddities – there was no passport or NRIC belonging to the dead man in the flat.

Only an old construction site pass and a UOB Plaza pass indicated the man’s photo and the name “Abdul Rahman Majid”.

However, fingerprints lifted from the dead man did not match any in the national database, nor any in the databases of Malaysia or Indonesia.

Blood samples showed that four of the dead man’s sons – excluding the eldest who had been given away at birth – were the dead man’s biological sons.

THE REAL ABDUL RAHMAN MAJID

The investigating officer tracked down the real Mr Abdul Rahman. He was a long-term resident living at a home since 1994, because of his chronic schizophrenia. He is now 69.

Inspector Ng Yun Ning had a brief interview with Mr Abdul Rahman, who could respond only by shaking or nodding his head.

She showed him a photo of the dead man, and he shook his head, indicating that he did not know him.

INSP Ng requested reports from all major hospitals and clinics on the dead man’s medical history, but only two returned answers – the Institute of Mental Health (IMH) and Tan Tock Seng Hospital.

The real Mr Abdul Rahman’s sister confirmed that it was her brother who had received treatment at IMH and Tan Tock Seng Hospital, so there were no clear medical reports tagged to the deceased.

The sister of the real Mr Abdul Rahman was also surprised to hear that someone was using her brother’s identity, and said it was her first time hearing this.

“I interviewed the sons, who received this information as a shock, because they always knew their father as Abdul Rahman Majid, bearing the IC number found in the birth certificate,” said INSP Ng.

OTHER CLUES

She also spoke to a cleaner who was in charge of the block the deceased lived in for more than 20 years. The cleaner said he previously had a brief conversation with the dead man, who told him to call him “Kassim”.

According to one of the sons, the family used to live in another rental flat in Hougang. When they lived there, there was a man saying he was from Malaysia, who visited and addressed their father as “Kassim”.

State Coroner Adam Nakhoda explained to the man’s fourth son and his wife, who attended the hearing on Tuesday, that an inquiry had to be held because the identity of the deceased is unknown.

On questioning by the coroner, INSP Ng said she had shown a photo of the deceased to the real Mr Abdul Rahman, but not to his sister.

Instead, she had given the woman the names of the deceased’s sons, and the woman said she did not know them.

In court, a photo of the real Mr Abdul Rahman was shown to the deceased’s son and his wife, and they said they did not know him.

None of the sons were aware of any paternal relatives or grandparents, INSP Ng said.

The officer said she had tried speaking to the deceased’s wife, but the woman suffers from schizophrenia and could only respond by nodding or shaking her head.

According to one of the sons, the deceased’s wife has some relatives on her side who also suffer from schizophrenia.

MORE INVESTIGATIONS

The coroner directed the investigating officer to conduct additional investigations.

She was asked to contact the relatives of the deceased’s wife to find out if they had any information about the deceased.

The police should also check with the Housing and Development Board over the rental flats in Hougang and Geylang Bahru that the family lived in, to see if there was any other name tagged as a registered tenant other than the deceased’s wife.

The coroner also asked the officer to check with the Registry of Muslim Marriages or the Registry of Marriages as to whether there is any record of the deceased’s marriage.

He asked the officer to canvass coffee shops the deceased frequented to see if anyone there could recall him. She should also show the photo of the real Mr Abdul Rahman to the man’s remaining son who had not seen it.

The son who attended the hearing had no concerns about his father’s death, but said he wanted to know his father’s real name.

The coroner told him that he could understand this, but said that this might not be able to be established at the end of the day, as “quite a lot” of the investigations did not yield any clues on his identity.

Findings will be given at a later date.

From PAP up-and-comer to Speaker: Tan Chuan-Jin’s career before resigning over affair

“DEMOTION” TO SPEAKER

In 2017, Mr Tan was nominated by Prime Minister Lee Hsien Loong to be the 10th Speaker of Parliament. Then-Speaker Halimah Yacob had resigned to contest the presidential election.

