China’s June exports rose 8.6 % year-on-year in US dollar terms and 10.7 % in RMB, exceeding analysts ‘ expectations and pointing to higher-than-expected GDP growth for the second quarter.

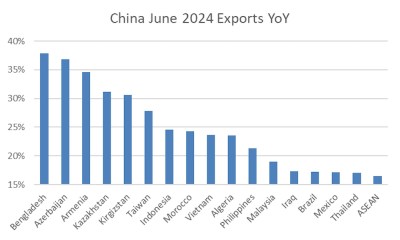

Supplies to Central Asia increased the most, reflecting China’s expansion of transportation and other network through the Belt and Road Initiative.

Export to Azerbaijan, Armenia, Kazakhstan and Kirgizstan rose year-on-year by more than 30 %, as China expands bridge and other transportation services across the European continent. Some of the overall might be a result of implicit imports to Russia.

But export were solid across the board, with particularly strong performance in Taiwan, Indonesia, Vietnam and the Philippines. Exports to Brazil and Mexico, China’s two largest Latin American markets, rose by 17 %.

China’s exports to created markets have increased significantly over the past four years, while exports to developed markets have doubled.

However, capital goods and parts are a part of China’s growth in exports to the global north for American ultimate sales.

China’s export to the Global South rose from about US$ 60 billion a month to$ 140 billion a month. US imports from the Global South increased at the same time, increasing from$ 60 billion to$ 90 billion annually.

Depends on US demand for roughly$ 30 billion per month of China’s incremental$ 80 billion per month of exports to the Global South. Although the 25 % tax on the majority of Chinese exports severely affects direct export to the US, America is all the more dependent on Chinese supply chains via third places.

Strong imports from China to the US jumped by 7.5 % year-on-year, although the amount remains well below the Covid top.

America’s trade deficit in goods now stands at a record US$ 1.2 trillion per year, compared to$ 800 billion a year before Covid. By boosting transfer payments to US citizens, the Biden administration increased consumer goods demand, while real-time investment in building tools in private US US plants decreased.

After inflation, nondefense orders for capital equipment ( excluding aircraft ) fell to$ 35 billion ( in constant 1982 dollars ) a month in 2024 from$ 38 billion in 2019, following a long-term trend of decline.

Biden’s governmental policy caused a storm of goods, either directly or indirectly, from China.

That leaves America in a quandary. Some experts to former president Trump have suggested that higher taxes to deter Chinese imports would raise prices for American customers.

And an overall price, favored by some prominent Trump campaign figures, may raise the cost of capital goods, deter expense, and increase America’s dependence on imports also more.

Following David P Goldman on X at @davidpgoldman