Floods hit China’s grain belt as storms following Doksuri head northeast

A goat was found stranded on top of a balcony, and two pigs were seen attempting to float through torrential floodwaters in an image that was widely circulated on social media. Power outages were likewise caused by the storms and floods in nearby Shangzhi area, where shops were running lowContinue Reading

Floodwaters rise in China’s northeast as rains lash Heilongjiang province

BEIJING: On Friday, August 4, Heilongjiang province issued a warning of swollen river amid severe conditions and even storms as storms pounded cities, including the now waterlogged provincial capital of Harbin. The most recent location hit by Doksuri, which has killed, displaced thousands, and put China’s disaster response devices toContinue Reading

Intel expands in China despite sanctions

Within the parameters of US federal restrictions on the Chinese semiconductor market, Intel continues to promote its business in China. The Chinese industry, which made up 27 % of its sales in 2022, is not something it wants to give up.

The recent opening of the Intel Greater Bay Area Innovation Center in the Nanshan city of Shenzhen, the southern Chinese town just across the inside borders from Hong Kong, is an example of how the company is determined to conduct China business as usual, as quietly as possible. WeChat made this announcement at the end of July.

The facility, a collaboration between the Nanshan government and Intel, may grow Intel’s presence in China while advancing the high-tech industrial policy of the city. Artificial intelligence ( AI ), edge computing, server and PC applications, energy efficiency, and other technologies are anticipated to be included in its activities. According to reports, six nearby businesses have already registered.

According to Wang Rui, senior vice president and head of Intel China, the organization will” leverage Intel’s systems and habitat, facilitate the inclusion and growth of emerging sectors in the Greater Bay Area, and help develop the digital business.”

That is to say, for local businesses using its technology, Intel will offer professional support and marketing help. It won’t be expanding China’s manufacturing capacity, which is prohibited for recipients of US CHIPS Act grants.

Pat Gelsinger, the Director of Intel, has already made two visits to China this year. He met with Tsinghua president Li Bin and H3C CEO Yu Yingtao in Beijing during the first quarter of July to examine their organization partnership.

The Xeon Scalable computer, the Habana Gaudi2 deep learning and conclusion computer from Intel, and the new energy-efficient servers from H3C are even based on Intel technologies. Gaudi2 was introduced to China by Intel on July 11 at a media event in Beijing.

Gaudi2 will also be used by Inspur Group’s AI machines, a H3C rival. Gaudi2 is exempt from trade restrictions, but Inspur, an IT company with interests in fog technology, big data, and hypervisor software, is on the Commerce Department’s institution list.

Gelsinger also met with Liu Hongyun, president of xFusion Technologies, to talk about AI technology and energy-saving information center technology. More than 200 Fortune Global 500 companies and other customers in the telecoms, financing, online, state, and various financial sectors are served by xFusion, a site and software provider, which is present in 130 countries and regions worldwide.

Gelsinger reportedly spoke with China’s State Administration for Market Regulation as well, but no further information has been made public. The skill of Tower Semiconductor, which was announced in February 2022, is still pending approval from China, according to Intel. The bargain might not be finished until the end of June, according to Intel’s announcement in January 2023. According to reports, August 15 is the ultimate date.

Gelsinger attended the 20th anniversary celebration of the opening of Intel’s IC promotional material and test center in Chengdu prior to these discussions. There were also the provincial government of Sichuan and the secretary of the Chengdu group.

Gelsinger met with Chinese Vice President Han Zheng, Chinese Minister of Commerce Wang Wentao, and Jin Zhuanglong, China’s pastor of business and information technologies, while also attending an Intel conference in Beijing in April. They officially talked about the security of the supply chain, the investment climate in China, and Intel’s plans to grow its operations there.

Local businesses that have joined the Greater Bay Area Innovation Center include Chipsea Technologies, another IC style business, Ugreen, a manufacturer of batteries, USB centers and other products, the Senary Technology Group, which consists of the electronic component distributor and design firm Serarytech.

Senarytech creates audio / video codec SoCs for commercial displays, virtual reality, auto dashboards, and other applications. For what purposes does China design Incident?

Power management, car, customer, and different applications, as well as professional measurement and control.

In Shenzhen, there are also the following partners and clients for Intel:

- Shenzhen Innovation Technology specializes in industrial and road traffic data, situation applications, and automated control of roadside infrastructure. It develops products, manufactures them, integrates systems in the fields of video detection and analysis.