Political analysts expressed surprise at the move, given that he was tipped to be a core member of the PAP’s fourth-generation, or 4G, leadership.

One observer said that it was unusual for a Cabinet minister in his prime to be made Speaker, while many online called it a “demotion”.

Mr Lee wrote on Facebook at the time that it was a “very difficult decision” to nominate Mr Tan as Speaker, as it “meant losing an effective activist” at the Ministry of Social and Family Development.

After accepting the nomination, Mr Tan wrote on Facebook: “May God continue to grant me wisdom, courage and love in all that I do. However inadequate as I may be, I hope that I can fight the good fight, finish the race and keep the faith.”

He was re-nominated as Speaker in 2020.

Last year, he appeared on news podcast Plan B where he was asked why he was not in the running to be Singapore’s next Prime Minister.

At the time, three Cabinet ministers were tipped as potential candidates – Mr Chan Chun Sing, Mr Lawrence Wong and Mr Ong Ye Kung. Shortly after, Mr Wong was endorsed as leader of the 4G team, then promoted to Deputy Prime Minister.

Mr Tan told the podcast host that he was not in the Cabinet, given that he was Speaker. This effectively ruled him out of the prime ministerial race.

CelcomDigi partners Huawei, ZTE for nationwide network integration and modernisation

Largest telco network deployment since merger of Celcom & Digi in 2022

Involves upgrades, consolidation of 25,000 existing Celcom & Digi sites

CelcomDigi Bhd announced that the company is partnering Huawei Technologies (Malaysia) and ZTE (Malaysia) Corporation for the purchase of network services, solutions and equipment for its nationwide network integration and modernisation project.

In…Continue Reading

Washington myopia undercuts Indo-Pacific partners

Over the last few weeks, Washington has been abuzz with everything India. On June 22, President Joe Biden, cabinet secretaries and the US Congress gave a rousing reception to visiting Indian Prime Minister Narendra Modi.

For his part, the prime minister cheered Republican and Democratic congressmen with his quip that he could “help them reach bipartisan consensus,” referring to the across-the-aisle support India enjoys in Washington.

It was certainly an apt decision to honor the Indian leader, given that the US-India partnership has significantly expanded under Biden. Both the White House and several members of the Biden administration, from National Security Advisor Jake Sullivan to Indo-Pacific Coordinator Kurt Campbell, have characterized it as the “most important bilateral relationship of the 21st century.”

However, over the last few months, some of the Biden administration’s regional policies in the Indo-Pacific have done more harm than good to its partners, particularly hurting India and its geopolitical leverage in the Indo-Pacific region.

The Biden administration’s foreign policy cut a significant departure from its predecessors until last month, when it returned to Washington’s old ways: myopic democratic interventions, benevolent outreach to adversarial nations and partisan bickering.

Over the last few weeks, Washington’s primary Indo-Pacific partners, India and Japan, have borne the brunt of these missteps.

Biden, in a last-minute change of plans, canceled his scheduled trip to Papua New Guinea and Australia to address the debt ceiling crisis in Washington, with Republicans stalling the Democrats from raising the debt ceiling levels.

While Secretary of State Antony Blinken went ahead with his own trip to Papua New Guinea and signed a crucial defense agreement with the Pacific Island nation, Biden’s cancelation of that leg of the tour was not the best messaging to a region increasingly falling under China’s orbit.

Prior to Biden’s cancellation, the Indian government had decided to accommodate his visit and cut short Indian official visits as a courtesy to the incoming American presidential delegation. Modi went ahead with his travel itinerary as scheduled – and turned it into an opportunity to showcase India’s position on the global stage.

New Guinea Prime Minister James Marape hailed Modi as the leader of the Global South. Taking an implicit jab at the United States and China, the island nation leader told Modi, “We are victims of global power play, and you are the leader of Global South. We will rally behind your leadership at global forums.”

While this was a minor setback for a coordinated approach toward Chinese expansionism in the Pacific, the Indian Ocean challenge is a more geopolitically complex Gordian knot.

In mid-May, Blinken threatened Bangladesh with sanctions if the Indian Ocean state did not host free and fair elections in the 2024 poll. Suppose the United States were to follow through with its threat.

In that case, India and Japan would be in a quandary as they have consistently positioned Bangladesh as a gateway connecting the Indian subcontinent to Southeast Asia for supply chain and infrastructure connectivity initiatives.

Geographically, Bangladesh is nestled between India’s state of Bengal to the west and India’s northeastern provinces to the east, bordering a thin strip of land the connects the rest of India to the northeast (also known as the “chicken’s neck”).

Thus the densely populated country’s interaction with the rest of the world is directed through India or the Bay of Bengal and the Indian Ocean.

Both New Delhi and Tokyo have invested in infrastructure in the region and have long-term plans to invest in Dhaka’s growth. Recently, Japan and India agreed to jointly develop the Matabari deep-sea port in Bangladesh to serve as a “strategic anchor” in the Indian Ocean.

Though often underreported, Japanese investment plays a vital role in South Asian development. Japan is also undeniably India’s Northeast region’s major infrastructure and development partner.

Through the Bay of Bengal-Northeast India Industrial Value Chain, the Japanese government envisions increased connectivity between India’s landlocked northeast and Southeast Asia, creating a single economic zone and an alternative trade connectivity project to China’s Belt and Road Initiative.

Japanese prime minister Fumio Kishida, articulating his government’s Free and Open Indo-Pacific strategy in New Delhi in early March this year, called for increased integration of India’s Northeast with Bangladesh to transform the region into a single economic zone.

Moreover, Japan is attempting to capture the businesses moving out of the pricier markets of Southeast Asia, using the Bay of Bengal region. Japan’s regional strategy has neatly complemented the Modi government’s policies.

Modi transformed the older “Look East” policy into an “Act East” policy of increasing strategic and economic engagement with Southeast Asia as a countervailing force to China’s involvement in the region.

Tokyo has slowly and steadily supported this transformation. A case in point is Tokyo and New Delhi’s hosting of the India-Japan Act East forum to discuss cooperation on a range of projects that will increase connectivity in India’s Northeast to Southeast Asia.

India’s Northeast has a history of civil unrest and strife, making it a challenging region for development. Furthermore, its landlocked topography and poor infrastructure limited its connectivity to both its neighboring countries and the rest of India. Only a party interested in the long game or having a vision for the region could invest in that part of the world, and in this case it is Japan.

Interestingly, as an extension, both Japan and India are engaging the immediate eastern neighbor to Bangladesh and India, Myanmar. Sanctioned by the United States, Myanmar has limited partners on the world stage. Nonetheless, Japan and India have continued engagement with the military junta to prevent the nation from falling entirely under China’s influence.

There, once again, Indo-Japanese interests are affected by America’s sanctions. In May, India-Myanmar inaugurated the Sittwe port in the Rakhine state of Myanmar. India supported this port to enhance sea lane connectivity between India’s eastern states and Myanmar.

However, since the sanctions, Indian companies have either had to depart Myanmar altogether or face global scrutiny for working with the military junta-led government.

As satellite images released earlier this year indicated, increased activity on the Great Coco Islands of Myanmar had the markings of Chinese military involvement. With the Great Cocos less than thirty miles north of India’s Andaman and Nicobar Islands, any potential militarization of the Coco Islands by the Chinese could pose a significant threat to India’s security in the Indian Ocean.

In this geopolitical equation, India cannot afford to disengage from Myanmar. And yet, America’s economic statecraft is undercutting India’s vital regional partnerships.

