An American open intellectual occasionally takes the political zeitgeist and leads the country on decades-long paths, whether for good or bad.

Ralph Waldo Emerson provided the nation with moral precision and moral courage, resulting in the Republican Party, the Civil War and the end of slavery.

The magnificent vision of regional triumph that was provided by Francis Fukuyama led to military mismanagement, a financial crisis, a tiered society, and our present insane clown posse politics.

While no one in our current cacophony has the appearance of Emerson or made an” End of History” sun move like Fukuyama, the Trump finance group are known acolytes of unorthodox analyst Michael Pettis, now teaching at Peking University.

Pettis ‘ innovative ideas and even more innovative career path have been able to reverse the conventional idea-to-policy way in economics.

Ben Bernanke, Joseph Stiglitz, Larry Summers and Paul Krugman were all Ph economics teaching at Ivy League universities. They published hundreds ( if not thousands ) of academic papers, advised dozens ( if not hundreds ) of PhD students, and were awarded three Nobel Prizes.

Their journey to the Washington plan globe is, for what it’s worth, very credentialed.  ,

Pettis was an emerging industry relationship businessman with two master’s degree, international politics and an MBA ( both from Columbia University ). He teaches MBA kids at Peking University’s Guanghua School of Management and, for the most part, does not release scientific studies.

Pettis has likened himself to a 19th-century polemicist, writing mass-market finance textbooks and op-ed content. What he does likewise is post. And oh does he comment. He is peer-reviewed, frequently brutally, but not by qualified economics on Twitter.

Do people academics shape public opinion? Or does the general public elevate mysterious academics and thinkers to attention based on the mood and wants of the country? Or is it a vous de deux between scholar and audience, leading and following continuously, both inseparable components of the ethos?

When Emerson wrote his poet essays, giving the country a spiritual vision based on individual self-reliance, America was still young and still finding its foundation. This broad idea of personal liberty was quickly accepted by an exceptionalist country looking for signifying as it filled its frontiers and confronted its demons.

Fukuyama made a star-studded comeback in a country that had experienced its greatest defeat. The Soviet Union had merely crumbled, the Japan balloon was bursting and China was also a town.

A gladly perplexed America slacked off into exceptionalist joy by latching onto young Fukuyama, who naturally juggled Marx, Hegel, and Tocqueville.

History has not been kind to the person who dared to proclaim its end. Kishore Mahbubani, a former foreign minister in Singapore, claimed in a statement that Fukuyama’s book had caused shared brain damage to America.

Maybe terrible, but Fukuyama does not come out looking much better in the solution situation – the kid who was balance Marx, Hegel and Tocqueville with one hand was merely a grifter.

The End of History and the Last Guy almost eluded publication in the dark years following the dematerialization of the Soviet Union. America was looking for adulation and the Chinese National kid who can offer Hegel and Tocqueville wins.

Where does Pettis meet into this, exactly? This quirky thinker issuing exhibitions by Twitter string has amassed a significant following.

He has unfavorably occupied the center of American media coverage of China economic thought, which, according to Han Feizi, has severely damaged China analysis and then threatens to harm America as his supporters formulate policies around his errors.

While a magnificent America looked to Fukuyama for praise, an troubled America latches onto Pettis for encouragement. And it appears that favour was returned.

For two years, Pettis has told the American world that China was overinvesting and under-consuming and that rise will decline to 2-4 %. China increased by two to three times since quickly.

Unsurprisingly, his thoughts are now more common than ever, worming their way into the heads of Treasury Secretary Scott Bessent and Chair of the Council of Economic Advisors Stephen Miran.

Michael Pettis writes:” In recent Twitter content, Michael Pettis writes:” In the conceitless design and implementation of Trump’s” Liberation Day” taxes, he appears beside himself.”

