Will DeepSeek deep-six the US economy? – Asia Times

By selling technology companies to immigrants, America has financed a current account deficit that soared to US$ 1.2 trillion in 2024. Tech stocks, however, are trading at valuations not seen since 2000, when the NASDAQ Composite began a descent that wiped out 75 % of its market capitalization by 2002.

If expectations deteriorate regarding synthetic intelligence’s ability to generate revenue, was a technology crash lead to a financing crisis for the United States? The question of the January 27 collision in AI-related stocks in response to less expensive and more effective Chinese rivals still lingers. Every capital investment in the world pays close attention to these issues.

Europeans stopped buying US debts of all kinds – Treasury, loan, and business – after the post-Covid prices of 2021 and the Federal Reserve’s subsequent rise in interest rates. That signaled the end of a 40-year bulls industry in US securities. From a 1981 peak of 15 %, the US 30-year bond yield fell in a nearly straight line to an August 2020 low of just 1.41 %.

The inflationary wave of 2021-2022 put an end to this bull work. In March 2022, moreover, the US and its allies seized half of Russia’s$ 600 billion in foreign exchange reserves, prompting other central banks to shift away from US Treasury securities to gold and other assets.

However, the world’s appetite for American tech stocks has been stagnant for the past ten years, which was rekindled by the development of Large Language Models ( LLMs) last year. Are raised valuations for AI-related shares justified? Which two aspects affect how quickly and which industries are most likely to make money from AI?

China’s DeepSeek R1 type appears to have made a model performance discovery: tale layout and related improvements reduce the amount of processing required by one or two orders of magnitude.

DeepSeek, also, offers its unit at a small fraction of the price that its US competitors then charge. That is not always detrimental to the overall US tech sector. If China has a better systems, US companies may choose it speedily, and lower costs for AI simulation does benefit the users of AI models.

US and China compete in seven distinct subcategories of AI uses. China leads most of them, and its Artificial skills are likely to strengthen it. They are

- Manufacturing: China has poured huge resources into stock technology. One test is the number of companies outfitted with devoted 5G systems, which support AI applications. China claims 10, 000 for installations, while the US has only a few hundred, concentrated in the automobile industry. The benefit is enormously advantageous for China, and breakthroughs in AI are likely to help. However, US production has had a small influence on equity valuations.

- Internet of Things: China is back in simplifying vehicles and warehousing, with entirely mechanical stores now in operation.

- China is now a major manufacturer of professional computers, installing more industrial computers each year than the rest of the world combined.

- China leads the so-called low level market, which was first cited by federal planners in a December 2024 working papers. Drone taxis, drone deliveries, and other applications are currently a$ 100 billion industry in China, and they are projected to double by 2026.

- Autonomous cars: We’ll call this a toss-up between the US and China, although China now has autonomous car companies operating on a smaller scale.

- Huge Language Models: afterwards, a toss-up. The Philippines ‘$ 40 billion call center business, which saw the most potential gain from AI systems, includes the gains made by LLMs. However, at this point, there are no guarantees that Bachelor applications will be approved for all of their possibilities because they are so varied and extensive.

- Biotech: The US has a distinctive advantage with a powerful medical development system. China has a direct in health statistics, but America’s advanced of large pharmaceutical companies, businesses and venture entrepreneurs give it an edge.

The big question is about LLM’s timing. Although the payoff might be significant, it may not be as quick as anticipated.

LLM deployment in the enterprise still has little to do with organizational performance and human adaptation ( management buy-in, workflow adjustments, etc. ). seems to be years away. Cost savings for specific categories of expenses, such as call centers or repetitive coding tasks, may be easily realized. However, the development of AI for higher-skill work is still in its infancy.

What does this mean for Nvidia’s chipmakers? On the assumption that Nvidia GPUs will provide a lot of this activity, one could argue a bullish case for Nvidia based on all of the AI sectors listed above. However, this hypothesis requires closer scrutiny of Nvidia’s competitive advantages.

Nvidia has a greater advantage in computation when training language and vision models, but less so when inference ( running the resulting models to get useful results ) is at its disposal. Notably, Huawei’s Ascend AI chips already perform fairly well with the new DeepSeek models, with comparable or even better cost performance than the weakened Nvidia H800s ( the weakened Nvidia chip that was cleared for export to China )  .

Additionally, the case that the top US tech companies ( the so-called Magnificent Seven ) will control equity returns going forward is much weaker than the market is currently perceptive of it. If we are right, and tech market valuations shrink to some significant extent, what are the macroeconomic implications? Key capital flows are more dependent on a small number of very large companies than at any other time in US history.