Henry Kissinger, who celebrated his 100th birthday in May, summed up this dynamic well: “It may be dangerous to be America’s enemy, but to be America’s friend is fatal.” It is undoubtedly proving so for Japan and India, but more so for New Delhi in the Indian Ocean.

Against the backdrop of these measures come the Biden administration’s attempts at thawing relations with China. While Biden departs from his predecessors as the only recent president not to ask for Kissinger’s advice, he is beginning to walk in the footsteps of the grand strategist by making attempts to mend ties with China.

From the dialogue in Vienna to Blinken rescheduling his trip to Beijing for last month to the official abandonment of economic “decoupling” for the less confrontational “de-risking,” Washington’s approach to China shows signs of softening.

While members of the Indo-Pacific Economic Framework for Prosperity (IPEF) agreed on moving ahead with a supply chain agreement in Detroit, US Trade Representative Katherine Tai met with her Chinese counterpart to discuss trade and economic ties in the same week on the sidelines of the APEC meeting.

Washington’s blow-hot, blow-cold approach does not reassure allies and partners – particularly partners that it courts for strategic competition with China – of the consistency of its priorities and policies.

Furthermore, Washington’s skewed sanction policies, opposing democratic backsliding in a few states at the same time it calls for engagement with authoritarian China, raise questions about the motives behind such policies.

While the United States has sanctioned Chinese officials allegedly involved in human rights abuses in Xinjiang, it continues to do massive business with Beijing. This selective condemnation only further isolates partners and strengthens Chinese engagement with the sanctioned nations.

This misbegotten strategy, according to Rob York, director for regional affairs at Honolulu’s Pacific Forum, is “a holdover from America’s unipolar moment that we need to outgrow. America’s moral authority, and the benefits of aligning with Washington, are no longer assumed but must be competed for, and sanctions must be employed far more judiciously than they have been.”

This type of awakening to multipolar realities of the world order should inform Washington of the pitfalls and shortsightedness of its foreign policies. America’s sanctions and other tools of economic statecraft should not be used for democratic interventions but to deter its enemies. If not, the United States will have few allies in its strategic competition with China.

Akhil Ramesh ([email protected]) is a senior fellow at the Pacific Forum and author of the US-India chapter for Comparative Connections: A Triannual E-Journal of Bilateral Relations in the Indo-Pacific.

The article in this version was first published by Pacific Forum. An earlier version appeared in The National Interest. Asia Times is republishing with kind permission.

Evergrande: Crisis-hit Chinese property giant reveals $81bn loss

Getty Images

Getty ImagesCrisis-hit Chinese property giant Evergrande has revealed that in 2021 and 2022 it lost a combined 581.9bn yuan ($81.1bn; £62bn).

The firm, which defaulted on its debts in late-2021, reported its long overdue earnings to investors in Hong Kong.

Evergrande has been struggling with an estimated $300bn (£229bn) of debts.

The huge losses highlight how much the developer was rocked in recent years by the property market crisis in the world’s second largest economy.

In filings to the Hong Kong Stock Exchange late on Monday, the company said it lost 476bn yuan in 2021 and 105.9bn yuan last year.

That came as revenue more than halved over the two-year period.

Evergrande said the losses were due to a number of reasons, including the falling value of properties and other assets as well as higher borrowing costs.

Shares in the firm, which was once China’s top-selling property developer, have been suspended from trading since March last year.

China’s real estate industry was rocked when new rules to control the amount big real estate firms could borrow were introduced in 2020.

The following year, Evergrande missed a crucial deadline and failed to repay interest on around $1.2bn of international loans.

Its financial problems have rippled through the country’s property industry, with a series of other developers defaulting on their debts and leaving unfinished building projects across the country.

Earlier this year, Evergrande laid out plans to restructure around $20bn in overseas debt.

The company racked up debts of more than $300bn as it expanded aggressively to become one of China’s biggest companies.

Over the last decade and a half the company’s expansion encompassed a wide range of industries including sports, entertainment and electric car making.

