BBC News

Getty Images

Getty ImagesIn its most recent effort to revive a sluggish market, the Taiwanese government has promised new care incentives, higher wages, and much paid left.

That’s in addition to a$ 41 billion reduction program that covers everything from electric cars and devices to dishwashers and home furnishings. It’s a investing binge that may entice Chinese citizens to use their cards.

Simply put, they are not spending much.

Good news was released on Monday. According to official statistics, retail sales increased by 4 % in the first two weeks of 2025, which is a positive sign for the restoration of consumption. However, with the exception of Shanghai, both new and existing home prices continued to decline in comparison to next year.

China is experiencing recession, which occurs when the rate of inflation falls below zero, causing prices to fall, whereas the US and other big rights have struggled with post-Covid prices. In China, they have fallen for 18 months straight in the last two decades.

Pricing dropping might seem like great news for consumers. However, a continual decline in consumption, which determines what households buy, indicates deeper financial trouble. Companies lose money when people stop spending, hiring slow, pay deteriorate, and the economy’s momentum comes to an end.

Given that China is already struggling with slow rise in the midst of a protracted housing crisis, soaring government debt, and unemployment, that is a cycle it wants to avoid.

Chinese customers either don’t have enough cash or don’t feel comfortable enough in their prospect to spend it.

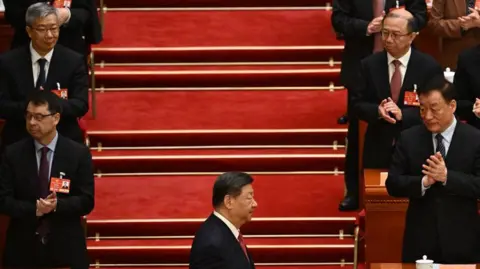

However, they are reluctant at a crucial time. President Xi Jinping has high hopes for boosting consumption because the economy is projected to grow by 5 % this year. He anticipates that rising domestic usage will process the negative effects that US tariffs will have on Chinese exports.

Does Beijing’s program actually work, then?

China is beginning to consider investing.

Beijing wrapped up its quarterly National People’s Congress last week by putting more money into social welfare programs as part of its great financial plan for 2025 in order to address its ailing economy and poor domestic demand.

This included a 20 yuan ($3; £2) increase in minimum pensions. Then came this week’s announcement with bigger promises, such as employment support plans, but scant details.

Some people think it’s a good move, but remember that China’s leaders need to show more help. However, it demonstrates Beijing’s knowledge of the changes required for a more robust Chinese consumer market, including higher pay, a stronger social safety net, and policies that encourage people to spend more than save.

Getty Images

Getty ImagesLow-paid migrant workers, who lack complete access to industrial social advantages, make up a quarter of China’s labor force. They are especially vulnerable during times of economic confusion, like the Covid-19 crisis.

Rising pay in the 2010s helped to address some of these issues, with common incomes increasing by about 10 % annually. Saving once more turned into a crutch as income rise slowed in the 2020s.

However, the Chinese government has been slower to grow social benefits, instead focusing on boosting intake through short-term initiatives like trade-in programs for electronics and household appliances. According to Gerard DiPippo, a senior scholar at the Rand think pond,” Household earnings are lower, and discounts are higher.” But that has not addressed a underlying issue.

Chinese buyers are more risk-averse as a result of the near-collapse of the housing industry, which has also caused them to reduce their spending.

According to Mr. DiPippo,” The home business matters not only for true economic activity but also for home sentiment because Chinese households have invested a lot of their wealth in their homes.” ” I don’t believe China’s consumption will fully recover until it is obvious that the property market has fallen behind, and that many families’ primary assets are beginning to recover.”

Beijing’s severity in addressing longer-term issues, such as falling birth rates, as more young people choose not to support their parents, is encouraged by some analysts.

According to a study conducted by the Chinese think tank YuWa in 2024, raising a child to adulthood in China would cost 6.8 times the country’s GDP per capita, which is among the highest in the world, compared to the US ( 4. 1 ), Japan ( 4. 3 ) and Germany (3. 6 ).

These fiscal strains have only served to further engender a deeply rooted keeping mindset. In 2024, Chinese families managed to keep 32 % of their disposable revenue despite a struggling economy.

That’s no surprising in China, where consumption has never been especially high. To put this into perspective, domestic consumption accounts for about 70 % of development in India and the US, and about 80 % of progress in the UK. Over the past ten years, China’s share has typically ranged between 50 % and 55 %.

But up until now, this wasn’t really a concern.

When savings increased while browsing decreased

Chinese customers once made fun of the irresistible allure of e-commerce deals, calling themselves “hand-choppers” and claiming that only cutting off their hands could prevent them from pressing the” checkout” button.

11 November in China, or Double 11, was named the nation’s busiest shopping time as rising wages fueled their wasting energy. Explosive sales pulled in over 410 billion yuan ($ 57bn, £44bn ) in just 24 hours in 2019.

However, the most recent one “was a dud,” according to a coffee beans online salesman from Beijing. It caused more trouble than it was fair, if something.

Foreign buyers have become more cautious since the epidemic, and this concern continues even after restrictions are lifted in late 2022.

Alibaba and JD.com stopped disclosing their sales figures in the year, a significant change for businesses that had once been the source of their record-breaking income. According to a cause with knowledge of the situation, Taiwanese authorities warned platforms against publishing numbers because they feared disappointing results might harm consumer confidence even more.

The high-end brands have been the victims of the investing crisis, with LVMH, Burberry, and Richemont reporting sales declines in China, which was once the backbone of the world luxury market.

Content tagged with” use drop” have received more than a billion views on Red Note, a Chinese social media app. People are sharing advice on how to change pricey items with less expensive ones. One customer remarked,” Tiger Balm is the innovative coffee,” while another remarked,” I apply fragrance to my nose and lips right away, saving it for myself.”

Getty Images

Getty ImagesChina’s client boom was not a fit for its exports, even at its peak. In addition, good state-backed funding in highways, ports, and exclusive economic zones was a key area of focus. China relied on high family discounts and low-wage workers, which helped the economy grow but left shoppers with few disposable incomes.

Countries are diversifying supply stores away from China, which reduces reliance on Chinese imports, as political difficulties increase. After centuries of strongly unsecured loans, especially in system, local governments are now burdened by debt.

Xi Jinping has already pledged to make “internal need” the main army and stabilizing anchor of progress. A representative for the National People’s Congress, Caiyun Wang, said,” With a population of 1.4 billion, even a 1 % increase in demand creates a market of 14 million people.”

Getty Images

Getty ImagesHowever, Beijing’s schedule has a catch.

According to many analysts, the Chinese Communist Party would need to rekindle the customer trust of a creation of Covid graduates who is struggling to buy a home or find employment in order for consumption to generate growth. Additionally, it may require shifting the focus from saving to saving.

The share of savings that China’s state-controlled banks rely on to finance important industries, including AI and cutting-edge technology, would offer Beijing an advantage over Washington, both financially and carefully, the more households spend.

Some experts believe that China’s officials are aiming for a consumer-driven business because of this.

According to David Lubin, a research fellow at Chatham House,” the main purpose of Beijing’s is not to improve the security of Chinese communities, but rather the security of the Foreign country.”

Perhaps Beijing doesn’t want to shift power from the position to the person.

China’s officials did that in the past when they started trading with other countries, promoting local organizations and attracting foreign investment. And it altered their way of life. However, it’s important to know whether Xi Jinping intends to do that once more.