The following is an extract from the writer’s innovative book.

The Nordic economies, the United States, and Japan have been trying to deal with the issues related to inequality and growth ( particularly, globalization and innovation ) and the choice of the functions of the government they have made. They have shown various choices for how to decide this.

Northern economies have prioritized overcoming growing injustice and maintaining an egalitarian community in response to the pressure of rising inequality. On the other hand, the United States is somewhat tolerant of wider injustice, and Japan is placed in the middle.

Northern economy and the United States have been aggressive in terms of promoting progress through industrialization and creativity. In contrast, Japan has been slow and limited in success in both respect.

Lastly, with respect to the functions of the government, the US has limited its features and depend more on business systems. In comparison, the Nordic economy expanded the government’s responsibilities to address the issues that arose.

The government’s responsibilities in Japan fall somewhere between these two.

All three are admirable goals for a world: reducing inequality, achieving great growth through promoting modernization and technology, and allowing marketplace mechanisms to operate by restricting the government’s functions.

If it were probable, the state should strive to achieve all three. None of the developed economies have, nevertheless, achieved all three. The best thing that each of them has succeeded in doing is to complete two of them and provide up the other one.

It is apparent from the observation that it is impossible to accomplish all three crucial coverage targets simultaneously. It may be acceptable to accomplish all three policy priorities, if possible, but the reality is that an sector can reach, at best, just two of them and that the remaining one has to be surrendered.

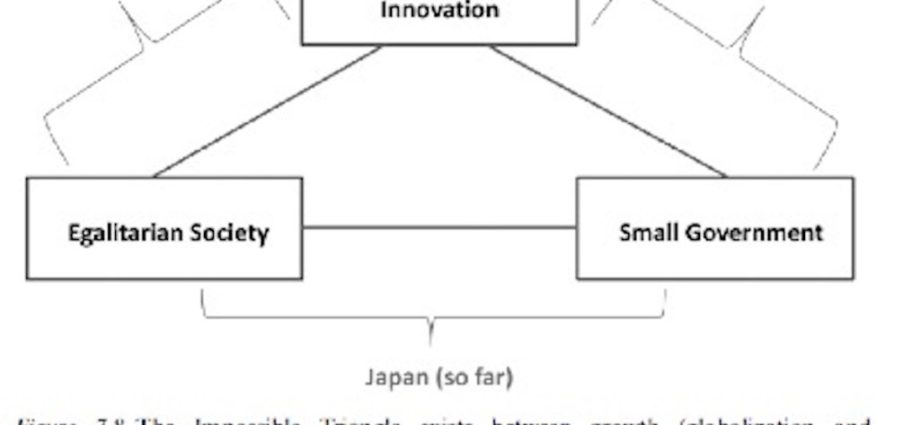

We will name this the “growth- equity- small government impossible triangle” that exists between growth ( promoting globalization and innovation ), equity ( realizing an egalitarian society ) and small government ( allowing only minimum functions of the government ).

The difficult triangle concept is already well-known in finance. In global finance, there is the “impossible godhead” between completely foreign capital flexibility, stable exchange rate and separate monetary policy.

In social business, Dani Rodrik has pointed out the existence of an “inescapable trilemma” between super globalization, national sovereignty and democratic policies.

These precedents have served as inspiration for the impossible square that is presented below, and it is hoped that it will provide new insights into the state of economies that are at risk of experiencing greater inequality.

From the point of view of the “impossible triangle”, the United States chose to obtain globalization/innovation and little state. In turn, the United States can enjoy a comparatively higher growth rate when compared to other developed nations because of its stable, versatile economy and low tax burden. Injustice is rising rapidly, however, and that has repercussions on the social scene.

The Northern markets chose to reach globalization/innovation and to retain democratic societies. In consequence, the Nordic economies are still living in societies that only see a small increase in inequality ( even before redistribution ), while also experiencing moderate growth.

The cost of this choice is to have a large government ( the “welfare state” ), which controls a sizable portion of the economy’s resources and actively participates in the labor market.

In Japan, it made the decision to keep an equitable society while keeping a small government. In consequence, injustice has decreased significantly in comparison to that in the United States, and government responsibilities have decreased significantly in comparison to those in the Northern economies.

However, the two goals were met by limiting industrialization and development and limiting the two’s resultant upward pressure on injustice. The Chinese economy had to experience a reduced growth rate, which was the cost of making this choice.

The difficult square provides a platform that makes clear the choices that the governments must make. It does help to comprehend how the markets are currently impacted. It should also be helpful in considering the choices that will be available to markets when they need to modify the policies that have been implemented.

Jun , Saito , is a senior research fellow at the , Japan , Center for Economic Research. He studied economics at the , University , of Tokyo and obtained an MPhil in economy from Oxford. He served as the Economic Research Bureau’s director-general from 2007 to 2012 while working as a state economist at the Economic Planning Agency and the Cabinet Office. During that time, he even worked as an analyst at the International Monetary Fund and at the , Japan , Center for Economic Research.

This article was adapted from Jun Saito’s Chapter Seven of Japan and the Rise, Equity, Small Government Impossible Triangle, which is licensed under the Creative Commons License to 2024. It is reproduced with authority from Taylor and Francis Group.