- Regulators to drive regulatory compliance to mitigate cybersecurity risks

- Amid competition, licensing framework allows new entrants to explore, grow

.png) Several Malaysian lenders believe that the country’s lending landscapte will continue to growth despite the increased competition brought about by the recent issuance of five new digital bank licenses.

Several Malaysian lenders believe that the country’s lending landscapte will continue to growth despite the increased competition brought about by the recent issuance of five new digital bank licenses.

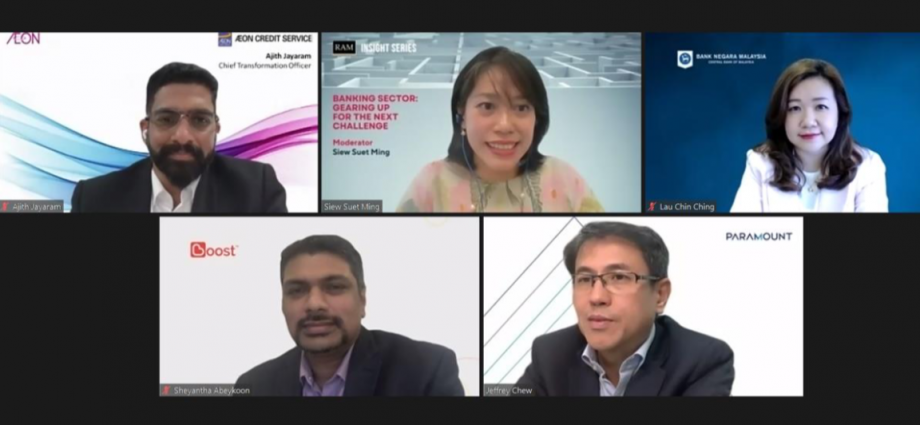

In a statement, Rating Agency Malaysia Holdings Bhd siad in its recent webinar on “What to expect from the changing digital financial landscape,” executives from Boost, Fundaztic, AEON Credit and Bank Negara Malaysia believes that competition between fintech players, digital banks and incumbent banks will continue to advance ahead and grow.

“Following the issuance of five new digital bank licenses, Bank Negara Malaysia anticipates that the new players will enhance the financial landscape, address the needs of the unserved and underserved segments and increase the dynamism of the sector, said Lau Chin Ching, director, financial development and innovation, Bank Negara Malaysia.

She said while the environment is competitive, the foundational phase in the licensing framework allows new entrants space to explore and grow.

Jeffrey Chew, Paramount Corporation Berhad’s group chief executive officer (CEO) and founder and non-executive chairman of Fundaztic, the challenge is in creating “awareness, trust and adoption” for new players.

He believes there is enough room to go up against digital banks as the P2P lending model is slightly different.

“The market based lending platform not only helps micro, small and medium enterprises (MSMEs) to get loans, but also serves the wealth management segment searching for higher- yielding investment products,” Chew said.

Meanwhile, Sheyantha Abeykoon, group CEO of Boost said that the MSME market is under-penetrated and far deeper than formal numbers suggest.

“In the MSME space, between the fintechs, the digital banks and the traditional banks out there, we have probably penetrated less than 5% of the market,” he added.

Having operated in the digital space for over four years, Abeykoon said onboarding a first-time MSME customer digitally and establishing trust has had its difficulties.

“However, customer stickiness tends to be quite high after the first adoption hurdle is crossed,”

“Over 90% of customers who have taken a loan from us have stayed on. The rollover statistics are quite high,” he argued.

Abeykoon said by using non-conventional methods to onboard customers, such as data analytics and artificial intelligence (AI) has also established an element of trust as these customers would have been unable to get credit facilities from banks without proper documents.

This was echoed by Ajith Jayaram, chief transformation officer of AEON Credit Service (M) Bhd.

“There is space for players using data and AI to solve issues like the inability to obtain credit facilities from traditional banks due to factors such as income inconsistency or job stability,” he said

He added that the five digital banks have their own sizable ecosystems to leverage on.

On securing deposits for digital banks, both Jayaram and Abeykoon believe players will remain rational in deposit pricing to build their funding base.

“Everyone is going to concentrate on converting their existing ecosystem [before] going out to the market once they’re done with the foundation phase. Otherwise, you are just going to spend a lot of marketing money. So, competition is not on our radar,” Jayaram explains.

Abeykoon agrees that it would probably be the last resort, adding that “competition based on pricing, in any business, only happens when you run out of good ideas”.

From the fintech perspective, Paramount’s Chew said sourcing for funding is still one of the biggest challenges for Fundaztic despite having been in the P2P lending market for five years.

He said while P2P investment is able to pay high yields, trust and perception are still issues compared to traditional banks. He added that retail deposit rates will rise if digital banks start chasing retail deposits.

“Digital banks need to be very careful [about trying to get retail deposits]. If not, you will see rates of even ‘float’ deposits (current account) going up to 2% to 3%, where they are supposed to be interest free deposits,” he said.

The discourse also touched on cybersecurity as a core risk, and how the regulator would drive regulatory compliance as data management and technology risks increase in the digital lending age.

Boost’s Abeykoon said cybersecurity is “a core component of the overall risk management framework” and “the cost of getting it wrong can be quite catastrophic”.

BNM’s Lau highlights that while cyber security requirements would be similar for digital and incumbent banks, the scrutiny on digital banks would be greater given the higher reliance on technology, adding that reputational harm from a cyber security failure could be far greater.

Moving forward, there is also the challenge of the increasing use of open data ecosystems, open finance and open banking, which blur the lines on how data is used, the panel noted.

Lau said one focus of the Financial Sector Blueprint will be to strengthen the building blocks in enabling the use of an open data system which will be beneficial not just for digital banks but all banking players, including fintech businesses.