Japan to convert cargo planes into missile carriers

Japan plans to turn transport aircraft into ad-hoc missile carriers operating from austere and remote airstrips and using a system with significant tactical, operational and strategic implications for conventional and nuclear deterrence vis-à-vis China and North Korea.

The Warzone reported this month that the Japanese Ministry of Defense (MOD) is looking to arm its Kawasaki C-2 transport jets with air-launched missiles to potentially attack enemy bases including missile launch sites in counterstrike operations.

Although the report did not indicate the type of missiles that may be deployed to its C-2 jets, of which it has 13 in active service, it did mention that the MOD seeks to use missiles that are dropped before their engine starts. That, the report said, would not require significant modifications to Japan’s existing aircraft.

The Warzone report notes that the US is developing related technology known as the Rapid Dragon air-launched palletized munition concept, which was first tested in 2021. The report says that Japan may use Rapid Dragon or a similar domestically-developed system aboard its C-130 cargo planes, of which it has 14 units.

Japan may have multiple payload options for a domestically-made palletized munition system. Asia Times reported in June 2023 that Japan is developing an “island defense anti-ship missile” featuring modular warheads and a stealthy turbofan-powered design with a purported 2,000-kilometer range. The missile may contain land attack, electronic warfare (EW) and reconnaissance warheads.

Firing multiple types of missiles from a palletized munition can significantly improve accuracy. Reconnaissance missiles equipped with a high-resolution camera can spot the enemy, follow up with an EW missile to eliminate enemy radar and other sensors, and then deliver a missile with a high-explosive warhead for a lethal strike.

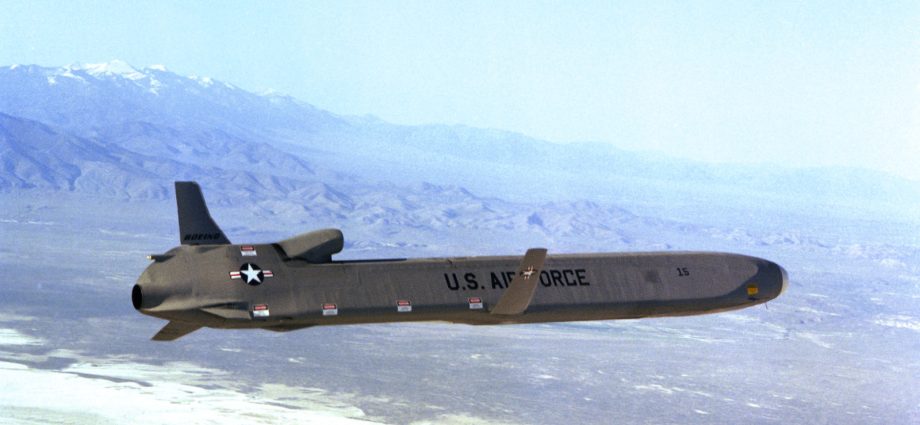

AIN says that palletized munition systems can solve the platform compatibility, availability and capacity issues of air-launched cruise missiles, such as the AGM-158 Joint Air-to-Surface Standoff Missile (JASSM), which were designed to be fired from fighters or bombers.

AIN also notes that most Western fighter designs are limited to two JASSM missiles, which may be sufficient for the US as it operates several bombers but may be an issue for its allies with none.

AIN also notes that Rapid Dragon enables the US to conduct long-range strikes without fighters or bombers. It describes the system as a palletized munition with 6 JASSMs for C-130s or 9 JASSMs for the C-17.

It also states that Rapid Dragon is designed for roll-on roll-off for rapid fielding, requiring no modifications to the launch aircraft since targeting data is programmed into the individual missiles using a laptop.

In deploying Rapid Dragon, AIN notes that a target is selected, a strike request is made and routing and retargeting coordinates are confirmed or updated. Operators follow standard airdrop procedures once the launching package deploys, with the multiple JASSMs stabilized under the parachute and systematically released to fly to the target.

AIN says that Rapid Dragon allows air forces to saturate an area with multiple weapons and effects, complicate adversary targeting solutions, help open access for critical target prosecution and deplete an adversary’s air defense munitions stockpile.

It also notes that palletized munitions can be an area-denial weapon and enable new concepts of operations, making it a key asset for US allies when aircraft availability may be limited.

However, basing issues may hobble the deployment of palletized munitions systems. In a December 2022 article for Insider, Christopher Woods notes that expanding the number of planes and bases involved in long-range strikes brings logistical challenges, especially in the vast Pacific where bases are scarce and often rudimentary.

Woods argues that these logistical issues will adversely affect the deployment of palletized munitions. He says, in particular, that weapons storage would be a significant concern, noting that how palletized munitions are stored would inevitably affect how effectively they can be used.

In a November 2019 article for Air & Space Forces Magazine, Rachel Cohen says that there would be high demand for cargo aircraft in their primary roles during a major regional conflict, stating that it wouldn’t make sense to allocate them for strikes instead of using them to deploy forces into areas of operation. It would also be difficult and costly to modify commercial-derivative aircraft to carry and safely eject many weapons, she says.

George Moore notes in an August 2023 article for the Bulletin of Atomic Scientists that Rapid Dragon can also be developed into a nuclear delivery system, including for the nuclear-capable AGM-86 Air Launched Cruise Missile (ALCM). That, he argues, could potentially turn every cargo aircraft into a nuclear weapons delivery system.

Moore notes that there is no plausible way to negotiate limitations on cargo aircraft with rear ramps that could deliver nuclear weapons. He notes that a palletized munition nuclear delivery system would require little or no training for pilots, which may prove to be superior to NATO’s nuclear-sharing model of pre-positioned nuclear weapons.

Moore also notes the challenges posed by a palletized munition nuclear delivery system to survival and deterrence concepts, noting that an aggressor may find it challenging to locate enough of the weapons and launch vehicles to ensure the success of a first strike.

He says that while the detection of cargo aircraft may be easier than combat aircraft, the former may be challenging to detect and engage if they fly at very low altitudes.

Moore also notes that US adversaries may come up with their own palletized munitions, forcing a total rethink of US concepts for using conventional deterrence and posing the question of how a US carrier battlegroup would respond to threats much further from an enemy’s shore.

He also mentions that cargo aircraft have far longer ranges than many combat aircraft fielded by US near-peer adversaries, which could expand the threat envelope posed by a hostile state.