In 2010, Evergrande took control of Guangzhou FC and changed its name to Guangzhou Evergrande Taobao FC.

With an infusion of new money, the squad was strengthened and it immediately won promotion to the top tier of Chinese football. From 2011 it won the Chinese Super League title eight times, including seven seasons in a row.

Last year, the club was relegated from the Super League, while Evergrande’s plans for a $1.8bn stadium were shelved. The club has also reverted to its previous name – Guangzhou FC.

Related Topics

-

-

10 August 2022

-

-

-

1 August 2022

-

-

-

3 January 2022

-

-

-

20 December 2021

-

Thwarted Thai PM candidate chases support for next vote

Thailand’s Constitutional Court could also take up a case on Wednesday on whether Pita, 42, should be disqualified from parliament entirely for owning shares in a media company, prohibited for MPs under the Thai constitution. Pita, who made his fortune in a family-run agrifood business, has said the shares wereContinue Reading

US climate envoy Kerry meets China’s top diplomat in Beijing

BEIJING: United States climate envoy John Kerry met China’s top diplomat Wang Yi in Beijing on Tuesday (Jul 18), as the two countries revive stalled diplomacy on reducing planet-warming emissions. Kerry was greeted by Wang at Beijing’s Great Hall of the People on the third day of a visit to ChinaContinue Reading

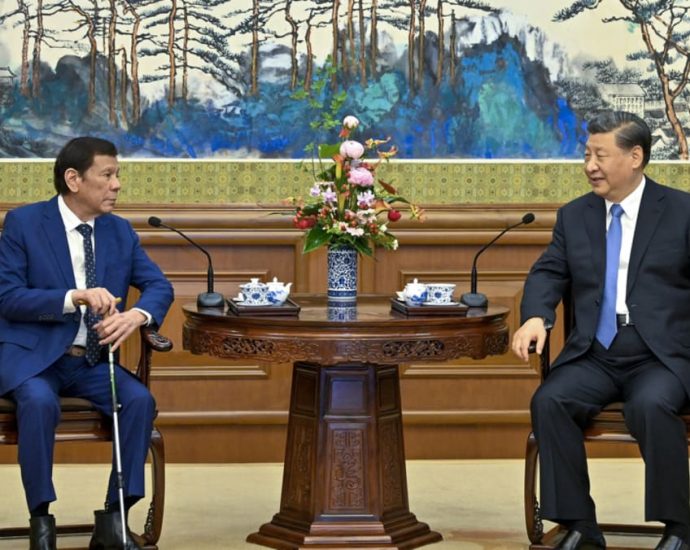

Xi tells ex-Philippine president Duterte to promote ties with China

BEIJING: China’s President Xi Jinping told former Philippine President Rodrigo Duterte to continue to promote cooperation between the two countries, after bilateral relations cooled with Duterte’s successor seeking closer ties with Washington. Ferdinand Marcos Jr was elected as president for a six-year term in 2022, taking over from Duterte whoContinue Reading

Caretaker Kedah chief minister charged with sedition over remarks against Selangor ruler

In a statement on Tuesday, Parti Islam Se-Malaysia (PAS) secretary general Takiyuddin Hassan said that the party was following the case closely and urged all their supporters to keep calm and respect the process of law. PAS is a PN component party.

Last Thursday, multiple police reports had been lodged against Sanusi for allegedly insulting the Selangor royal institution.

In a viral video, Sanusi appears to have belittled the appointment of Selangor chief minister Amirudin Shari during a political rally.

In a Facebook post on Jul 15, Sanusi said that he sent a letter to the Selangor palace, where he had apologised to the ruler but claimed that his speech had been spun out of context.

On Monday, Sultan Sharafuddin said in a post on the Selangor Royal Office Facebook page that the issue was yet to be resolved.

Inspector-General of Police Razarudin Husain had also said that investigations into Sanusi’s remarks would go on despite his apology to the Selangor ruler.

