A baffled group of chip industry experts, in a symposium discussion published November 4 by the ChinaTalk newsletter, tried and failed to explain Washington’s new export curbs on chip tech to China.

A close reading of the Commerce Department’s specifications shows ignorance about the technologies involved and confusion – if not duplicity – about the ban’s implications for China’s military. The experts’ group concluded that the new policy was rushed into effect in panic mode, without weighing its civilian or military implications.

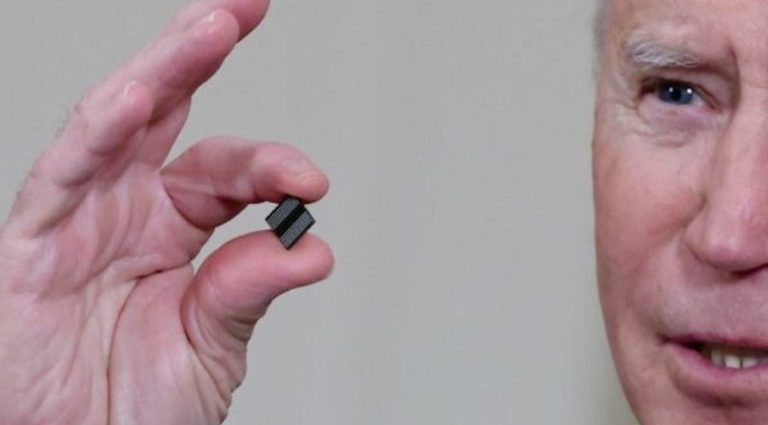

The new export controls “will restrict the People’s Republic of China’s ability to both purchase and manufacture certain high-end chips used in military applications,” the Commerce Department’s Bureau of Industry and Security wrote October 7.

That makes no sense, according to the experts, who included Jay Goldberg of Digits to Dollars, Doug O’Laughlin of Fabricated Knowledge, ChinaTalk’s Jordan Schneider and Martin Chorzempa of the Peterson Institute for International Economics. At the laboratory level, they observed, China can make enough advanced chips to power its key weapons systems.

Jay Goldberg:

I think there is an important distinction here between technical capability and commercial capabilities. I’m sure that there is some research lab in China somewhere that has a small EUV system and can produce 5nm chips, but they can’t do it at scale. They can do a wafer a day as opposed to 30,000 a month.

Doug O’Laughlin:

It’s one thing to make one wafer, but it’s another thing to make thousands of wafers with 99.999% accuracy over and over and over again. That’s the real problem: this is a cumulative benefit. If this is all you’ve ever been doing since the 1980s, all that cumulative knowledge and experience comes with you.

Jordan Schneider:

If you can do a wafer a day in a lab, you can probably make enough for your missile systems, no? And if so, then it really is just an economic competition.

In fact, China has had missiles that can destroy US aircraft carriers hundreds of miles from its coast since 2015, as Office of Net Assessment Director Andrew Marshall told me at the time.

The 5-nanometer chips that contain 57 billion transistors in Apple’s latest incarnation are powering 5G handsets and Big Data/AI applications, but the computer that guided Apollo 11 to the moon had just 36,000 transistors. Military systems use older chips that China makes at home, according to a 2022 RAND Corporation report.

But if China requires the most advanced 5nm chips for AI-driven military applications – for example, drone swarms controlled by a 5G broadband network and guided by artificial intelligence – China can make enough of them, although at high cost.

The US ban won’t affect weapons systems, but it will delay China’s rollout of autonomous vehicles, data centers and other civilian applications.

Yes, “it really is just an economic competition,” as ChinaTalk’s Schneider concluded.

Martin Chorzempa:

I think there’s been a shift away from trying to freeze or hold back China’s advances in chips. I see this as an attempt to roll back and degrade China’s existing capabilities. China can produce 14-16nm logic chips. Biren can produce GPUs at these thresholds. YMTC can produce NAND at this threshold too. What’s very interesting is that [Washington officials] did not set the thresholds at an aspirational level for China. They set them at levels that China already is able to do, and it’s cutting off their ability to do it.

If the Austro-Hungarian Empire was a tyranny tempered by incompetence, as the old joke goes, the BIS export controls are an economic blockade mitigated by ineptitude. In the rush to publish the new guidelines, the BIS produced an incomprehensible jumble of half-baked tech criteria.

Jay Goldberg:

I would love to hear from the people who wrote the regulations: In crafting these rules, which agencies showed up and really did their homework? And who phoned it in? Because it feels like some people did more work than others. Some things are incredibly specific, like the rules around AI performance. [In] other areas, it’s just like, “supercomputers.”

Doug O’Laughlin:

They go ham on metals deposition. They talk about 14 different types of metals, different types of processes, ALD.… And then they don’t talk about etch once. Whoever did the etch part mailed it in, and whoever did the deposition became an industry expert. The metals deposition part was mind-blowingly specific, and then they talk about ion implantation, which is something that I know a little bit about, and it’s so vague it could mean the entire set of tools that have ever been made.

Jordan Schneider:

There is limited expertise in the US government on this stuff, and I think it’s probably pretty spiky for certain things and not others.

Jay Goldberg:

In last week’s show, Kevin was really clear that the timing between [the] announcement and implementation of the rules was deliberately very, very short. I understand they had valid reasons for keeping that window tight, but it opens up all sorts of unintended consequences. In the rush to get the rules out, there was very little or no consultation with industry.

Goldberg concluded, “I’ve heard that it was deliberate: they wanted to keep certain industry bodies out of the process because they have a lot of lobbying weight.”

US chip equipment makers like LAM Research and Applied Materials, and design tool providers like Synopsis and Cadence, stand to lose the 20% to 30% of revenue they derive from China, with devastating consequences for their CapEx and R&D budgets.

Scott Foster of Asia Times reported October 17 that US semiconductor firms would suffer more damage than China from the new regulations.

The shoddiness of the Commerce Department’s technical specifications and the exclusion of US industry from the policy loop suggests a sudden onset of panic in the Biden administration over China’s technological advancement.

In January 2020, by contrast, the Pentagon overruled a Commerce Department plan to block exports of chip technology to just one Chinese company, namely Huawei, because US chip equipment firms would “lose a key source of revenue, depriving them of money for research and development needed to maintain a technological edge,” the Wall Street Journal reported at the time.

The Biden administration has made sure that the industry wouldn’t have the opportunity to object.

Follow David P Goldman on Twitter at @davidpgoldman