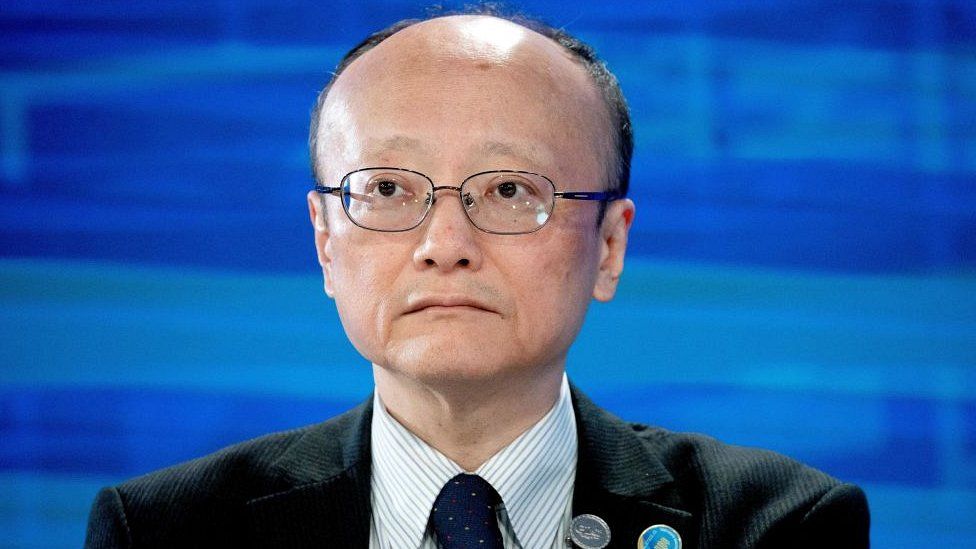

The finance ministry of Japan has requested that X, formerly known as Twitter, remove an account that poses as Masato Kanda, the country’s leading currency diplomat.

In a rare post in English on the social media platform, the ministry pleaded with users not to follow the impersonation account and / or post comments.

Mr. Kanda is a key player in the third-largest business in history’s efforts to stabilize the value of the yen.

The fictitious profile now seems to have been shut down.

A BBC request for comment was not instantly answered by X.

Mr. Kanda is a powerful figure among Japan’s decision-makers in economic policy. His remarks in people may cause the currency’s value to fluctuate against another significant currencies.

According to the Reuters information agency, the bill, which was followed by about 550 people, had not commented on the financial or hankering markets.

According to the organization, there had been five posts on the account, the most recent of which appeared to be a fake account of Mr. Kanda’s journey to Ukraine earlier this month.

” Currently requesting that X( formerly Twitter ) suspend the impersonation account ,” the ministry continued.

A recognize on X on Friday stated that the bill had been suspended for breaking” Twitter Rules.”

Investors have historically purchased the yen during times of crisis because it has long been regarded as a secure haven in the world’s economic markets.

But, in recent months, the currency’s price against the US dollar has decreased. This is due to the fact that despite sharp increases in interest rates across the globe, Japan’s central banks has maintained its primary interest rate below zero.

A money tends to be more appealing to investors when interest rates are higher.

As a result, there is less need for assets from nations with lower exchange rates, and the value of those assets declines.

The Bank of Japan maintained interest rates at extremely low levels last week but stated that it would permit rates to rise more easily.

Nevertheless, the yen fell to its lowest level in more than a month on Thursday, hitting 143.89 against the dollar.

Related Subjects

On this account, more

-

-

October 28, 2022

-