Commentary: India’s food security is being choked by climate change

Where India is succeeding is biofuel. The government is running ahead of its 10 per cent ethanol blending mandate and looks on track to hit a 20 per cent rate by 2025 as it seeks to trim its oil import bill.

That’s putting pressure on farm production, however. Sugarcane is a thirsty crop which, unlike most Indian food grains, needs a whole year or more to grow to maturity. It predominates in many of the same northern states where rice and wheat would otherwise be grown.

POLICYMAKERS NEED TO SHIFT THEIR PRIORITIES

Thanks to government pricing levels that make it an unusually profitable crop, the area planted went up around 17 per cent between 2017 and 2022, while rice had an eight per cent increase and pulse fields shrank by 0.8 per cent.

If policymakers want to reduce emissions while cutting the impact of petroleum on the balance of payments, they need to reverse the current situation where biofuels are prioritised over electrification.

With renewables, too, India needs to lift its game. The 15.7 gigawatts of wind and solar installed last year is only about half of what is needed to hit the government’s target, and left the country 32 per cent short of where it had intended to be by that date.

Planned tenders of 50 gigawatts a year through March 2028 are markedly more ambitious – but they need to be turned from words into reality first.

No country will suffer more from climate change this century than India – but no country is going to see its emissions grow faster over the coming decade. If New Delhi doesn’t want to see a future of more crop failures, floods, droughts, export bans and farmer suicides, it’s going to need to do everything to reverse that trend.

Commentary: Jumpers and jackets shouldnât be needed in Singaporeâs tropical heat

Beyond its impact on health, air-conditioning also causes greenhouse gas emissions. Buildings account for more than 20 per cent of Singapore’s emissions, and more than a third of the country’s electricity consumption. A typical office in Singapore expends 60 per cent of its energy on cooling, according to the Building and Construction Authority (BCA).

The World Economic Forum has estimated that emissions from air-conditioning alone could account for as much as a 0.5 degree Celsius increase in global warming by 2100.

It’s a vicious cycle. The hotter it gets, the more energy office buildings use on their air conditioning. And the more they turn on their air-conditioner, the warmer cities gets.

SOLUTIONS ARE POSSIBLE

Many people feel intuitively they will be healthier and accomplish more if temperatures are more comfortable. The research backs them up. Singapore can achieve its net zero goals faster if temperatures in buildings go up a bit too.

Yet change may be difficult. There are concerns that changing the behaviour of landlords and tenants could be the biggest hurdle. NUS assistant professor Clayton Miller told Eco-Business that there are many underused green building technologies, including innovative cooling. “Too many decision-makers want to play it safe and stick with conventional systems.”

Fortunately, a multitude of initiatives are underway to overcome hindrances to action. Since the early 2000s, for instance, the Garden City Action Committee has pushed for green buildings, which can reduce utility expenses and Singapore’s carbon footprint. The BCA has established a green mark for new buildings.

SP Digital created Green Energy Tech (GET) TenantCare, an automated submetering solution that gives tenants and landlords visibility of their utilities consumption. GET Engaged provides a digital dashboard which, when displayed in lobbies, could spur tenants to make more sustainable choices.

Some make nothing, others can earn S$1,000 a month: Group buy organisers on why they do it

SINGAPORE: Group buy volumes are not what they used to be during the COVID-19 pandemic, but organisers who continue say they do so in order to support small local businesses and help participants save.

For three organisers who spoke to CNA, group buying is a side hustle on top of full-time jobs. While one did manage to make some money, the other two said they earned just enough to cover their costs.

After CNA reported on the nightmare experience of a group buy organiser’s neighbour, questions were raised about how much money these organisers make and whether they should be allowed to run these activities out of their homes.

Home-based businesses do not require approval from authorities but are subject to certain conditions, such as not bringing “extraneous traffic” and no frequent loading and unloading of goods, according to the Housing Board’s website.

But as group buying is not considered a business, these conditions do not apply.

CNA spoke to group buy organisers to understand more about what motivates them, how they cover business costs and what can be done to improve operations.