- Video insights for safety and security surveillance, according to Shenzhen Extreme Vision Tech. Cutlery, guns, fireworks, and other suspicious objects are found by the Intel Open VINO profound learning conclusion kit examination algorithm.

- Shenzhen Eii Tech specializes in audio / video technology for Windows office tablet and notebook computers, industrial control, security, medical, education, networking, etc.

- Shenzhen Decenta Technology: Manufacturer of terminals and top servers for a variety of applications, including retail, online banners, industrial power, and stability systems. Custom creator of embedded components solutions based on X86 and ARM.

One of China’s largest amounts of high-tech businesses can be found in Shenzhen, including a number of start-ups, telecoms equipment manufacturers Huawei and ZTE, the technology and entertainment business Tencent, and the Southern University of Science and Technology in China. There are about 13 million people living there.

Nine places in the province of Guangdong, including Shenzhen, the mill town of Dongguan, and the capital city, are part of the Greater Bay Area, which also includes Hong Kong and Macau. They encircle the river of the Pearl River. Greater Bay Area has a population of more than 86 million people, and its GDP is significantly higher than that of South Korea — more than US$ 1.8 trillion. It plays a significant role in Intel’s presence in China.

Wang Rui earned a PhD in architecture and nbsp at Columbia University after graduating from the South China University of Technology’s Electronics Engineering School in Guangzhou. She worked at electronic design automation ( EDA ) company Cadence and Intel rival AMD before joining Intel in 1994. In the current political climate, it would be very challenging, if not impossible, for a Chinese student to do such an occupation.

Wang spoke at the Baidu World 2020 technology conference in 2020 while serving as vice president of Intel’s Sales & amp, Marketing Group, and China country manager. At the conference, Intel and Alibaba announced their joint efforts in AI, 5G telecom, data centers, cloud computing infrastructure:

The most crucial factor in creating an business ecology in China, she said, is to firmly establish roots in the local business and its users’ needs. With the full-speed construction of” new equipment” and 5G, China has moved into the phase of accelerated industrial web development. In order for technology to improve everyone’s life, Intel and Baidu will work closely together to develop endless possibilities for the future through ongoing advancement.

Since 1985, Intel has been based in China. It’s likely to last longer than the existing anti-China panic in Washington, DC.

@ ScottFo83517667 is the author’s Twitter account.

US leaders split on China policy

China has evolved into the United States’ main economic rival and therefore army, so US scheme aims to restrain its economic, political, and military development. On the other hand, US scheme aims to ensure that its businesses’ business with and investments in China will benefit the United States in a variety of ways.

The US’s disagreements over” decoupling” the two nations’ economies from the more moderate version of the same thing,” De-risking ,” show how divided US policy is toward China on both sides.

The challenging real for the United States is its economic reliance on the No. 2 economy in the world, which only gets worse as China continues its relentless march to overtake it. Similar to this, China’s astonishingly rapid economic growth over the past few years has complicated its relationship with the US market, US dollar, and US interest charges.

Contrarily, neither the Soviet Union nor Russia always provided the US with similar economic opportunities or aggressive challenges as China does today. Consider the following World Bank 2022 GDP data for Russia, Germany, China, and the US:$ 14.7 trillion,$ 1.5 trillion; and$ 29 billion, both, in this context.

The military-industrial advanced and the political right arms of both main US political parties have long dominated how US mainstream media portrays the nation’s international policies.

Particularly over the past ten years, China has been accused by the media more and more of sharply increasing its influence abroad, domestic authoritarianism, and policies that target the United States.

Great business interests have pushed for a very unique US foreign policy in recent decades, prioritizing profitable cooperation between China and the US. The US’s foreign legislation vacillates and veers between these two wires. While President Joe Biden refers to Xi Jinping as a” dictator ,” Jamie Dimon of JPMorgan Chase Bank and US Treasury Secretary Janet Yellen travel to Beijing one day to support mutual interests.

Due to the Cold War’s record and legacy, US media, politicians, and academics have become accustomed to exponential criticisms of communism as well as the parties and governments they associate with it.

Right-wing political forces have always been willing to upgrade anti-Soviet and Cold War justifications and catchphrases to use as ongoing foes against China’s authorities and Communist Party. An ongoing strategy is marked by both fresh problems( Uighurs ) and older ones( Taiwan and Hong Kong ).

