The issue with interest rates is not how great they’ll go, but rather how much they will stay at the current high levels before declining.

Following 11 consecutive increases, the Fed maintained its benchmark interest rate at its most recent conference, which ended on November 1, at a constant level of 5.25 to 5.5 %. ( Average borrowers’ rates increase with the Fed’s benchmark; the 30-year fixed rate for mortgages recently reached 8 %.)

Some analysts believe that any additional increase may be modest, despite Fed Chair Jerome Powell’s open invitation to do so at a later meeting. Some believe that the Fed has raised its money. There is growing agreement that prices have reached or are very close to reaching their peak.

Because experts are divided on the perspective for the market, there is less agreement on how much before prices start to decline. The answer, according to many bond traders, is” longer than we originally expected.” Customers are being informed by Goldman Sachs that the Fed won’t start cutting interest rates until the end of the following month.

Bond traders have been demanding higher provides to make up for what they perceive to be an increase in the risk of holding long-term bill because they anticipate that short term rates will stay high for a longer period of time. The yield on the 10-year Treasury note recently reached 5 %, though it has since decreased slightly.

Of course, owners might be mistaken or may be compelled to reevaluate due to shifting economic and financial circumstances. Therefore, it’s worthwhile to look at what Federal Reserve policymakers themselves predict.

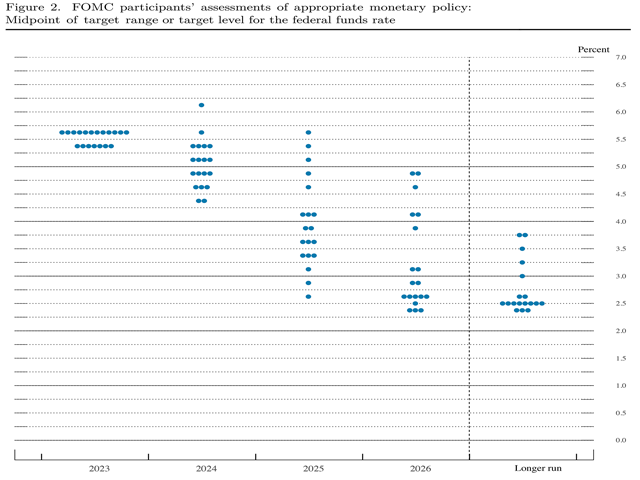

Reviewing the so-called” circle story” that the Fed releases every third will help us achieve this. It expresses the opinions of the 19 Federal Open Market Committee people, who frequently refer to the FOMC as” the Fed.” These are the people who determine interest costs and economic policy.

Seven of the 19 have been confirmed as Federal Reserve Board rulers by the Senate. The other leaders are the leaders of the 12 local Federal Reserve banks that are separate. Only 12 of the 19 votes, or the seven administrators and five president, are cast at any given time. The New York president often votes, and four of the five rotate each year. The circle story displays the interest-rate forecasts for the upcoming three years and the longer term for all 19 participants in the sessions.

The Fed’s benchmark rate is above 5 % at the end of 2024, according to the most recent dot plot, which was published in September, and above 4.5 % for 17 of the 19. They forecast that prices did stay close to their present levels for at least another year.

12 of the 19 projects had a standard level of between 3 and 4 by the end of 2025. We won’t receive bulk support for the 2s until the end of 2026.

For the next three decades, just one FOMC part will see the Fed’s benchmark rate rise above 5.5 %, which is great news for farmers, farmers, and other business loans.

The projections are still close to new highs due to uncertainty regarding prices. Fed Chair Jerome Powell stated following its most recent meeting that the FOMC didn’t low rates until it is certain that 2 % is a manageable level of inflation. He said,” We’re a long way from 2 % inflation.”

With all, the FOMC people might also be mistaken. These lines are basically predictions. They shift from one appointment to the next. No one has an unfailing crystal ball, despite the fact that the persons making them more knowledgeable about these topics than the regular citizen.

Is there anything that may occur to change the discussion and lower rates earlier, you may wonder?

Crisis does occur. Although it appears that the Fed has so far planned for the business to experience a” soft landing,” some analysts also predict that there will be another recession. If those economists were to be proven correct, there would be a lot of pressure on the Fed to reduce rates. A Fed decision to cut may be fairly simple if the crisis brought inflation down. ( For the Fed, a recession coupled with obstinate inflation would be nightmare. )

The compromise may be mistaken in another way, and this would be worse for company borrowers: inflation could spike once more.

Charges may soar if the Middle East and Ukraine are still at war. If many other labor unions match the sizable wage increases that Teamsters and United Auto Workers and Air Line Pilots ( CQ ) recently won, inflation may also return. ( Overall, though, recent wage increases have been declining. )

The Fed would almost surely raise rates if inflation returned to the northeast and all bets were off. Although it is conceivable, a sharp increase in inflation is not the most possible result. The real question right now, and perhaps for a few months to come, is not how large, but how much.

Urban Lehner & nbsp, a longtime editor and correspondent for the Wall Street Journal Asia, is the editor emeritus of DTN / The Progressive Farmer. & nbsp,

Copyright 2023 DTN / The Progressive Farmer is the title of this article, which was first released on November 2 by the latter news organization and is now being republished with authority by Asia Times. All right are reserved. Urban Lehner andnbsp on Twitter: @ urbanize