NO EARNINGS VS S$1,000 A MONTH

Ms Irene Ng, 50, who organises the iheartSK group buy in Sengkang, does not make any money from group buy activities.

The full-time administrative executive usually organises four to eight group buys a month. During festive occasions, this can go up to 12 times a month.

Her pool of participants numbers more than 260, and she does not charge them any fees.

“As food enthusiasts, my buyers are aware that we can benefit from bulk purchases,” she said. “My intention is to give back to the community, and my buyers frequently express their gratitude for my efforts.”

Collections are hosted at her HDB flat, where she is “fortunate to possess a corridor space of my own”.

“Up to this point, none of my neighbours have expressed any concerns regarding the placement of my group buy items outside my corridor.

“I make it a priority to maintain substantial walking space for my neighbours and diligently (keep) the area as tidy as possible,” she said, adding that she pays attention not to obstruct fire-fighting access.

Another organiser, Ms Michelle Lim, 37, was making S$1,000 (US$740) a month at the height of her activities during the pandemic, when she was hosting group buys every day.

She started organising group buys as she liked trying different foods, and continued when she found that she could save on delivery costs and make some money.

Unlike other organisers CNA spoke to, Ms Lim charges each participant an administrative fee of S$2 to S$3. She introduced the fee as she felt the work involved was “quite tedious”.

There are about 200 people in her WhatsApp chat group, and she estimates about 10 to 20 people participate in each group buy, hosted at her landed house in the Newton-Bukit Timah area.

Ms Lim was unemployed when she started organising group buys but now works as a wedding planner, and estimates that her group buys have dwindled to once a month.

Ring removed from tourist’s thing

PUBLISHED : 26 Jul 2023 at 04:53

NEWSPAPER SECTION: News

Chon Buri: Pattaya rescue workers helped a Swiss tourist take off his constriction ring after it became stuck, and he is now recovering, local officials said on Tuesday.

On Monday night, rescue workers from the Sawangboribul Foundation in Pattaya were called to help a 52-year-old Swiss man who was suffering acute pain from the ring, usually worn at the base of the penis, to maintain an erection by slowing blood flow.

Thanapong Ok-oun and Jeerasak Nuchlek, rescue workers from the Sawangboribul Foundation, said that the Swiss tourist called them from an apartment in South Pattaya at 9pm and said that his penis became painfully swollen due to the ring.

The stainless steel ring was carefully removed by the medical team.

Ex-mayor jailed for 9 years

PUBLISHED : 26 Jul 2023 at 04:49

Prai Pattano has been sentenced to nine years of imprisonment without a suspended jail term by the Supreme Court for abuse of power while working as mayor of Hat Yai municipality in Songkhla in 2005.

The ruling was disclosed on Tuesday by Kosolwat Inthuchanyong, deputy spokesman of the Office of the Attorney General.

The Supreme Court reversed the ruling handed by the Court of Appeal, which earlier acquitted Prai.

The conviction against Prai is based on an abuse of power charge stemming from an accusation he had wrongfully transferred state money worth 26.9 million baht for amulet production in 2005 while serving as mayor.

According to the ruling, Prai used his power as a municipal mayor to transfer the money from the savings account of the municipal office to the Sirindhornrajvithayalai Foundation.

The amulets were to be sold to raise funds for the repair and gold-plating of the Buddha Mongkol Maharat statue, an important religious landmark in Hat Yai municipality.

Prai was found to have failed to comply with proper regulations in conducting the amulet production project.

He was accused of awarding a contract to a single amulet maker who landed the job without a bid being held. Not holding a bid was a violation of related procurement regulations, according to the investigation.

As well as the prison sentence, Mr Kosolwat said Prai had been ordered to return the state money worth 26.9 million baht spent on the amulet project.Prai has already given back 12.4 million baht of that amount to the Hat Yai municipal office.

