On Wall Street, the S&, P 500 and Nasdaq rallied again to reach new information, helped by powerful performances by software titan Apple, Google family Alphabet and Facebook’s Meta.

Asia took up the stick in early business, with Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Wellington and Jakarta all higher heading into the trip.

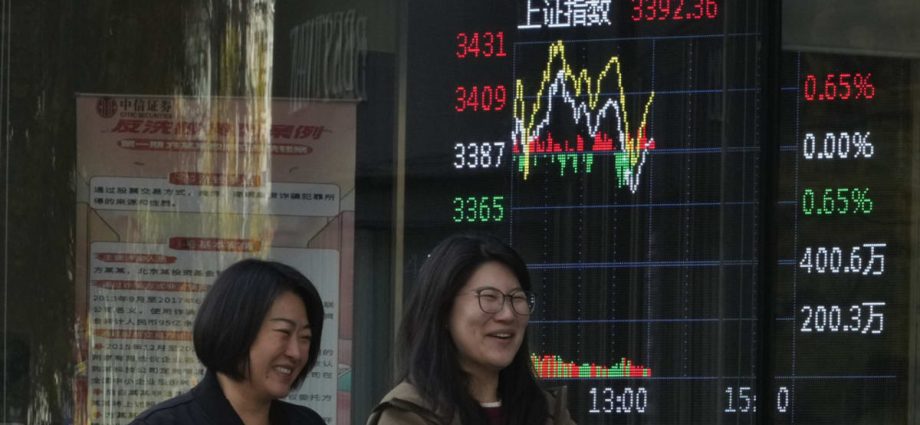

Mainland Chinese orange bits were up 0.5 per cent as of 0155 GMT, after a 3 per share wave on Thursday. Hong Kong’s Hang Seng gained 1 per share.

Japan’s Nikkei added 0.25 per share, off 3.7 per cent for the week.

Australia’s property standard climbed 1 per share, and Taiwan’s standard gained 0.7 per share.

After falling in response to the Fed slice, the dollar strengthened somewhat against the yen on the exchange markets.

Investors are anticipating the result of the week-long meeting of Beijing’s leaders trying to find a way to restart China’s economy.

According to economists, lawmakers should approve hundreds of billions of dollars in additional budgets, with a particular emphasis on aiding obliged local governments as well as money for banks, in order to write off non-performing loans over the past four years.

After Trump’s victory, who warned during his campaign that he would impose high tariffs on imports from the nation of up to 60 %, there is uncertainty surrounding the outlook for China.

According to National Australia Bank’s Gerard Burg, “on average, it is likely that Trump’s political defeat puts further upward pressure on China’s expansion in the coming years ( depending on numerous policy actions in both the US and China ).”

But, Michael Hewson at MCH Market Insights, added:” There is a feeling of déjà nostalgia with respect to Donald Trump winning the US presidential poll, both socially as well as from a business point of view.

On the one hand, there is some serious hand-wringing happening as some political parties experience a collective pearl-clutching panic in the wake of four decades of unrestricted Trumpism.

The market response has been more balanced than the one we saw eight years ago, when the uncertainty was much greater.