Up until last week, investors believed that it stocks could only go up and the Chinese yen could only go along, and bubbles next until they feel like basics. By Monday’s business beginning, investors cowered for shelter as the two balloons popped in harmony.

Both the Biden administration in Washington and the Tokyo Kishida management engaged in the same untenable strategy, ballooning the government’s balance plate to raise asset prices.

The central banks held half of the remarkable fly of Chinese government securities by July 31 when the Bank of Japan announced that it would “taper” its payments of government securities and raised its short-term interest rate to 0.25 % from zero.

Japan’s debt-buying spree pushed up prices objectives, weakened the yen and buoyed Japan’s stock market during the past three years.

A rise in inflation and foreign earnings led to a shift in true wages, causing corporations to lose their federal income from households.

The japanese exchange price, expected inflation ( as shown by the supply distinction between inflation-indexed and regular promotion government bonds ), and stock prices all moved in accordance with the above table. The August 5 period saw a decline in Japan’s big stock indexes, which recovered at the August 6 entry.

However, in the United States, the Biden administration tried to shovel wealth into customers ‘ pockets by increasing transport payments, as I explained in an August 2 study.

Washington’s choice of weapon was fiscal rather than monetary: Transfer payments ( federal checks to individuals ) rose nearly 20 % above the long-term trend.

According to Lawrence Summers, who was president Barack Obama’s Treasury Secretary, the actual inflation rate, which included higher interest rates on consumer loans, reached 18 % in 2023 and remained at 8 % in 2024, more than the official figure.

In May, American consumers began to reduce their financial purchases, and by July, employment growth had stopped.

In Japan’s event, a general rebellion by voters, who gave Prime Minister Kishida an approval rating of only 15.5 %, forced the hands of the Bank of Japan.

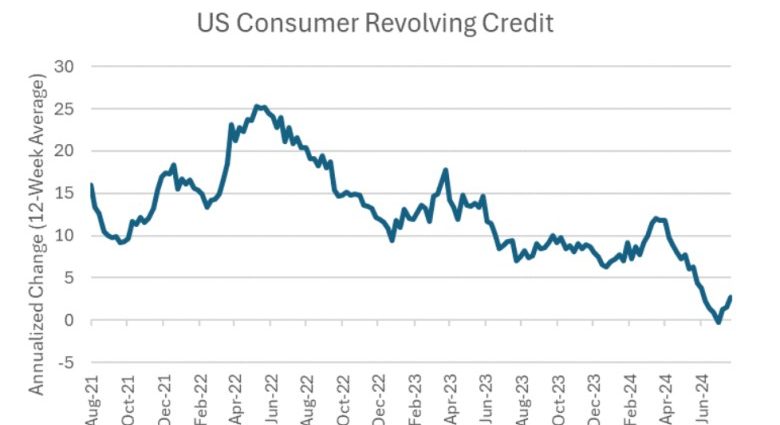

The prices that had been causing their living conditions long ago made Japanese voters uneasy. Consumers in the United States used credit cards to close the gap between average weekly earnings of 8 % and inflation, which had increased by only 3.3 % in July from the same month in 2023.

By June, US customers had stopped putting money on the table and cutting costs, and the inflationary balloon that was stifling US progress was beginning to devalue. Friday’s employment report, which showed the highest homeless level in three years, was a wake-up visit.

Due to economic weakness, the massive estimates of Big Tech companies, whose massive opportunities in artificial intelligence had no apparent connection to future income, were questioned.

We wrote in Asia Times ‘  , Global Risk-Reward Monitor on July 31:” Since 2017, foreign holdings of US Treasuries have risen to$ 8 trillion from$ 6 trillion, while foreign holdings of US equities jumped to$ 15 trillion from$ 6 trillion. The dollar’s primary draw is America’s command in artificial knowledge and the microprocessor development that supports it. The money will also be vulnerable if technical shares lose their luster.

The trailing P/E percentage of the S&, P Information Technology field was almost the same as the general S&, P 500 P/E throughout the ages 2008-2022. It’s then half again as great. Is that determined?

According to a widely-publicized estimate released by Sequoia’s David Cahn on June 20, revenue from large language models ( LLMs) must reach$ 600 billion annually to cover the significant investment in software, chips, and data centers currently devoted to AI.

OpenAI, meanwhile, is earning$ 3.4 billion a year, and according to The Information, losing$ 5 billion a year. A spiritual leap of faith is necessary to fit the prohibitive CapEx and LLM provider revenues.

The US property market downturn was largely caused by technology. Investors are concerned that the AI balloon will collapse, leading to a decade of missing returns for digital stock investors, similar to the dot-com balloon of the 1990s.

Observe David P. Goldman on X at @davidpgoldman