China’s export growth rate was higher than expected in May, with growth rates of 11.2 % in RMB terms and 7.6 % in US dollars year-on-year. This indicates that the nation is willing to meet its government’s 5 % growth goal for 2024.

Exports to established markets remained weak at levels well below their earlier peaks, despite the total growth coming from the Global South.

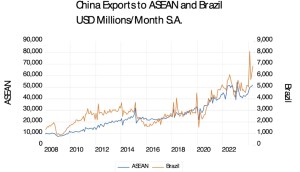

Although detailed data by country is n’t yet available, several ASEAN nations as well as Brazil reported strong growth.

The American joke about Chinese “overcapacity” does n’t play well in the Global South, where demand for Chinese telecoms equipment, low- cost Vehicles, solar panel and metal is growing. Despite some slight frictions with developing- business customers, for example, Brazil’s material business, China has found an expanding marketplace in the World South.

China’s exports to established markets reached their highest levels during the Covid growth, which was fueled by a rise in domestic electronics demand. However, they have since recovered to the level of 2018-2019.

China’s strong exports to the United States, though, show only part of the story. After the Trump Administration imposed a particular 25 % tax on about US$ 200 billion of Chinese goods, Chinese companies re- routed supply stores through third places in the Global South, for instance, Vietnam.

A modest increase in home sales and higher consumer spending on cars and appliances indicate a subdued increase in consumer demand. A moderate growth rate in the range of the government’s 5 % target for this year appears achievable, despite the property market slump.

The International Monetary Fund raised its 2024 growth forecast for China last week from 4.6 % to 5.5 %.

Follow David P Goldman on X at @davidpgoldman