Ukraine’s commitment for the passage of its gasoline across Ukraine expired on December 31st, 2013, and Kyiv refrained from taking into account a new arrangement. Ukraine’s decision was supported by the European Commission, even though the lost imports are equivalent to 5 % of European demand.

Some people may have been surprised to learn that fuel had continued to flow while the two nations were at war. And although most pipeline gas from Russia to Europe had ceased, in 2024, Europe imported , a record 21.5 billion cubic meters ( bcm )  , of liquefied natural gas ( LNG ) from Russia – 19 % of its LNG imports.

Newly published data from Spain reveals that Russia remained its second-biggest supplier of LNG, accounting for 21.3 % of Spain’s LNG goods. With 48 % of the LNG supplied in 2024, the US continues to be the largest distributor to Europe.

Russian LNG that enters Europe is re-exported to second places, a process that will be prohibited by EU restrictions in March.

But, what is Europe’s approach here? And how might Ukraine’s shutting off the presses affect Russian oil revenue globally?

In May 2022, three weeks after Russia’s invasion of Ukraine, the EU launched its REPowerEU schedule. Through the growth of strength products, one of its main goals was to reduce the EU’s dependent on Soviet fossil fuels.

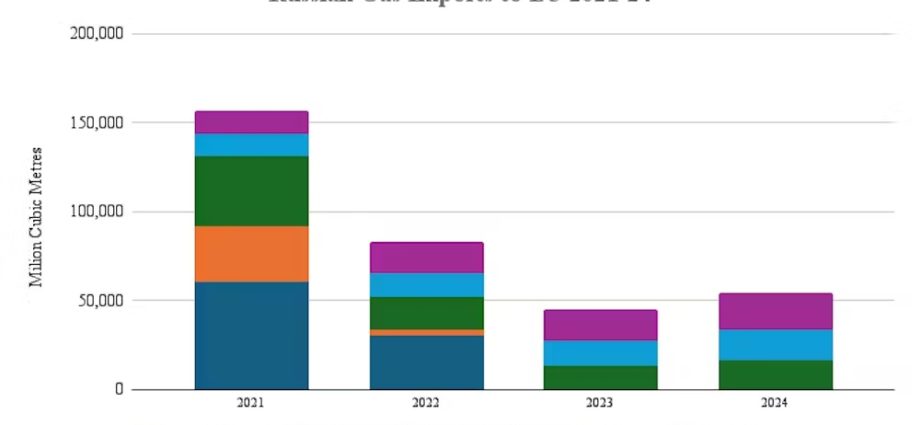

The European Commission now points out that 45 % of the EU’s gas imports came from Russia in 2021, and that percentage had dropped to 15 % in 2023 ( although data suggests that it increased to 18 % in 2024 as a result of higher imports of Russian LNG ).

The EU has yet to impose sanctions on importing Russian oil, despite announcing sanctions for the Arctic-2 LNG project and related delivery, and outlawing the reloading of Russian LNG in EU slots.

Russian actions like demanding payment in roubles and the damage of the Nord Stream pipelines, an event that is still subject to significant conjecture, have contributed to the rapid decline in pipeline exports to Europe.

The European Commission is also aware that the world oil sector is still carefully balanced, and that Russia’s gas imports would result in extremely high rates, like those seen in the summer of 2022, as a result of sanctioning them.

That energy crisis cost European governments an estimated 650 billion euros ( US$ 669.6 billion ) between September 2021 and January 2023 in measures to mitigate high prices.

In 2024, Russian gas reached Europe via three routes: transit through Ukraine ( 30 % ), via Turkey and the TurkStream pipeline ( 31 % ) and as LNG ( 39 % ). If there is no resumption of Ukrainian transit in 2025, flows may be limited to TurkStream and LNG.

Sinking Russian imports expose Europe to continued rate volatility because the global LNG market is still constrained. However, it is possible that the EU will cease all exports of Russian oil by the end of 2027 as a wave of new Gas production is anticipated to start in 2027.

This is what the EU’s fresh strength director, Dan Jorgensen, announced in November 2024. What the European Commission intends to do is unknown; it is probably a continuation of efforts to increase energy efficiency, expand the transition to renewable energy, and lower gasoline demand. However, it’s doubtful that Russian exports will be completely prohibited until the world’s LNG market is more abundant.

However, the incoming US administration has merely imposed more sanctions on the Belarusian oil and gas industry, which might cause problems for Brussels. Due to Donald Trump’s frequent criticism of Europe’s dependency on Russian oil, some tough choices may have to be made as part of the new plan.

Gas future

What does this imply for Russia and the protection of international gas? In Nature Communications, our team of researchers at the UK Energy Research Center ( UKERC ) published a paper that forecasts how Russian gas sales might behave under two important circumstances.

The first is called “limited industry,” and assumes that the EU will halt all Russian oil exports by 2027. Additionally, sanctions against LNG systems, system, and the lack of fresh network power make it difficult to export.

If the Kremlin and Beijing don’t agree on the construction of the 50 billion cubic meters ( bcm ) Power of Siberia 2 pipeline, this would happen in the latter case. Exports to China would be restricted due to the new 10bcm pipeline from the Russian Far East and the 38bcm Power of Siberia 1 route.

The second scenario, known as the “pivot to Asia,” assumes that Russia is able to increase LNG exports more quickly and that Power of Siberia 2 is reached. Additionally, Turkstream is assumed to continue to export goods to Europe and that there are no restrictions on imports of LNG ( as is the current situation ).

Additionally, the study takes into account each scenario where there will be a significant increase in the global gas demand in the future, which will be influenced heavily by climate policy objectives.

Overall, the research finds that Russia will struggle to regain pre-crisis gas export levels. Compared to 2020, Russia’s gas exports will have fallen by 31 % –47 % by 2040 where new markets are limited, and by 13 % –38 % under a pivot-to-Asia strategy.

Russia’s prospects won’t significantly improve if China’s demand increases. Any future expansion into Asia is conditioned on Chinese energy security and climate mitigation strategies, according to the climate.

It is interesting to note that Gazprom, a Russian state gas company ,’s stock dropped to a 16-year low in late 2024. This was partly because of a US$ 7 billion ( £5.73 billion ) loss in 2023 and a cancellation of dividend payments. However, there is also geopolitical uncertainty regarding the state-controlled company’s capacity to find new export routes.

Two crucial questions are raised by our research regarding the potential impact of Russian gas on global markets. First, will the EU maintain its resolve and stop all exports of Russian gas to the EU by 2027, or might the end of Russia’s conflict with Ukraine cause a powerful U-turn? Second, come what may, can Russia find new export routes and markets for its huge gas reserves?

The two questions are related because more Russian pipeline gas is exported to China, which lessens the need for China to import LNG, which leads to a more stable global LNG market for Europe to import the gas it needs, primarily from the US.

Ironically, this might lead to a solution that could lessen looming trade disputes between the EU and the incoming US president.

Steve Pye is an associate professor of energy systems at UCL, and Michael Bradshaw is a professor of global energy at Warwick Business School.

The Conversation has republished this article under a Creative Commons license. Read the original article.