Richard Nixon and Henry Kissinger, however, reconnected with a China that had already started on an economic growth wave that never stopped as the Cold War wound down and finally collapsed with the fall of the USSR.

” Communist” China feeds capitalists’ profits

Investors from the Group of Seven( Western Europe, North America, and Japan ) capitalists poured into China to take advantage of its comparatively much lower income and its rapidly expanding domestic market. Consumer products and investment products have been flowing out of Chinese companies over the past 50 years to markets around the world.

Global supply chains became very intertwined with China. Bills in US dollars began to flow in as a result of imports from China. To cover its expanding budget shortfalls, China lent many of those dollars up to the US Treasury. The United States, the largest debtor nation in the world, has two main creditors in China and Japan.

China’s expense of its accumulating funds in US Treasury securities over the past 50 years has aided in the rapid growth of the US national debt. In order to support US economic growth and recoveries from a number of financial crashes, this contributed to keeping interest rates reduced.

China’s somewhat low-cost exports were a reflection of its lower wages and lively government development initiatives. Over the majority of those centuries, those exports to the US contributed to preventing prices. Lower prices consequently eased employee forces to demand higher pay, supporting US capitalists’ profits.

The working and accomplishment of US capitalism were greatly influenced by US-China relations in these and other ways. Cutting those contacts would put the United States at great financial risk.

Additionally, many of the proposals that support for cutting are illogical and ineffectual fantasies. If Washington may compel US and other foreign corporations to shut down operations in China, they would probably relocate to another low-wage Asian countries. Because American income and additional costs are too high and non-competitive, they would not go back there.

Where they do get will require them to import goods from China, who is already their most prolific manufacturer. In other words, making businessmen left China may only slightly benefit the United States and slightly harm the Chinese.

It is also a false story to shut off the China industry for US chip manufacturers. US-based businesses won’t be able to compete with different bit manufacturers based in nations that are not cut off from the Chinese market if they lack access to the booming market in China.

The majority of Chinese exports must come in for US socialism to compete in China’s areas. European, Japanese, and Chinese banks may eventually outpace US megabanks if they don’t have access to China’s rapidly expanding areas.

China’s banks and those of its allies in India, Russia, Brazil, and South Africa( the BRICS ) would have control over access to the profitable financing of Chinese growth, even if the US could coerce or force G7 banks to join a US-led exit from China. The BRICS now outperform the G7 in terms of overall GDPs, and the gap between them continues to grow.

becoming” hard” on China

Without nuclear war, the United States was chance significant dislocations, losses, and expensive adjustments for US socialism if it continued its resumed Cold War campaign against China. Of all, the dangers associated with nuclear war are also higher.

No one wants to take such challenges, with the exception of the most serious aircraft groups in the US. The G7 supporters of the United States most certainly do no. They are currently visualizing their ideal futures in a manic world divided between hegemons that are on the decline and those who are rising, as well as possibly opposing groups of other countries.

The majority of the planet understands that China’s unrelenting expansion and growth are the main forces behind the global market of today. Most people also believe that the United States is the main enemy working against China’s ascent to power status on a global scale.

Some observers of the China-US conflict overlook the factors and determinants of this conflict, which are found in the extreme conflicts and inconsistencies plaguing the disputes between the employer and employee classes in both superpowers.

Whose prosperity, income, and social standing will have to endure the heavy burden of covering the costs of declining hegemony? is the fundamental question that those class conflicts in the United States address. Will there be a continuation, cessation, or reverse of the upward wealth distribution over the past 30 to 40 years? Are the growing workers violence in the US and the quasi-fascist right wing’s resurgence foretastes of future conflicts?

A remote, underdeveloped agrarian economy was quickly transformed into an urban, middle-income, and industrial economy by China’s remarkable ascent. It took centuries for the horizontal change in Western Europe to result in significant, acrimonious, and harsh class conflicts. Because the transformation in China took a few years, it was probably the most deeply distressing.

Will there be identical group conflicts? Are they already constructing beneath Chinese society’s edge? Could the Global South be the place where international capitalism, as defined by its employer-versus-employee productive core, suddenly plays the finale of its profit-maximizing fetish?

