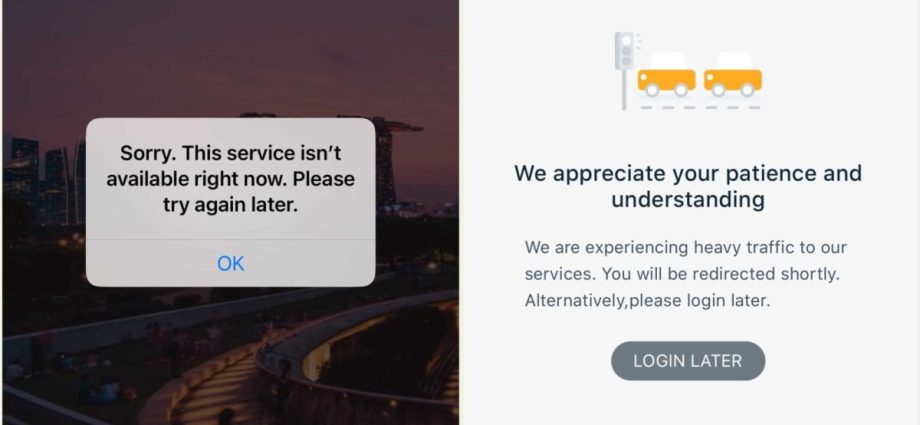

Less than two months have passed since the last disruption to DBS ‘ online banking systems, which was a day-long interruption.

The Monetary Authority of Singapore( MAS ) issued a statement following the incident on March 29 stating that the disruption was” unacceptable” and the bank had not lived up to the regulator’s expectations.

After gathering the necessary information,” MAS will take the appropriate regulatory actions against DBS ,” it declared.

Piyush Gupta apologized for the service disruption at the company’s annual general meeting on March 31 and referred to the event as” sobering.”

Our top priority, he stated, has been to ensure uninterrupted digital banking services andnbsp, 24 / 7. ” Unfortunately, we fell short, and I sincerely apologize. & nbsp, Our clients and shareholders are entitled to better.

At the meeting, Chairman & nbsp Peter Seah declared that a special board committee had been established to look into the outage. The bank may hire outside experts to look into the situation, he continued.

DBS experienced a similar great disturbance in November 2021 that lasted two decades. In the midst of that affair, MAS imposed new funds requirements on DBS. For operating risk, the provider had to multiply its risk-weighted assets by 1.5 times, adding S$ 930 million in extra regulatory capital.

The bank reported a stronger-than-anticipated 43 % increase in first-quarter profit earlier this week, setting new records from the previous year thanks to higher net interest margins, continued business momentum, and resilient asset quality.

For a statement on the gap on Friday, CNA contacted MAS.