Alia Bhatt, one of Bollywood’s most sought-after young women, is officially cashing out three times after launching her clothing line Ed- a Mamma. According to Indian papers, her business will be purchased for 3 billion rupees($ 36 million,£ 28 million ) by the wholesale division of one of India’s largest companies, Reliance Industries.

According to early-stage investor Bhaskar Majumdar, the deal do” push” the now-established trend of Indian movie stars investing in start-ups and owning consumer-facing brands.

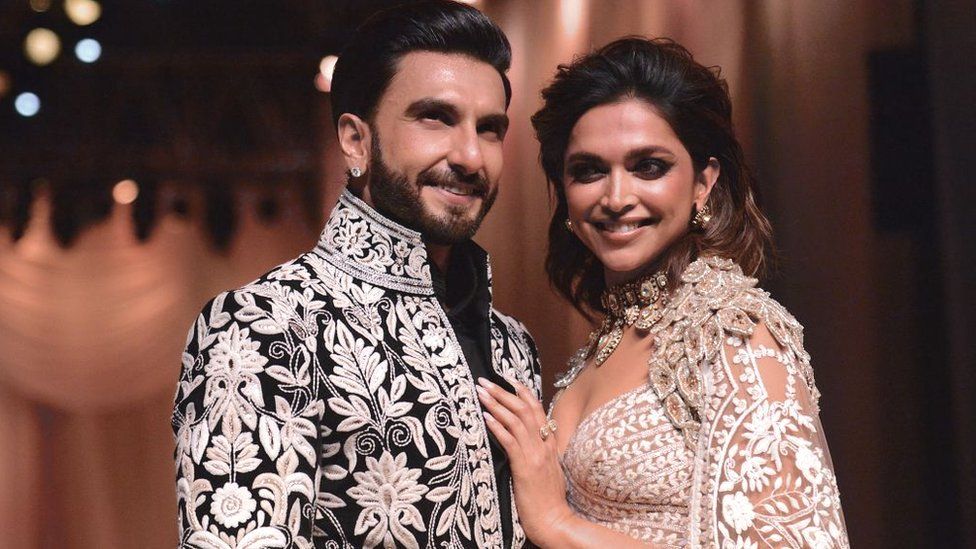

Bhatt is just one of many Bollywood celebrities who have just been actively investing in start-ups. Around the same time that her husband, actor Ranveer Singh, purchased a stake in the beauty company Sugar Cosmetics, her contemporary Deepika Padukone introduced her own skincare line, 82 ° E, last year.

The fad isn’t fresh, according to industry observers. It all started when India’s startup picture gained momentum in the early 2010s. When Salman Khan, one of Bollywood’s most well-known players, acquired a majority interest in the travel website Yatra in 2012, he was among the first to enter the industry.

However, this has gained more momentum as India becomes the third-largest start-up habitat in the world.

According to Aviral Jain, managing director of Kroll’s valuation consulting services practice,” Celebrities nowadays don’t want to be seen as only movie stars but also as clever investors.” ” Alica Bhatt has demonstrated how a celebrity can use her fame and fan base to turn an eco-conscious, homemade product into an effective business.”

In the past, when several actors would happily admit to relying on family members to manage their finances, this is a major change from how Indian actors approached cash and investing. Stars like Amitabh Bachchan and Jackie Shroff faced bankruptcy because they invested the majority of their money in a high-risk endeavor like video production, despite the fact that many people, including Shah Rukh Khan, went on to become successful entrepreneurs by investing in sports businesses and eateries.

However, today’s stars are a more financially savvy group, and according to Navjot Kaur, associate producer at Epiq Capital, in addition to making investments in established industries like public markets, real estate and equipment, they are also allocating capital to start-ups as’ diversification tools from an investment portfolio standpoint.

She continues,” Indian venture capital is attracting funds from domestic ultra-high net worth individuals( UHNIs ), and many celebrities are a subset of that.”

According to Mr. Jain, many celebrities have also established family offices to handle their investments professionally.

According to experts, collaborations between famous people and businesses may be advantageous for both parties.

Getting opportunities and offers from a brand gives start-ups credibility right away and helps them reach millions of customers. According to Shauraya Bhutani, companion at Breathe Capital, these start-ups typically have limited resources, so” preserving income by giving away capital is frequently a smarter approach.”

According to Benaifer Malandkar, Raay Global Investments’ chief investment officer, start-ups can” use a person’s internet presence to publicize the brand.” Additionally, the connection to a well-known star gives branded goods immediate recognition and makes them appear more reliable to consumers.

The same thing happened to Blue Tribe Foods when actor Anushka Sharma and bowler Virat Kohli invested in the fledgling plant-based meat business.

” We wanted to raise awareness of the issue with the latest foods value chain and provide an alternate solution.” Instead of just promoting the brand, their endorsement has increased category awareness across the nation, according to Sohil Wazir, the company’s main business officer, who spoke to the BBC.

Stars get to participate in the face if the business does well and invest their money in companies that align with their own individual ethos by taking equity in a organization more than receiving cash up front. Kohli and Sharma are both eaters who frequently support the rights of species.

But, K Ganesh, a serial entrepreneur and producer, asserts that relying only on the notoriety of famous people may not be sufficient to expand one’s company. He also cautions that celebrities should exercise caution when supporting start-ups, examining both the” reputation risk” associated with a business as well as its” business risk.”

Some well-known Indian start-ups have lately been rocked by governance scandals, and many of them have also seen their valuations decline as a result of the funding crisis.

However, Mitesh Shah, companion at the god fund Physis Capital, claims that rather than viewing this as a deterrent, it might actually be an excellent time to take advantage of the opportunity.

According to Mr. Shah, these start-ups have the potential to long-term generate significant money for investors thanks to their appealing valuations.

Celebrities in the West have made sizable returns on their investments, including Jay-Z, who bought a$ 2 million stake in Uber, and Ashton Kutcher, an active investor who now owns venture capital.

According to Mr. Bhutani,” we can expect a couple billion dollar new-age consumer brands to be built or supported by Indian celebrities in India in the next ten years.”

Learn more BBC reports about India here: