The semiconductor industry in China will face more challenges as a result of strict US tech punishment, but this should help the Chinese understand that self-sufficiency is the only long-term option.

In fact, the US Commerce Department’s retaliatory measures to cut off supply chains in order to safeguard US national security are now having a positive impact on Chinese chip design firms, producers of production equipment, and foundries.

However, due to US export restrictions, tech exporters like the US’s Nvidia and the Netherlands’ ASML stand to lose a sizeable portion of their international sales, and any gains from the latest attempts by the Biden administration to relieve tensions with China may already be gone.

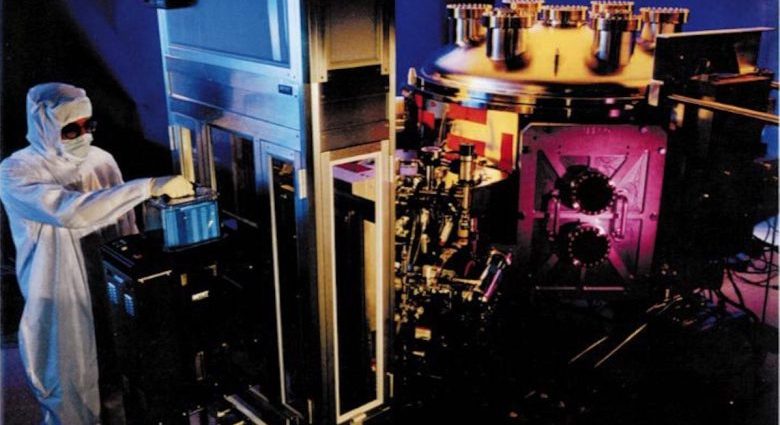

New limitations on the export of semiconductor manufacturing equipment, new types of chips used in artificial intelligence ( AI ) and other advanced computing applications, and indirect supplies of those products to China were announced by the Bureau of Industry and Security ( BIS ) of the Commerce Department on October 17.

The BIS” Entity List” of businesses and other organizations content to US export restrictions even included two more Chinese firms.

The new regulations are updates to those put in place in October 2022, ostensibly to address concerns about national protection brought on by the development of the Chinese army but also having the unintended consequence of impeding China’s industrial and economic development.

Gina Raimondo, the secretary of US Commerce, stated that” yesterday’s updated rules will increase efficiency of our regulates and more close off pathways to escape our restrictions.” These settings keep our attention on military applications and address the dangers to our national surveillance posed by the military-civil integration strategy of the PRC [ People’s Republic of China ] government.

The changes released now build on our continuous assessment of the US national security and foreign policy issues that the PRC’s military-civil integration and military development present, according to Alan Estevez, under Secretary of Commerce for Industry and Security.

Thea Rozman Kendler, assistant secretary of commerce for trade management, stated,” By imposing strict registration requirements, we ensure that those seeking to get effective advanced chips and chip production equipment will not use these technologies to undermine US national security.”

These statements’ vehemence may be in part in response to Democratic criticism members of Congress who have criticized the BIS’s frailty and contagiousness.

However, they also suggest that the Commerce Department is not likely to be persuaded by CEOs of large technology companies, whose arguments about the significance of maintaining their revenue and cash flows are not very persuasive in light of this BIS speech:

Because they can be used to increase the speed and accuracy of military decision-making, planning, and logistics,” Advanced AI capabilities— andnbsp, facilitated by supercomputing, built on advanced semiconductors — present US national security concerns.” They can also be used for jamming, sensor, signals intelligence, and mental electronic warfare. When used to help facial recognition security devices for human rights abuses and violations, these capabilities can also raise questions.

For the trade to China of AI computers produced by Nvidia, AMD, and Intel that were not covered by the BIS opinion from a year ago, the new regulations call for certificates, which are definitely not going to be granted.

Along with the A100 and other products, the Commerce Department now has a restricted list for Nvidia’s A800 processor, an improved version of its A101 top-of-the-line graphics processing unit( GPU ) created specifically to meet BIS requirements.

According to reports, the A800 is frequently sold out in China, where it has been a huge hit. According to media reports, Chinese firms like Alibaba, Tencent, Baidu, and ByteDance ordered the delivery of A800 chips for about US$ 1 billion this year and another$ 4 billion in 2024.

Before the new BIS limits go into effect on November 16, just a small portion of these devices will probably be shipped.

Technically, the BIS claims that the removal of” wire bandwidth” as a factor for chip restrictions was prompted by recent technological advancements and an evaluation of the effectiveness of last year’s decision. Instead, in order to prevent future solutions, the new regulations limit the export of cards if they go over a fresh” performance density threshold.”

In other words, the networked A800 from Nvidia is too efficient for the Commerce Department to like, despite the fact that it is significantly slower than the A100( 30 % slower, according to an estimate published by the electronics news website Tom’s Hardware ).

This can be viewed as an error in the initial analysis that was found in Under Secretary Estevez’s” continued assessment.”

Huawei’s August release of its new Mate 60 Pro 5G cellphone, which featured a 7nm computer made by the Chinese semiconductor foundry SMIC, even caught the Commerce Department off guard. While she was in China, Secretary Raimondo found the information to be” very troubling.”

The Commerce Department incorrectly believed that 7nm chips could only be produced using ASML-monopolized extreme ultraviolet ( EUV ) lithography systems that were prohibited from being sold in China.

However, executives in the semiconductor industry and observers were aware that deep ultraviolet ( DUV ) ArF immersion lithography systems from ASML or Japan’s Nikon, which Chinese chip manufacturers had already widely purchased, could be used to create 7nm chips. In fact, Nikon’s website publicly advertises the ability of ArF absorption lithography to make chips at 5nm.

We don’t have any evidence that they [ the Chinese ] can manufacture 7nm( chips ) at scale, Raimondo said in a US Congressional hearing in September, according to Reuters. According to Nikkei Asia, Huawei intends to almost triple its handset sales to 60 to 70 million units in 2024, and SMIC’s 7nm manufacturing capacity may reach half that number.

In accordance with US export restrictions, the Netherlands and Japan have halted the shipment of sophisticated DUV printing systems to China. This indicates that, though the exact number is unknown, the Chinese may then produce a certain number of 7nm or 5mm chips.

This is also true of the engraving techniques and other machinery that are currently subject to US restrictions. All of this indicates that before they can produce semiconductors at full capacity at higher yields using imported machinery, the Chinese are currently in a race to build their own.

The Chinese are producing, or attempting to produce, the full spectrum of semiconductor production tools, but they are also experiencing significant printing bottlenecks.

By the end of this year, Shanghai Micro Electronics Equipment ( SMEE ), the top manufacturer of chip lithography equipment in China, is anticipated to release its first 28nm-capable ArF immersion system. SMEE, which was established in 2002, currently produces i – line( 280nm ), KrF( 110 ), and ArF dry ( 90.1 ) lithography systems.

The largest device manufacturer in the world, Taiwan’s TSMC, was established in 1987. In 2004, it introduced 90nm process systems; in 2011 and 2019, it added 28nM; and in 2019. As a result, SMEE and its clients are making headway despite being at least 12 years after at 28nm. SMIC, on the other hand, trails TSMC by just four years at 7nm when using imported products.

Taiwanese manufacturers of various semiconductor production tools are apparently profiting as well. The majority of Advanced Micro-Fabrication Equipment’s( AMEC ), which reported a 32 % year-over-year increase in sales of its etching systems in the first half of 2023, now comes from China.

Selling at Naura, a manufacturer of etch, deposition, washing, and other types of technology, increased by 55 % in the six-month period leading up to June. ACM, a manufacturer of cleaning supplies, reported an increase of 47 % during that time. The China Electronic Production Equipment Industry Association ( CEPEA ) predicts a 38 % rise in sales of semiconductor equipment produced in China for the entire year 2023.

Top Chinese foundries may use a small number of machines from Chinese suppliers prior to the sanctions, but they would definitely simply experiment with new products when they added new potential, according to one Chinese business resource. Industries are currently testing out Chinese-made components for each international equipment they own, and if they discover that they are satisfied, they replace all of them. They desire as some foreign devices as are practical.

In response to the prohibitions, European tech CEOs officially warned their governments that this trade substitution was likely to occur. Raimondo’s Commerce Department chose to ignore these warnings.

Peter Wennink of ASML stated in a September telecast that China will take over technology if Europe and the US are willing to do so. Digitimes compiled this statement. They are developing solutions that European businesses have not yet thought about with a population of 1.4 billion, many of whom are very smart. China is being forced to become very innovative as a result of the stringent policies of European governments.

According to Intel CEO Pat Gelsinger, China currently exports between 25 % and 30 % of semiconductors. If this is the case, then I must build fewer factories, right? You cannot expect to continue funding the R & amp, D, and manufacturing cycle after moving from 25 % to 30 % and the fastest-growing market in the world.

Jensen Huang, the CEO of Nvidia, told the FT in May that” If ] China ] can’t buy from.” The United States will simply construct it themselves. According to some experts and people of the Chinese products, Huawei’s Ascend AI chips are getting close to Nvidia standards.

Nvidia stated the following regarding the new BIS restrictions in a Form 8-K submitted on October 17 with the US Securities and Exchange Commission( SEC ):

The licensing requirement may have an effect on Nvidia’s ability to finish product development on time, assistance current customers of protected products, but it does not guarantee that the US government will give any exceptions or licenses, or that USG will respond to the request promptly.

The US-based business partnership SEMI released this statement on the same day:

The government’s national security goals are centered on maintaining a strong US semiconductor industry, which we recognize and appreciate. We will nonetheless continue to assess the effects of these export controls and inform the administration of their effects on the world and US semiconductor supply chain given the risks associated with punitive and wide controls.

At the same time, Secretary Raimondo stated to NBC’s” Meet the Press” that” We are trying to choke their Chinese military capacity.” Therefore, if they experience that, our strategy is effective. On my view, we are not going to buy China the most cutting-edge British chip they need for their military capabilities.

Follow this author on Twitter at @ ScottFo83517667.