PM vote postponed pending new ruling

MPs also cite clash with King’s birthday

Parliament president Wan Muhamad Noor Matha has postponed the vote for a new prime minister from Thursday, pending a Constitutional Court ruling on the rejected renomination of Move Forward Party (MFP) leader Pita Limjaroenrat.

Mr Wan said on Tuesday he made the decision after consulting with legal officials from the House of Representatives and his advisers.

They concluded that if the PM vote were to go ahead on Thursday, it could potentially lead to problems when the court makes its ruling afterwards, said Mr Wan, who also serves as the House speaker.

“With the vote postponed, today’s planned meeting of whips from the coalition allies, other political parties and senators became unnecessary,” he said.

Another reason for delaying the joint sitting of MPs and senators was that many were worried they would not be able to attend ceremonies to celebrate His Majesty the King’s birthday in their respective provinces on Friday if the sitting was prolonged, Mr Wan said.

The joint sitting for a prime ministerial vote can be put back on the parliamentary agenda after the court’s ruling.

Mr Wan earlier set Thursday for MPs and senators to vote again for a new prime minister, possibly a candidate from Pheu Thai, the second-largest party in the same alliance led by the MFP.

The MFP has agreed to let Pheu Thai take the lead in nominating a prime minister and forming the government.

The MFP also faces a challenge because many parties outside the eight-party coalition disapprove of its plan to revise Section 112 of the Criminal Code, also known as the lese majeste law.

Meanwhile, the MFP insists it will continue trying to get Mr Pita elected as prime minister.

He failed to win a majority in a joint vote by both houses on July 13.

Mr Pita was renominated at a joint sitting on July 19, but this was turned down, citing a parliamentary regulation.

Opponents argued the renomination was in violation of parliamentary regulation 41, which prohibits the resubmission of a failed motion during the same parliamentary session.

Mr Pita’s supporters and many academics disagreed and asked the Constitutional Court to rule on parliament’s rejection.

Constitutional Court president Worawit Kangsasitiam said on Tuesday the Ombudsman had electronically submitted a petition asking the court to rule on Mr Pita’s rejected renomination as well as to suspend the prime ministerial vote.

Mr Worawit said court officials will spend two days checking the document before forwarding the petition to a panel of judges to consider whether to accept it for deliberation — a process which will take five days.

Meanwhile, Tuesday’s planned meeting of the eight political parties seeking to form a new government was abruptly cancelled.

It had been called by Pheu Thai to discuss progress in getting support for the nomination of a preferred prime minister.

Pheu Thai announced its cancellation in a message sent to reporters on the LINE app early on Tuesday afternoon. The message said the other seven parties had been informed.

According to sources, Pheu Thai had apologised to all the other parties for the cancellation.

Pheu Thai said its assigned task of seeking support from political parties outside the eight-party alliance, and from senators, in a parliamentary vote to select the new prime minister had not made satisfactory progress.

The move came after the Ombudsman on Monday decided to ask the court to rule on Mr Pita’s rejected renomination and order parliament to postpone the prime ministerial vote scheduled for Thursday.

MFP secretary-general Chaithawat Tulathon said Pheu Thai probably now needed more time to prepare a proposal to be presented to the eight parties.

Chinaâs anti-Mario Draghi moment surprises markets

For weeks now, global markets have ricocheted between excitement over a Chinese stimulus boom and disappointment that Beijing was taking its sweet time to jolt a slowing economy.

It’s now clear that Xi Jinping’s team has settled on a strategy somewhere in between. And for the global economy, the signals from this week’s meeting of the Politburo, the Communist Party’s top decision-making body, seem short-term negative for world markets – but long-term positive.

As Bill Bishop, long-time China-watcher and author of the Sinocism newsletter, sees it, the policy direction being telegraphed seems “fairly dovish,” but “doesn’t seem to signal much more significant stimulus incoming near-term.”

That’s bad news for bulls betting on a new Chinese stimulus bonanza that lifts markets from New York to Tokyo. Under the surface, though, there are myriad hints that the arrival of Premier Li Qiang in March is putting reforms on the front-burner once again. In other words, Beijing cares more about avoiding boom/bust cycles going forward than just mindlessly fueling a 2023 boom.

