Hong Kong sees surge in startups; entrepreneurs say climate remains competitive

RECORD HIGH STARTUPS

Uncle2 is among a surge of new firms shaping Hong Kong’s entrepreneurs environment.  ,

Last year, the town saw 4, 694 new companies, up 40 per cent from about 3, 400 in 2020.

These companies employed 17, 651 employees, a 65 per cent leap from four years ago, according to a record by InvestHK, a government agency that helps organizations set up in Hong Kong.  ,

Officials have touted the state’s corporate site as a gateway to Asia, particularly mainland China, for the record number of startups.  ,

Another important attractions for investors included a small income level, accessibility to funding and an accessible pool of bilingual talent, the report said.

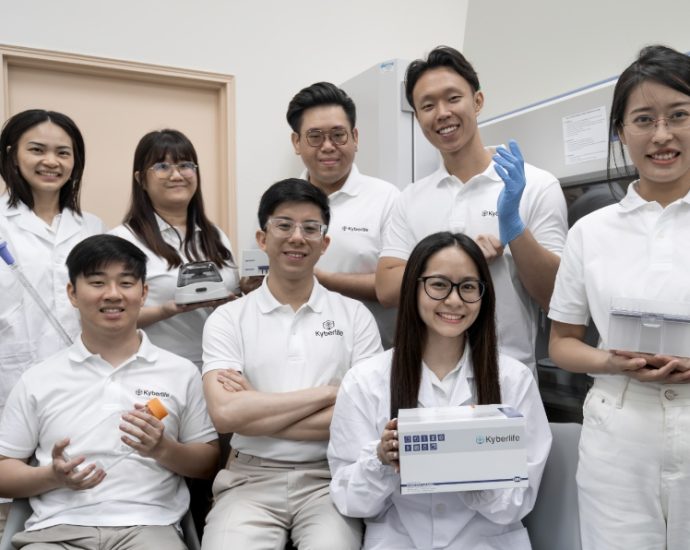

The best sectors with new ventures were generally modern – monetary technology, information technologies and e-commerce. There has also been progress in the health and medical area, as well as the conservation sector.  ,

Hong Kong citizens made up 72 per share of the business owners. Among foreign members, 40 per cent were from mainland China, followed by the United Kingdom, United States, France and Australia.  ,