KUALA LUMPUR: The Employees Provident Fund’s (EPF) total investment income tumbled 21%, or RM7.06bil to RM27bil in the first half to June 30, 2022 (1H22) from RM34.06bil in the corresponding period in 2021.

In a statement, the retirement fund said the lower investment income was due to the market reaction to the elevated risk of both slower global growth and high inflation, not experienced by major economies since the 1970s.

“Underlying these risks include the protracted Ukraine-Russia conflict, which disrupted global supply chains that sent prices soaring; rise in global inflation rates, hitting multi-decade highs; and in-step interest rate hikes by numerous central banks, partly in response to US Federal Reserve rate hikes and partly to reel in inflationary pressures,” it added.

EPF said these risks had been flagged at the beginning of the year, but the rate at which they materialised was unprecedented, like the magnitude and speed of US Fed rate hikes.

“All these factors had intensified and resulted in most markets posting their worst first half of a year in decades, with US stocks recording their worst in more than 50 years,” it said.

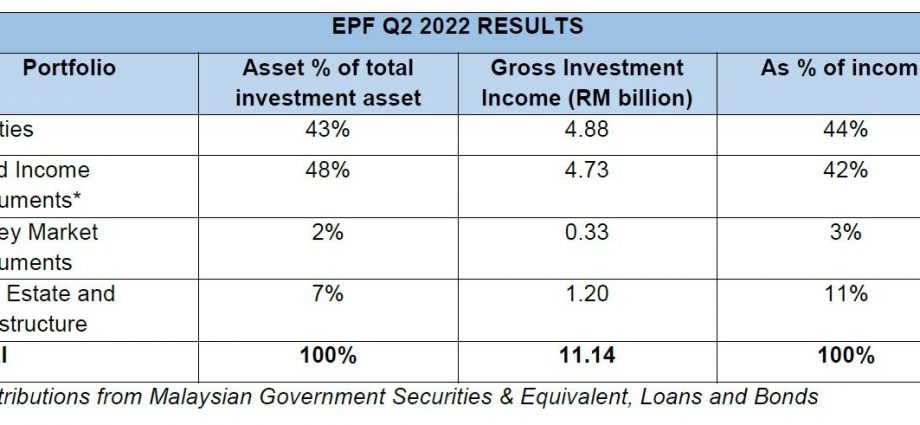

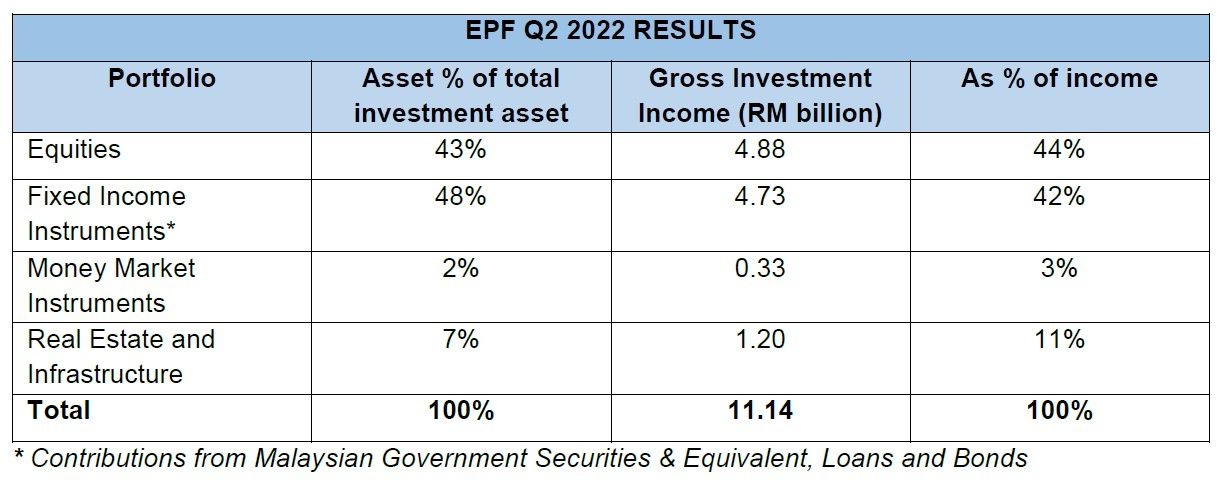

The EPF’s total gross investment income for the second quarter (2Q22) was RM11.14bil, down RM3.63bil from RM14.77bil recorded in the same quarter last year.

