NEW YORK- The largest peace budget shortfall in history and a deluge of transfer payments in the form of governmental hand-outs to folks helped the US economy add an unexpectedly large 336, 000 work in September.

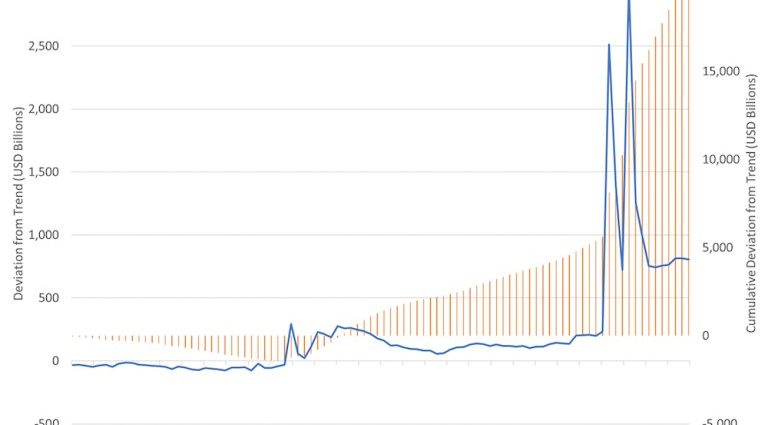

Today, the federal government checks nearly one-quarter of every penny spent on private consumption in the United States. Over the past four years, excess payments to Americans ( above the long-term trend ) totaled$ 15 trillion, or more than half the US economy’s annual output.

The United States must lend from or sell goods to foreigners in order to fund itself due to its negative net foreign asset place of$ 16 trillion and ongoing trade deficit. Possibly much sooner than Washington officials seem to comprehend, this could result in an Italy-like sin in which the federal government is paralyzed by the cost of paying off existing debt at a constant high yield.

Everyone is wealthy but no one has the means to live in the economy that has been created by the storm of national generosity. In 2023, the federal government will borrow about$ 2 trillion, or almost 8 % of the country’s gross domestic product ( GDP ), a deficit that was only surpassed by the Covid recession of 2020 and the Great Recession of 2008, respectively. This has never happened before during an economical growth.

Bills to people account for the majority of the boost in the gap. The Trump administration approved a$ 3 trillion emergency stimulus package in response to the country’s shutdown in April 2020. While the business was recovering, the Biden administration followed this with yet greater stimulation. As can be seen in the chart above, the amount of transfer payments is still$ 1 trillion higher annually than the pattern.

Since 2020, the total amount of federal payments to Americans in excess of styles has reached$ 20 trillion, or roughly three-quarters of the US economy’s yearly result. Almost all of private consumption expenditures now include exchange payments, up from just 6 % in 1946.

According to scholar Herbert Stein’s famous adage,” What doesn’t go on long, will not.” In 2023, nearly$ 1 trillion in spending will be consumed by the US due to its annual borrowing of$ 2 trillion at steadily rising interest rates. By 2053, 35 % of all federal spending may be accounted for by interest charges totaling$ 71 trillion, according to the Peterson Institute consider reservoir in Washington, DC.

The largest cause of higher bond generates during 2023 was the source of Treasuries needed to fund the gap. Analysis research can be used to demonstrate this.

The Federal Reserve’s anticipated immediately, or federal funds rate, in two ages( derived from futures markets ), and the size of its own assets profile are the only two factors used in a straightforward analysis model to explain the offer on Treasury Inflation-Proted Securities. During the Covid crisis, the Fed increased its investment by$ 5 trillion, and it is now starting to reduce that amount.

The result of the two forecast variables is finally calculated, and it is displayed separately on the chart above:

Surprisingly, this research demonstrates that over the past year, actual or inflation-protected Treasury yields haven’t been significantly impacted by Fed expectations regarding future interest rate changes.

A year ago, in October 2022, the impact of the anticipated federal funds rate on real yields reached its lowest point, just below 3 %. However, almost a full percentage point of the increase in real produces over the previous year can be attributed to the Fed Portfolio effect, which contributed to lowering yield levels between March 2021 and May 2022.

True US yields may increase as the storm of Treasuries keeps rising. A continuous burden on growth, similar to what is happening in Italy now, could result from the Federal Reserve losing control over the longer end of the yield curve.

Follow David P. Goldman at @ davidpgoldman on X, formerly Twitter.