Treasury Secretary Scott Bessent’s statement on February 25 that the US was experiencing a personal business crisis and that the Trump administration intended to “re-privatize” the economy flashed crisis instructions.

The previous administration over-relying on excessive government spending and excessive regulation, according to Trump’s chief economic official in a speech.” We had an economy that may have had some reasonable metrics but finally was brittle underneath.

Does the Trump administration use the threat of tariffs to stifle international funding in the US, or did taxes began a trade conflict with Europe and Asia, depending on one important political matter: whether the US will experience a recession this year.

Higher tariffs will have a significant impact on domestic inflation because the United States is so dependent on imports. However, the outcome will benefit US growth if the response of the European Community, Japan, and China is an increase in investment in the US.

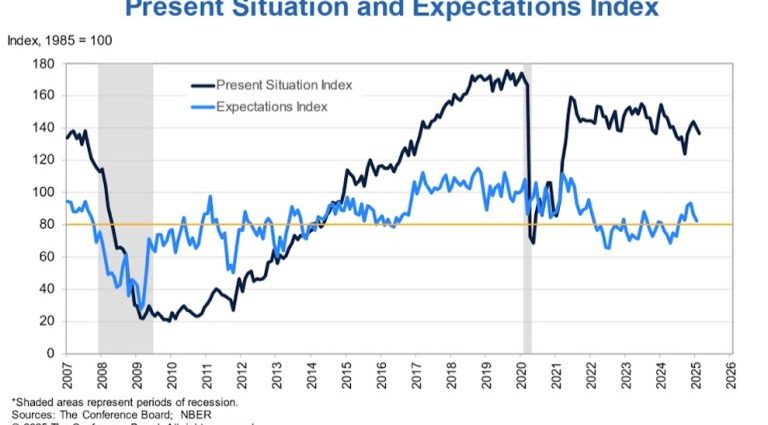

Recession indicators include the worst consumer confidence survey results since 2021, a decline in freight shipment volumes, a decline in equipment investment in the fourth quarter of 2024, and a 0.9 % decline in retail sales ( before factoring in inflation ) in January.

It’s difficult to connect the dismal survey results released last week by the Conference Board and the University of Michigan with the fact that the top tenth of US earners account for half of consumer spending. The average consumer may be pessimistic, but a tenth of US households ‘ spending choices will determine the pace for aggregate data.

The decline in private investment during the fourth quarter is a major concern. The worst investment report since 2021 was nearly 6/10ths of a percentage point off the fourth quarter’s GDP growth.

The final GDP report for 2024 should be read with caution because the investment component is volatile and the gross domestic product is one of the least reliable series we have. However, it’s still a problem.

A rise in investment in subsidized semiconductor manufacturing facilities was a result of the Biden CHIPS Act. The end of the Biden subsidies likely accounts for a large portion of the equipment investment decline.

A harder number to find is nondefense capital goods orders that exclude aircraft, and this indicates a year-over-year decline of more than 20 % as of December 2024.

The CASS Index of Freight Volume, which was created from billions of CASS payments, is one of the few reliable indicators of US economic activity. This indicates a significant decline in January. Although wet might be a factor, but freight volume has been declining for several months.

If tariffs result in higher prices for both consumers and industrial users, Treasury Secretary Bessent’s “private sector recession” could quickly worsen.

Since 2020, imports of capital goods ( excluding cars ) have increased by nearly 40 % in real terms. Semi-finished goods and other production inputs are some of the items that the US currently imports more than it does domestically.

It will be difficult for domestic manufacturers to replace imports with local production because so much of US manufacturing is dependent on foreign inputs. Ex ante, it’s impossible to predict how much of the tariffs will be absorbed by foreign exporters, either through currency devaluation or lower prices, and how much of it will result in price increases.

The Trump administration has threatened that the answer to 20 % tariffs on Chinese imports and 25 % tariffs on European imports will be” a lot.”

Follow David P. Goldman on X at @davidpgoldman