As “no fiscal expansion plans have been revealed so far, the impact will only be felt very progressively,” says economist Carlos Casanova at Union Bancaire Privée.

Economist Wei He at Gavekal Dragonomics added that “the Politburo’s meeting on the economy shows that officials recognize weak demand is an issue. But the meeting mainly called for ‘precise’ policy adjustments.” As such, it “remains far from certain whether those can deliver a near-term turnaround in growth. The conservative stance points to, at best, a stabilization or weak recovery” in the second half.

Instead of aggressive plans for massive monetary easing and fiscal pump priming — as markets had assumed — the chatter is about prudent policymaking with an emphasis on lower taxes and fees and incentivizing increased investment.

Rather than sharp drops in the yuan to boost exports, Li’s reform squad is focused on catalyzing greater scientific and technological innovation and giving the private sector more space to thrive and create new good-paying jobs.

In lieu of scores of top-down decrees or public jobs-creation schemes, the zeitgeist is that developing a thriving micro, small and medium-sized enterprises (MSME) sector is a more forceful way to address record youth unemployment than large-scale stimulus.

What Xi and Li are telegraphing might be best called the “anti-Mario Draghi” approach to enlivening Asia’s biggest economy.

The reference here is to the former European Central Bank president’s infamous pledge “to do whatever it takes” to stabilize the financial system via powerful monetary easing.

A year later, Draghi’s liquidity onslaught inspired then Bank of Japan Governor Haruhiko Kuroda to follow suit.

On Draghi’s watch, the ECB unleashed stimulus on a level that would’ve been unfathomable to Bundesbank officials of old. In Tokyo, between 2013 and 2018, the Kuroda BOJ’s balance sheet swelled to the point where it topped the size of Japan’s $5 trillion economy.

Neither monetary boom did much, if anything, to make the broader European or Japanese economies more competitive, productive or, broadly speaking, more prosperous. Instead, executive monetary support generated a bubble in complacency.

Draghinomics — and Kurodanomics — took the onus off government officials from Madrid to Seoul to loosen labor markets, reduce bureaucracy, incentivize innovation, tighten corporate governance or invest big in strengthening human capital.

China, it seems, is determined to go the other way. In the months since Xi started his third term — and Li arrived on the scene as his number two — Beijing has confounded the conventional wisdom on Chinese stimulus.

The start of this week’s Politburo is no exception. Markets were betting on major stimulus moves. Instead, China unveiled a 17-point plan to attract more private capital its way.

In a note to clients, analysts at Capital Economics said that “the absence of any major announcements of policy specifics does suggest a lack of urgency or that policymakers are struggling to come up with suitable measures to shore up growth.”

One possible interpretation was that Xi’s inner circle wants to put some actions on the scoreboard before next month’s annual huddle in the resort of Beidaihe to discuss long-term policy direction. Yet the tenor of steps seems more about supply-side reforms than fiscal and monetary pump-priming that might squander progress in reducing financial leverage.

Instead of talking about reaching this year’s 5% growth target, the government said the priority now is that “good foundation is laid for achieving the annual economic and social development targets.” Officials admitted, too, that “economic recovery will show a wavy pattern and there will be bumps during progress.”

In other words, the instant gross domestic product gratification that investors came to expect in Xi’s first two terms has been replaced with a more pragmatic approach. While there will be “prudent monetary policy” and at times an “active fiscal policy,” the bigger objective is to “extend, optimize, improve and enforce tax cuts and fee reductions.”

Stimulus will indeed emerge when, and where, needed. The Politburo said, for example, that it would “accelerate the issuance and use of local government special bonds.”

This means it’s entirely possible that local governments may be allowed to “dig into” remaining special bond quotas, including from previous years, says economist Yu Xiangrong at Citigroup, who estimates the quota to be about 1.1 trillion yuan (US$154 billion).

