With energy prices at historically high levels, all of eyes are on government authorities.

Disruptions within energy supply chains due to the war in Ukraine have prompted countries to look towards energy sources they had begun to shift away from — Tiongkok has increased its coal production and The japanese will come back to nuclear — to obtain their energy supply.

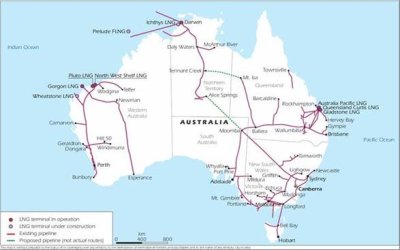

The Australian government, like many more, faces increasing pressure to intervene within the gas market. As the world’s largest melted natural gas (LNG) exporter, Australia’s choices may have significant global influences.

Australia’s major LNG consumers — China, Japan and South Korea — are nervously awaiting a decision through the Australian government. They are the world’s top 3 LNG importers and imported 85% of Australia’s LNG exports in 2021.

Australia’s LNG accounted for 29, twenty-eight. 7 and 16% of total LNG imports in China and taiwan, Japan and Southern Korea in 2021 respectively. These countries are on the lookout for LNG foreign trade controls, which will minimize their provide sources and increase their place prices.

In spite of being one of the world’s largest coal and LNG exporters, Quotes still faces a power sector crisis. The particular Australian Energy Market Operator (AEMO), accountable for operating the gasoline and electricity marketplace, made history when it suspended the national electricity market on June 15, 2022.

Australia’s east coast fuel market is also in crisis. The Gas Supply Ensure — the gas industry’s mechanism to ensure that gasoline supply can meet peak demand within the National Electricity Marketplace — has been turned on twice since 06 this year.

The first activation in June capped the particular gas prices within the state of Victoria at AU$40 per gigajoule (US$27) to shield gas consumers through rising prices. AEMO then ordered Queensland state suppliers to provide gas to the condition of New South Wales instead of overseas on July 19, 2022.

The particular gas price problem arose after Australia’s east coast started exporting LNG in 2015 . This connected domestic markets with global gas markets. By causing domestic consumers compete with consumers abroad, the particular Australian market became subject to international gasoline prices.

Connection to international markets has contributed to skyrocketing gas prices considering that 2020. The month-to-month Japan Korea Gun, a spot price standard for gas within East Asia, increased 14-fold in two years.

Uk thermal units — a measure of the power content in fuel — increased through US$4. 2 per million units in August 2020 to US$18. 2 within August 2021 and US$56. 3 in August 2022. The particular monthly Dutch Title Transfer Facility natural gas price increased twenty-four times in the exact same period.

East Australia’s domestic gas prices are subsequent international prices, even if less dramatically. The particular quarterly average associated with the Victorian gas market increased from AU$4. 65 to AU$28. 83 for each gigajoule from June 2020 to June 2022.

To shield gas supply security on the east coastline, the Australian Competition and Consumer Commission (ACCC) suggested how the federal government activate the particular Australian Domestic Gasoline Security Mechanism (ADGSM).

The ADGSM is designed to ensure a sufficient supply of gas to meet the forecasted needs of Aussie energy users. In the event of a looming supply shortfall in the domestic market, ADGSM enables the federal government to enforce export settings on LNG.

Because the ACCC forecasts that the Australian east coastline could face a shortfall of 56 petajoules in 2023, the federal government may need to power up the ADGSM plus consider export handles.

But given the difficult process of activating the ADGSM and the recognized “ sovereign risk ” associated with cutting exports, the federal government and LNG exporters have a mutual interest in avoiding the activation.

In an agreement with all the Australian government in 2021, east coast LNG exporters committed to offering surplus gas to the domestic marketplace before selling it to the LNG market in Asia.

As a net gasoline exporter, Australia’s crisis is more a price issue than a lack of provide. At the heart of Australia’s energy crisis is usually affordability.

But neither the ADGSM nor the particular gas exporters’ contract can be expected to reduce the exceptionally high costs being inflicted on Australian consumers.

The LNG exporters’ agreement with the authorities upholds the theory that domestic costs remain competitive along with prices offshore, so there will be no price suppression effect.

ADGSM cannot legally be activated based on high gas prices alone. If international LNG prices remain around the current degree, domestic gas costs could reach the particular AU$40 price cap set in the Gasoline Supply Guarantee — even with export controls.

The federal government will need to find new tools to solve the particular affordability problem. One could be the installation of a gas reservation policy on the east coastline similar to that in Western Australia. This could reserve 15% associated with LNG production from each LNG foreign trade project for household consumption.

Yet gas reservation plans could have a net negative economic effect on Australia and potentially discourage future purchase.

Canberra may also introduce a LNG levy specifically upon east coast exports. This would provide a favorable price differential so producers will be incentivized to supply domestic users first.

The federal government could also redistribute some of the profits from gas producers to customers to protect vulnerable consumers without distorting the gas market.

The choices produced by the Australian government will have far-reaching ramifications, not only for the Aussie public but also for worldwide LNG markets — especially Eastern Asian markets . It remains to be seen what choices will be made and exactly what their outcomes is going to be.

Xunpeng Shi is Professor and Research Principal at the Australia – Tiongkok Relations Institute at the University of Technologies Sydney.

This article was first published by East Asia Community forum, which is based from the Crawford School of General public Policy within the College of Asian countries and the Pacific at the Australian Nationwide University . It really is republished under an Innovative Commons license.