Both China and the United States have workforce systems that are centered on working organizations where a small number of employers control the majority of newly hired workers.

These work businesses are primarily secret businesses in the United States. China has a hybrid program where businesses are both privately and publicly owned and run, but where both types of working organizations share the employer-versus-employee relationship.

In that business, the company class normally has much more wealth than the worker class. Additionally, that rich school of employers may and frequently does purchase powerful political influence. Conflicts, conflicts, and social change are brought on by the resulting blend of economic and political injustice.

In both China and the United States, that truth is now well-established. As a result, since 2009, the federal minimum wage of$ 7.25 per hour has not increased in the United States. Both significant social events are to blame.

Janet Yellen delivers remarks lamenting the escalating inequality in the United States, but it keeps getting worse. American capitalism has a history of placing the blame for the poor’s plight on the sufferer.

Xi Jinping also expresses concern about escalating inequality, which is probably more pressing in countries that identify as socialistic. China’s just severe socioeconomic disparities continue to be a major cultural issue despite significant efforts to reduce them.

The conflict between the US and China is influenced by both countries’ inside class conflicts and struggles as well as their interactions with one another.

China adjusts to the complexities of the split-police strategy used by the United States. It is ready for both scenarios: fierce economic nationalism encouraged by military conflict or a jointly planned quiet economic coexistence.

China’s growth will likely continue as it waits for America to decide how to shape the United States’ financial future, matching and finally outpacing that of the US.

China’s amazing hybrid business of private and state businesses supervised by and subordinate to a strong political party is ensured by its astounding economic growth success over the past 30 years.

The upcoming chapter in capitalism’s perilously odd mix of class and regional conflicts is eagerly anticipated by a worried world.

The Independent Media Institute’s Economy for All task, which was provided to Asia Times, created this content.

Man gets 13 years’ jail and caning for trafficking cannabis when he was an 18-year-old polytechnic student

SINGAPORE: On Friday, August 4, a man who assisted his dealer in gathering and selling cannabis in exchange for 30 % of the revenue was given the death penalty of 13 years in prison and eight wood strokes.

He was an 18-year-old poly student at the time of the offenses.

Kwan Jun Yan, now 23 years old, admitted guilt on Friday to one matter of cannabinol variant use and hemp prostitution. A third charge was dropped while a second one was taken into account.

The prosecutor was informed that Kwan, a Singaporean, began smoking marijuana or” smoke” in April 2017 after being introduced to it by his friend.

He and his companion had each take 10g of the drug, which would last them both around two months and cost Siemens$ 120.

Kwan claimed that the reason he smoked marijuana was to impress those around him and that it was a” great practice.” & nbsp,

Kwan quickly gave up smoking the drug after his friend was arrested in soon 2017.

But after approaching a marijuana supplier in June 2018 in search of work to make fast money, he restarted.

Kwan was given 30 % of the profits by the vendor in exchange for his assistance in gathering and supplying cannabis to his clients.

Kwan consented because he needed money to cover his” extravagant expenses ,” according to the prosecution. These were used for alcohol, cigarettes, and betting on basketball games.

Kwan may use a prepaid SIM cards his vendor gave him to speak with him via phone calls and WhatsApp messages. His dealer was not identified in court papers.

On the instructions of his supplier, Kwan would gather consignments of hemp from unexplained individuals before repackaging it into smaller pieces for reusable bags.

He would give the cannabis to the customers of his supplier, collect payment, and then give the supplier 30 % of the proceeds.

Kwan purchased two blocks of hemp from an unidentified Hindu man at a vehicle stop along Gul Crescent on July 11, 2018.

He put the blocks in his knapsack, which now held 15 extra marijuana packets from a previous variety, and waited for his provider to give him more instructions.

The Central Narcotics Bureau( CNB ), however, was aware of the deal. Kwan was detained by a group of CNB officers at the bus stop, and they discovered the medicines on him, along with several sealed bags, an electronic measuring level, as well as several penknifes.

With least 480.79g of marijuana was discovered on the teen in full.

When he was brought to his apartment on Kim Tian Road, more medicine exhibits and accessories were found after a research of his home.

Kwan’s blood samples contained a cannabinol generic that was discovered. He claimed that the day of his most recent set was the last time he had smoked marijuana, and that it had left him feeling stress-free for two to three hours.

That same day, Kwan’s vendor was also taken into custody.

