The kind way to describe the yuan weakening decisively past 7.3 to the dollar is that China’s currency is reflecting the widening cracks in Asia’s biggest economy.

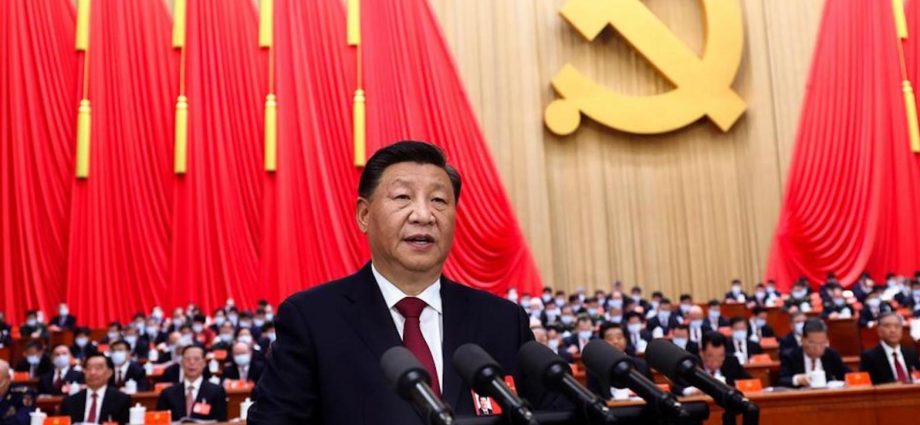

That the move came a day after President Xi Jinping achieved his longtime goal of remaking the Communist Party in his own image raises more difficult questions.

Worse, Hong Kong stocks had their worst day since the 2008 global financial crisis as the yuan hit 14-year lows. Shares in e-commerce giant Alibaba Group, food delivery behemoth Meituan and social media and gaming colossus Tencent all had a very rough Monday in the wake of China’s Communist Party Congress.

Some global investors are worried about Xi’s concentration of power and the stacking of his leadership ranks with loyalists, an arrangement that many view as one-man rule. Others worry about signals that the growth-killing “zero-Covid” strategy isn’t going anywhere.

Yet one thing is certain: the most powerful Chinese leader since Mao Zedong is on the clock with markets as never before. And the months ahead will attract intense scrutiny from CEOs who call the shots on global capital flows.