- Integration & synergy targets met, network modernisation efforts ahead of schedule

- Service revenue rose 0.4% Y-Y, with 4Q FY2023 revenue up 0.9% across core segments

CelcomDigi Bhd (CelcomDigi) has announced its fourth quarter and full year results for the financial year 2023 marking a solid first year of operations as a merged company. In a statement, the company said it delivered strong growth performance in line with its 2023 guidance, enabled by solid execution and efficient cost management. It also reported significant progress on integration and synergy targets.

First-year integration and synergy targets on track

In 2023, CelcomDigi successfully achieved all first-year integration milestones enabling the company to realise gross synergy of over US$62.5 million (RM300) million.

The telco said it completed 35% of its network integration and modernisation target, ahead of its initial plan of 30% by end 2023. It also modernised over 5,600 sites as of Dec 2023, enabling customers in post-consolidation areas to now enjoy improved download speeds by between 20% and 26%, and better signal strength by between 13% and 16%.

Additionally, its 4G LTE and 4G LTE+ network coverage grew to 97% and 91% of populated areas nationwide, respectively, in line with its commitment to deliver the widest and fastest 4G network in the country.

In the fourth quarter, CelcomDigi invested US$210.6 million (RM1.01 billion) in capital expenditure (capex), bringing its total capex to US$365 million (RM1.75 billion), translating into a capex intensity of 13.8% in FY2023. The company said it managed to optimise capex efficiencies while pushing ahead on prioritised network and IT integration initiatives.

[RM1 = US$0.208]

CelcomDigi’s CEO, Idham Nawawi said, “In 2023, we made significant progress integrating many business areas, achieving this with minimal disruption to customer experience while competing effectively to lead in the market. We introduced the CelcomDigi brand and launched over 50 product campaigns showcasing our dedication to innovation and customer obsession. This market execution and operational excellence enabled us to deliver a strong performance and shareholder value in line with our FY2023 guidance.”

2024 has started with good growth momentum with Idham optimistic that it will further unlock synergies and benefits envisioned from the merger.

“It will be an exciting year for CelcomDigi as we move deeper into our integration efforts and strengthen our market leadership by being a brand that Malaysians can trust and rely on in the age of ‘digital-everything’. On a personal note, it has been a privilege for me and the management team to bring two amazing teams together in our first-year post-merger. CDzens have embodied the ‘stronger together’ spirit and have leveraged their industry-best expertise to deliver a solid first-year, and we very much look forward to what team CelcomDigi will bring to our customers in the coming year,” he said.

Continued growth across all core segments sustaining market share

The company registered across-the-board improvements in its Postpaid, Prepaid, Home Fibre, and Enterprise segments, driven by enhanced 4G and 5G offerings introduced for all segments in the fourth quarter. Increased uptake of these attractive offers bolstered customer confidence in its network strength, resulting in a record breaking monthly average data per user for Digi customers reaching 26.1 GB, up 6.5% YoY, while Celcom customers registered 31.2 GB usage monthly, up 11.8% YoY.

Consequently, CelcomDigi recorded Service Revenue of RM2,737 million in 4Q FY2023, and continued to grow its quality subscriber base with additions of over 466,000 subscribers Y-Y, bringing its total subscribers to 20.6 million. Efficient cost management efforts strengthened Ebitda by 2.6% Y-Y to RM1,597 million, delivering an Ebitda margin of 48.8%, while normalised Profit After Tax (PAT) stood at RM507 million.

Additionally, the company declared a fourth interim dividend of 3.5 sen per share or a FY2023 total dividend of 13.2 sen per share, in line with its progressive dividend commitment to shareholders.

In Dec, CelcomDigi pledged its intent to set near and long-term company-wide emission reductions in line with science-based net-zero with the Science Based Targets initiative. This aligns with its broader ESG ambitions to operate a sustainable and responsible business for the long-term.

Financial highlights

.png)

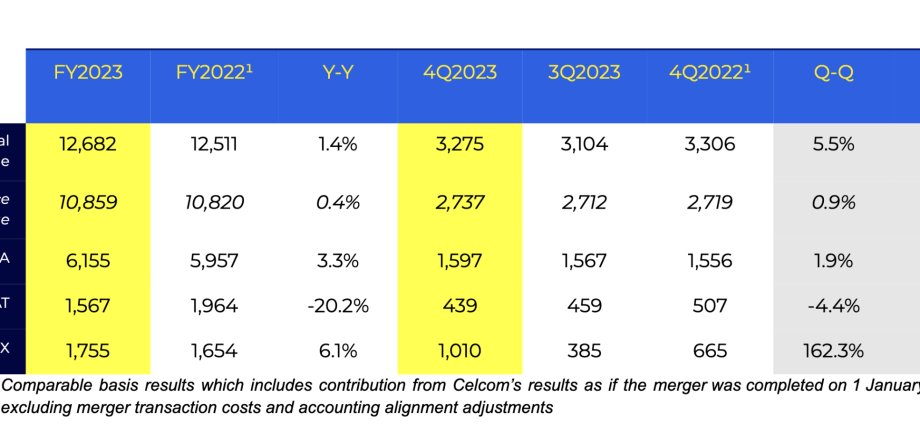

FY2023 Service revenue grew 0.4% Y-Y to RM10,859 million. 4Q FY2023 Service revenue rose 0.9% Q-Q to RM2,737 million from growth across all core segments, particularly in Postpaid, Wholesale and Home Fibre.

· FY2023 Postpaid revenue declined 0.8% Y-Y to RM5,076 million resulting from softer interconnect revenue while 4Q FY2023 grew 0.9% Q-Q to RM1,268 million fuelled by higher roaming activities.

· Prepaid revenue grew 0.8% Y-Y to RM4,573 million for FY2023, while 4Q FY2023 rose 0.1% Q-Q contributed by continued strong data traction.

· Home Fibre revenue grew 27.2% Y-Y to RM173 million and 4.4% Q-Q to RM47 million for FY2023 and 4Q FY2023 respectively, benefiting from expanded product offerings and affordable fibre plans, attracting more customers with net additions of 30,000 subscribers.

· FY2023 EBITDA rose 3.3% Y-Y to RM6,155 million attributed to topline improvements and sustained total costs from integration synergies and cost optimisation efforts; while 4Q FY2023 EBITDA stood at RM1,597 million and a margin of 48.8%.

· Normalised Profit After Tax (PAT) increased by 3.2% to RM2,151 million in FY2023, after adjusting for accelerated depreciation.

Operational Highlights

· Net additions of 466,000 subscribers Y-Y in FY2023, with new subscribers from stronger uptake of enhanced product offerings despite a slight decline of 48,000 in 4Q FY2023 to reach a total of 20,552,000 subscribers.

· Blended 4Q FY2023 ARPU was RM41 while Postpaid and Prepaid ARPU stood at RM66 and RM28 respectively.

· Postpaid net adds for FY2023 were 266,000 Y-Y, including 74,000 Q-Q for 4Q FY2023 to 6.9 million subscribers driven by a wide range of appealing packages and bundles.

· Prepaid base grew 170,000 Y-Y for FY2023 to 13.5 million due to continued growth and sustained renewals in monthly subscription packages despite a slight reduction of 132,000 Q-Q.

· Home Fibre subscribers increased to 131,000, marking a growth of 30,000 Y-Y for FY2023 including a 10,000 Q-Q increase for 4Q FY2023 from improved plan offerings strengthening ongoing subscriber acquisition and growth in ARPU.

· Average data per user up 10.2% Q-Q to 31.2 GB for Celcom and 5.7% Q-Q to 26.1 GB for Digi.