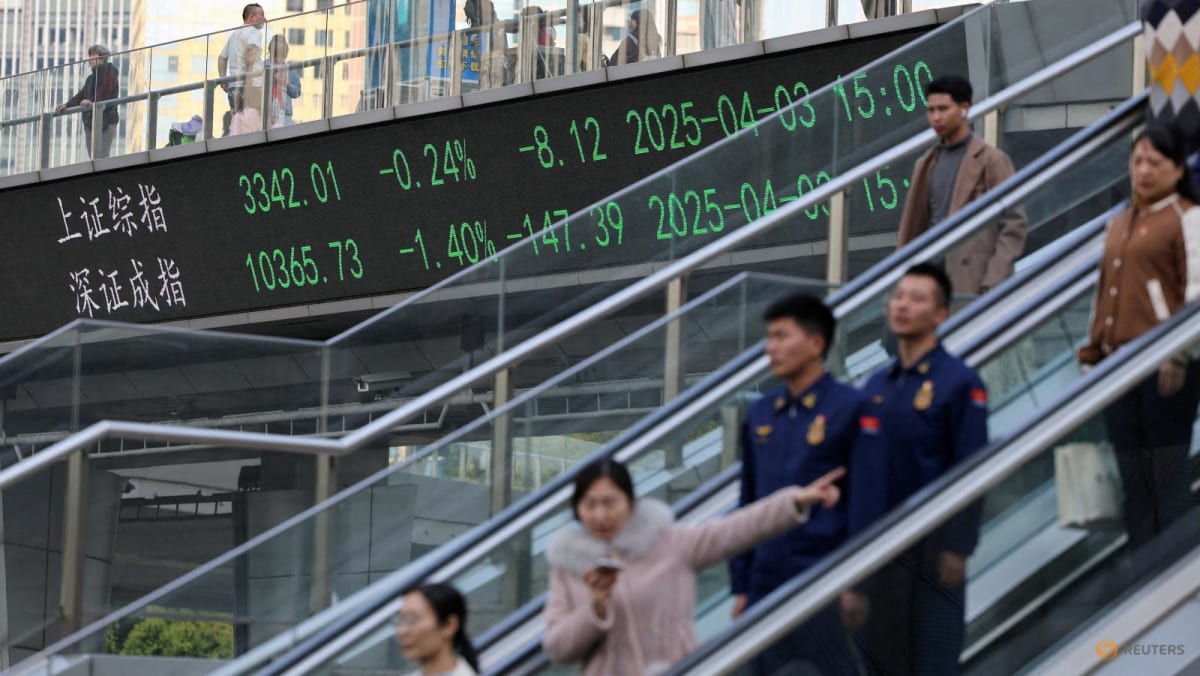

Stock dropped in Hong Kong and Shanghai, and they dropped in Seoul, Wellington, and Jakarta as well.

Sony’s stock increased in Tokyo as a result of a statement that it is considering selling its chip system, giving the impression that this would add value to the Chinese entertainment and electronics business.

Additionally, Sydney, Singapore, Taipei, and Manila all edged away.

As institutions hold talks with Washington and Trump show a little more freedom on some problems, stocks have recovered from the massive losses suffered at the start of the month.

While Treasury Secretary Scott Bessent claimed progress had been made with India, South Korea, and Japan, US Commerce Secretary Howard Lutnick claimed he had reached a bargain with a nation but did not name it.

However, Charu Chanana, the head of Saxo’s funding strategy, warned that the economy’s outlook is likely to increase.

She wrote in a commentary,” We’ve definitely seen peak tariff rates, but no peak tariff uncertainty.”

” The painful data also shows the effects of front-loaded demand, as businesses and consumers rushed to purchase goods in anticipation of anticipated tariff increases,” said the analyst.

” We haven’t yet seen the actual data that shows how much the drag is from persistent uncertainty and rising tax charges. We anticipate a more significant decline in true financial activity- in manufacturing, hiring, and investment- as uncertainty filters through business decisions.

In summary, the charge shock may be over, but the true growth harm is only beginning to occur.

Buyers are anticipating the release of important US economic growth and inflation statistics that will be released later in the day, and Friday job announcements are planned for the same day.

The transfer of revenue from Wall Street titan like Microsoft, Apple, Meta, and Amazon comes this month, which spectators hope will provide an insight into how corporate America is handling the taxes problems and how they anticipate doing so.