The US unemployment rate rose to 4.3% in July, the highest level in three years, the Bureau of Labor Statistics reported this morning (August 2), as the US economy added just 114,000 jobs, far below the consensus estimate of 175,000.

US consumers, buoyed by an unprecedented rise in federal transfer payments to individuals, sustained GDP growth during the past two years while business investment lagged.

A fall in weekly hours to the lowest level since the Covid-19 pandemic produced a decline in nominal weekly earnings of US workers. After inflation, that means a pay cut in real terms.

Earlier this week, the US Institute for Supply Management reported, “Economic activity in the manufacturing sector contracted in July for the fourth consecutive month and the 20th time in the last 21 months.”

Consumers accounted for 1.6 percentage of points of annualized GDP growth during the second quarter of this year, out of a total of 2.6 percentage points of annualized growth.

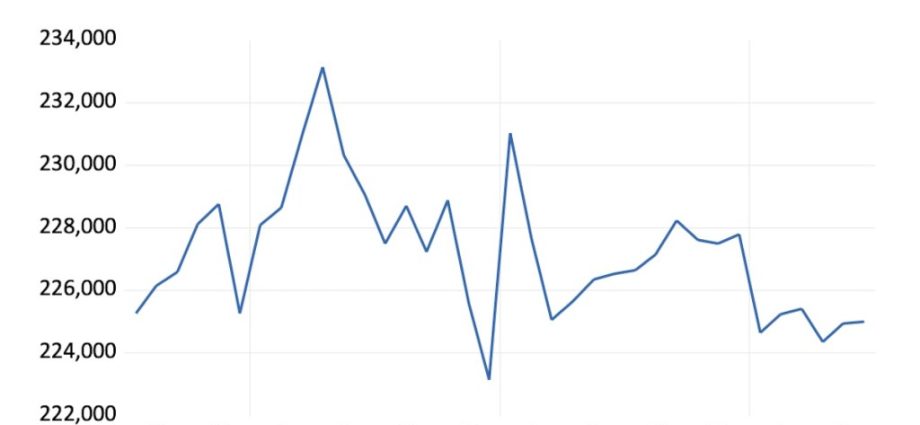

But consumers can’t keep up with inflation and retail sales adjusted for inflation are falling.

Federal economic stimulus in the form of higher transfer payments (subsidies to individuals) has been the main driver of nominal growth under the Biden administration – as well as the chief source of inflation.

Transfer payments under the Biden administration remain about 20% above the long-term trend.

Follow David P. Goldman on X at @davidpgoldman