But there was far more discussion of ways to “adapt to the major change in supply-demand relations in the property market,” and, in timely fashion, to “adjust and optimize real estate policies.” That, Beijing says, means steps to “increase construction and supply of low-income housing,” and “revitalize all types of idling properties.”

To economist Zhiwei Zhang at Pinpoint Asset Management, “this is an interesting signal as the property sector downturn is arguably the key challenge the economy faces now.” As such, “it seems the government has recognised the importance of policy change in this sector to stabilize the economy.”

Just as important, arguably, is the government saying it’s committed to “effectively prevent and resolve local debt risks, make a package of plans to resolve the debt.” The same goes for commitments to “concretely optimize private firms’ development environment” and “build and improve the routinized communication mechanism with companies.”

Furthermore, the party’s latest phraseology includes pledges to “firmly crack down on excess fee and fine charging, resolve the receivables governments owe to companies” and “accelerate the fostering and growing of strategic emerging industries.” The plan, the party notes, is to “strengthen financial regulation, steadily push for the reform and risk resolution at small and medium-sized financial institutions of high risks” as a means to “stabilize the basic market of foreign trade and investment.”

Such language is more the stuff of Adam Smith and Milton Friedman than Mao Zedong. More Hans Tietmeyer of Bundesbank fame than Draghi or Kuroda. One possible area of optimism is that Xi’s government is finally serious about fixing the underlying troubles in the property sector – not just treating the symptoms.

Casanova points to the Politburo’s statement that authorities would recalibrate property policies based on the “local property market situation” and consider developments related to “demand and supply imbalances.” To him, “that last point is new, suggesting a change in the macroprudential regime, as the government now sees a structural shift, requiring bottom-up measures to better reflect local conditions.”

That’s not to say Xi and Li won’t support demand where needed.

“We expect the government to roll out modest fiscal support in the second half of 2023, but no aggressive fiscal stimulus,” says economist Ning Zhang at UBS AG. Even so, Zhang says, “some policy room may be kept to support economic growth in 2024.”

Additional stimulus measures that Zhang expects Beijing to prioritize: an acceleration of special local government bond sales; a resumption of policy banks’ special infrastructure investment funds; Beijing providing credit to clear up local governments’ arrears to corporate suppliers; modest property policy easing and credit support for stalled property projects; a modest credit growth rebound; and perhaps a small official rate cut.

There also could be “some small-scale and targeted support” for selected consumption categories as well, Zhang says.

Mostly, though, the signals coming from Beijing this week suggest a greater emphasis in increasing confidence via reform and more vibrant safety nets than runaway stimulus. Bottom line, China’s Draghi days seem over – and that’s a good thing.

Prayut scorns plan to avoid senators

PUBLISHED : 26 Jul 2023 at 04:29

Prime Minister Prayut Chan-o-cha has spoken against a proposal by some allies of the Move Forward Party (MFP) to wait 10 months for an end to senators’ tenure before forming a new government.

“I don’t think it’s appropriate,” Gen Prayut said in response to reporters’ repeated questions about the idea after he arrived at Government House on Tuesday morning.

Gen Prayut announced his retirement from politics earlier this month.

The Thai Sang Thai and Fair parties have proposed the eight coalition allies wait for the five-year term of the military-appointed Senate to end in May next year, so the MFP alliance could have its prime ministerial candidate elected by the House of Representatives alone.

The MFP won the most seats in the May 14 general election, with 151. The Pheu Thai Party came second with 141 seats. They are the core of the alliance, with a 312 majority in the 500-seat elected House.

The current 249 senators are entitled to take part in the vote for the new prime minister, together with the elected representatives. The new prime minister needs a majority of the two chambers, at least 375 votes.

On July 13, the joint sitting rejected Mr Pita, the then-sole candidate for prime minister. He received 324 supporting votes, including only 13 from senators.

MFP secretary-general Chaithawat Tulathon said it is within the rights of the Pheu Thai Party to take its pick of coalition partners. The MFP has handed the right to lead the government formation effort to Pheu Thai following Mr Pita’s failure to win the parliamentary nomination to be prime minister.

