Essential tools for increasing productivity and global competitiveness are robots. Therefore, national rates of machine adoption are significant indicators of financial performance.

Calculating the number of commercial drones as a reveal of manufacturing workers is the most popular method for benchmarking machine acceptance rates. However, it is crucial to keep in mind that there is a stronger economic case for using computers in economy with higher wages than in those with lower wages.

The more important issue is therefore: Where do countries have in terms of robot adoption when we consider wage levels?

China installed 18 % more computers per producing worker than the US in 2021. China also had a 12 times higher level of machine use in producing than the US, even after accounting for the fact that Chinese producing income were significantly lower than US wages.

Government plan, no market forces, was to blame for this. The adoption of manufacturing robots has been made a top priority by the Chinese Communist Party ( CCP ), which has provided it with generous subsidies.

US duty policy does nothing to help robot adoption by businesses, and strategic policies to enable manufacturing automate, including with robots, are only slightly funded to the extent that US policymakers talk about them, frequently to criticise them for accepting jobs.

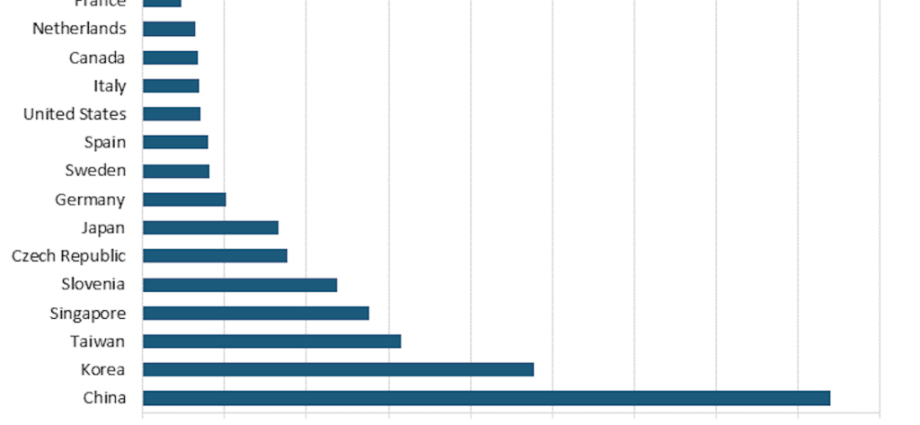

Data on the use of robots in manufacturing by various countries are reported by the International Federation of Robotics ( IFR ). The most recent data & nbsp are from 2021. With 1, 000 industrial robots per 10,000 production staff, Korea was the world’s largest user. Singapore came in second with 670, followed by Japan and Germany with shut to 400.

China had 322, compared to the United States’ 274 computers per 10,000 staff. ( See illustration 1 )

However, the decision to install and operate a robot is typically based on the cost savings that can be made when compared to individual workers, which are directly correlated with manufacturing workers’ pay rates. Thus, it should not be surprising that high-wage Germany has a higher penetration level of computers than low-paying India.

The payback time for a machine decreases as fabrication labor costs rise, so it is interesting to see how regional economies fare when it comes to robot adoption when controlling wage levels. Notice the 2018 report” Which Countries Really Lead in Industrial Robot Adoption” for a detailed explanation of the International Technology and Innovation Foundation’s approach on this issue.

Numerous patterns appear when comparing the rating of expected robot adoption rates to real rates. The first is that South Asian countries are the world leaders in machine adoption on a wage-adjusted basis. ( See illustration 2. ) China is the world leader with an incredible 8 days more robot adoption than anticipated, an increase from 1.6 days in 2017. There are 4.8 days more computers in Korea than anticipated. Singapore has 2.8 times more and Taiwan has 3.2 % more.

Only 70 % of the anticipated drones are in the United States.

China is back, but why?

With its national and provincial governments committing sizable sums of money to support the implementation of robots and other technology tech, China appears to be in a league of its own when it comes to machine acceptance.

This is one of the reasons why China has held the title of largest technological robot market in the world for eight years running, according to IFR. Some of this, but probably not the majority, may be an exaggeration brought on by company fraud andnbsp in order to obtain government grants for the installation of drones.

By 2025, China’s Robotics Industry Development Plan ( 2016 – 2020 ) aims to increase robot use tenfold. As a result, some provincial governments are generously subsidizing businesses to purchase computers, though the accuracy of reported figures may be questionable given that their sizing is incomprehensible.

For instance, Guangdong province andnbsp planned to invest 943 billion yuan and npspe in 2018( approximately$ 135 billion ) to assist businesses in” machine substitution.”

Similar to this, the provincial authorities of Anhui announced that it would spend 600 billion yuan and nbsp( approximately$ 86 billion ) to support the business development of its province’s companies, including through technology. To put this into perspective, it is equivalent to the United States investing$ 4 trillion on a per-GDP base.

These figures could be exaggerated because the Boston Consulting Group reported that subsidies totaled about$ 6 billion. China also offers tax breaks and nbsp for investing in gear. Additionally, it has established a following, five-year program for the robotics sector.

In either case, China appears to offer the highest overall and per-robot subsidies for robot adoption of any country. In contrast, there are no incentives for installing computers in the United States. Yet firms are no longer permitted by the federal tax code to deduct products expenses from their first year of taxation.

The effects of this ought to be obvious. The only way for American manufacturers to contend with China’s lower production wages that are dollar-adjusted is for them to be more successful, and automation, including robotics, is the best way to achieve this.

However, US production has experienced a productivity decline over the past ten years, according to US Bureau of Labor Statistics. As a result, China will overtake US companies in the global production market share unless US production substantially accelerates mechanical adoption.

In order to change this, Congress needs to triple money for the NIST Manufacturing Extension Service and the National Robotics Engineering Center in Pittsburgh as well as create a 10 % investment tax breaks for companies.

The Information Technology and Innovation Foundation( ITIF ) originally published this article. It is republished these with our consent.