Washington once again has outraged Beijing, this time by announcing new “guardrails” prohibiting any recipients of US government funding that operate in China from

- spending more than US$100,000 to expand their chip facilities there, or

- boosting such facilities’ production capacity by more than 5%.

They also are forbidden to expand any existing facility’s production capacity by more than 10% unless at least 85% of its output is incorporated into final products that are consumed locally.

The new curbs officially apply to four countries, but it’s basically China that they target as most high-end chipmakers do not have fabs in the remaining three, Russia, Iran and North Korea.

Some analysts think Taiwanese chipmaker TSMC’s plan to expand its production lines in Nanjing will be affected.

The new measures announced in Washington also include a list of semiconductors that are critical to national security, including current-generation and mature-node chips used for quantum computing, in radiation-intensive environments and for other specialized military capabilities.

Washington pointedly chose Tuesday – the day when Russian President Vladimir Putin and Chinese President Xi Jinping, who was visiting Moscow, signed a joint declaration to boost the two nations’s economic ties – to announce that it would collaborate with allies and partners to make global supply chains more “resilient” and “diversified.”

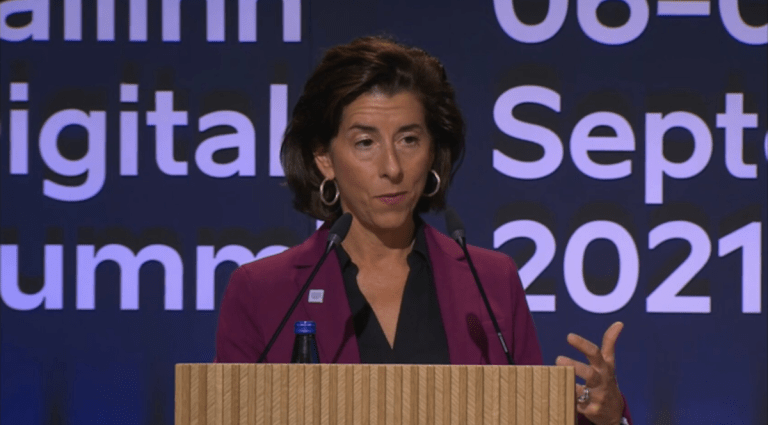

“These guardrails will help ensure we stay ahead of adversaries for decades to come,” said Secretary of Commerce Gina Raimondo. She added that the new measures are in line with the recently enacted law CHIPS for America: The legislation “is fundamentally a national security initiative and these guardrails will help ensure malign actors do not have access to cutting-edge technology that can be used against America and our allies.”

Wang Wenbin, a spokesperson of China’s Ministry of Foreign Affairs, objected Wednesday, saying the so-called “guardrails” are technology blockages and protectionist actions that aim to maintain US hegemony. Wang defiantly insisted that the curbs will not slow China’s development pace but, rather, will strengthen China’s determination and ability to achieve technological self-sufficiency.

“The US keeps generalizing the concept of national security, abusing export control measures, even sacrificing the interests of its allies, coercing some countries to contain and suppress China and artificially promoting the ‘decoupling’ of industrial chains,” Wang complained, adding that all these will undermine fair competition and slow global economic recovery.

TSMC’s Nanjing fab

The biggest immediate question is how the guardrails affect The Taiwanese TSMC’s mainland operations.

In 2015, TSMC, the world’s largest contract chipmaker, announced its plan to build a fab in Nanjing to produce 16nm chips. The facility commenced mass production in 2018. In April 2021, TSMC said it would invest US$2.9 billion to expand its Nanjing fab to make 28nm chips.

Some “patriotic” Chinese netizens at that point slammed TSMC for gearing up to spend US$12 billion to build a fab in Arizona to make 5nm chips while planning to produce only lower-end semiconductors in mainland China.

They also said TSMC should make 7nm chips in mainland China, noting that a mainland firm, Semiconductor Manufacturing International Corp (SMIC), was capable of making 28nm ones.

However, an IT expert wrote at the time that TSMC wouldn’t be able to make 7nm chips on the mainland, a place where it cannot import extreme ultraviolet (EUV) lithography.

Besides, the expert said, TSMC should be allowed to make 28nm chips in the mainland as demand for such mid-end products will remain strong for some more years due to the robust growth of the country’s e-vehicle sector.

Things are a bit confused at this point. Last December, Taiwanese media said the expansion plan was scrapped – but TSMC said it would go on.

It is unclear how TSMC can push forward with the plan after the Dutch and Japanese governments reportedly agreed with the US last month that they will stop shipping certain deep ultraviolet (DUV) lithography machinery to China. DUV, a lower level of technology than EUV, is essential for making 28nm chips.

On March 16, the Chinese Communist Party (CCP) sought to stir this apparent impasse up, establishing a technology committee to accelerate the development of high technology in China.

The Financial Times reported on Tuesday that Beijing will subsidize local chipmakers, including SMIC, Hua Hong Semiconductor and Huawei Technologies, and encourage them to produce their own chip-making tools.

Meanwhile, on the Russian front

Although China is the primary target of the guardrails just announced, the chips war continues to rage between the United States and another of the adversary countries mentioned Tuesday, Russia.

On January 22, Silverado Policy Accelerator, a Washington-based think tank, said in a report that Russia has turned to mainland China and Hong Kong to source semiconductors since it invaded Ukraine in February 2022.

“Russia has made significant efforts to re-establish a network of suppliers in non-sanctioning countries from which to source semiconductors due to their potential use in military applications,” says the report. “Hong Kong and China were the largest shippers of these semiconductors after the invasion of Ukraine.”

It says products are also shipped in smaller amounts to Russia through other countries, including Belarus, Turkey, Kazakhstan, Kyrgyzstan, Armenia and Uzbekistan. It also says some Russian fabless firms have contracted with manufacturers such as TSMC for integrated circuit production.

The think tank recommends the US government to set up a joint interagency task force on export enforcement and ask the private sector to help report “bad faith and illicit actors that are aiding adversaries and distorting markets to the detriment of legitimate actors.”

It says the US should find out what chip products Russia is importing from non-sanctioning sources and whether Russia is recycling chips from appliances, old computers or e-waste.

Read: China’s grand plan for a world-beating digital future

Follow Jeff Pao on Twitter at @jeffpao3