When US President Joe Biden sat down next to Israeli Prime Minister Yair Lapid in front of a large screen in a Jerusalem hotel last month, it appeared as if the usual post-pandemic videoconference was about to unfold.

But on the other end of the video call were two more world leaders, President Mohamed bin Zayed of the United Arab Emirates and Indian Prime Minister Narendra Modi. Together they launched a new multilateral alliance that crossed traditional, regional and geopolitical boundaries.

Named the I2U2 – Israel and India as the two I’s, the US and the UAE as the two U’s – the grouping reflects a new trend toward transregional alliances.

Focused on goals from security to economics, these alliances bypass the post-World War II institutional architecture. The most prominent are the security alliances like the Quad – the US, Australia, India and Japan, with shared interests in the Indo-Pacific region – or the more recent AUKUS – Australia, the UK and the US pledging broad security and defense cooperation with an eye toward China.

A few of these groupings already involve Middle East states. The East Mediterranean Gas Forum, for example, links Cyprus, Egypt, France, Greece, Israel, Italy, Jordan and Palestine. The Negev Forum joins together Bahrain, Egypt, Israel, Morocco, the UAE and the US.

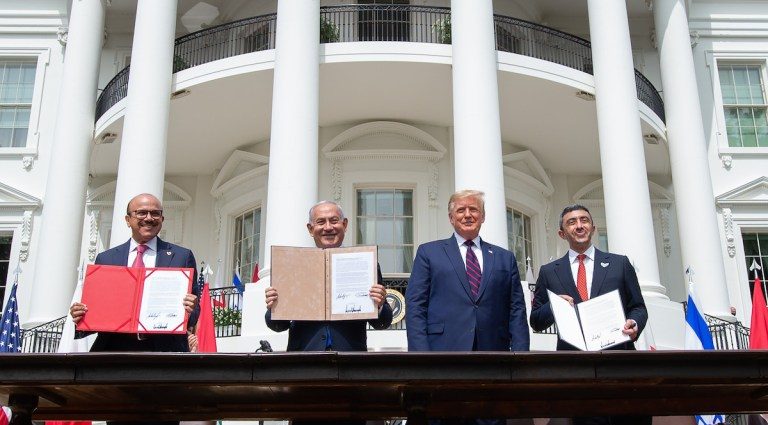

Then there is, of course, the 2020 Abraham Accords that normalized ties between Israel and Arab states comprising the UAE, Bahrain, Sudan and Morocco. Since then, UAE-Israel commercial ties have exploded, with two-way trade hitting US$1 billion in the first quarter of 2022.

Economic drivers

Stretching from the Mediterranean Sea to the Arabian Sea and the Indian Ocean, the I2U2 alliance was born amid the winds of change swirling with the Abraham Accords, the US-China rivalry, and the global realization brought about by the Covid-19 pandemic that the most intractable problems, from food insecurity to stunted economic growth, require global solutions.

It would be tempting to see the I2U2 grouping as solely part of the larger US-China tensions, but that would miss the mark. In fact, the I2U2 group – much like other groupings recently announced – reflects the institutionalization of a mostly economic alliance that was already forming.

Consider the trade ties among the member states. By my calculations, based on 2021 IMF figures, trade among the four nations clocks in at nearly $400 billion. Thriving trade corridors already exist between the UAE and India, as well as between the US and Israel.

India tops the list as the biggest trader with the other three countries, at $188 billion, heavily weighted to the US and the UAE. The US comes in second with some $167 billion in trade with the other states, a figure with much room to grow given the United States’ roughly $5 trillion trade profile.

As for the UAE, its trade relations with India are deep and historic, and its trade ties with Israel are growing fast. Israel still has significant room to boost trade with both the UAE and India.

Keystone India

The UAE-India economic partnership can serve as the bedrock of this new group. The UAE, a small country of some 10 million people, is India’s No 2 export destination, with some $25 billion worth of goods flowing from the South Asian giant to the Gulf Arab state. On the UAE side, India is the Emirates’ No 1 export destination, with some $43 billion worth of exports.

UAE airports have also become India’s gateway to the world – a key primary destination and also connecting hub for travelers. Before the pandemc, one-third of all international flights that landed in India emanated from the UAE.

The UAE has also been a magnet for Indian professionals and workers. All told, some $15 billion in remittances flowed from the UAE to India in the 2020-21 financial year. The UAE and India recently signed an ambitious free-trade agreement that seeks to double down on their growing commercial ties.

So when the first I2U2 meeting announced an ambitious food-security initiative in which the UAE would invest $2 billion to develop a series of food parks across India with US and Israeli assistance to tackle global food insecurity, what may have seemed like a breakthrough project was actually repackaged from earlier agreements between India and the UAE.

The Israel-India relationship has also been growing over the past decade. Israel is a major supplier of arms to India, and Israeli companies have been widely engaged in water-management issues to boost India’s agriculture sector.

According to International Monetary Fund figures, India clocks in as Israel’s third-largest export destination. More recently, an Indian company was awarded the contract to manage a key terminal at Israel’s Haifa Port.

Economic focus crucial

For US policymakers, the I2U2 presents a unique opportunity. The other three states have demonstrated either historic trade, technology, and investment ties (India and the UAE) or fast-growing ties (Israel and India, Israel and the UAE). Clearly, all three are motivated to accelerate those ties.

But all four states have different risk profiles on how they see the world, whether it relates to China or Iran or Russia’s war in Ukraine. The enthusiasm and unanimity of the I2U2 today would likely grind to a halt if Washington sought to use the group toward geopolitical ends. There are other venues for that.

On the other hand, if Washington and other member-state policymakers see the grouping as a way to contribute, bolster and accelerate already existing commercial cooperation among the member states while adding government heft to the process, the I2U2 would have a positive future.

It may even have other countries knocking on its doors for membership.

This article was provided by Syndication Bureau, which holds copyright.