Also on Tuesday, Deputy Prime Minister Wissanu Krea-ngam said he was optimistic a new government might be up and running later next month even though more time will be needed to divide up cabinet portfolios among coalition partners, a process that precedes the swearing-in of the new cabinet.

Mr Wissanu said it would be extremely difficult to name a non-MP or non-member of a political party as prime minister to break an impasse in setting up a new government.

LGBTQ+: When 15 rain-soaked marchers made history in India

Owais Khan

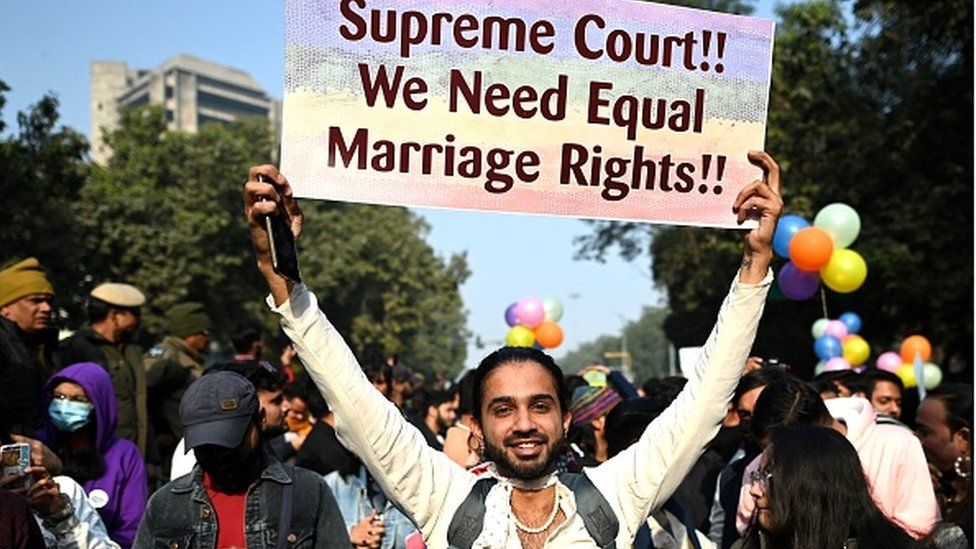

Owais KhanPride parades in India today are vibrant affairs, where thousands gather to express themselves and offer support to the queer community. But things were very different in 1999, when the country’s first Pride walk was organised in the eastern state of West Bengal. Journalist Sandip Roy revisits the trailblazing event.

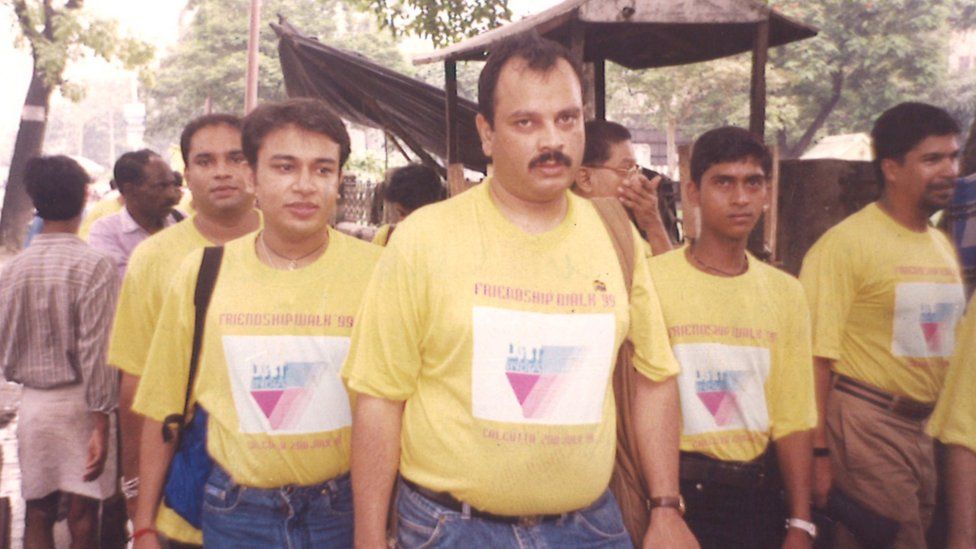

On 2 July 1999, Pawan Dhall, a queer rights activist in Kolkata city, was among the 15 intrepid marchers to participate in what was later called the first Pride walk in India.