Based on the quantity of drugs trafficked— 329.99g of cannabis — the prosecution demanded 13 years in prison and 10 cane strokes for Kwan, who has no prior convictions.

According to the prosecutor, the suggestive starting phrase for such a sum is 15 years.

DEFENCE, HE WAS Just 18

Wee Hong Shern, a defense attorney, requested two more wood breaths but agreed on the prison sentence.

He claimed that in this instance,” we are presented with arctic extremes- where, on the one hand, the buyer was tender age 18 but he had committed a pretty significant offence.”

According to Mr. Wee, he had been working on this situation since 2019. He claimed that he had to emphasize Kwan’s youth— only 18 years old at the time of the offenses.

” The process of punishment does not go too far forward in light of the fact that he is still 23, a very young time.” There is more room for treatment to take center stage, he added.

Additionally, he claimed that his customer had depressive symptoms and adjusting disorder.

In his written prevention appeal, the attorney claimed that Kwan had mixed with the incorrect business during his technical years and had been exposed to cannabis, to which he later developed an addiction.

The younger of the two boys is Kwan. On Friday, his family attended the hearing and eagerly listened to the proceedings.

Determination OF THE JUDGE

Kwan was informed by Principal District Judge Jill Tan that it was extremely terrible for him to be in poor business.

To Kwan’s smiles, she said,” I note that you have already spent five years in custody, and I hope that this time you’ve used it to reflect on the failure of your way and think about how you can walk the right path upon your transfer.”

Before taking into account any aggravating and mitigating components, the judge determined that 15 times and 11 wood stroke would be the ideal starting point.

Regarding the aggravating components, Judge Tan claimed Kwan was actively helping his supplier traffic in drugs by splitting 30 % of the profits and using the money to wager on sports games in addition to smoking and drinking.

She stated, giving the word the defense had requested,” On harmony, my view is that your children must be given large mitigating bodyweight in sentencing you, despite the aggravating factors.”

Kwan may have received five to fifteen wood strokes and spent between five and twenty years in prison for trafficking a Class A controlled substance.

Eight killed, three injured as pick-up hit by train at railway crossing

Pick-up drivers claims that despite seeing a warning light, he tried to drive across the bridge track.

PUBLISHED: 4 August 2023 at 10:45

CHACHOENGSAO: A pick-up vehicle was struck by a freight train early on Friday night in the Muang region of this eastern province, killing eight people and injuring three others.

According to Pol Capt Teerawat Pornprasit, a duty agent at the Muang police depot, the incident happened around 3 am at Moo 6 in tambon Khlong Udom Chonlajorn.

Officers rushed to the scene, along with health staff from Buddhasothorn Hospital and a group of volunteers.

They discovered cargo coach No. 833 on the road trail, its motor still running. The coach, which was carrying pots, was traveling from the Laem Chabang Port to the interior container depot at Lat Krabanang.

Five men and three women’s bodies were found scattered throughout the region, along with a seriously damaged Isuzu pick-up vehicle.

One of the three victims was really hurt. They were taken quickly to Buddhasothorn Medical Center.

The 55-year-old pick-up drivers, Wichai Yulek, revealed to the police during doubting that he was transporting a group of employees from Wat Buaroy in Bangkok’s Lat Krabang area to ostensibly fish farms in Khlong Udom Cholachorn.

Mr. Wichai claims to have seen a warning light indicating the approaching coach as he got closer to the railroad crossing. But a fellow traveler told him to proceed. He therefore made an unsuccessful attempt to cross the bridge track.

The pick-up was violently propelled off the road when the train collided with the remaining part of it. Eight deaths and three injuries were caused when the employees seated at the back of the car were ejected during the effects.

Surapat Prasop, 20, a victim and one of the staff riding in the pick-up, claimed that upon spotting the approaching coach, he made the decision to jump off. A few seconds afterwards, the pick-up was struck by the coach.

The fish farm’s owner, Wichian Saengthapson, 58, stated that he had hired the workers to get fish there and anticipated their introduction by 2 a.m. At three in the morning, he learned of the injury. He had heard the coach bell several days at the farm, but he had never taken it to be a reminder.

The volunteers transported the eight workers’ bodies to the hospital for an examination before giving them to their loved ones for religious rituals.

