Following discussions in Geneva, Switzerland, the United States and China have announced an essential deal to de-escalate diplomatic trade tensions. Here are the positive, negative, and unpleasant things:

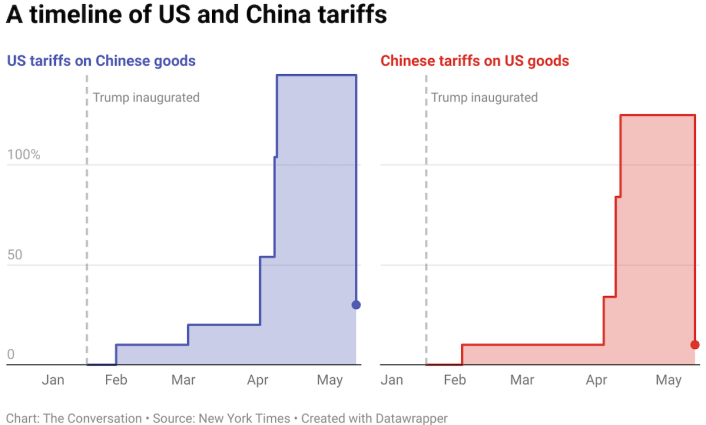

The good news is that their most recent price increases may be reduced. China has reduced levies on US imports from 125 % to 10 %, while the US has reduced tariffs on Chinese imports from 145 % to 30 %. This significantly lessens significant bilateral trade conflicts, and it explains why economic industry rose.

The bad news is double. Second, the existing tariffs are also high by contemporary standards. On January 1, 2025, the average trade-weighted tariff rate in the US was 2.2 %, up from currently estimated 17.8 %. It is the highest price roof since the 1930s, that is.

Ultimately, it is very possible that a new standard has been established. Bilateral tariff-free business dates back to a bygone age.

Next, while negotiations are ongoing, these tax cuts will remain in effect for 90 days. A long list of challenging-to-resolve concerns will likely be present in discussions. China will put its hands up against a method of industrial subsidies and forex management policies dominated by state-owned enterprises. Beijing is also disable and move on and off the numerous non-tariff barriers like a faucet.

In a follow of the US-China “phase 1 offer” from Trump’s first president that was not implemented, China is offering to buy unknown amounts of US products. Trump ordered a review of the application of that deal on his first time in office in January, amid a storm of professional orders. According to the review, China failed to fulfill its commitments to protect intellectual property in the fields of agriculture, financing, and intellectual property.

It’s difficult to imagine the US being duped once more unless the US has then decided to succumb to Beijing’s punitive actions.

If these issues are not resolved, it would reveal the unpleasant truth that both nations continue to impose diplomatic export controls on goods deemed sensitive, such as processed crucial minerals from China to the US.

Additionally, the US is pressing its trading partners to cut some vulnerable China-sourced products from their export destined for US markets in its so-called “reciprocal” discussions with other nations. China has threatened to retaliate against trading partners who accept these needs and is greatly unsatisfied with them.

A momentary end to the conflict

Nevertheless, the announcement is best understood as a ceasefire that doesn’t alter the fundamental fundamental fact that the US and China are locked into a long-term period of escalating proper competition.

That period will have both ups and downs ( the price war that came before it ) thanks to both recent announcements. Both parties have agreed to declare victory and shift their attention to various issues at this point.

This means ensuring there will be customer items on the shelves in time for Halloween and Christmas, even at exorbitant prices, for the US. For China, it means restoring some exposure to the export market to relieve stress on its already fragile business.

The good long-term outcome of a frozen conflict is that neither side can defeat the other. This will be accentuated by attempts to “escalate dominance,” which will decide who emerges with better conditions. The ideas of observers on where the balance is right now are divergent.

In addition, it is said that “jaw-jaw is better than to war-war,” in accordance with a phrase frequently quoted by Winston Churchill. If you wear your seatbelts, there will be more turmoil to travel.

Where does this left the rest of us, exactly?

Notably, the US has not ( so far ) altered its fundamental objectives for all of its bilateral trade agreements.

Its top priority is to reduce the goods trade deficit by lowering exports and removing non-tariff restrictions, which it claims are “unfairly” preventing US exports. The US also wants to “derisk” some imports that it consider to be sympathetic for national safety reasons and remove the obstacles to online business and investments by tech giants.

These objectives are clearly reflected in the US and UK’s recent contract. The remaining taxes, which were imposed by the US on April 2, are higher nevertheless, at 10 %, despite the UK receiving some concessions. Additionally, the English may expand its market for some commodities while removing the origin of China from metal and pharmaceuticals destined for the US.

Little has changed for Washington’s Pacific security agreement allies, including Australia. Discussions with the Trump presidency are likely to be challenging, especially if the US decides to employ our safety concerns as leverage to force concessions in business. Progress should be carefully monitored in Japan, where it has now rejected the link between industry and security.

In order to avoid China tariffs, the US has recently stopped imposing higher tariffs on South-East Asian manufacturing countries, especially those that other countries use as export platforms. Vietnam, Cambodia, and other nations will continue to experience unpredictability and managing maneuvers. For them, the economical bets are higher.

They have long been trained in the gentle art of balancing the two giant, just like the Chinese. However, managing ties with Beijing and Washington may turn into the form of a higher-and-higher-wire rope performer.

The University of Adelaide’s Jean Monnet seat of commerce and culture is Peter Draper, a teacher and the senior director of the Institute for International Trade. The University of Adelaide’s Institute for International Trade is home to Nathan Howard Gray, a senior research fellow.

This content was republished from The Conversation under a Creative Commons license. Learn the article’s introduction.