The event was timed to coincide with global celebrations marking 30 years of the Stonewall riots in New York which sparked the LGBTQ+ movement in the US.

But July is monsoon season in India, and the 15 marchers in their custom-made bright yellow t-shirts with pink triangles were soon soaked to the bone.

“It was more of a wade than a walk,” Mr Dhall says.

The marchers also did not call the event a Pride march, instead going for the more innocuous-sounding “Friendship Walk” to avoid trouble.

In 1999, homosexuality was still criminalised in the country – a Victorian relic in the Indian Penal Code – and gay life was largely underground, though a few groups dedicated to supporting the community had formed in some cities.

Queer Indians found each other through mailing lists and Yahoo groups, and the idea of a Pride march surfaced there.

On 28 April 1999, Owais Khan, a convener of the LGBTQ+ India group, suggested doing something to celebrate “Gay Liberation Day” in New York – he called it “a small pada-yatra (procession) complete with pink triangles and rainbow-coloured peacocks”.

Mr Khan said he was inspired by the Pride parades in cities like New York, but also by Mahatma Gandhi’s famous Salt March during India’s independence struggle.

But not everyone shared his enthusiasm. Rafiquel Haque Dowjah, a communications consultant and one of the 15 marchers, says some members of the community called Mr Dowjah an “attention seeker” and accused him of “copying a western idea”.

Even Mr Dhall remembers being less than enthusiastic. “Another procession in Kolkata! I’ve been part of many processions and it’s quite a pain,” he thought to himself, he said.

But Mr Khan was determined to make the march happen. In the book Gulabi Baghi, an anthology of essays on the LGBTQ+ movement in India, Mr Khan recalls telling his peers: “Friends, The Walk is happening even if I am the only walker.”

But it wasn’t easy for a motley group of volunteers to pull off a march with practically no money.

Mr Khan says he woke up on the day of the walk with “a stomach full of fluttering butterflies” and wondered if anyone would turn up.

Eventually, 15 people participated, seven from Kolkata and the rest from Delhi and Mumbai and from smaller towns such as Bongaon and Kurseong in West Bengal.

An elderly woman, who was passing by, asked one of the participants why they were marching. He said they were demanding their rights. The woman shook her head and wondered aloud why the state had nothing better to do than “police people’s private lives”.

Others were more bemused. After their initial walk the marchers split into two groups and visited non-governmental organisations and the state’s Human Rights Commission to distribute information brochures.

“We met a junior official there who was completely bewildered by the issue,” says Mr Dhall.

At a press meeting later in the afternoon, reporters complained that they had no pictures of the parade.

So the group re-staged their historic “walk” for the cameras. “That’s what eventually appeared in the newspapers,” Mr Dhall laughs.

Not all of the participants had come out to friends and family at the time. “My relatives had no idea where I disappeared on the day of the walk,” says Navarun Gupta who lived in Atlanta but was visiting relatives in Kolkata that day.

Aditya Mohnot, now a fashion designer in Kolkata, said he joined the walk because his parents were not in town that day. But he did not realise pictures from the march would appear in newspapers the next day, with headlines like “15 friends walk with gay abandon”.

At first, Mr Dhall said the walk felt like “an unnoticeable ripple” as the participants went back to their lives.

But the ripples were noticed – and they sparked a flurry of reactions.

Mr Mohnot said his friend’s parents read about him in the newspaper. Luckily they were “surprised but proud”.

In Mr Dowjah’s case, his neighbour cut off all ties with him after she found out about the march.

