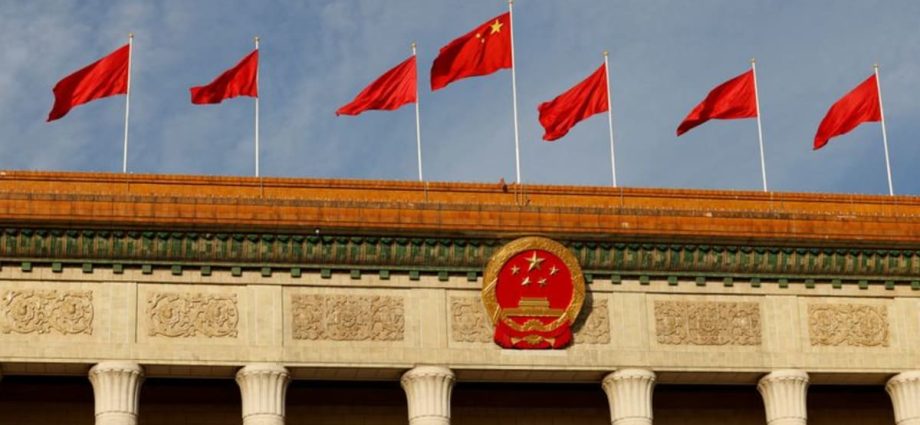

Record numbers sit for China civil service exam, hoping for job security

BEIJING: More than 3 million people took China’s annual civil service exam on the weekend, state media reported on Monday (Nov 27), a record number that underscores young people’s concerns about getting a secure job in a rocky economy. With stubbornly high youth employment in the world’s second-largest economy, theContinue Reading