It is hard to see much widespread thinking in the new round of tariffs, and because industry can only be resolved on a widespread basis, and not on a diplomatic basis, this means that they are improbable to be very beneficial.  ,

Pettis seems aghast at what Trump has done, viewing it as a perversion of his belief that the global trading system needs to be systematically rebalanced:

The new tariffs don’t really address the real issue facing the US. One obvious reason is that the tariffs are largely bilateral, and while bilateral imbalances may impress those who don’t understand trade and capital flows, they are, in fact, pretty useless.

Han Feizi has written extensively about China’s economy in ways that challenge Michael Pettis ‘ heterodox viewpoints ( see here, here, here, here, here, here, here, here, here, here, here, here, here, and here ).

Fundamentally, Pettis believes that America runs persistent trade deficits because Asia has implemented policies that incentivize production at the expense of consumption and is externalizing those imbalances onto the US, the” consumer of last resort”.

His preferred set of policies would include targeted tariffs, industrial subsidies, and taxation of capital flows, which would even out the playing field.

Han Feizi believes this framing is erroneous and Pettis’s policies, even correctly implemented, will result in years of suboptimal growth, impoverishing the US for decades. Because of this, America experiences persistent trade deficits when asset-rich countries trade with labor-rich nations.

Yes, China has implemented industrial policy to marshal its abundant labor but, at the same time, the US has implemented policies to better harness its abundant assets ( e. g. mortgage market, agency bonds, derivative market etc. ), allowing their trading and financialization.

Yes, China took advantage of the US’s open market for growth and employment. The US also capitalized on its enormous asset endowment and China’s productivity for both growth and employment.

The concern that Pettis displays for China’s put-upon consumers does not hold water. China has increased household consumption more quickly than any other economy in the last few decades, accounting for all 194 of them.

And not by a little. China increased household consumption twice as quickly as South Korea did. And the US has increased household consumption faster than all major developed economies.

Disturbing this organic trade between an asset-rich economy and a labor-rich economy is not only economically inefficient, it is highly destructive in the short to medium term. The labor force in America has been prepared for asset sales. It does not have the skills for manufacturing.

1 ) China’s economy is wasteful, ineffective, and poised to stagnate, and 2 ) consumption creates value.

Both of these ideas are not only wrong, they could not be further from the truth. The brain trust ( or lack thereof ) surrounding President Trump is highly likely to have been misled by these two beliefs, believing that the US had the upper hand in a trade war against China.  ,

Han Feizi has written extensively about the error that the China collapse/stagnation view is ( see links above ).

If Bessent, Howard Lutnick and Stephen Miran were not stuck in the Western media echo chamber, they would figure out that the United States was about to start a trade war with an economy 2-3 times its size – not 36 % smaller as reported nominal GDP would suggest. This is the Jaws equivalent of” We need a bigger boat.”

But perhaps more pernicious is this economic fallacy that consumption creates value and that China’s factory workers need American consumers more than American consumers need China’s factory workers.

Pettis has been a victim of this fallacy for decades, which is the idea that consumption, especially US consumption, is some sort of public service. This fallacy has high purchase in America because it appeals to what Americans have become – shoppers.

Additionally, it has led to unfortunate economic expressions like” supply of demand.” As in the US economy is accomplishing great feats by supplying demand to needy Asian factory workers.

We now have supply of demand as if supply and demand weren’t useful enough economic concepts. Which, of course, begs the question, what about demand of supply? Or supply of supply of demand? Or demand of supply of supply? Or supply and demand equal supply? Capiche?

This is total nonsense. There is no such thing as supply of demand. Consumers in America are not offering their demands for Nikes from Vietnam. American demand has no value to the Vietnamese. American consumers are converting Vietnam’s Nikes for American assets. That’s what the Vietnamese want.

The liquid dollars that can be converted into Treasuries, Freddy Mac bonds, Apple stock, or Malibu mansions. The wants and desires of American shoppers, as wonderful as they may be, are worthless to the Vietnamese. They and everyone else want apartments in New York City with views of Central Park.

