A month or so has passed since DBS ‘ online banking systems went offline for a day before the most recent gap occurred.

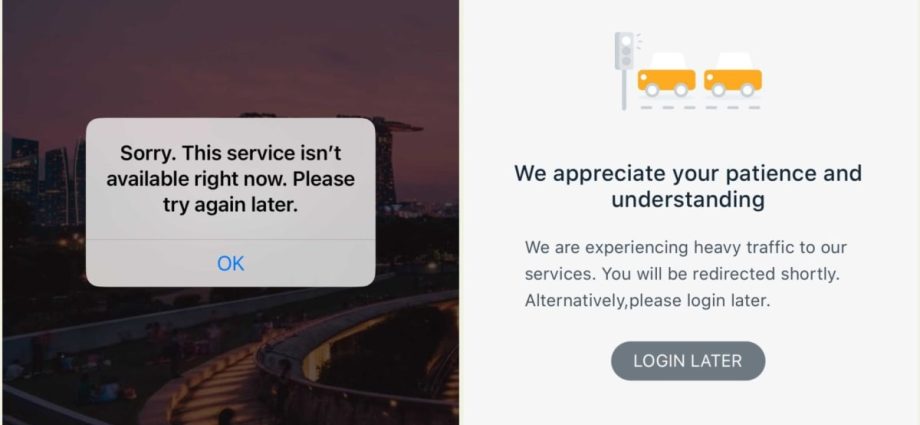

The Monetary Authority of Singapore( MAS ) issued a statement in response to the Mar 29 incident stating that the disruption was” unacceptable” and the bank had fallen short of the regulator’s expectations.

After gathering the necessary details, it stated that” MAS will have the comparable regulatory actions against DBS.”

Piyush Gupta apologized for the service disruption and referred to the event as” sobering” at the company’s annual general meeting on March 31.

Our top priority, he stated, has been to ensure uninterrupted digital banking services andnbsp, 24 / 7 & nBSP. We however fell thin, and I sincerely apologize. & nbsp, Our clients and shareholders are entitled to better.

A special board committee had been established to look into the outage, Chairman & nbsp Peter Seah announced during the meeting. The banks may hire outside experts to look into the situation, he continued.

DBS experienced a similar significant gap in November 2021 that lasted for two years. In the midst of that affair, MAS imposed new funds requirements on DBS. For operating danger, the merchant had to use a multiplier of 1.5 times to its risk-weighted assets, which added up to S$ 930 million in extra regulatory capital.

A higher net interest margin, continued business momentum, and resilient plus quality led the lender to report a stronger-than-anticipated 43 % increase in first-quarter income earlier this month, setting new records from the previous years.

Regarding the gap on Friday, CNA has requested a statement from MAS.