- Domestic demand to remain a key growth driver with RM expected to outperform

- Core inflation to remain benign, Bank Negara to maintain Overnight Policy Rate at 3.0%

Standard Chartered expects Malaysia’s Gross Domestic Product (GDP) growth to pick up to 4.8% in 2024 from 4.3% in 2023, with domestic demand likely to be a key growth driver.

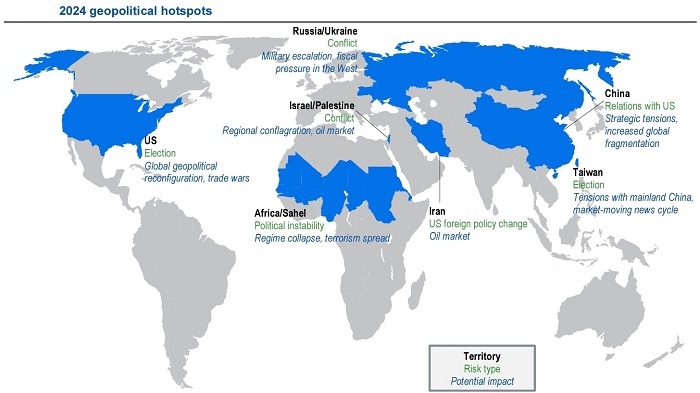

Looking ahead at some of the key economic trends to come in 2024, this year’s Global Focus report expects global GDP growth to slow marginally to 2.9% in 2024 from 3.1% in 2023. The publication anticipates that the world economy may be able to achieve a soft landing after the most aggressive monetary tightening cycle in years. However, inflation and geopolitics pose the biggest threats to this scenario.

In contrast, Asia’s growth should slow only slightly to 4.9%, making it the world’s fastest-growing region. While China’s growth may remain lacklustre, improving exports and tourism should drive stronger recoveries in some Asian economies; in India, Standard Chartered expects a post-election growth pick-up.

Against this backdrop, Malaysia’s economy is expected to remain steady in 2024 amidst global uncertainties. But moderation is expected in the pace of expansion, with average 2024 growth to be softer than in 2023 on a quarter-on-quarter basis. External demand could face challenges from the tight global monetary policy and subdued growth in China. However, Standard Chartered foresees that the bottoming of the electronics cycle could provide some relief. Malaysia’s exports are also well diversified across both markets and products.

Remaining as a primary growth driver for Malaysia, consumer spending is expected to slow in 2024. Due to the removal of subsidies, consumer spending might be dampened. The Global Focus report further states that although labour-market conditions are robust, it may have peaked as employment growth eased to 2.0% year-on-year in Q3 2023 – the slowest pace in two years.

In terms of investment, the public sector is expected to lead and boost investment growth amid the ongoing implementation of key infrastructure projects such as the East Coast Rail Link and MyDIGITAL 5G project, while private sector investments may be soft in 1H 2024 due to high funding costs.

On the inflation front, Standard Chartered expects core inflation to remain benign and for Bank Negara Malaysia to maintain the Overnight Policy Rate at 3.0% in 2024. At this level, it seems that the central bank views the monetary policy stance as supportive of growth, which is likely to slow in 1H 2024. The risk to this forecast is if stronger-than-expected economic growth causes any subsidy removal to lead to second-round inflationary effects, driving up core inflation, and resulting in further tightening by Bank Negara Malaysia.

After underperforming in 2023, the RM is expected to outperform its regional peers in 2024. A key contributing factor to this is the Federal Reserve’s pivot and other drivers such as a steadier CNY sentiment and the large accumulation of onshore USD deposits by corporates may provide an impetus for RM outperformance if USD weakness is sustained amid softer US economic growth. Corporates’ USD deposits stood at 10% of their total deposits as of Sept 2023, up from 8% at end-2020. Meanwhile, higher oil prices have not been supportive of the RM, as Malaysia has a neutral oil balance even though it is a net commodity exporter; crude palm oil and LNG prices have stayed low. Low reserve import cover may also lead BNM to opportunistically rebuild FX reserves.

Malaysia’s currency should also be set to benefit from further recovery in tourism and the bottoming of the electronics cycle.

Edward Lee, Chief Economist, ASEAN and South Asia, commented: “Amidst global uncertainties that are expected in 2024, the RM may actually benefit, especially if the USD correction is sustained amid softer US economic growth. On top of this, Malaysia is expected to have a steady year ahead as domestic demand and consumer spending will be the anchor in driving the country’s growth performance this year.”