The number of significant train accidents at Thai railroad crossings has increased as a result of this tragedy. A cargo train struck a vehicle carrying 57 passengers from Samut Prakan territory on October 11, 2020, as it was traveling through the Muang district’s tambon Bang Toey. This was the yearly presentation of new clothes to Buddhist monks.

30 other travellers were hurt, and 20 died.

embedded material

US dollarâs decline could benefit Asian economies

The major credit rating for the US government was downgraded from AAA to AA on Tuesday by the global standing agency Fitch. Additionally, Fitch repeatedly engaged in down-to-the-wire debt-ceiling negotiations that put the government’s ability to pay its charges in jeopardy and predicted financial decay over the following three years.

There are serious, legitimate questions to be asked about the long-term trajectory of the dollar because this is the second major rating agency( after Standard & amp, Poor’s) to deprive the US of its triple-A rating.

Read also: The$ 3.2 trillion in Asia is at risk due to Fitch’s lowering of the US.

Past firmly teaches us that little lasts permanently, despite the fact that no one can predict the future. Previously, global supply economies have come and gone. It may occur once more.

In fact, I think we are seeing the world start to leave a dollar-dominated economic program in real time.

This is due, among other things, to the huge amount of desperate money printing that has been done to monetize these debts and the astronomical levels of debt that have resulted in a significant decline in the long-term value of the currency.

As Russia and Saudi Arabia pursued the Taiwanese yuan for fuel deal earlier this year, I was one of the first to raise concerns about the US currency’s supremacy.

One of the most significant and frequently traded commodities worldwide, crude has historically been priced and traded in US cents. Due to the fact that nations that want to buy oil must first obtain US dollars to do so, this has given the US money a strong position in international financial markets.

The desire for the money may be drastically reduced if petrol trading shifted away from the US dollar, which may result in a decline in the value and dominance of the greenback.

For Asian markets, a transition away from the impact of the money may be advantageous.

Asian nations stand to gain from reduced reliance on the dollar as the most populous and commercially diverse region in the world. & nbsp, It would give them more freedom to choose their monetary policies.

Now, several Asian nations, including China, must consider the US Federal Reserve’s actions when deciding on their own interest rates and financial policy measures. They would be able to implement policies that are more suited to their home economic conditions if their reliance on the dollar was reduced, probably fostering stability and growth.

Asian economies may probably diversify their reserve currencies as the dollar lost its hold, opening up more opportunities for local trade and investment. & nbsp,

A international currency system would encourage the widespread use of local currencies like the Indian rupee, Chinese yuan, and Japanese Yen, increasing the accessibility and effectiveness of trade within Asia. This would strengthen intra-regional economic cooperation and lessen the dangers of being exposed to a single strong money.

Asia has long struggled with the fluctuations of the dollar, which can have a negative effect on their cash flows and business balances. A lessening of the dollar’s potency may result in more stable exchange rates, lowering the uncertainty and uncertainty of cross-border transactions.

Eastern companies could therefore make more confident plans and investments, which improved the region’s financial stability and growth.

Additionally, as a precautionary measure, Asian economies have frequently accumulated sizable foreign exchange reserves, mainly in dollars, due to the dollar’s dominating status. This practice does have an opportunity cost, though, as those resources could be used to invest in more profitable home projects or different currencies.

Asian nations may be encouraged to diversify their reserve holdings as the dollar’s dominance declined, which would improve resource allocation and boost investment in creative industries.

Adopting a more varied and balanced currency system, in my opinion, could be crucial to realizing the full potential of Asia’s active economies as the world becomes more connected and multipolar.

Nigel Green is the CEO and founder of deVere. Follow him @ nigeljgreen on Twitter.

South Korea’s President Yoon orders water trucks, buses for heatwave-hit scout jamboree

SEOUL: After hundreds of young participants became sick as a result of the hot weather, South Korean President Yoon Suk Yeol ordered on Friday, August 4, that air-conditioned buses and waters trucks be sent to the country’s global hunter event. According to authorities, as least 600 attendees of the WorldContinue Reading

