- Now, companies are more financially secure and economically sound.

- Giving up is a fundamental tenet of Soonicorn Collective, which helps to sustain ecosystem.

” No more fun and flip”, quipped Dr Sivapalan Vivekarajah ( pic ), Chairman &, Senior Partner of Soonicorn Collective &, ScaleUp Malaysia, at his presentation on 23 , April at the KL20 Summit. It was a stark reality search for members.

The Silicon Valley Narrative, in his opinion, has been the one tale that has persisted throughout the business habitat in Malaysia for the past 20 years.

Firstly, you must raise as much money as you can, and as many times as you can, but you do n’t spend enough time building your business.  ,

Next, you need to spend the money you raise and double your income two to three times per year, without worrying about the results.  ,

Finally, you may develop huge- then flip the company to an innocent buyer and” we all get rich”, he said.

However, this has a drawback. He continued,” This tale is scam,” citing the fact that not many businesses in Malaysia or even those in its neighboring countries have successfully done this. Plus, most companies know that M&, A fail most of the time, but hardly anyone in Asia buys this storyline.

He claimed that he has spent 25 years in this habitat, and that he has not even identified 10 big corporations in Malaysia that have bought startups in the last five to ten years.

The truth is that in Asia, raising money is difficult, and there is a good chance that the faucet will nearer when raising and flipping.  ,

However, the last couple of years were the hardest years previously to increase money and it is still difficult today, to which Sivapalan may attest to based on his 51 investments, 16 of them specific and 35 with his Scaleup Malaysia accelerator.  ,

Even in the US, where many companies have very strong balance sheets and very high income, getting acquired is n’t common.

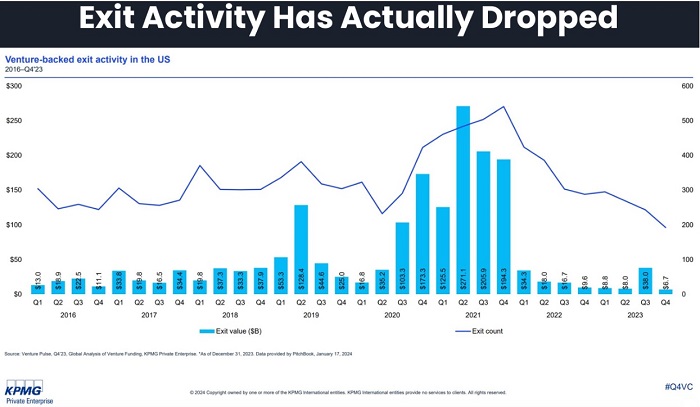

Sivapalan, sharing data from KPMG research ( chart ), showed that even in the US, where we are led to believe that startup acquisitions happen all the time,  , significant M&, A activity only happened in seven quarters between the 2016 to 2023 period. In every other third there was  , pretty little M&, A action.  ,

The only times when , M&, A , does happen is when times are good, because according to the Harvard Business Review, between 70 % to 90 % of M&, A in the US actually fail.  ,

It’s time to alter the tale, it is time to get back to basics

Furthermore, Singapore venture capital firm (VC ) Insignia, which recently raised US$ 1 billion ( RM4.75 billion ) stated that when it comes to building resilient companies in ASEAN, “fundraising today favors the financially robust and capital efficient”.

Seizing on this, Sivapalan stressed,” The good thing about Indonesian companies is that most of them are money successful”.

Indonesian companies have been forced to get money successful, he explained, like Singaporean VCs who are looking for bargains in Malaysia, because they, in contrast to firms in Singapore and Indonesia, have raised ridiculous amounts of money and are now struggling.

Sivapalan instead suggested founders consider the IPO route, noting that some of the world’s leading tech companies did so. Sivanaran opposed the raise and flip strategy. This is the route to building a lasting business, he said.

Siva dispels the myth that startups struggle to obtain IPOs. Everyone says going public about IPOs is difficult, but not the smart VCs. Those that tell you the IPO route is hard, want you to flip”, he said.

Siva shared that in Malaysia, if one can generate US$ 2.11 million ( RM10 million ) in profit a year, an IPO is guaranteed with bankers lining up to help you.  ,

Thus, driving home his key message, Siva stressed, “you have to rethink this narrative, and think of building enduring businesses”.

The Soonicorn Collective and nation-building

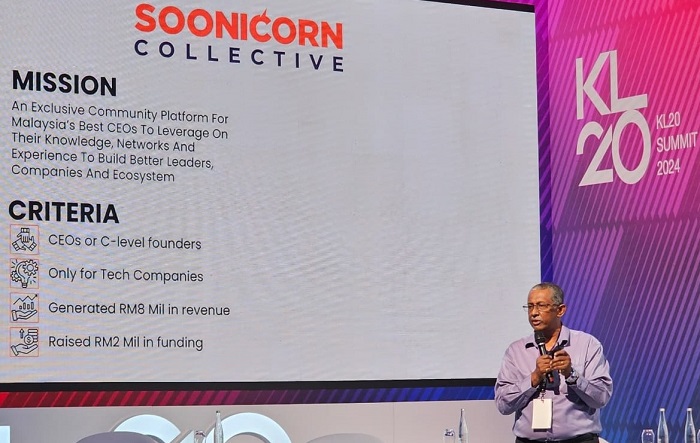

Sivapalan recently launched the Soonicorn Collective, a membership- driven community platform for Malaysian CEOs to leverage their knowledge, networks and experience to build better leaders, companies and ecosystems.

His motivation? Imagine a group of these kinds of people, Sivapalan said,” If a single person can make a difference in this world, you can multiply that change, you can make a real difference in this world.”

The best startup founders are united in order for them to collaborate and create better and stronger businesses, according to” we have a mission to bring them together.” We are aiming to improve the ecosystem for everyone by raising all the ships as a result of a rising tide.

So far, the collective has made policy recommendations for budget 2024, two of which were accepted.  ,

” We also recently had a meeting with the Deputy Minister of International Trade, giving recommendations and working with the Ministry of Investment, Trade &, Industry. Even if half of the recommendations are accepted, they are going to make it easier for businesses to grow exports”, he said.

” You have to be the change if you want to make a difference. We want to make sure the ecosystem is better for everybody, and we’re getting together to do that”, Sivapalan said.

To join, one has to not only be a tech company, but also be a CEO/C- level founder, generate at least US$ 1.79 million ( RM8 million ) in revenue, or have raised a minimum of RM2 million funding.  ,

Since there is a lot of assistance for young startup companies already, the collective is for the more mature companies, and there is little assistance for late-stage businesses.

So far, the collective has 20 companies with sales last year of RM217 million with projected 2024 sales of RM766 million with projected exports of RM290 million. They have raised RM156 million in funding, and have a total headcount of 1, 260.

]RM1 = US$ 0.211]