“It was very hurtful and painful. Her family had known me since I was born,” he said.

Mr Khan, however, remained hopeful. “Fifteen was a modest number but at least one needed two hands to count them,” he said.

Soon, reactions began to pour from abroad as well.

“I am moved to tears,” said Faisal Alam, founder of the queer Muslim support group Al Fatiha in the US, in a letter to the organisers.

“For a young queer person like me, the march showed that we could struggle for a better and more queer-friendly India visibly, proudly and publicly,” said Parmesh Shahani, author of Queeristan – LGBTQ Inclusion in the Workplace.

“It showed us literally, and not just abstractly, that queer alternatives are possible in our country.”

In 2019, Mr Dhall and Mr Khan recreated the Friendship Walk to mark its 20th anniversary. But this time, they felt like they were marching in a different country.

Homosexuality had just been decriminalised in India in 2018. In a few years, the Supreme Court would be hearing arguments to legalise same-sex marriages. Transgender activism had led to a landmark (though controversial) transgender bill. And a panel they organised saw participation from several small cities and towns in India.

Then again, not everything had changed. “The 20th anniversary walk was also quite a washout because of the rains,” Mr Dhall says.

There was a happier postscript though. Years after she stopped talking to him, Mr Dowjah’s neighbour knocked on his door and finally apologised for her behaviour.

Mr Dowjah says it just showed one had to keep doing the right thing. “People will come around, if not today, then in 20 years.”

Sandip Roy is an author and journalist based in Kolkata city.

BBC News India is now on YouTube. Click here to subscribe and watch our documentaries, explainers and features.

Read more India stories from the BBC:

GICâs annualised real return at highest since 2015; to invest more in infrastructure amid economic headwinds

Apart from sticky inflation and chronic geopolitical risks, GIC sees disruptions to businesses arising from the shift to a regime of higher interest rates, along with the emergence of generative artificial intelligence (AI).

Asked what that would mean for future returns, Mr Lim said: “We have been warning about lower returns over time.

“Even for the 20-year number, it’s hard to foretell what that number is (year to year). But generally, the investment environment is uncertain … so I think it is better to assume that the return prospects are challenging.”

INFRASTRUCTURE OPPORTUNITIES

GIC said investments into infrastructure would provide opportunities for “inflation-protected returns” and was one way to navigate the uncertain environment.

This is because several aspects of infrastructure, such as rental income, are “inflation-linked”, said GIC’s group chief investment officer Jeffrey Jaensubhakij. Infrastructure is also tied to essential services such as utilities, which remain much needed even in an economic downturn.

“So that stability is actually quite valuable, as we go into an uncertain environment,” he said.

In particular, GIC is “focused on businesses which generate stable, predictable and often times have inflation-linked cash flows across macroeconomic cycles”, said Mr Ang Eng Seng, chief investment officer for infrastructure.

This generally includes businesses that are regulated, have long-term offtake contracts or are in segments with high barriers to entry, he added.

Opportunities in infrastructure are “large and growing” due to factors such as energy transition and the digitalisation of the economy. These two trends have led to the need for new infrastructure like fibre networks, data centres as well as green power generation and storage, Mr Ang said.

GIC has increased the size of its infrastructure portfolio by five times since 2016, with an annual deployment pace of US$10 billion (S$13.3 billion) to US$20 billion in new commitments a year. These investments are highly diversified and spread across six continents, according to Mr Ang.

This ramp-up in infrastructure investments could be seen in the increased composition of real estate in GIC’s portfolio, which went up to 13 per cent from 10 per cent.

Elsewhere, allocations to emerging market equities inched up by one percentage point to 17 per cent, while that of developed market equities was cut by one percentage point to 13 per cent.

Nominal bonds and cash, which are generally seen as safer investments, still accounted for the biggest share of the portfolio at 34 per cent, although that marked a drop from 37 per cent a year ago.

Allocation to inflation-linked bonds and private equity remained unchanged at 6 per cent and 17 per cent, respectively.