Let’s say foreigners reduced their purchases of tech stocks as the value of the stocks declines. The United States would need to sell more bonds to both domestic and foreign investors to pay off its current account deficit and federal budget deficit. The chart below shows the amount of new Treasury debt bought by US banks, US households, foreign official institutions, and foreign private investors, respectively.

Banks stepped in and reabsorbed the$ 4 trillion in Covid subsidies that were funded by the Treasury debt, but by 2023 they had exhausted their savings deposits. Households, who were drawn to the higher interest rates on Treasuries, saw the biggest increase in new investment in Treasury securities. Additionally, foreign private investors decreased their Treasury holdings.  ,

A full-blown financial crisis is most unlikely. The cash-burning dotcoms of 2000 have been replaced by cash-rich monopolies like Microsoft, Google, Apple, Amazon and Meta. By offering higher bond yields to domestic and international investors, the United States can adjust to an air-pocket in the demand for its tech stocks.

However, the DeepSeek shock exposes flaws in Big Tech’s core strategies as well as in the stratospheric valuation of its best-performing stocks. The outcome is likely to be a combination of persistently higher interest rates, slower growth, a decline in wealth, and strong economic headwinds.

The S&, P’s technology sector, correspondingly, trades at a P/E of 37, compared to an overall P/E for the S&, P 500 of 26. That accounts for the largest portion of the difference between the lofty valuations of American stocks and those of European, Japanese, and Chinese stocks.

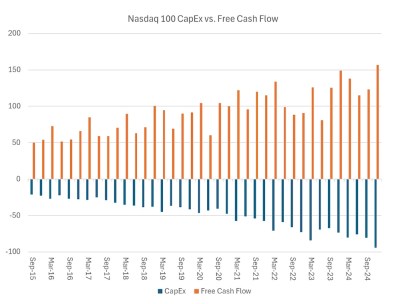

A brass-tacks gauge of equity valuation is the free cash flow (FCF ) yield, namely the ratio of cash income to market price. Investors accept less current income because they anticipate higher income in the future, the higher the FCF is expected to be. For the S&, P 500 as a whole, FCF is below 3, a level not seen since the eve of the tech stock crash of 2000.

For a monopoly like Microsoft, the free cash flow yield has fallen to just 2, the lowest on record.

Between 2020 and 2024, Big Tech invested more than double in capital expenditures, and it is still investing heavily in AI-supporting data centers. The DeepSeek shock raises questions about the viability of these plans economically: If Chinese developers can create cutting-edge models using innovative model architecture designs, the raw computing power under development could be significantly overvalued.

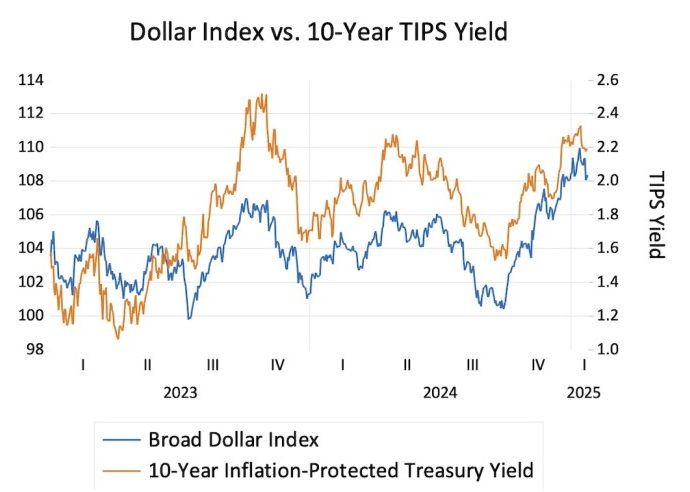

To entice price-sensitive buyers into the Treasury market, the US government—still running a record peacetime non-recession deficit of 6 % to 7 % of GDP—probably will have to offer higher yields. That’s a problem for the economy and also a problem for the Treasury, which is already paying$ 1 trillion a year in interest, nearly quadruple the service cost of America’s national debt in 2020.

It also puts a headwind in front of the US economy for interest-sensitive activity, particularly housing. Longer-term, the US runs the risk of an Italian-style spiral, in which the rising cost of debt service eats away at the budget and limits what the federal government can do to support the economy.

Steve Hsu is professor of theoretical physics and of computational mathematics, science, and engineering at Michigan State University, and the founder of several AI startups. Follow him on X at @hsu_steve. David P. Goldman serves as Asia Times ‘ deputy editor. Follow him on X at @davidpgoldman