October’s jobs report helps clarify Donald Trump’s disaster electoral victory. For the first time since the post-Covid treatment, secret payments decreased.

American families, especially lower-income households, were crushed by inflation rates twice the officially reported levels. Nowadays, jobs are drying up. Standard readouts indicate that the economy is much worse than expected.

By awarding billion in so-called signal checks after the US market had now begun to recover from the 2020 Covid crisis, Biden set the worst inflation rate since the 1970s and probably since the US Civil War.

The Federal Reserve poured oil on the fire after pretending inflation was a problem for a year before jacked up interest charges. It should soon lower the federal funds rate by 2 percentage points, easing the burden on communities and the expenditure.

Government statisticians claim that higher private use is to blame for the US economy’s continued expansion, but investment in both businesses and homes has remained stagnant. The American public did n’t buy the official version, because it just is n’t so.

Somehow, Americans have managed to increase “real personal consumption expenditures” ( the calculation of consumption in the gross national product series ) without buying anything.

True financial profits, as reported by the Census Bureau, have been falling since 2021, while private consumption keeps rising. The actual retail sales report’s and the private consumption estimate’s are the largest ever gap ever found.

The US market is much weaker than federal researchers state, which is the most likely reason and one that corresponds to the experience of most American families. Private consumption is significantly lower and inflation-adjusted use is significantly higher.

So, Trump may now be living in a crisis as a result of the Biden administration. And it is continually being given by the Federal Reserve.

The current prices is NOT the result of excessive credit generation, as opposed to the prices of the 1970s. According to the Bank for International Settlements, which releases weekly data through March 2024, the US personal sector’s complete record has decreased over the past few years.

Biden’s campaign to pay voters with massive subsidies contributed to this inflation.

When the cost of higher interest payments to American homes is added in, Lawrence Summers, the Treasury Secretary for Barack Obama and Lawrence Summers, the former president of Harvard University, calculated prices at 18 % in 2022. It still rises to 8 % today.

Credit card debt outstanding exploded after Covid, rising from about$ 800 billion to nearly$ 1.1 trillion. Higher interest rates, however, were the actual kick. Between 2021 and 2023, the average interest rate on revolving credit increased from 14 % to 22 %.

When the interest charge on revolving credit is divided by the outstanding balance, it becomes clear that average home interest payments on credit accounts increased from about$ 100 billion in 2020 to approximately$ 225 billion in 2023.

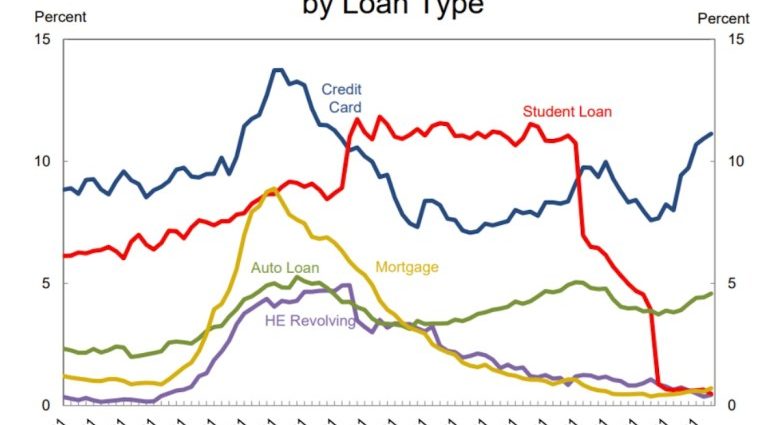

The New York Federal Reserve’s study of consumer credit shows that past-due credit card balances now exceed 11 % of the full, the highest degree in 10 years, while criminal car loans are about 5 % of the total.

Additionally, prices caused higher taxes on income earners by putting them in higher tax brackets. Personal income tax revenues increased significantly more quickly than the minimum GDP.

At the top of 2020 prices, US citizens were paying$ 400 billion a year more in federal income taxes than the level of GDP do had predicted.

The Fed’s whipsaw is also the main cause of budget considerations. Interest obligations on federal loan doubled as a result of Biden’s spending spree and Fed’s excessive reaction.

Jerome Powell, the main perpetrator of the monetary policy blunder, has declared that he wo n’t step down from office before 2026.

It’s not clear whether President Trump will be able to inspire Powell to left sooner. However, the President-elect needs to explain to the British people why they are in this mess and who was responsible for them.

Observe David P Goldman on X at @davidpgoldman