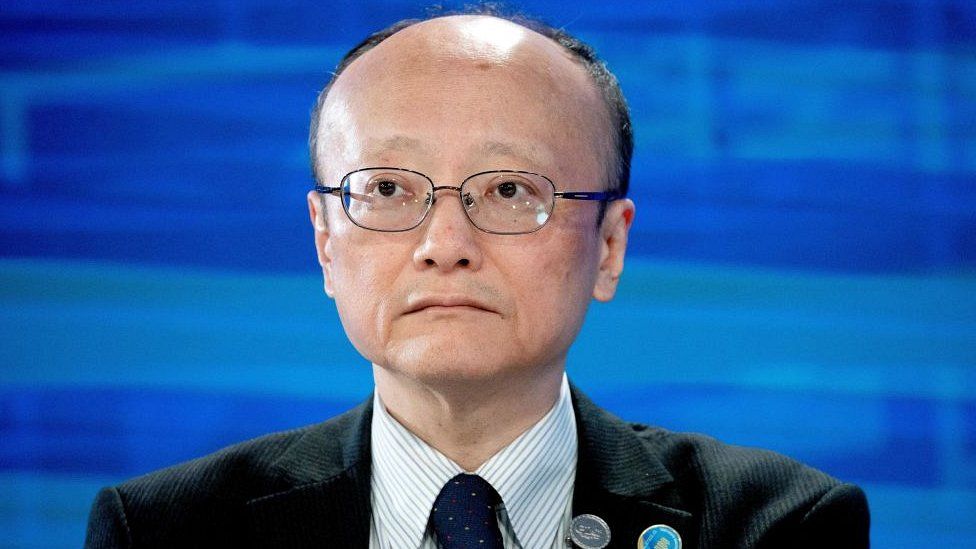

Japan issues rare warning over fake X account

shabby pictures

shabby picturesThe finance ministry of Japan has requested that X, formerly known as Twitter, remove an account that poses as Masato Kanda, the country’s leading currency diplomat.

In a rare post in English on the social media platform, the ministry pleaded with users not to follow the impersonation account and / or post comments.

Mr. Kanda is a key player in the third-largest business in history’s efforts to stabilize the value of the yen.

The fictitious profile now seems to have been shut down.

A BBC request for comment was not instantly answered by X.

Mr. Kanda is a powerful figure among Japan’s decision-makers in economic policy. His remarks in people may cause the currency’s value to fluctuate against another significant currencies.

According to the Reuters information agency, the bill, which was followed by about 550 people, had not commented on the financial or hankering markets.

According to the organization, there had been five posts on the account, the most recent of which appeared to be a fake account of Mr. Kanda’s journey to Ukraine earlier this month.

” Currently requesting that X( formerly Twitter ) suspend the impersonation account ,” the ministry continued.

A recognize on X on Friday stated that the bill had been suspended for breaking” Twitter Rules.”

Investors have historically purchased the yen during times of crisis because it has long been regarded as a secure haven in the world’s economic markets.

But, in recent months, the currency’s price against the US dollar has decreased. This is due to the fact that despite sharp increases in interest rates across the globe, Japan’s central banks has maintained its primary interest rate below zero.

A money tends to be more appealing to investors when interest rates are higher.

As a result, there is less need for assets from nations with lower exchange rates, and the value of those assets declines.

The Bank of Japan maintained interest rates at extremely low levels last week but stated that it would permit rates to rise more easily.

Nevertheless, the yen fell to its lowest level in more than a month on Thursday, hitting 143.89 against the dollar.

Related Subjects

On this account, more

-

-

October 28, 2022

-

Jammu & Kashmir on the cusp of sustainable growth Â

Content 370 of the American constitution was repealed four years ago, on August 5, 2019. A momentary clause in Article 370 allowed Jammu and Kashmir to have its own charter. It was developed in the particular historical perspective of India’s division and the territorial dispute between the two post-colonial states, India and Pakistan. & nbsp,

There was a lot of debate over the years as to whether Article 370 had outlived its usefulness. There were worries that its culmination in Jammu and Kashmir was obstructing the basic rights of women and children as well as immigrants. & nbsp,

All rules of the Indian Constitution and other liberal laws could be applied to Jammu and Kashmir after Article 370 was repealed. Additionally, Jammu and Kashmir’s state was split in two, giving rise to the Union Territories of Ladakh( J & amp, K ) and Jamp, Kashmir. In addition, & nbsp,

There was a lot of speculation at the time that Article 370 was repealed that the action had cause hostilities between India and Pakistan to suddenly rise and the entire area to be engulfed in assault. The previous four years’ experience has been the exact opposite.

