In a major escalation of the US-China tech war, China’s memory chip sector is expected to be particularly hard hit by new export restrictions imposed by the United States, according to Chinese analysts and commentators.

That bleak assessment comes after Yangtze Memory Technologies Co (YMTC), China’s top memory chipmaker, and 30 other Chinese “entities” were added to the US Commerce Department’s Bureau of Industry and Security’s (BIS) “unverified list” on October 7.

The BIS said it was unable to verify the bona fides of the Chinese firms because an end-use check could not be completed satisfactorily for reasons outside of the control of US authorities. It said the named companies would face restrictions when trying to purchase US products.

From October 12, US citizens will be forbidden to support the development or production of integrated circuits at certain chip fabs in China without a license, according to the BIS.

On tech war cue, China’s foreign and commerce ministries criticized the US for imposing yet another raft of export curbs on Chinese companies.

“Out of the need to maintain its sci-tech hegemony, the US abuses export control measures to maliciously block and suppress Chinese companies,” said Chinese Foreign Ministry spokeswoman Mao Ning.

“It will not only damage the legitimate rights and interests of Chinese companies but also affect American companies’ interests,” she said. “By politicizing tech and trade issues and using them as a tool and weapon, the US cannot hold back China’s development but will only hurt and isolate itself when its action backfires.”

A Chinese Commerce Department spokesperson said China strongly opposed the US export ban, which would seriously hinder the normal economic and trade exchanges between Chinese and US companies and seriously undermine market rules and the international economic and trade order.

Since early 2020, the US has stopped the Netherlands from exporting its extreme ultraviolet (EUV) lithography equipment to China, hobbling its ability to produce high-end chips smaller than 22 nanometers (nm).

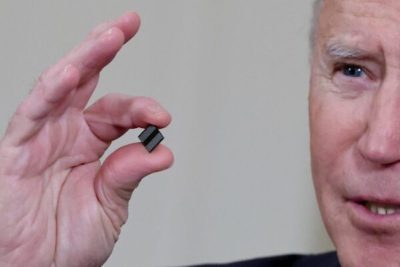

On August 9 this year, US President Joe Biden signed the CHIPS and Science Act to boost domestic semiconductor production and scientific research to enhance US competitiveness vis-a-vis China. At the same time, media reports said Washington was considering limiting the export of US semiconductor-producing equipment to Chinese chipmakers like YMTC.

YMTC can now produce NAND chips with 128 layers. (The higher the number of layers, the bigger the storage of a memory chip.) In July, memory chip giant Micron started mass production of its 232-layer stacked NAND in Singapore.

The US Commerce Department’s new curbs aim to stunt such developments in China.

Under the BIS restrictions, mainland China-based chip fabs that produce logic chips of 16-nm or below, DRAM memory chips of 18-nm half-pitch or less, or NAND chips with 128 layers or more will have to apply for licenses to purchase items from the US.

It said licenses for facilities owned by Chinese entities would face a “presumption of denial”, while facilities owned by multinationals would be decided on a case-by-case basis. The rule took effect on October 7.

The BIS also said US citizens would be banned from supporting the development or production of chips at certain unlicensed Chinese fabs from October 12. It also said Chinese companies on its “entity list” would be banned from obtaining certain advanced chips for their supercomputers. That measure will take effect from October 21.

Thea Dwosh Rozman Kendler, US assistant secretary of commerce for export administration, said: “The People’s Republic of China (PRC) has poured resources into developing supercomputing capabilities and seeks to become a world leader in artificial intelligence by 2030.”

The Chinese are “using these capabilities to monitor, track and surveil their own citizens” while fueling the country’s “military modernization,” Kendler said, putting the restrictions in ideological terms.

CITIC Securities said in an October 11 research note that certain Chinese chip fabs may not be able to boost their capacity as planned while their production developments would also be slowed due to the new US export ban.

At the same time, CITIC Securities said the curbs would force Chinese firms to boost their R&D investments over the medium and long-run, meaning Chinese chip makers would have to rely more on local raw material and equipment suppliers.

Gu Wenjun, chief analyst with the Shanghai-based consultancy ICWise, wrote in an October 11 article that the new curbs would have a big negative impact on China’s memory chip sector.

“The intensifying sanctions have had a chilling effect on China’s semiconductor industry. We must seriously think about what should be done and take action as soon as possible, instead of doing nothing,” Gu wrote.

Gu said it was a new normal for the US to keep broadening the coverage of its sanctions, which are having a diminishing effect on China. Gu said as the US was determined to suppress China’s chip sector, Beijing should not hope for bilateral reconciliation any time soon.

YMTC will be among the biggest losers of the new measures. The US government probed YMTC when its NAND chip was found in the Enjoy 20e smartphone produced by US-sanctioned Huawei Technologies, the Financial Times reported in April this year.

On September 6, Business Korea reported that Apple had already included YMTC in its list of NAND flash suppliers for its new iPhone 14. US Senators including Republican Marco Rubio told media that Apple’s move to use YMTC’s chips would pose a national security risk to the US.

Apple told the Financial Times that it would only use YMTC’s chips in products sold in China.

Citing industry observers, the China Business Journal said in an article on October 6 that by using YMTC’s chips, Apple could cut production costs and, more importantly, please the Chinese government in order to maintain access to mainland markets.

Read: Chinese pundits split over US decoupling prospects

Follow Jeff Pao on Twitter at @jeffpao3