- ICT spending anticipated to reach US$1. five trillion by 2026

- Investment in the instruction expected to grow sluggish in 2023

Based on IDC’s latest production of Worldwide ICT Wasting Guide Enterprise and even SMB by Market , the agency forecasts Asia/Pacific’s ICT spending to grow from over 3. 8% in 2022.

Based on IDC’s latest production of Worldwide ICT Wasting Guide Enterprise and even SMB by Market , the agency forecasts Asia/Pacific’s ICT spending to grow from over 3. 8% in 2022.

The research firm said this is expected to reach US$1. 4 trillion (RM6. a couple of trillion) by 2026 with a compounded annually growth (CAGR) associated with 5. 2% by the end of 2026.

It said consumer technologies spending in Asia/Pacific as been strike, with growth slowing in 1H2022. Yet , enterprise technology paying, including service providers, continued to be strong, IDC said.

The firm stated the ongoing supply string constraints, geopolitical stress, rising inflation, weakening of local foreign currencies against the US monetary, and a resurgence in infections in storage compartments continue to impede global financial recovery post-Covid-19.

Tensing monetary policy to overpower rising inflation in the community is driving an increased risk of economic slowdown and poses stable headwinds for ICT spending growth over the following 18 months, it talked about.

Vinay Gupta, research overseer, IT Spending Guides at IDC Asia/Pacific, said IT paying out in the region has relocated from exuberant progress last year to that associated with strategic growth.

“Technology finances are stable as of now, however , leaders will place greater examination on technology assets as they represent a much larger share regarding spend and also to permit them sustainable business growth, ” he said.

Typically the survey notes of which Asia/Pacific is home to a new mixed bag of countries.

It highlighted that countries such as Singapore, South Korea, Indian, Thailand, and Taiwan, are net importers of energy and goods and are facing the particular brunt of enhanced imported inflation because of the weakening of the nearby currency.

Whereas Indonesia as well as Australia, which export commodities such as fossil fuel, oil, and intestinal gas, have benefited on the current situation, that added.

Their inflation results from the maximizing demand due to the perfect of the economy and supply chain constraints, the exact survey said.

Over-all, few industries are expected to have a slight slowdown in 2022 ICT spending, mainly owing to the global challenges, in addition to expected to grow wearier throughout 2022 until finally government measures get caught in place to keep the economy stable, it included.

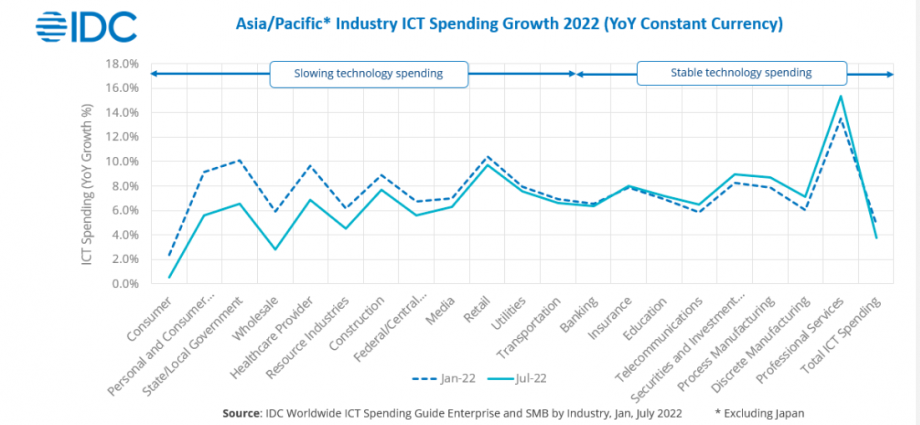

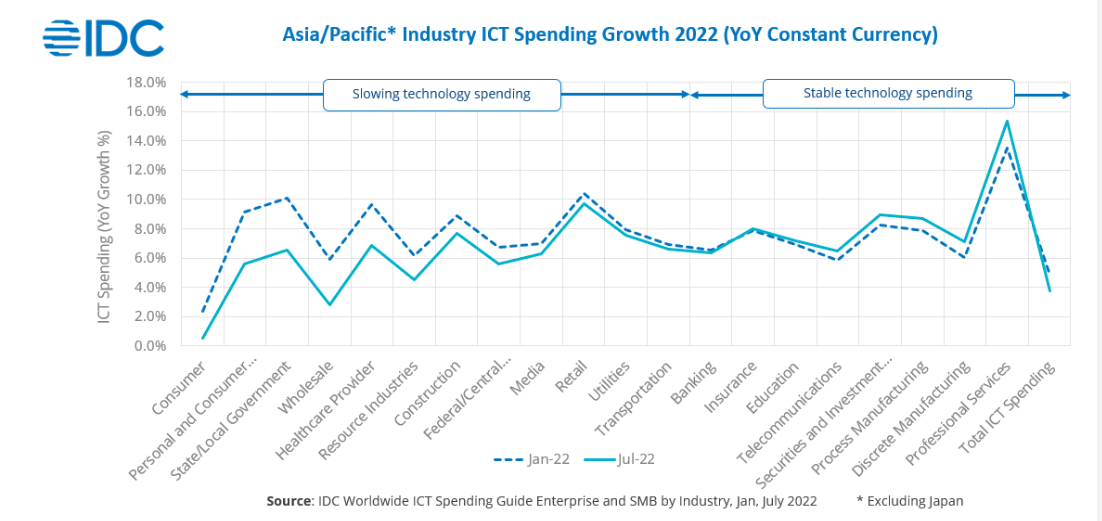

The above mentioned chart shows the in 2022 technologies spending growth between your January and This summer releases of worldwide ICT spending information enterprise and SMB by industry.

Consumer-driven sectors such as private and consumer providers, wholesale, construction, plus retail have slowed up due to rising inflation or lockdowns to control infection spread, based upon the geography in question, IDC said.

Industries along with lesser dependence on consumer discretionary spending or even which provide important services are displaying stable technology investment, it said.

These include banking, insurance, telecommunication, securities, investment, and expert services.

Mario Allen Clement, associate research manager, IT spending instructions at IDC Asia/Pacific said, “Enterprises may continue to focus on functional efficiency. However , brand new initiatives may be stalled. ”

According to the survey, education is expected to grow slower in 2023 as IT investments might be stalled due to extra and sudden investing in 2021, followed through in 2022.

Wholesale on the other hand is expected to have an increased bounce back as budgets focus on improving omnichannel selling, growing commerce ecosystems, expanding directly into global markets, supply transparency, and automation, the research showed.

IDC noted that Large Business (more than one, 000 employees) carry on and hold the largest marketplace throughout the forecast and yes it contributes to almost half of the ICT Spending, excluding the consumer segment.

The Worldwide ICT Spending Guide Enterprise and SMB simply by Industry is IDC’s flagship all-in-one data product capturing IT spending across greater than 100 technology types and 53 countries.