Sri Lanka received a bailout from the International Monetary Fund (IMF) in March amid soaring inflation, debt and a sovereign default.

In exchange for US$3 billion, the government committed to spending cuts and tax and financial sector reforms. Leading to protests in the streets of Colombo, these measures have prevented Sri Lankan wages from recovering after they fell by almost half in real terms during the preceding financial crisis.

Sri Lankans’ experience of these measures has been far from uniform. Emerging evidence indicates that the government — led by Ranil Wickremesinghe, part of the Buddhist Sinhalese majority — has concentrated the burdens primarily on ethnic minorities, which include many of the poorest people in Sri Lanka and which typically support the opposition.

The government has sought to protect the primarily Buddhist Sinhalese elite by avoiding imposing wealth taxes and only making small increases in corporation tax. It has placed the cost burden of austerity on low-income people by doubling the value-added tax rate to 15%.

It has also doubled the tax that people pay on pension fund returns. Again, this hits poor ethnic minorities hardest because they frequently earn too little to pay income tax.

Unfortunately, this experience is part of a worldwide pattern. Our new book, IMF Lending: Partisanship, Punishment and Protest, shows how governments lump the burden of adjustment on opposition supporters while shielding their own backers – in other words, using IMF programs for political gain.

IMF programs and past research

Scholars have long noted that IMF restructuring programs create winners and losers, but always in relation to different sectors of the economy. For example, the fact that programs attempt to strengthen exports has been shown to favor farmers and business owners over urban middle-class state employees like civil servants.

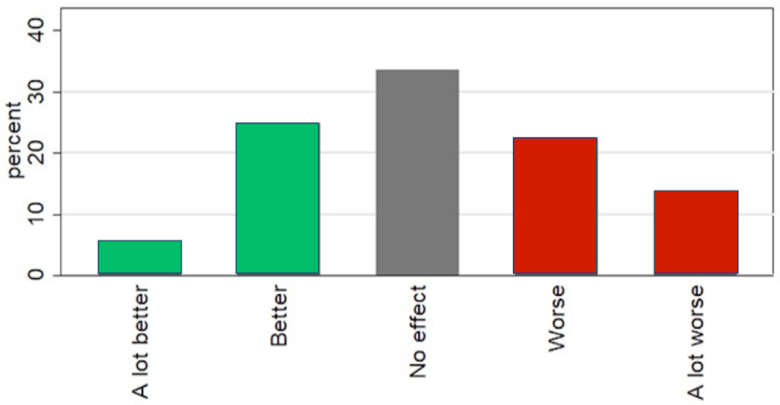

The problem with purely comparing sectors is highlighted when you look at citizens’ experiences. One segment of the survey data we used in our research, covering nine countries in Africa, showed that three out of ten civil servants actually thought IMF reforms made their lives better, while a similar proportion observed no difference.

Admittedly this data is from 1999-2001, since none of the more recent surveys that we used asked this question, but it raises an important point: If IMF reforms are entirely bad for the civil service, why are so many civil servants upbeat about the effects? Politics is likely to be the missing piece of the puzzle.

Citizens’ views of IMF programs in their countries

An extensive academic literature already shows that governments often use their discretion to play politics over development loans. For example, a recent study found that projects funded with Chinese money are more likely to be undertaken in the birth region of a political leader.

IMF programs are commonly assumed to narrow borrowing governments’ policy options, but that is an oversimplification. Borrowers certainly have less overall freedom over economic policy, but they maintain broad discretion in how they implement loan conditions. Our study is the first to quantify how they use this discretion and examine the consequences for protests within the countries in question.

Our study

We collected individual survey data from over 100 countries from four widely used sources: Afrobarometer, Asian Barometer, Latinobarómetro and the World Values Surveys. The study covers a 40-year timespan up to the late 2010s, with periods varying from region to region.

We first examined whether opposition supporters had different experiences of reforms than government supporters. Sure enough, these were indeed more negative.

We worried this might be because opposition people are more critical of their governments in general. So we compared countries that had just experienced restructuring programs with others that had not – and found that sentiment among opposition supporters was much more negative in borrower countries.

The following graph explains, showing that opposition supporters in countries on IMF programs suffer relatively more deprivation than government supporters compared with countries not in programs.

Partisan deprivation in IMF v non-IMF countries

This “partisan gap” was also wider in countries that went through more burdensome recent IMF adjustments, which points to the same conclusion.

Partisan deprivation by severity of IMF restructuring

The effect on protest

We expected that this highly unequal treatment would increase the chances of protest – especially protest stoked by opposition politicians. This, too, was robustly supported across the surveys.

In Africa, people who reported being worse off due to the structural adjustment programs were more likely to protest. Opposition supporters as a whole were also more likely to protest, especially if their country had just experienced a more severe IMF program.

Again, this data was from 1999-2001. Nonetheless, the other surveys also showed that protest was more likely among opposition supporters, especially during times of high pressure for adjustment.

What can be done?

Scholars normally blame the increase in inequality caused by IMF programs on the loan conditions, but the effects are clearly amplified by governments’ policy choices. How could this situation be improved?

The IMF could require borrower countries to impose loan conditions in a non-partisan way, but would probably argue that its mandate prohibits considering domestic politics. Policing this would also be very difficult and time-consuming.

An alternative would be for the IMF to tame its demands on borrower countries. This would reduce the burdens that could be inflicted on opposition supporters. Economists might warn that this could encourage countries to be more financially irresponsible.

Equally, however, it ought to make it more likely that adjustment programs will be completed, thereby making the borrowing countries more economically resilient in the future. It would also avoid adverse reactions from financial markets against a country that broke conditions.

Another potential avenue is to let opposition parties and civil society organizations participate in bailout negotiations. This would ensure everyone “owns” the bailout, and might even make it harder for incumbent governments to exploit policy conditions for political gain.

M. Rodwan Abouharb is an associate professor in international relations at University College London; Bernhard Reinsberg is a reader in politics, at the University of Glasgow.

This article is republished from The Conversation under a Creative Commons license. Read the original article.