The police had conducted their investigations under the Penal Code, the Sedition Act, and the Communications and Multimedia Act.

Early last month, Sanusi – who is known for his controversial statements – had been investigated over his alleged claims that Penang falls under Kedah’s ownership.

Ayalaâs path to an ESG driven business | FinanceAsia

With several ESG-backed initiatives in recent years, the Philippines-based conglomerate Ayala has solidified its commitment to sustainability. Operating across verticals including energy, finance, infrastructure, and real estate, Ayala has committed to net zero greenhouse emissions by 2050. The conglomerate’s energy wing ACEN recently created the world’s first energy transition mechanism (ETM) in November 2022, backed by BPI and RCBC.

On the social front, Ayala’s GCash app and BPI’s BanKo have played pivotal roles in financial inclusion for unbanked Filipinos and small to medium size enterprises. BPI and Globe are currently reviewing their framework to consciously focus on these areas.

When it comes to governance, Ayala’s boards are working towards an appropriate level of diversity and independence. This involves maintaining high standards when it comes to transparency and disclosure.

The 190-year-old company’s social and sustainability initiatives have a long history. Albert de Larrazabal, CFO at Ayala Corporation said, “We have always aligned ourselves to national interest and had very high standards of governance and stewardship. As we must be mindful of the ecosystems we operate under, ESG in various forms has always been part of our value proposition.”

Ayala’s approach to ESG

Today, ESG-based financing is a priority for Ayala. Apart from ACEN’s implementation of the world’s first ETM, Ayala has issued a social bond with the IFC in support of its cancer hospital. Larrazabal said, “We are looking to do KPI-linked social and ESG financing, which incorporates targets into the commercial terms and conditions of the loan.”

Even during the M&A process, the conglomerate is mindful of integrating new acquisitions into its ESG framework. Ayala has also taken steps to ensure that ESG is a priority that is ingrained at the highest levels of the organisation, leveraging its membership with the World Business Council for Sustainable Development (WBCSD). The conglomerate’s board has received training which ensures they can play an active role in tracking and monitoring developments in the ESG space.

Corporates making public commitments to sustainability draw a lot of attention, not all of it positive. Asked how Ayala approaches concerns about greenwashing, Larrazabal said, “Sometimes it happens inadvertently because of incorrect measurements. That’s why we brought in South Pole. We have taken steps to ensure we are on the right track by committing to independent verification, to give people a degree of reassurance.”

Building a model for the APAC region

While the need for sustainable leaders is strongly felt across APAC, many countries in the region have a minimal contribution to emissions — the Philippines emits half the global average on a per capita basis. Larrazabal said, “Between 80% to 88% of our emissions — depending on individual businesses — are scope 3.” These emissions are defined as the result of activities from assets not owned or controlled by a reporting organisation, but which are a part of its value chain. Larrazabal said, “Our scope 3 is somebody else’s scope 1 and scope 2. We need an environment that enables, incentivises, and if that fails, penalises those who disregard scope 1 and 2.”

Many emerging markets grapple with issues similar to those facing the Philippines — adopting renewable energy, while meeting the demands of a growing population and economy. As a result, ETM-like arrangements may be embraced to a greater extent. Asked for his advice on managing such a transaction, Eric Francia, president and CEO at ACEN said, “It is important for investors to reconsider their position on coal, so long as the principles are well understood. One may be investing in a coal plant, but for a good purpose, which is enabling its early retirement.”

Offering a financial perspective on the ETM, TG Limcaoco, president and CEO Bank of Philippine Islands added, “We provided lending and brought in other institutions. We took reduced rates of returns for equity and debt exposure, which allowed us to shorten the life of the plant by 10 to 15 years. It is a big win for everyone involved.”

For more on Ayala’s adoption of ESG and a deeper insight into the world’s first ever ETM, please watch the accompanying video.

¬ Haymarket Media Limited. All rights reserved.