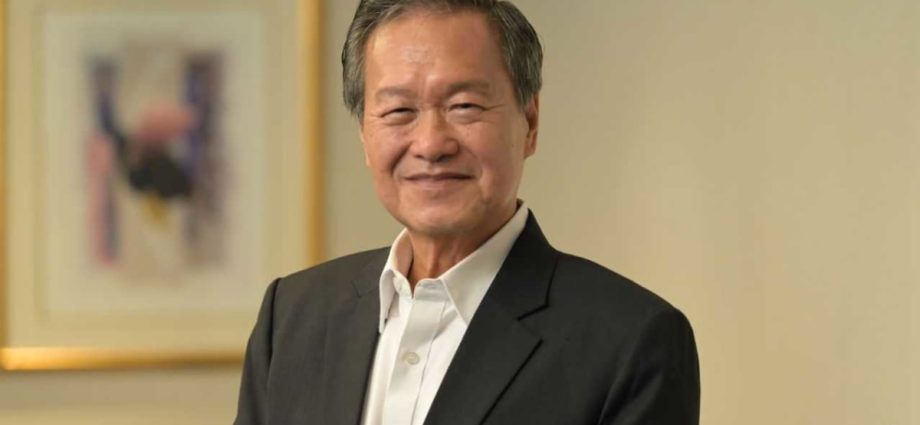

Tan Kin Lian launches bid for Presidential Election, stresses desire for candidate outside ‘establishment’

SINGAPORE: Former NTUC Income chief executive Tan Kin Lian announced his bid to run for President on Friday (Aug 11), emphasising his belief in the importance of offering Singaporeans the chance to vote for what he described as an independent candidate.

And while fellow presidential hopeful George Goh is an “independent person”, Mr Tan said he decided to throw his hat into the ring following comments and his team’s advice that Mr Goh might not meet the qualifying criteria, resulting in a possible two-way contest between former GIC chief investment officer Ng Kok Song and former senior minister Tharman Shanmugaratnam.

“I believe I will be the only candidate from outside the establishment,” added Mr Tan, 75.

Speaking at a press conference where he launched his presidential campaign, Mr Tan added that he was initially prepared to “stand aside” when Mr Goh expressed interest.

“I have high respect for him, I have high respect for his enthusiasm and his team,” Mr Tan said of Mr Goh.

“We don’t want to have a contest between two candidates that are from the establishment, and it will also look very bad … because the people of Singapore will be very sceptical,” added Mr Tan.

In response to CNA’s questions about whether he will continue if Mr Goh qualifies, Mr Tan said he does not want to split the votes between non-establishment candidates.

“I will certainly want to make sure that there is only one non-establishment candidate, that we will not split the votes … How it is going to happen depends on who and whatever the circumstances are, we’ll know about (it) when the time comes,” said Mr Tan.

Mr Goh, who is the founder of Harvey Norman Ossia, had on last Friday addressed doubts about his eligibility by laying out details from his summary of submission to the Presidential Elections Committee (PEC).

To meet the private sector service requirement to be President, an applicant must have served as the chief executive of a company for at least three years. During this time, the company must, on average, have shareholders’ equity of at least S$500 million (US$372 million) and made a profit after tax for the entire time.

“I have a group of five companies that have a combined shareholders’ equity of S$1.521 billion over three years,” said Mr Goh, adding that this is collectively equivalent to an average shareholders’ equity of S$507 million annually for the group as a whole.