To make predictions about the financial repercussions of the repeal of Article 370 in August 2019 is a little to first. According to Professor Durgesh K Rai, the global Covid – 19 pandemic that followed the abrogation in early 2020 limited the Indian government’s ability to swiftly implement a number of policy measures to revitalize J & amp, K.

However, there has been a noticeable increase in economic activity in J & amp, K. & nbsp, during the post-pandemic phase.

It was estimated that an unprecedented 18.8 million tourists visited J & amp, K in 2022, the highest number in 75 years, as a result of the perception that overall terrorist incidents have decreased. The increase in visitors led to new job opportunities in the hospitality industry as well as related fields like travel and hospitality. & nbsp,

In J & amp, K., there has been a rise in hotel construction and an increase in paying-guest accommodations over the past two years. The tourist infrastructure is also being renovated.

As part of the” Tourist Mission” initiative, the government is developing” 75 new destinations, 75 new Sufi / religious sites, 75 % new cultural / heritage sites and 75 percent new tracks” to ease congestion in well-traveled tourist areas and provide travelers with a wide range of experiences.

A Film Policy – 2021, with provisions such as a time-bound single-window permission mechanism, financial incentives, easy access to transport infrastructure, and revival / upgradation of cinema halls, was also approved in order to encourage” film tourism” in picturesque J & amp, K.

Administrative allocations to the hospitality industry have significantly increased. The number of visitors to J & amp, K will continue to rise in the upcoming years thanks to improvements in tourist infrastructure and government initiatives. & nbsp,

The agricultural exports from J & amp, K., which produces more than 75 % of the nation’s total apple production, have increased by 55 % in recent years.

Despite an increase in apple generation, there have been difficulties due to price fluctuations in the market yards. An” Apple Cluster” is being established in the Shopian city in order to overcome these obstacles. In order to compete on international markets, this clump may promote price improvement close to farms and improve branding and marketing initiatives.

The planting industry is also prepared to take off in the area. Lavender from J & amp, K, and other medicinal plants are highly sought after in international markets. The colored trend initiative has increased lavender cultivation over the past few years. & nbsp,

Similar to this, crops like lemon grass, thyme, rose, and wild flower have been grown more successfully thanks to aroma missions. Additionally, there has been a rise in the production of yellow over the last two years.

The craft industry has seen solid advancements. A unique credit-card system was introduced in 2020 to make it simple for artisans and weavers to obtain financial resources.

The Karkhandar program was introduced by the central government two years ago with the goal of reviving dwindling crafts through talent advancement by imparting new skills and raising the wages of the workers. Between the fiscal years 2021 – 22 and 2022 – 23, the export of handicrafts from J & amp, K., such as shawls and carpets, nearly doubled. & nbsp,

The Kashmir Valley is being connected to the rest of India by massive infrastructure projects being implemented in J & amp, K. Indian Railways. The rail line between Jammu, Udhampur, and Katra in the Jamdu area and Baramulla, Banihal, Kashmir Valley, has so far been operationalized. The Chenab River in the Himalayas will be the site of the world’s tallest railway bridge, according to & nbsp. & nbsp,

Large construction projects have also been started, including the longest road in Asia, the Zojila Tunnel, which will guarantee all-weather connection between Kashmir and Ladakh. J & amp, K’s economic interactions with India and the outside world will be fundamentally changed by the operationalization of the railway line and new road projects.

In terms of foreign immediate assets, the EMAAR class, a Dubai-based company with offices all over the world, is building an all-purpose tower and shopping mall in Srinagar, Kashmir. One of the first investments made in Kashmir by a foreign business is this job. The Third G20 Tourism Summit, which was successfully held in Srinagar in May, demonstrated J & amp, K., and nbsp’s potential as a tourist destination.

Sustainable peace in post-conflict situations, like J & amp, K., necessitates a wide range of economic and political actions. Many financial and system initiatives are being rapidly implemented in the federation territory despite the difficulties caused by the pandemic.

However, Pakistan’s actions will also have an effect on the future trajectory of peace and prosperity in J & amp, K. The international community needs to persuade Pakistan to stop encouraging violence and taking reckless behavior in the area.

After all, India will be able to project power to its north, which is also in the best interests of New Delhi’s strategic partners, thanks to sustainable economic growth and the successful completion of its infrastructure projects in J & amp, K. In addition to & nbsp,