Equities continued to be the main contributor of income for 2Q22 at RM4.88bil, accounting for 44% of the total gross investment income in the quarter under review.

EPF chief executive officer Datuk Seri Amir Hamzah Azizan said: “Expectations of global growth have suffered which caused a persistent sell-off in the global markets. The consistent downtrend impacted EPF’s equity earnings, especially through global stock markets, which declined between 17% and 21% during the 1H 2022.”

“Nonetheless, the EPF’s diversification into different asset classes, markets, and currencies, as prescribed in its strategic asset allocation (SAA), has helped the EPF to remain resilient against turbulent market conditions and to protect its long-term investment returns,” he said.

Private equity which is part of the equities asset class has managed to deliver healthy returns of RM1.15bil, up over 100% against RM540mil recorded in 2Q21.

EPF said this portfolio was gradually becoming more important for the EPF’s diversification efforts as the volatility in listed equity markets remained high.

Fixed income instruments, comprising Malaysian Government Securities and equivalent, as well as loans and bonds, contributed a significant portion of gross investment income for 2Q22, at 42% of total income or RM4.73bil.

Real estate and infrastructure registered an income of RM1.20bil, while income from money market instruments generated RM330mil, in line with the return expectations set for these asset classes.

In 2Q22, the EPF’s overseas investments, which make up 36% of EPF total investment assets, generated RM5.51bil in income, representing 49% of the total gross investment income recorded.

A total of RM1.16bil out of the RM11.14 billion gross investment income was generated for simpanan shariah in 2Q22, and RM9.98bil for simpanan konvensional.

Taking into account the effect of the RM2.15bil that was written down for listed equities during the quarter, the EPF’s total investment income in 2Q22 was RM8.98bil.

The EPF explained that cost write-down was an internal policy adopted on its listed equity investment as a prudent measure to ensure the health of its portfolios.

As at June 2022, the EPF’s assets under management were RM957.25bil, taking into account the pandemic-related withdrawals amounting to RM44.6bil.

However, the EPF’s asset growth remained healthy as contributions received amounting to RM43.23bil as at June 2022 supported by the income generated from its investments.

The EPF remains cautious of key risks that continue to rattle markets and investor sentiment such as soaring global inflation rates, geopolitical tensions and tightening of monetary policies.

Crude oil prices have witnessed a decline amid the growing threat of an economic recession. Further aggressive interest rate hikes by central banks are also expected to slow economic growth and impact equity and fixed income markets.

“Markets are still very volatile, and while we are deeply concerned by these developments, we maintain our long-term and balanced approach in our investment decisions as there are pockets of opportunities which we can capitalise on during this challenging time,” Amir Hamzah said.

“As a retirement fund, the EPF’s overarching strategy focuses on long term sustainability of our investments and returns. We will take all necessary measures to ensure our financials remain strong and resilient to be able to withstand any volatility risks and short-term challenges.”

Meanwhile, the EPF membership showed a gradual and stable growth over the past five years with CAGR of 2.0%.

This was attributed to the strong growth of new member registrations of 177,230 in the second quarter of 2022 to a total of 323,416 for the 1H22, adding to the total number of EPF members as at June 2022 of 15.5 million.

Out of that amount, a total of eight million were active members, the highest recorded in the last five years, from 7.2 million in 2018.

The EPF noted that imputed wages of active members also reflected the economic recovery, with median wages averaging 6% growth in the 12 months to June 2022. Wage growth was broad-based across the income spectrum of active members.

Growth of new employer registrations recorded the strongest in five years at 50,429 in the first six months of this year.

Until June 2022, the number of active employers reached 572,847.

“Operationally, we remain focused on rebuilding the retirement income adequacy of our members and expanding coverage through our strategic initiatives encompassing financial literacy education as well as products and services enhancement,” Amir Hamzah said.