China has spent the past four years shifting its bulk of its exports to the Global South aside from developed areas while also creating production facilities that re-export to developed markets, avoiding America’s 25 % tax on the majority of Chinese products and other developed-market trade barriers.

There must be some trickery behind China’s trade progress, according to the black murmurings of American economics: China is in recession, so it’s selling products on the cheap.

The Wall Street Journal wrote in May about “foreign officials concerned about a duplicate of the China impact of the first 2000s,” in which pro-market measures in China and its membership in the World Trade Organization fueled an export boom that helped users but defied competing companies in the US and elsewhere.

The dollar’s real loss “is obviously contributing to higher export” from China,” said , Krishna Srinivasan, chairman of the Asia and Pacific section at the International Monetary Fund, told the WSJ. True loss means that after prices, the money has become cheaper.

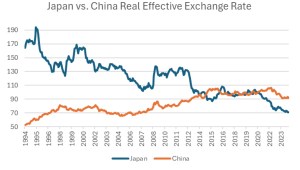

The problem with this reasoning is that China’s real effective exchange rate ( its swap rate adjusted for inflation ) has risen more than fallen, according to the Bank for International Settlements, from an index levels of 50 in 1994 to a degree of 90 immediately. It dropped slightly over the previous two years, but not nearly as much as the Japanese yen.

Moreover, Japan’s exports stagnated despite the sharp fall in its inflation- adjusted exchange rate, while China’s leapt. That’s an appropriate comparison because China and Japan compete directly in the world’s largest industry, namely automotive.

China exported 5.22 million passenger cars in 2023, a 57 % jump from the previous year, while Japan—previously the world’s largest auto exporter—sold only 4.22 million, a 16 % increase.

China’s cheap electric vehicles ( EVs ), including the US$ 9, 500 BYD Seagull, fill a demand for low- cost, reliable small cars in the Global South.

Henry Ford’s Model T appeared in 1908 with a price of$ 850, roughly America’s per capita GDP at the time—the right price point for a mass- market vehicle. China’s EVs meet a similar price point in the Global South.

EV prices have dramatically decreased because of significant scale economies of scale in vehicle production rather than currency fluctuations. More industrial robots were installed in China last year than were installed globally.

Ford’s$ 850 Model T of 1908 sold for just$ 250 in 1925 thanks to economies of scale. In a short period of time, China has accomplished what Ford did.

The pattern seems to apply to other sectors as well. A Huawei 5G base station sold for$ 57 in 2020, according to reports, but only$ 13 per unit was reported for a sale to China Mobile last year. Huawei does not publish price data for 5G infrastructure.

The remarkable thing is that China’s exports to developed countries have n’t changed much in the last four years, while exports to the Global South have increased by a whopping 40 %.

Meanwhile, US imports from the Global South rose in tandem with China’s exports to the Global South:

From the charts, it is obvious that China’s exports to the Global South have enabled higher exports to the United States and other developed markets.

China, in other words, is building infrastructure and manufacturing, not simply flooding the Global South with cheap consumer goods. For poor countries with low rates of entrepreneurship, an auto is a capital good that allows small businesses to make deliveries.

I came to the conclusion that the Communist Party of China, through the construction of mobile broadband networks throughout the Global South, has fostered an unprecedented wave of entrepreneurship in the developing world in a study released in November 2023 for the journal American Affairs. The notionally communist party has since become the record’s most effective propagandist. This conclusion is richly supported by data on broadband usage, business formation, and economic growth.”

According to all the available data, China’s impressive export performance is attributed to investment in robotics and AI applications.

Follow David P Goldman on X at @davidpgoldman