NEW YORK – The bad news is that America hasn’t invested much in manufacturing during the past 20 years. The worse news is that most of the manufacturing capital equipment that America uses came from imports.

Not only does the US have a US$1 trillion trade deficit, but about $300 billion of that deficit comes from imports of capital goods, namely goods that make other goods.

Federal subsidies for chip fabrication plants and green energy have recently bulked up the numbers for factory construction, but orders for capital equipment remain depressed. The subsidy-driven increases in factory building help explain an enormous surge in US imports of capital goods.

America’s dependence on foreign capital goods reached an all-time high in 2022, as capital goods imports exceeded domestic production of capital goods for home use, according to Asia Times’ calculations.

To reduce its $1 trillion trade deficit, the US would have to invest in capital goods. But it would need to import most of these capital goods, which means that the trade deficit would have to increase in the short term in order to shrink in the long term.

That rules out a broad “decoupling” from China, which accounts for the largest share of America’s trade deficit. Decoupling has become a shibboleth in US politics, and calls for a trade cutoff with China will grow shriller as the 2024 presidential election approaches.

But advocates of a broad decoupling are arithmetically challenged: America’s atrophied capital goods industry can’t supply the needs of existing production.

Rather than trying to de-couple existing industries from China at a prohibitive cost, America should direct its investment resources to leadership in key Fourth Industrial Revolution technologies and leapfrog China in strategic industries.

The US now imports as many capital goods as it produces at home for domestic customers. That is, imports of almost $900 billion of capital goods now equal US manufacturers’ annual orders for nondefense capital goods (excluding aircraft).

Nearly $500 billion of capital goods made in the United States are exported (again, excluding aircraft), so the net supply of capital goods to domestic users (domestic production minus exports) is roughly $300 billion. That’s about equal to the trade deficit in capital goods.

“Orders Net of Exports” in the above chart means domestic nondefense capital goods production (ex-aircraft) for domestic use, that is, net of exports. This is now smaller than the volume of capital goods imports (ex-aircraft).

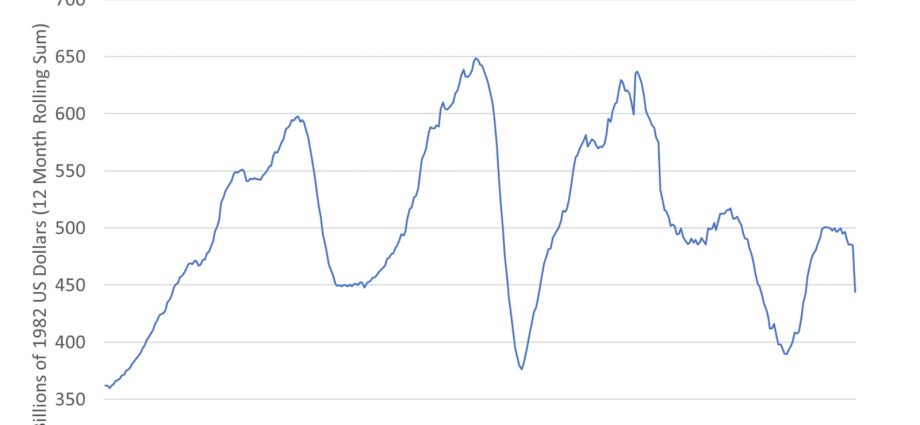

It’s important to note that the numbers shown in nominal dollars in the above charts look much smaller after taking into account inflation. The chart below shows US manufacturers’ orders for nondefense capital goods (again excluding aircraft) in constant 1982 dollars (using the Producer Price Index for Private Investment Goods).

Deflated, the volume of orders stands at an annualized $450 billion, a 30% decline from the 2013 level. Most of that decline reflects the boom and bust of fracking.

Capital spending by industrial companies in the S&P 500 has also fallen substantially from previous peaks.

China is one of America’s largest suppliers of capital goods, which include everything from industrial machinery to circuit boards.

Mexico exports a great deal of semi-finished goods to the US which fall under the rubric of capital goods. A growing part of Mexico’s exports to the US, however, represent the re-export of Chinese goods to Mexico.

Asia Times showed in an April 6, 2023 study (“The Great Re-Shoring Charade”) that Mexico, Vietnam, India and other “friend-shoring” venues increased their imports from China in lockstep with their exports to the United States.

A granular analysis of individual industries would be required to specify America’s degree of dependence on Chinese imports. Last year, China exported nearly $140 billion of electronic devices and equipment to the US, as well as $125 billion of industrial machinery, boilers, and power plant equipment.

A cutoff of Chinese imports would thus create immediate and devastating supply shortages across a wide range of US industries.

Follow David P Goldman on Twitter at @davidpgoldman