Similarly, the Pettis MO is to take something conventional– efficiency gains drive wage growth – and flip it on its head in a way that soothes American anxiety. High wages increase productivity!

The whole thing is then wrapped with a sprinkle of virtue signaling,” The stereotype of high-saving Asians is racist”! and fed to agitated Americans who later believe they have been given some secret information.

Dealing with economic nonsense to ease American angst is just as a gimmick as Fukuyama dropping that iconic Tocqueville quote in the sour days of American triumph.

Pettis and Fukuyama have their grift. Americans want to be fooled, and it’s simple. It is hard to even blame them. In any other situation, they might have just been obscure academics who coerced academics into giving them a low-paid professorship. But the American zeitgeist made them stars.

Han Feizi is American, but he will always have a small place in the American zeitgeist, for those who don’t know. Emerson I will never be, although I gave it a shot ( see here ).

What transpired between Vivek Ramaswamy and everyone else was seen. He brown gaffed – an Indian American accidently told white Americans the truth– and was quickly shuffled off the stage.

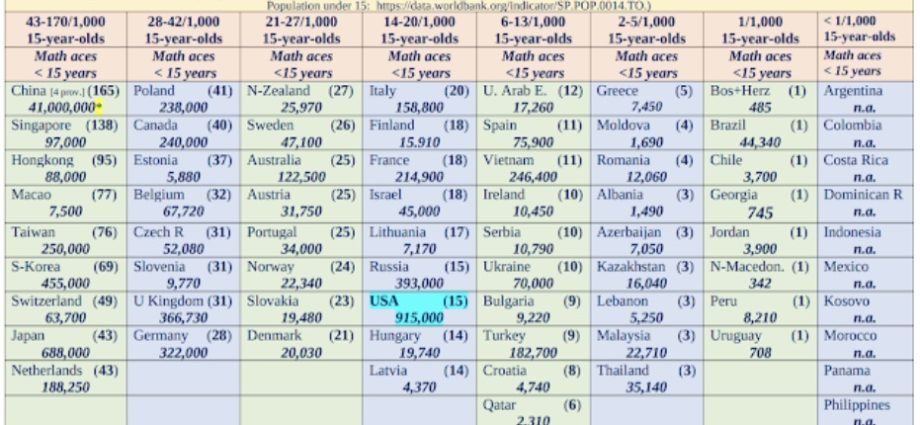

Some numbers are provided here. There are 45 times as many highly able ( top few percentiles in the US) math students in China as there are in the US.

Nine of the top ten research institutions are now located in China, up from their previous low of zero 25 years ago, according to the Nature Index. Out of 64 technology verticals tracked by the Australian Strategic Policy Institute, China now leads in 57.

Two decades ago, the US was in charge of 60 out of 64 technologies. These trends are accelerating and have about 25 more years to go.

And let me speak with my fellow Americans more openly. 60 % of those who score in the 99th percentile on the math portion of the SATs are Asian Americans who make up 5 % of the population. In Asia, math proficiency at the 99th percentile in America is a serious consideration.

20-30 % of Chinese high schoolers would likely score in the 99th percentile on the US math SAT. The biggest challenge confronts Chinese American families who are considering moving to China because they fear their children won’t be able to keep up with local PhD students.  ,  ,  ,

If Americans don’t reform their educational system and raise their game, the tariffs, capital flows, and industrial subsidies will amount to a mountain of beans. The Ivy League should not be 25 % Asian. Silicon Valley shouldn’t be disproportionately Asian. Even Wall Street should not be 16 % Asian.  ,  ,  ,

As America had been led down the disastrous” End of History” path after its moment of triumph, we fear the zeitgeist is now leading the nation down a nonsensical” supply of demand” economic path during its age of anxiety.

Without a doubt, the country shouldn’t start an economic conflict by using conceited economics tactics like” They need our consumers.” The first humiliations are already in with Trump caving on certain tariffs. Han Feizi fears that the final humiliation of the Americans will be psychologically intolerable when the returns all come in.